Hello, Mr. Chips!

~5 min read

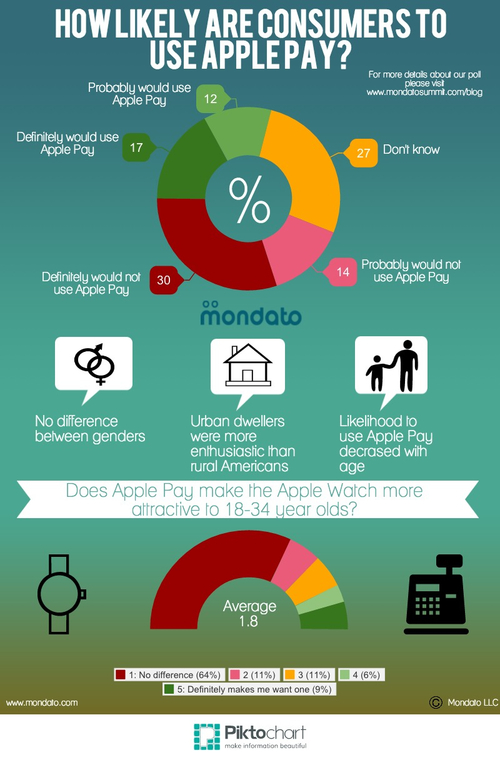

Apple Pay's unveiling in the fall of last year appeared to most people in the mobile payments industry that it had at least the potential to catalyze uptake and usage of mobile payments. Some went even further, claiming that it was not only going to upend payments, but marketing, online retail and a whole host of other associated sectors as well. Here at Mondato, we were a little more circumspect, partly based on our own analyses, and partly influenced by the findings of our poll that found consumer reaction to be lukewarm.

Nevertheless, Apple's timing appeared propitious. In particular, the impending migration of credit and debit cards in the United States from mag-stripe to the EMV "Chip-and-PIN" standard appeared to lay the groundwork for a shift to NFC-enabled Point of Sale (POS) card readers without requiring any effort on the part of Apple or banks. The "liability shift" of October 1st 2015 meant that merchants who did not have POS card readers that accepted EMV chips would bear the cost of fraud, rather than the banks as had previously been the case. Therefore, or so the thinking went, the additional costs of integrating NFC (Apple Pay) would be so small that the decision to accept it would be a "no-brainer." Merchants had 13 months before the liability shift to get into the NFC payments business.

For many analysts, therefore, the prospect of many more than the initial 220,000 Apple Pay-compliant merchants upgrading to EMV, and coming on board the good ship NFC in the process, meant that Apple Pay's initial limited reach was not a great cause for concern. Samsung Pay's rush to become Apple's Pay mate (or foe) seemed to confirm the wisdom of Apple's timing. But as the Scots poet Robert Burns almost said, the best laid Pay schemes of Apple men often go awry.

As we noted earlier, a poll Mondato put into the field at the height of the buzz surrounding Apple Pay last September found limited enthusiasm for the new payment method (and numbers soon to be by Mondato show no increase in enthusiasm in the interim either.) Mondato's September figures were similar to data published by Pymnts and InfoScout earlier this year, when in March only 15% of iPhone 6 owners had ever tried Apple Pay. InfoScout methodology involves surveying consumers after they had made a purchase for which they could have used Apple Pay, but didn't. When asked why they did not use Apple Pay, responses were fairly static from March to June: 1 in 3 simply forgot, while 31% were not sure if they were able to use Apple Pay in that store (and evidently didn't care enough to find out). This points to a potential headache for the Cupertino tech giant, and an indication that their bet on the EMV upgrade may not be paying off.

####

Part of the problem, from a mobile payments enthusiast/Apple Pay perspective, is the collective shrug that has been emitted by U.S. merchants in the face of the "great liability shift". By the start of October, when the liability shift went into place, only around 30% of merchants were equipped to take EMV. Both MasterCard and Visa reported that this represented something in the region of a 450% increase on the reported approximately 55,000 that were operational in September 2014. There are now 314,000 Visa merchants and 350,000 MasterCard merchants (with obviously considerable overlap) who take EMV.

