COVID’s G2P Revolution: Togo as a Case Study

~9 min read

Effective targeting is critical for government programs as well as market penetration strategies to succeed — a challenge exacerbated this past year by the distancing requirements imposed by the COVID-19 pandemic. What approaches can get aid or deliver services to the neediest as quickly, safely and effectively as possible? What technologies can be utilized to optimize relief coverage given operational, geographic and financial limitations? This week’s Insight explores early results from what may be the largest wave of digitized government-to-people (G2P) cash transfers in history.

Targeted Assistance

The challenge of effective targeting has bedeviled projects of “development” since at least the 1970s. This decade marked a period of transition in the dominant development discourse in which international financiers like the World Bank were debating a programmatic focus on people’s “basic needs” against policies targeting income growth.

Even while the World Bank oversaw significant increases in public expenditure projects around the world during this period, its monitoring and evaluation programs made it increasingly clear that no amount of donor budget increases alone ensures that the supply of support naturally finds its way to those who most demand it. Program evaluators sounded the alarm around “elite capture,” wherein the principal beneficiaries of purportedly poor-focused programs tended to in fact be the least-poor of the targeted group.

“Some basic needs can be satisfied effectively only through public services, subsidized goods and services, or transfer payments. The provision of public services is, of course, not a distinct feature of a basic needs strategy. Emphasis is placed, rather, on investigating why these services so often fail to reach the groups for whom they were intended and on ensuring that they do.

World Bank, 1979

Even at the international level more recently, some researchers have suggested that aid still disproportionately flows to regions with more of the richest people. The fundamentally gendered ways in which different societies mediate access to financial services — whether legally or culturally — provides an additional layer of complexity in designing equitable social programs.

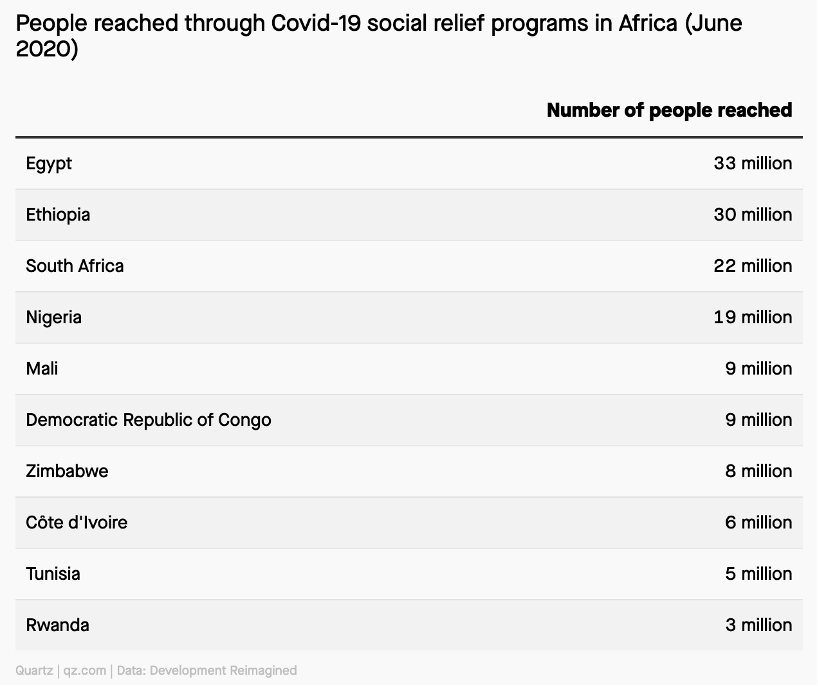

The COVID-19 pandemic, with its emphasis on contactless-everything, did little to ease the challenge. But sometimes, constraints foster creativity. On the African continent, social and economic relief measures during the pandemic were estimated to reach more than 175 million people, with cash transfers among the most common methods utilized. The possibilities harbored by government-to-people (G2P) payments through such unconditional cash transfers have been widely noted for their high social impacts in the evaluation literature.

