Minding the DFS Gender Gap: Battling Social Norms to Level the Playing Field

~7 min read

Last week, Mondato hosted a webinar focused on the digital financial services (DFS) gender gap, as part of its “The New Normal in Digital Finance” series. While the DFS gender gap has slowly narrowed over the past few years, much work needs to be done in order to completely close it, with the COVID pandemic only exacerbating barriers to financial access for women globally. Digital finance stakeholders, as well as academic experts, virtually gathered to discuss recent trends and data focused on demand-side challenges to financial inclusion that provided insight into progress made, as well as informed future strategies and considerations to further close the gap.

As DFS providers recognize that women are better borrowers, with higher and more timely repayment rates, certain supply-side barriers have marginally improved. And as women tend to allocate funds for more productive purposes, usually investing in either their business and their children’s education or healthcare, once a woman becomes financial independent, she continues to thrive, but the financial inclusion gender gap still exists. Now more than ever, it will be essential for women to participate in the financial ecosystem to realize the much-needed economic growth potential as the global economy seeks recovery from the pandemic.

Delving Deeper into the DFS Gender Gap

From CGAP’s FinEquity, a community to advance women’s financial inclusion, Technology Lead Catherine Highet kicked off the session with an insightful presentation on the role of social norms in restricting a women’s ability to access and benefit from digital financial services. Research pertaining specifically to gendered social norms, described as societal or community expectations on behavior related to one’s gender, is being conducted by CGAP out of concern that some advancements in digital financial services uptake could potentially worsen gaps in access for underserved groups like women.

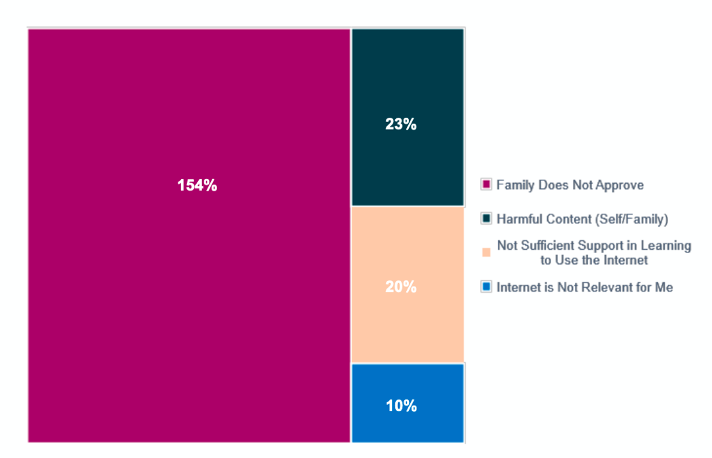

The study looked at key barriers to inclusion: access to devices, internet connectivity, infrastructure, and literacy and data availability. The findings predicted that the gender divide for smartphone uptake and mobile data usage will persist, with certain social norms as the culprit. As illustrated in the figure below, family approval – guided by gendered social norms – is the most significant perceived barrier to mobile internet use for women.

Perceived Gender Barriers to Mobile Internet Use

Source: GSMA Intelligence Consumer Survey, 2019; CGAP analysis

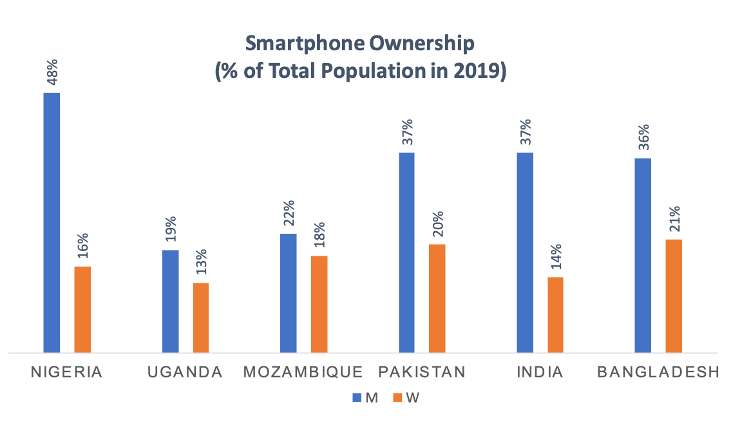

An example of a social norm creating barriers to access was found in India, where there is a societal fear that women’s access to a mobile phone would enable promiscuity or erode traditional courtship significantly contributed to the gender gap in mobile phone ownership, and versions of this story can be found in many lower- and middle-income countries. Overall, across emerging markets, women are 20 percent less likely to own a smartphone than men.

