Easy Come, Easy Go: Customer Churn Amid COVID

~10 min read

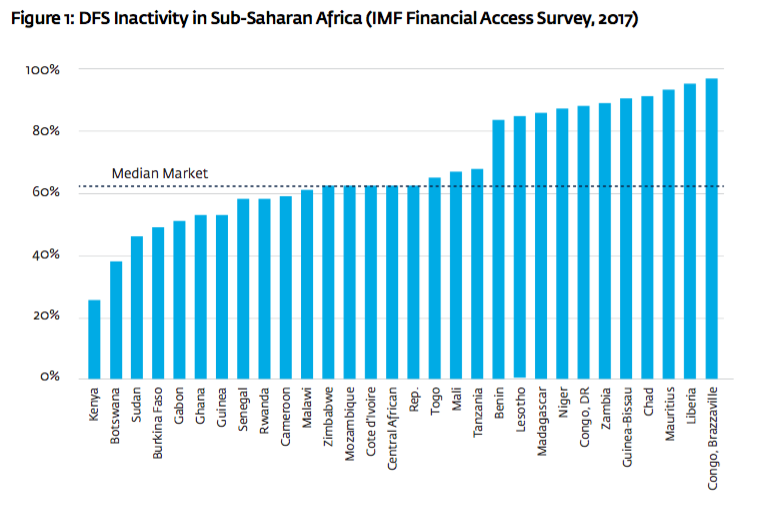

The curse of dormant accounts has long plagued the digital finance and commerce industry and bedeviled financial inclusion objectives. Beneath the topline figures of growth in new accounts among countries with the highest rates of the unbanked and financially excluded, the true picture of usage is that elevated levels of inactive or seldom-used accounts are a systemic issue that not only undermines the narrative of progress but also threatens the financial health of operators with finite customer acquisition budgets. Amid a potential paradigm shift in the adoption of digital tools (courtesy of the COVID-19 pandemic), is the ‘curse of dormant accounts’ any closer to lifting? And what do recent advances in predictive analytics reveal about the battle against customer churn?

As Mondato has previously covered, the narrative of ever-expanding financial inclusion driven principally by the African mobile money success story is problematized by a simple examination of what usage statistics lie ‘under the hood.’

Indeed, of 469 million registered mobile money accounts in Sub Saharan Africa, only 38.5% of were actually ‘active’, according to GSMA’s 2019 State of the Industry Report. The difference between active and inactive, of course, is not a simple binary but a spectrum of usage. Industry standard metrics consider an ‘active’ account one that has seen transaction activity in the past 30 days; beyond 90 days without a transaction, the account has gone ‘dormant.’ Users who cease to use a service after signing up for an account represent ‘churn’ for the operator, who has expended significant resources on a customer acquisition strategy that seeks to overcome the many obstacles to on-boarding the unbanked into the digital finance ecosystem, ranging from (digital or ‘analog’) illiteracy, to poverty, to cultural trust barriers.

To give a sense of the endemic nature of this churn problem, take Safaricom, the parent company of East Africa’s dominant m-Pesa and undisputed global leader in mobile money systems. In 2017, Safaricom reportedly experienced a churn rate of 21% year, representing 5.5 million customers. For those familiar with the challenge of customer acquisition and retention, such figures are likely unsurprising. The Boston Consulting Group estimates that globally, such kinds of user attrition characterize between 30-50% of traditional banking entities’ client base on an annual basis.

Intuitively, the pattern is recognizable; who amongst us has not signed up for a service with a ‘throwaway’ email account, either just to try a service out without committing any actual personal information, or just to benefit from a customer sign-up promotion? Pity the customer acquisition teams whose jobs it is to ‘hook’ new customers with the right bait, only to watch up to half of the ‘fish’ bite - then vanish.

Source: Mastercard Foundation-IFC

The issue of churn and account inactivity, of course, is not unique to the financial industry. Companies in sectors from e-commerce to ed-tech and gaming must grapple with the issue of ‘ghost users’ in developing a sense of their actual customer base - a prerequisite for not only informing their customer acquisition strategy but for improving their actual product or service through refined KYC (Know Your Customer) processes.

As The World Churns

The widespread challenge of account inactivity can be particularly instructive in today’s unprecedented period of digital usage, driven by the global pandemic whose impacts are far from running their course, despite the emergence from strict lockdowns in many countries in Asia, Europe and the United States.