When set alongside Apple's claims of 220,000 Apple Pay-ready terminals at big-box stores last October, the 450% number looks somewhat questionable. Were there really 170,000 POS terminals in October 2014 that could take Apple Pay but weren't capable to take EMV-chip cards? If not, then the numbers of merchants who have upgraded over the past 12 months would be well, well below that which the September year-on-year numbers indicate.

According to a recent poll of small businesses conducted by Gallup on behalf of Wells Fargo (on admittedly a small sub-sample), one in three small-business owners who currently accept credit card payments indicated that they either would never upgrade to NFC or said they didn't know when they would. And for those who do want to upgrade in order to avoid suffering liability for fraud, the picture is not a particularly rosy one. For a merchant to avoid liability, they must get certified, a process for which there is currently a six-month waiting list and which takes, according to one report, nine to 12 months to complete. At this rate it is likely to be several years before the ability to pay with Apple Pay becomes ubiquitous.

####

While Apple is certainly responsible for exciting interest in NFC mobile payments, of course it's not the only show in town. As *Mondato Insight* previously [observed](http://blog.mondato.com/samsung-pay/), Samsung's acquisition of Loop Pay earlier this year gives it a huge advantage when it comes to merchant acceptance, as Samsung relished pointing out in an advertisement it released to coincide with the launch of Samsung Pay in the United States, just a few days before the EMV liability shift (see below).

Samsung/Loop Pay's magnetic secure transmission (MST) technology allows it to communicate with ordinary mag-stripe card readers without requiring it to accept NFC. As such, it has the potential to overcome the critical disadvantage that Apple Pay faces: Samsung Pay can become habit forming.

As we noted above, almost two thirds of consumers who did not use Apple Pay to make a purchase when they could have either forgot about Apple Pay or weren't sure if it would be accepted. Neither of those reasons will apply to Samsung Pay, which posted strong numbers during its first few months in South Korea. The bigger problem, in terms of growing the mobile payments ecosystem in the United States, is likely to be Samsung's continued sluggish sales figures, which although accounting for over 50% of U.S. Android sales in the first half of the year, were accompanied with predictions of a 4% drop in Q2 operating profits.

####

One of the most curious aspects of the transition to what is generally known in the rest of the world as "Chip-and-PIN" is the absence of the PIN element. Chipped debit cards will now require use of a PIN, but credit cards will still have to be signed for. Retailers were [reportedly](http://blogs.gartner.com/avivah-litan/2015/09/30/emv-rolls-out-with-lots-of-tension-between-retailers-and-card-issuers/) keen on requiring PINs on both card types (see above), whereas card issuers were concerned about the unpopularity of having to remember yet another [password or PIN](http://blog.mondato.com/biometrics/). This could, perhaps, provide a small but important fillip to both mobile payment systems, ironically, as a result of the added security offered by EMV.

EMV is somewhat slower than swiping a mag stripe. Entering a PIN or having to sign a paper receipt or POS screen makes the process slower still. Biometric fingerprint recognition, offered by both Samsung and Apple, is therefore likely to make mobile payments more attractive than chipped cards in terms of speed. Biometrics are also, clearly, much more secure than PINs or signatures, thereby neutralizing one of EMV cards' main advantages.

In truth, though, issues like speed and security are peripheral and are unlikely to make much difference in terms of uptake and usage. As the InfoScout numbers previously referenced make clear, consumer awareness of mobile payments is key to widespread uptake and usage. Beyond that, however, remains the even more important aspect of habit formation. Apple Pay is, and is likely to remain for some time, too sporadically available to become habit forming. Samsung Pay, on the other hand, has the potential to become instinctive. Ironically, rather than emerging as an even stronger player in the payments space after the shift to EMV, Apple might well have gifted Samsung an open net. The question remains, though, whether Samsung will be able to generate enough S6 sales to be able to take advantage.

The Lion Tweets Tonight?

Let the Games Begin!