Source: Quartz Africa

One 2012 study in Niger, for example, found that a cash assistance program digitized through mobile money platforms not only reduced the implementing agency’s distribution costs as well as recipients’ costs of obtaining the transfer — recipients were also observed to purchase a more diverse set of goods, consume a more diverse diet, and women were observed to grow more types of cash crops.

Such once-radical ideas seem to be gaining purchase across the world, not only as particularly critical support for vulnerable segments during the pandemic, but through the increasing popularity of universal basic income models even in welfare-allergic locales like the United States. But even the most altruistic proponent of cash assistance programs recognizes the fundamental limitations of resources, requiring decision-makers to look very closely at their prioritization strategies.

“While there has been much progress on the spread of digital payments across Africa, we still have little evidence about how to effectively design policies to maximize benefits from digital G2P payments.”

Jamil Abdul Latif Poverty Action Lab

Raising the Bar on Effectiveness

The Effective Altruism movement occupies a particularly intriguing niche at the intersection of Western-style impact investing and development discourse. Its animating principle is that altruism should be approached with the same ruthless ‘return on investment’ focus as venture capital, and that breaking from inefficient means of helping people in need can help individuals and organizations do good more effectively.

GiveDirectly embodies one of the movement’s core tenets: reduce overhead using technology. A non-profit dedicated to direct cash transfers, they’ve been running direct assistance through mobile money programs primarily in East Africa since 2012, and today they claim to deliver roughly 83 cents to recipients for each dollar donated to them. Given the often labyrinthine-like nature of the “assemblages” constituting the international money transfer system (and the high hidden costs baked into such opaque transfers, covered in previous Insights), this is no easy feat.

But COVID-19 may have catalyzed a shift in the ways cash programs are delivered across the world. Anya Marchenko, a Senior Program Associate at University of California, Berkeley’s Center for Effective Global Action (CEGA), recalls the unprecedented pace at which some cash-delivery programs were rolled out over the past year:

“About a year ago — this was April 2020 — we were all just wrapping our heads around COVID. At that time, Esther Duflo, who won the Nobel Prize in 2019, reached out to Josh Blumenstock, CEGA's co-Director and Associate Professor at Berkeley. She’d been talking to members of the Togolese ministry who had real ambition to support the most vulnerable citizens but needed support in developing a process for targeting them effectively.”

Anya Marchenko - Senior Program Associate, CEGA

As in many parts of the world, the Togolese government, with a consortium of research and business partners, sprang into action. They’d managed to mobilize funding to provide aid to its poorest citizens, but with more than 50% of the population under the poverty line and only finite resources, they needed an efficient triage and delivery mechanism to stretch each dollar.

Within weeks, with the CEGA team’s help, they’d put together a process for a lightning-speed cash targeting and deployment for a subset of the broader cash assistance program recipients. This sample group would then form the basis for comparison against other methods employed to target most effectively — a particularly empirical aspect to the innovative Togolese approach.

Since its inception last year, the Novissi program has delivered impressive results, with over US$24 million disbursed, 1.6 million citizens registered for eligibility and over 800,000 individuals benefiting from the cash assistance equivalent of US$20, disbursed in tranches every two weeks through the official state of emergency. This may seem to pale in comparison to other assistance programs around the world, but for those living on US$1.25 a day, this covers basic consumption needs for 48 days.