Indeed, the fact that an enormous swathe of the world population remains in quarantine, lock-down or ‘shelter-in-place’ has not been lost upon digital services firms who have realized the unique opportunities for uptake this represents. And yet, the exact way such a trend will manifest in digital usage is notoriously hard to predict, as Mondato has previously covered about the resilient remittance industry.

The question of which spikes in usage, in the context of COVID, can be sustained, is a vital question to digital operators and the broader digital ecosystem at large. This past month, for example, telecom operators including MTN, Vodacom, Airtel Africa and Orange announced a collaboration with an Africa-focused UN initiative to facilitate information flow around outbreaks and virus hotspots between authorities and more than 600 million mobile users.

A study by MasterCard revealed that since the beginning of COVID-19 in South Africa, 89 percent of South African respondents have been using contactless methods to pay for groceries, 60 percent for pharmaceutical items, 39 percent for other retail items, 15 percent for fast food, and eight percent for transport.

Mastercard Newsroom

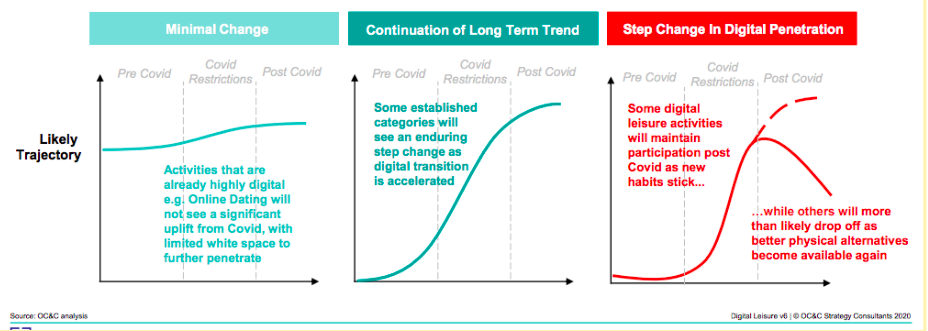

Will such initiatives last beyond the pandemic? There is cause for optimism. Consulting firm Bain estimates that by 2025, the adoption of digital payments will be 5-10% higher globally than it would have been without the pandemic (with necessary caveats about how persistent lockdowns remain with us). But this sustained increase will certainly not be distributed evenly; research shows that while the pandemic will have initiated a step-change in sustained adoption rates for some digital services, others will have simply proved an interim stop-gap to the ‘physical’ world alternative.

Source: OC&C Consultants

To answer this question of sustained uptake, both amidst and beyond the COVID context, we must delve deeper into the factors that drive ‘stickiness’ - the ability of a company’s product to retain users beyond the initial success of a customer acquisition strategy. This is a question that touches on a number of other operational concerns for operators, particularly around the theme of on-going customer engagement and satisfaction. It also speaks to the fundamental ontological question of KYC - how well do you understand your user base, their needs, and what drives their behavior?

Different approaches to this age-old question have yielded the observation that there is simply no replacement for deep qualitative understanding of a given market. For example, in the digital finance industry, the importance of understanding the specific trust barriers to uptake in a given geography, the better to remove them for users, has led firms to look beyond traditional market segmentation and towards ethnographic approaches. But these time-intensive approaches offer outputs with often insufficient generalizability for business purposes - you might say anthropological insights are hard to scale into market sizing and expansion exercises.

One approach from researchers at the University of Oslo attempts to bridge this qualitative-quantitative gap through extensive surveys across 47 countries using established social psychology approaches measuring cultural traits like ‘time-orientation,’ ‘masculinity’, ‘individualism’ to derive insights about the different ways and sources different populations consume information from. Though with significant limitations, the study’s novel methodology speaks to the demand for disentangling cultural factors into meaningful, operationalizable insights.