Source: GSMA Intelligence Consumer Survey, 2019; CGAP analysis

The GSMA’s most recent Gender Gap Report cited that 54 percent of women in low- and middle-income countries now use mobile internet, which lowered the gap for mobile ownership (a prerequisite to digital financial access), to 8 percent, but 393 million women are still un/underserved. Though improvements have been made, the reduction was primarily driven by improvements in South Asia rather than evenly distributed across all developing countries.

Social Norms and Financial-Decision Making

To better understand the effects of social norms on digital financial adoption and usage for women, Abigail Barr, Professor of Economics at the University of Nottingham was invited to present her ground-breaking research on financial decision-making, gender and social norms in Zambia. Using a series of behavioral experiments, a quantitative dataset and analysis were developed based on how spouses in Eastern Province, Zambia make decisions about how money is controlled at the household level.

On the one hand, the data indicates that social norms guide and constrain financial decision-making less than originally expected, but behavioral prescriptions between spouses were found to have particularly strong implications for decision-making. For example, while there was evidence pointing to the existence of a social norms against saving money in secret from one’s spouse, which applies to both husbands and wives, wives, not husbands, are more likely to compromise household-level earnings in order to maintain control over money. And though both husbands and wives agreed that saving is good, husbands are less tolerant when it comes to ‘secret saving,’ an action “on par with neglecting the children or refusing to have sex.” A husband would be considered justified in beating his wife for such an act. Focus groups also indicated that when a wife saves in secret, suspicions will arise about how she got the money.

“One can make a case for helping women save… but if that involves keeping their savings secret, then it may encourage situations that can put them in harm... Another approach could be to work with couples so that husbands better understand the benefits to the household that come with allowing their wives to control money and savings.”

Abigail Barr - Professor of Economics, University of Nottingham

Social norms can affect the way women see themselves and their ability to engage with financial products. An Africa-focused study discovered that women’s perceptions of their own creditworthiness fed into their continued exclusion from the financial system. Observations suggest that this response was not due to discriminatory lending practices but rather confidence in financial decision-making.

Social norms are not impossible to change, but it can be particularly difficult if the norm is internalized and going against it generates guilt or shame. This type of behavioral change will require creative supply-side approaches from DFS providers and stakeholders, in collaboration with local communities.

Data-Driven Insights from Zambia & Mozambique

Given the importance of measurement in better understanding the factors at play in perpetuating the gender gap, the final session presented the most recent financial consumer surveys conducted in Sub-Saharan Africa, otherwise known as FinScope, in Zambia and Mozambique. FinScope is a nationally representative survey that provides an overview of the financial behavior; the surveys provide invaluable statistics on financial literacy, health and inclusion. Usually collected and released every five years in select African markets, FinScope findings for Zambia and Mozambique were recently published, leveraging granular and gendered datasets, which can be evaluated and compared to distill regional trends in the digital financial services gender gap. The survey measured both levels of access and uptake of financial products across formal and informal segments as well as income ranges and demographics, including gender.

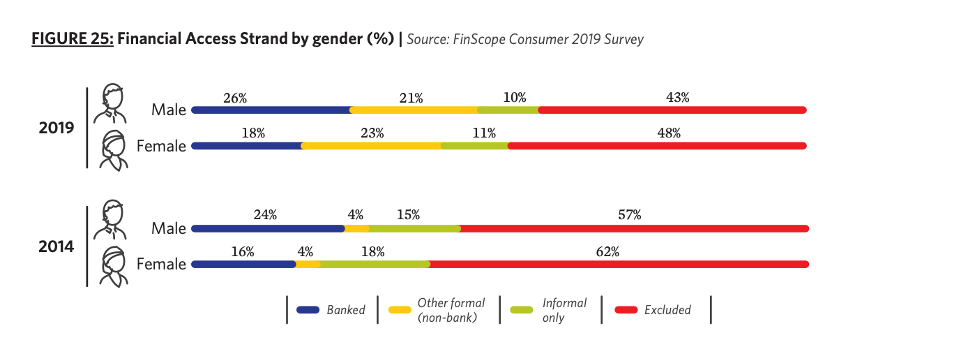

Esselina Macome, Chief Executive Officer of Financial Sector Deepening Mozambique (FSDMoç) presented relevant discoveries from Mozambique’s 2019 FinScope. While there was an uptick in access to formal financial services in Mozambique, attributed largely to an increased availability of mobile money, the gender gap remained unchanged at 5 percent. Women in Mozambique lagged in ownership and usage of mobile and smart devices, with an 8 percent gap in mobile phone access. The main barriers for women to be financially included were the time it takes to reach a given financial access point, as well as a lack of income, documentation and financial literacy.