Togolese Takeaways

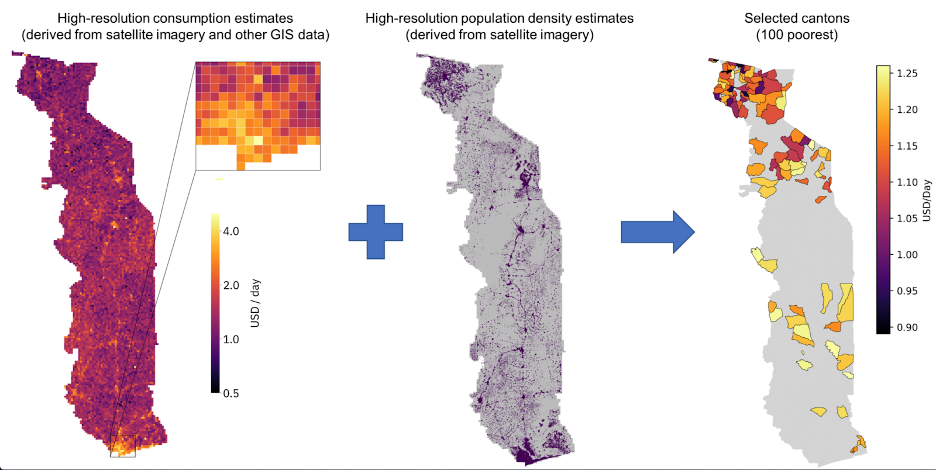

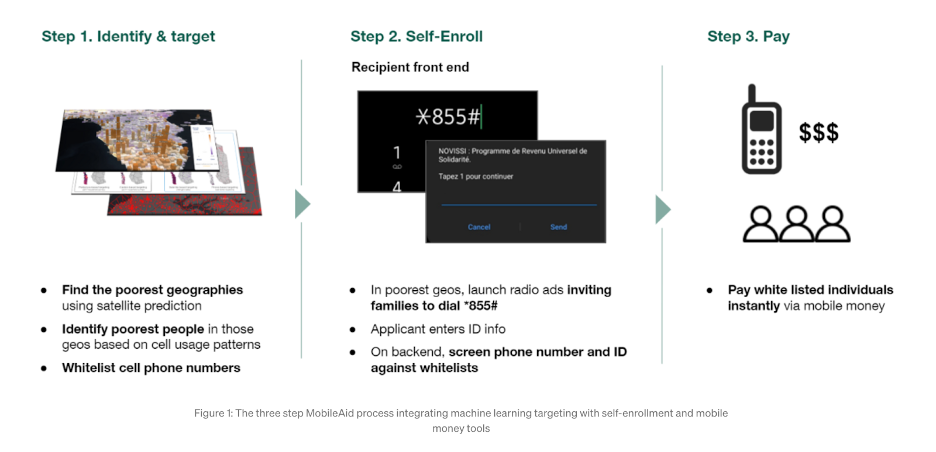

With support from international funders, the philanthropic community, and research practitioners, the government of Togo outlined their plan to maximize the impact of each dollar sent. Recent research methods seeking to optimize “data for development” were combined, leveraging the trifecta of remote sensing, mobile phone data and machine learning.

Source: CEGA

First, the 100 poorest sub-regions were identified throughout the country by processing satellite images with wealth estimation algorithms. Like in many African countries, Togo’s official demographic statistics are generated through a laborious twice-a-decade survey with World Bank money and assistance — the last one of which was in 2011.