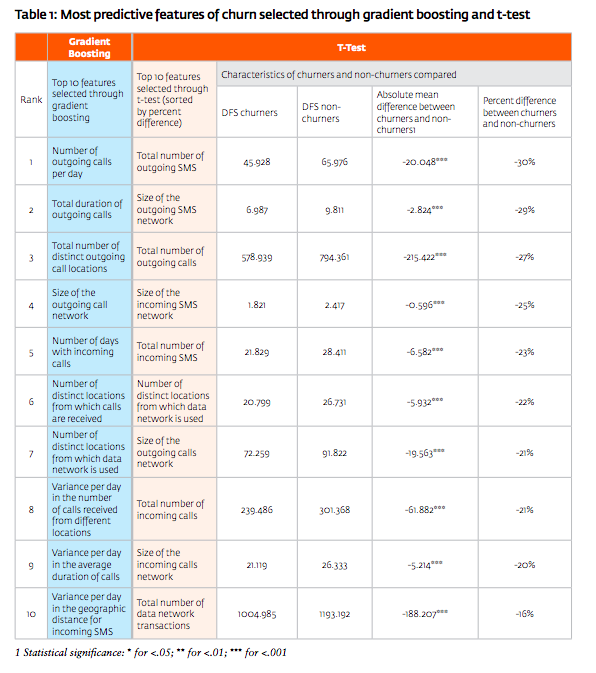

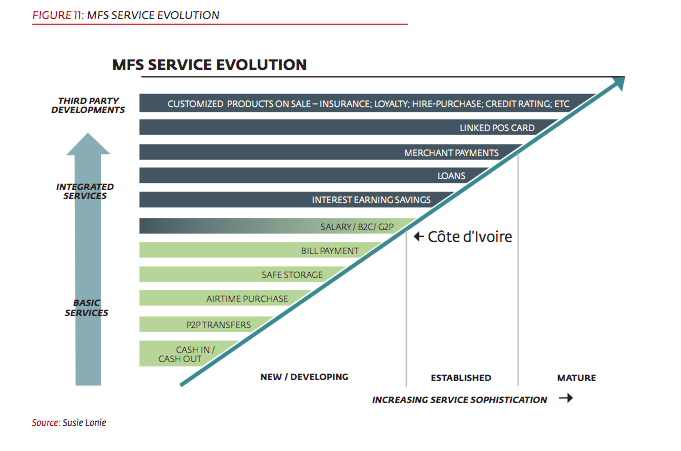

An emerging approach that is less qualitative - and thus perhaps more scalable - is to train an algorithm on an ocean of proxy data using advances in data science and predictive analytics. In “Who Will Churn?” a recent report released by Mastercard Foundation-IFC, researchers leverage surveys, segmentation analysis, and predictive modeling in Uganda, Zambia, Ghana and Côte d’Ivoire to identify relevant factors for inactivity, such as age, gender, and education.

Some obvious correlations emerge as significant to predicting churn in a customer base: irregular income, no perceived need to use digital financial services, and high service prices emerged as key reasons for inactivity.

But the research offers some granularity by demographic that offers a glimpse into the potential of the big-data approach, based on key indicators operators may have on their users. For example, in Zambia and Uganda, educated users were found far less likely to be inactive; younger users more likely to be inactive in Ghana; and women tend to use DFS less actively in Zambia and Ghana.

Critically, the approach reveals the power of using mobile usage patterns to predict churn - social network size, as measured by the amount of voice contacts a user has, set apart active from inactive and non-users:

Likely churners show consistently lower usage in terms of SMS sent and calls made (30 percent and 27 percent lower rates respectively). They also exhibit less variation in the location from where they make and receive calls.

Mastercard Foundation-IFC, 2020: Who Will Churn? Leveraging Predictive Modeling for Insights and Action on DFS Customer Inactivity

In other words, proxy data like communication usage patterns and physical movement activity can provide significant predictive ability on whose accounts are likely to lapse into inactivity. Of course, training a predictive algorithm on a huge data-set has its limitations. The approach yields little insight into “why” such correlations may exist - why, for example, a proxy variable may unexpectedly offer a high-degree of correlation with churn. But such insights offer the potential for a step-change in how digital finance operators think about growth. If you can predict who among your user portfolio is likely to become inactive, why not prioritize targeting these customers rather than allocating budget to acquiring ever-harder-to-reach new customers?

Source: Mastercard Foundation-IFC

Does Data Drive Depth?

It is, of course, well-known how cost-efficient a strategy this is; an oft-repeated rule of thumb drawn from Bain analysis across different industries shows that it can cost five to 25 times more to acquire a new customer than to retain an existing one. And while the relative tradeoffs between expanding through scale versus depth in the financial access industry has been around for over a decade, the trend towards depth is showing signs of accelerating and reveals a significant change in the way DFC providers may be thinking about their operations.