Source: FSDMoç / FinScope 2019

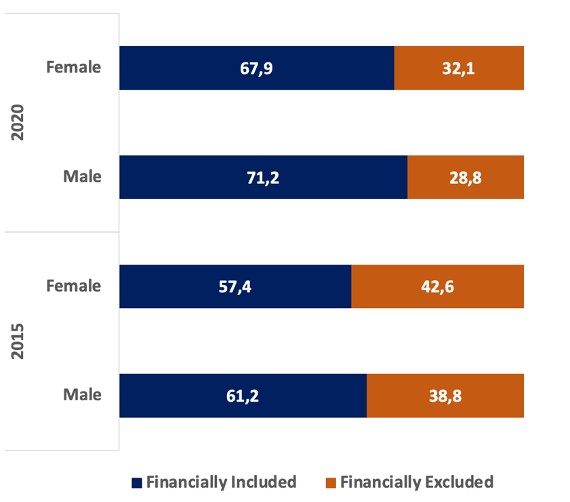

Betty Wilkinson, Chief Executive Officer of Financial Sector Deepening Zambia (FSDZ) shared some positive news from Zambia’s 2020 FinScope, including an increase in overall formal financial inclusion and a reduced gender gap of 3.3 percent, though behind these figures there still lies a wide range of challenges. Women were found to be 4 percent more likely to engage in financial decision-making, but Zambian women were also found to be less financially healthy and literate than men, as well as less likely to be aware of financial products and their benefits, and therefore more likely to financially depend on others. Women were also less likely to engage in mobile money and other informal financial services.

Zambia FinScope 2020: The Gender Gap

Source: Zambia FinScope, 2020

Zambia, like many African markets, is moving in the right direction, but still requires public and private sector partnerships and investment to ensure progress continues. To promote greater access in times of COVID, FSDZ has championed an effort to distribute 44,000 mobile phones across Zambian provinces, coupled with training and solar chargers. Because empirical evidence confirms that owning a mobile device is not necessarily enough to achieve financial inclusion, the Zambian government will also introduce financial education in the national curriculum to encourage confidence in digital and financial literacy. Approaches like these will be crucial in closing the gender gap, particularly in light of the hardships created by COVID.

COVID Considerations

Since women have been disproportionately affected by COVID, targeted efforts must address the rising inequalities that will inevitably affect the gender gap, particularly in lower income countries where women are less likely to be financially included. A UN Women survey found that women were more likely to experience job loss and reduced hours than men as a result of COVID, since women traditionally dominate many of the hard-hit sectors like tourism, textiles, manufacturing and garments, while juggling childcare responsibilities. Approximately 740 million women working in informal sectors globally saw their income fall by 60 percent this past year, and 250 million women are expected to be driven into poverty, half of whom reside in Sub-Saharan Africa alone.

Promoting gender disaggregated data is an important component to better informing national and regional recovery policies, as well as enacting gender-responsive budgeting and policy to ensure accountability. Regulators like the State Bank of Pakistan (SBP) are taking the lead. In December 2020, SBP announced a policy to confront the gender gap and promote equal access for women by improving institutional diversity, diversifying financial products, and collecting gender disaggregated data to better identify women segments. “Financial institutions shall be asked to develop policies to improve gender diversity and ensure a minimum 20 percent female participation in the workforce by 2023,” according to an SBP official statement.

“COVID will bring a rise in gender focus – and the key will be financial literacy and education,” according to BBVA Microfinance Foundation Board Member Claudio Gonzalez-Vega.

Changing the Norms: Lessons Learned and Ways Forward

In order to close the gap, education will be the key to restructuring adverse social norms that restrict women from engaging with digital finance, and as more robust data illuminate the barriers, risks and needs faced by women, public and private sector actors must continue to respond to these hardships with deliberate, and localized approaches.

DFS providers will also need to be incentivized to develop women-specific products, and even more importantly, educational campaigns need to be more diversified and targeted to achieve a meaningful change in behavior for women. Behavior change requires a combination of accessible and inclusive distribution of services with a holistic understanding of women’s needs.

A recording of this webinar is now available online.

Image courtesy of Ninno JackJr.

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Pandemic-Proof? Revisiting Remittance Rails

EdTech Takes Over: COVID-19 Spurs a Digital Transformation of Education