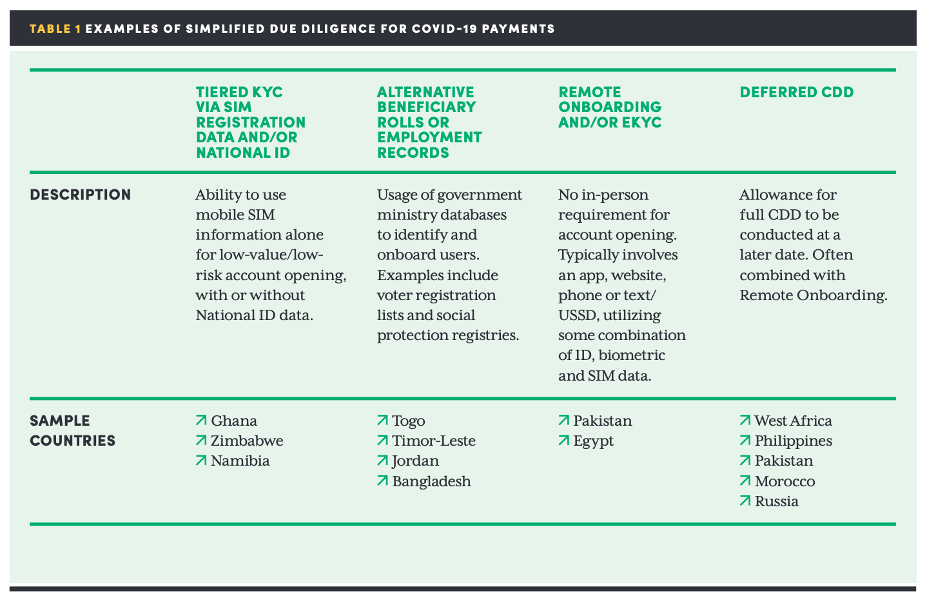

Then, in concert with Togolese telcos and CEGA researchers, the Novissi implementation team generated a cash transfer eligibility list built on the most recently updated voter registration IDs issued to adult citizens. Aggregated and anonymized call record data (CRD) was used to estimate wealth profiles for those in the priority geographies, enabling a rapid determination of eligibility upon self-registration among potential recipients, recruited by radio and word of mouth.

As a last step, a mobile money account creation process was streamlined for those without an existing account, and once activated, the transfer was effectuated. The CEGA research is specifically geared towards assessing the advantages and drawbacks of this approach, particularly regarding how accurate its application of inclusion and exclusion criteria is for recipients’ eligibility. For example, the program’s mobile-focus may exclude those who are too poor to own their own device, potentially up to 10 percent of its population. Further research — phone-based and in-person surveying — is planned to detect other potential algorithmic biases, with particular attention to women, the illiterate and marginalized sub-groups, as well as evaluate impacts on food security and well-being.

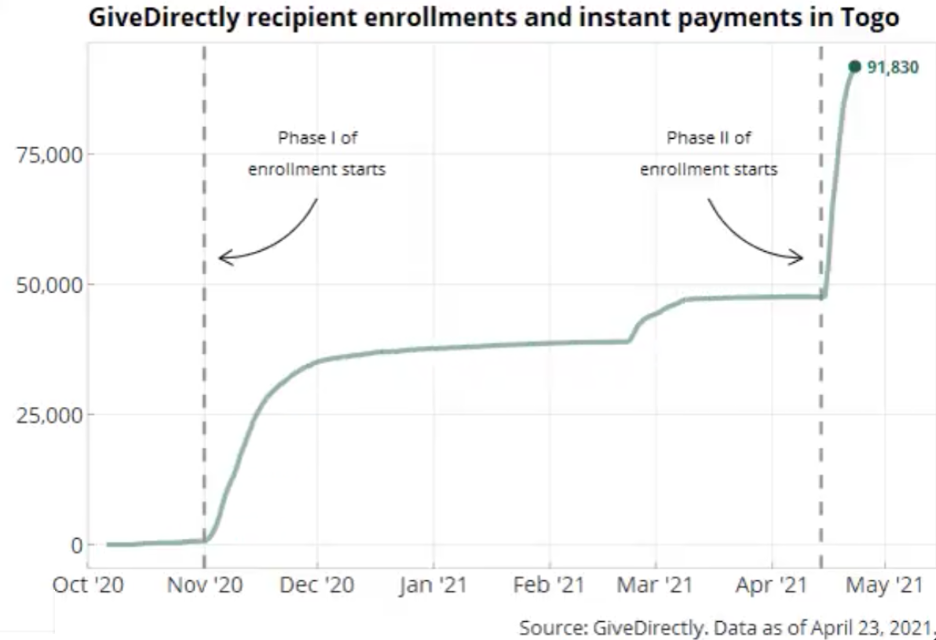

Evaluators are sanguine about the satellite+phone approach, however, which is “expected to provide benefits to nearly 2.5x as many of the poorest citizens as a program that provided benefits based on occupation [the strategy alternatively considered by the government],” and the partnership’s second phase already set out to double the regions targeted.