Soren Heitmann, one of the authors of the Mastercard Foundation-IFC report, reflects on the inflection point we may have reached, noting that customer acquisition costs for digital finance providers in Africa have been increasing, leading many financial service providers to pivot their focus from the acquisition of new customers to the retention of existing customers.

The question now is whether applying customer engagement strategies designed for acquisition can work equally well to boost retention, long-term customer activity and deepen financial inclusion within the existing customer base. And, of course, from a competitive market perspective, how such strategies can protect one’s customers from being poached.

Source: IFC

Of course, another key issue is acquiring the right data and computing power to design data-driven customer engagement, retention or poaching strategies. While large institutional research providers like IFC benefit from anonymized data from telecom providers and industry associations, most operators jealously guard what data they have on users.

This data piece is the million dollar question. Will telcos ever decide that generating more open-access to select datasets on customers create enough sector-level value to risk eroding their competitive advantage? In hotly contested markets, and in the absence of strong regulatory guidelines protecting user privacy, no one is holding their breaths.

As smartphones proliferate across emerging markets, however, telcos’ user data monopoly is in jeopardy. Wildly popular messaging apps like Whatsapp and Messenger (both Facebook-owned) offer alternative routes to developing rich user profiles that reinforce the ‘stickiness’ of products through ‘autogenic data’.

This strategy is one that TikTok is riding to stickiness; the Chinese-backed short-video app is currently the third most popular social media app in the Google Play Store in Nigeria, as well as the sixth most popular in Kenya. It’s success can in large part be attributed to a powerful algorithm that utilizes users’ location data and learned content preferences to serve up customized streams of content from nearby and globally recognized uploaders in an aptly named “for you” feed. When the whole channel is designed for your specific tastes, of course the chances of churn are lower.

This degree of personalization represents a parallel the digital finance industry is listing towards as the use of alternative data and predictive analytics emerges as a winning formula for learning about users’ preferences and dynamically engaging them. Researchers from Tuck School of Business at Dartmouth, INSEAD & HBS allude to this trend towards hyper-personalization that has such implications for preventing churn before it happens:

As products and services become more digitized...success is now assessed in terms of context-specific relevance—“is it right” versus “is it right for me, right here, right now.”

Institute for Operations Research and the Management Sciences, 2020: What Is Different About Digital Strategy? From Quantitative to Qualitative Change

The Price Of Prediction

What is clear is that predictive analytics will inevitably become a standard tool in the arsenal of digital financial services providers in designing and executing both customer acquisition and retention strategies. The signs point towards the latter as an increasingly ripe target for such methodologies, given the higher degree of visibility, lower engagement costs, and higher return on investment. And indeed - the trend is emerging in the data; scratching beneath the surface of GSMA’s 2019 State of the Industry Report reveals that the gap between activity on a 30-day and 90-day basis is narrowing, with 70 per cent of 90-day active accounts now active on a monthly (30-day) basis.

What is also clear is that across every sector and every industry, crisis breeds change. Today’s pandemic will likely represent the prologue to a cleavage in uptake among providers who leverage the ‘exogenous’ surge in digital uptake to get much closer to their users and those who assume our new normal will remain so.

Anecdotally, there are indicators that the global financial community's plan for recovery is mobilizing around a massive roll-out in lending capacity specifically targeting small and medium businesses - the economic lifeblood of the majority of developing country populations. For the digital rail providers who will undoubtedly play a pivotal role in the mediation and distribution of these funds, the ability to effectively merge predictive analytics techniques, geospatial intelligence, and a variety of qualitative approaches drawn from the social sciences are the next frontier of success at the digital frontier.

The future is a fraught one - one where marketers and executives will be relying on algorithms whose predictions far exceed the comprehension of its creators, creating a somewhat dystopian future with uncharted ethical implications, where managers’ reach will exceed their grasp. As the business school researchers capture it:

“There is a delicate balance that managers may have to strike in this area: they may need to let go of the need to understand in order to satisfy the need to predict.”

Image courtesy of Markus Spiske

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

What's Up With WhatsApp? A Case Study In Payments

Pandemic As Proof: Digital Identity Is Essential