Impact Measurements: Driving Revenues In Emerging Markets?

~7 min read

One of the driving forces of digital finance and commerce (DFC) in emerging markets has hinged on its purported social impact on traditionally unbanked or underbanked individuals. Mondato has previously examined the impact of mobile money and the financial inclusion sector. Yet as the financial sector continues to ride the big data wave, social impact quantification remains a challenging question.

Impact investors, or those who invest into companies, organizations, and funds with the intention to generate a measurable, beneficial social or environmental impact alongside a financial return, thus represent perhaps the most interested group in elucidating the link between DFC and positive social outcomes - especially as financial services (including microfinance) command the lion’s share of impact investment. And with over 114 billion USD under management and an estimated growth rate of 17 percent from 2016 - 2017, the significance of this maturing class of investment is certainly nothing to sneeze at.

Yet even as adoption of best practices in impact measurement in emerging markets has lagged, players in these markets - from investors to corporates to non-profits, and ‘social enterprises’ writ large in particular - should take a closer look at recent trends and opportunities afforded by innovations in impact measurement. Not only can the judicious use of technology and data offer a clearer picture of the outcomes such organizations have in their stakeholders’ communities, it extends to the discerning business leader cutting-edge tools for gaining a competitive strategic advantage in frontier markets.

Impact Existentialism: What To Measure And Why?

Impact measurement as a tool to quantify the effectiveness of social interventions has its roots in the monitoring and evaluation imperatives of the development community. The UN’s Evaluation Group, for example, was inaugurated in 1984 and immediately confronted the, at times, intangibility of measuring impact - both theoretical and practical.

From a strictly empirical perspective, the critical factor allowing for the measurement of impact is a robust control group against which to compare effects of a given variable, intervention, or program. Yet the generation of a perfect comparison group is extremely difficult in the real world, to say nothing of the unpredictability of exogenous factors in affecting outcomes. Furthermore, as the use of comparison groups is often criticized for denying services to potential beneficiaries, ethical considerations must be weighed carefully.

From the more concrete implementation side, measuring impact has historically been expensive, time-consuming, and required specialized expertise. Should organizations invest in a randomized control trial (RCT), the gold standard for impact measurement rigor? A quasi-experimental process, where the control group is selected among existing populations rather than created? Before-and-after comparison, time-series design, panel design, performance monitoring, process evaluation, social return on investment (SROI) approach? With so many options and complexity, it is no wonder many organizations have viewed the impact measurement process as something closer to dental extraction than as an enlightening process providing a mission compass. As Margot Brandenburg, former associate director at the Rockefeller Foundation, notes subtly:

“People, I find, believe that nonfinancial performance measurement is essential in principle, but they are eager to defer further conversation to the social metrics person at their institution.”

In fact, even the most well-resourced and impact-committed organizations, like Acumen, the Robin Hood Foundation, or the Millenium Challenge Corporation, rarely measure impact directly. Standard practice for these organizations is to rely on secondary literature linking existing or easily obtainable proxy metrics to desired outcomes in quantifying the sum total of impacts on end-beneficiaries. And if some of the most sophisticated funders and investors can only hypothesize about outcomes and impacts, it is indeed worth considering whether and to what extent such measurement makes sense for all social sector organizations.

Leaning In To The Data

Responding to a need for standardization across the fragmented impact measurement landscape, a number of organizations have developed pioneering impact frameworks. In partnership with Google.org, Rockefeller Foundation, and B Labs, Acumen pioneered what has become known today as the Impact Reporting and Investment Standards (IRIS) in 2006. Similar to the role the UN’s Sustainable Development Goals (SDGs) have played in streamlining and rationalizing development donor finance flows, standardized impact metrics simplify the impact legwork for social sector organizations by providing a comprehensive framework for describing sector specific impacts.

In the energy space, for example, one such metric is ‘Amount of greenhouse gases (GHG) that would have been emitted by the replaced product during the lifetime of the organization's product’ - e.g. kerosene. Critically, such frameworks also provide investors with a clear way to target impactful investments and compare performance across individual organizations or portfolios - much as a traditional investor can parse through company data in pursuit of good-fit stocks for its unique portfolio strategy. How well these metrics respond to organizational needs is a question still in the flux.

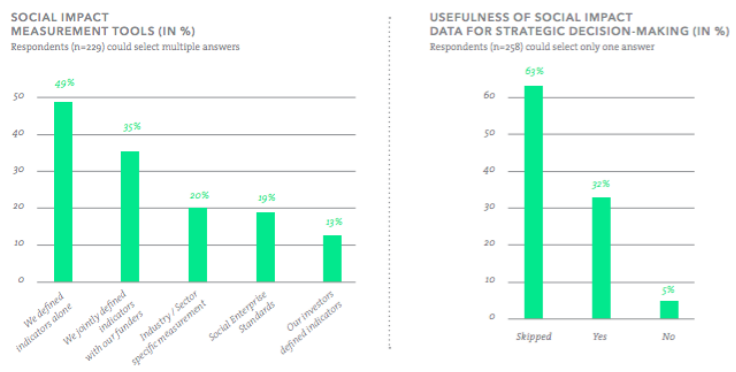

According to a 2015 survey of social enterprises in Columbia, Mexico, South Africa and Kenya, only 19 percent of social enterprises adopted standard industry metrics like IRIS or its offshoot GIIRS (n=229). The 2017 GIIN Report, which focuses on the global impact investor community, in contrast, offers a more encouraging 57 percent of investors (including 70 percent for emerging markets-focused investors); anecdotally, this could imply that the impetus for adopting widely standardized social impact metrics is still to some extent top-down driven. A 2018 report from the off-grid sector on collecting and leveraging data offers some insight into the primary obstacles limiting social metric adoption amongst companies on the ground, and they are not surprising: companies face prioritization challenges, lack of funding and/or capacity issues.