Source: GiveDirectly via Twitter

Two factors deserve particular attention in placing the Togolese experience in the global pandemic relief context. The first is speed; in the context of a crisis, the ability to get support to those who need them rapidly is half the challenge. But speed of delivery must also be paired with repeatability and customization of the process. Africa’s vaccine roll-out illustrates this point well; millions of COVID-19 vaccines delivered to the Democratic Republic of the Congo through the global COVAX program had to be “redeployed” last month after distributional challenges and uptake hesitancy almost led them to spoil.

The second factor is precision, and the reasons for this are in turn ethical and utilitarian. Programs aiming to maximize impact will naturally seek to give to those most in need, and alternatively not give to those who aren’t. Developing nuanced ways to understand final recipients’ financial situation is thus an exercise in delicately balancing speed of delivery with scale; the more effective a program is, the more people it can reach with the same budget.

Targeting More Than Cash

The pandemic has certainly seemed to accelerate the digitization of social assistance programs, which portends a progression not just in the way that mobile money platforms fit into the G2P narrative, but potentially aid more broadly. Indeed, according to the World Bank, more than 300 cash transfer measures, both digital and non-digital, were undertaken in 156 countries by September 2020, adding 1.1 billion new recipients to social safety nets in some shape or form. A tremendous amount of experimentation is thus taking place around the world, and robust evidence of the learnings from these experiments will take several years to emerge.

Source: Center for Financial Inclusion

But with the US and parts of Europe in the midst of an uneven but significant vaccination campaign as well as the possibility of new vaccines becoming available in the coming months and years, the prospect of a return to normal for many countries in the developing world is looking more attainable. In this future world, the central role of mobile money agents will undoubtedly return to the center of discussions regarding expanding financial inclusion — after all, a mobile money agent has seven times the reach of ATMs and 20 times the reach of bank branches, according to GSMA. In Togo, the first wave of Novissi deployments alone created 170,278 new mobile money accounts as of January 2021, a 7 percent increase in the penetration of mobile money in the country overall.

Source: CEGA

Among research groups like CEGA, including JPAL/IPA and CGAP, the increasing recognition that satellites and mobile phones can be rapidly mobilized to deliver targeted support is only beginning to gain traction, with its full potential far from realized.

“It can sound like targeting is all about cash, because that’s the dominant way geospatial methods have been leveraged during COVID. But we’re finding there’s much broader scope, many lessons to be learned for social protection programs, such as in health or education, that can benefit from these kinds of improved targeting techniques.”

Anya Marchenko - Senior Program Associate, CEGA

Such is the promise of crisis: it is in the cracks revealed by catastrophe that the seeds of improvement are sometimes incubated. Indeed, the financial crisis of 2007, paired with local election dynamics, played a significant part in catalyzing mobile money’s explosive traction in Kenya. Today, as public and private partners grapple with balancing speed and precision in the delivery of COVID-19 relief, the digitization of G2P may open the door for a broader rethinking of how social assistance is delivered, particularly as the affordability of ‘internet devices’ continues to drop, as it has done by almost 50 percent in the past 5 years.

Critical to the continued success of such programs is the expanded access of forms of digital identity, as well as increased access to mobile money infrastructure. In regard to both, the combination of satellites, mobile phones and machine learning will continue to improve the targeting precision and thus efficacy of cash assistance and social assistance programs, but this will not be enough by itself. Innovations in biometric, facial, and even personality recognition, as a recent Mondato Insight discussed, will also be part of the story. But given the unique set of challenges each country or region faces in developing accurate and up-to-date situational awareness for the delivery of goods and services to its most vulnerable populations, much more experimentation will be needed if the full potential of targeting technologies is to be marshalled for an effective and equitable global recovery.

Image courtesy of Katie Moum

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Fintech’s Cybersecurity Soft Spot: Vendors

Is Gig Work Financially Sustainable?