Source: Taking The Pulse, 2015

Source: Taking The Pulse, 2015

And yet, the organizations embracing data are finding that its usefulness is not in matching with funders eager to communicate how granola they are, but in learning more about their users.

Mobile To The Rescue

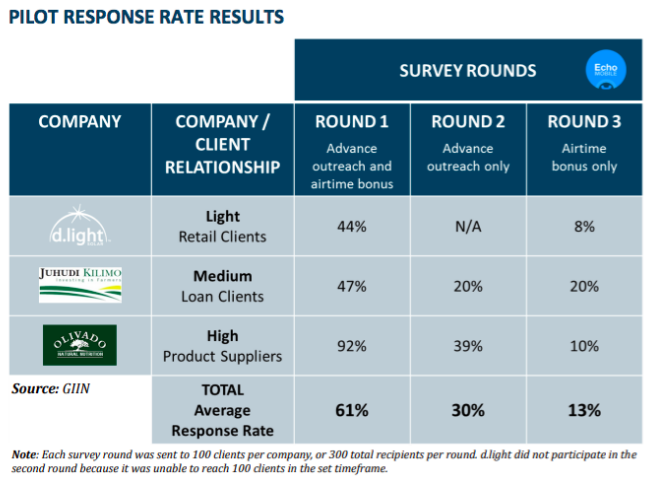

Leveraging the ubiquity of mobile, innovators have started to use technology to lower the cost, time and difficulty of collecting data, blurring the lines between impact evaluation and market research. In 2012, GIIN partnered with several impact-focused organizations to showcase the power of mobile-based feedback channels to quickly collect user data - focusing on wealth segmentation - through a simple 10-question survey developed by Grameen Microfinance. One key learning from this project was that high-response rates were obtainable among participants using a combination of airtime incentives (equivalent of 30 SMS or 10-15 minutes of airtime per user, or 35 cUSD) and advance notification - notably when the company-customer relationship was already high-touch.

Building on the momentum, Acumen’s Lean Data approach has shown how mobile technology can help emerging market organisations obtain KYC intelligence, inform strategic direction, and iterate on products at relatively low cost. Using SMS-based questionnaires, interactive voice response (IVR) and Call Centers to reach varied end-users, companies that partook in Acumen’s pilots were able to conduct their own mini strategic intelligence exercise based on the impact question driving their customer engagement - even those in rural areas.

The fastest turnaround of cases took about one month for a PAYG solar provider seeking to segment its target market along wealth / poverty indicators. Despite finding that its products did not seem to significantly reduce energy costs in end-users, the provider also discovered that a higher proportion of its customer base fell below the World Bank poverty line than expected, allowing it to pivot its customer proposition messaging and strategically orient towards customer satisfaction. Not including Acumen staff time, the process leveraged the company’s call center as well as a third-party call center and remote field staff, and cost only 2,000 USD.

When should companies envisage employing such tools? Research from Chemonics suggests that companies whose target markets have high illiteracy rates or unreliable mobile networks may want to consider the more analog (if expensive) face-to-face methods of customer engagement, as well as those whose degree of customer communication channels require more nuance than can be conveyed in much more than a tweet (given the 160 character limit of most SMS services).

Companies whose data requests are of a sensitive nature, on the other hand, may be particularly interested given that survey respondents have been shown to be more honest in responding to digital surveys than in-person. In any case, the rising swell of demand for consumer engagement platforms in emerging markets has supported the growth of a peppering of tech start-ups in the mobile tech space, including companies like Echo Mobile, mSurvey, PollAfrique and Geopoll.

Impact-ing The Bottom Line

As impact investment as a funding class continues to grow and diversify in investor type, DFC and other data-progressive companies operating in emerging markets will find that the information they collect through their daily operations will increasingly provide the transparency and visibility sought after by the impact investor community - to say nothing of the development finance community, with coveted reserves of ‘free cash’ aimed at early-stage companies with high potential for competitive social returns.

Looking forward, it is clear there is some way to go before impact measurement becomes a frictionless business tool for all - and in fact, trends in the industry may be pointing towards another step-change towards impact management as a lighter-touch, more qualitative way for investors to orient the impact of their portfolios. Yet as research is developed to disseminate further best practices and key insights into this fertile intersection of impact verification and business insight analytics, technology even beyond mobile will continue to be a driving force; what data troves are to be found at the forefront of Africa’s drone economies, AI advances in satellite image pattern recognition and prediction or free Wifi?

Perhaps a good start would be for mobile money leaders to get together with big data firms and strategic communications partners to showcase the social impact stories lying dormant in their business intelligence. The demand for this kind of data is as exciting as it is urgent, as lessons learned from 2014’s Ebola crisis prove that the shift towards more agile and sophisticated engagement with frontier demographics can go much deeper than the ubiquitousness, and often superficiality, of impact rhetoric.

Image courtesy of Greater Kansas City Community Foundation

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Digital-Only Banks Go Global

Voice + A.I. = Frictionless Payments?