Psychometrics: What Makes A Reliable Borrower?

~8 min read

With various forms of data proving insufficient or invasive (or both), the quest for privacy-protective — yet repayment-predictive — data for applicants leads back to that basic question of what makes a good borrower. Emerging research and data collected through psychometric assessments are getting right to the heart of the matter, pinpointing the psychological attributes that portend a promising borrower, while detailing how to tailor products and solutions according to individual psychological traits.

Quantifying Character

Judging loan applicants by credit scores or bank statements often is not sufficient, as it fails to account for financial opportunities they have not been afforded. But going beyond the simple binary judgment of a credit score to unearth the underlying characteristics of a good borrower is not a simple endeavor. The first digital attempt at doing so — exploiting data from sources like social media or phone contacts — brought data privacy issues while never seeming to give the true potential borrower profile, filters and all.

“For all the data that flies around like social media data, it's not very pertinent to making [lending] decisions about individuals because it's extremely fragmented.”

James Hume, CEO, Begini

Especially when it comes to thin-file borrowers, finding the “hidden gems” that prove themselves capable of fulfilling credit obligations requires a more holistic approach.

Efforts to do so by measuring core personality traits, or psychometrics, have taken time. Humans are complicated creatures, and so is identifying the characteristics most telling of a potential good borrower, all while maintaining responsible, consensual and seamless data gathering. But after years of trial and error — and with the capabilities of analytics and lending models improved dramatically through machine learning — the psychometrics approach seems to be hitting its stride.

For years, research provided evidence of the potential for psychometrics to expand financial inclusion to thin-file applicants. A 2017 World Bank study looked at a collaboration between EFL and a bank in Peru that used a psychometric assessment to offer loans to SMEs. In this case, the psychometric assessment increased loan use among SMEs by 59% — without leading to worse repayment behavior. On the behavioral front, a 2021 study found a statistically significant relationship between borrowers’ levels of self-control, conscientiousness, selflessness, and attitudes toward money, and their likelihood of repaying credit debts.

Struggling to keep up with fintech’s drive for seamless onboarding, adoption of these methods as a data stream for credit provisioning fell short in its early years. However, the case of Begini, a behavioral data analytics company, is prescriptive in the advancement of psychometrics as a tool to both expand credit access and inform individually tailored financial products.

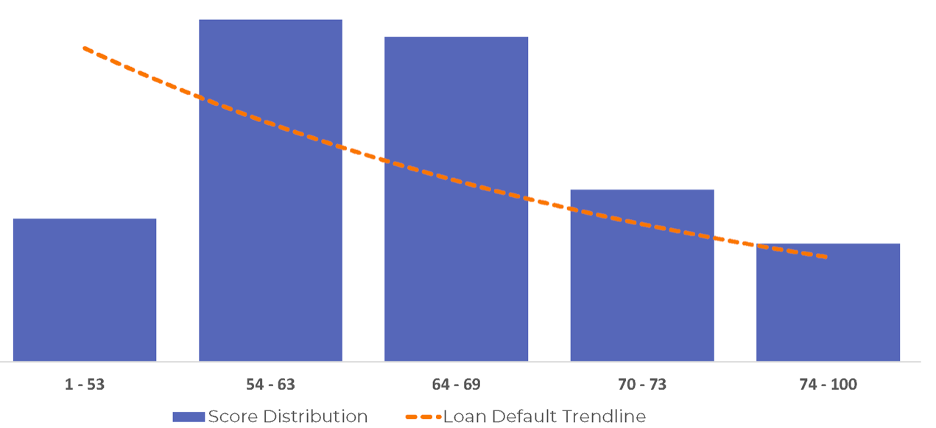

In Begini’s case, a gamified assessment measures the psychometrics of individuals through 12 core personality traits. The simple exercises are designed to be culturally neutral, using as few words as possible, and take less than 10 minutes to complete. Each applicant is subsequently given a composite risk score from 1 to 99, with higher scores suggesting a potentially more reliable lendee. Lenders can subsequently decide a given cutoff point to offer loans for any scores above that figure, depending on how risk-averse they wish to be, while deciding which terms to offer this group of applicants that otherwise have their loan applications rejected without the psychometrics data.

In validating its models, Begini received an informational gold mine when an innovative financial institution in Thailand told Begini to test for character traits of all loan applicants they previously rejected — and offer them loans anyway, regardless of their psychometric results.

With such a large sample size of over 20,000, including a substantial “control” group, subsequent repayment rates proved definitive in psychometrics’ favor. In the aggregate, applicants that scored 53 or below were found to be three times as likely to default on loans as those who score 80 and above.

Source: Begini

Taking it a step further, Begini found in its pilots that the cohort of rejected borrowers “rescued” by psychometrics ultimately repaid at similar rates as the average borrower approved through conventional means.

The Model Borrower

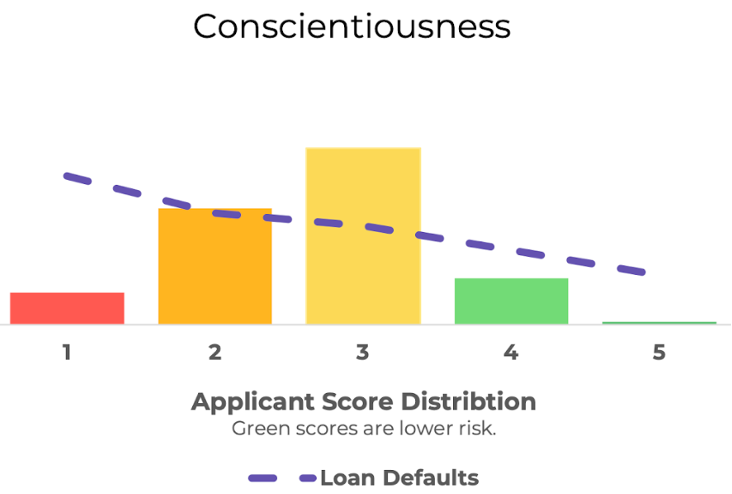

The efficacy of psychometrics in predicting repayment rates established, Begini researchers began to develop a clearer idea of which personality traits demonstrate the strongest relationship to being a faithful borrower, regardless of finances. Begini rated applicants for each of the 12 personality traits on a scale of 1 to 5, with 1 as the lowest and 5 as the highest score for a given trait. Over pilots like the one in Thailand, comparing these scores to ensuing repayment data gave a clearer picture of what makes a promising thin-file borrower.

Through its research, Begini found conscientiousness and honesty to be the traits most suggestive for a good borrower, with applicants scoring highest regarding conscientiousness proving to be almost three times less likely to default than those who scored lowest.

Source: Begini

Such results support the prevailing idea that expanding financial services to thin-file applicants requires not a narrow-minded understanding of a person’s on-paper finances, but a deeper understanding of how individuals handle these financial circumstances.

“If someone has that high level of conscientiousness, regardless [of financial circumstances], they will find a way to make that critical payment if they view that product to be extremely important in their lives.”

James Hume, CEO, Begini

In Begini’s trials, research showed several other traits strongly correlate with being a good loan applicant. Having a present bias— in which people lack patience to receive rewards (i.e., money) that would be larger with time — increases the risk of default. Those who are overconfident evince higher rates of default.

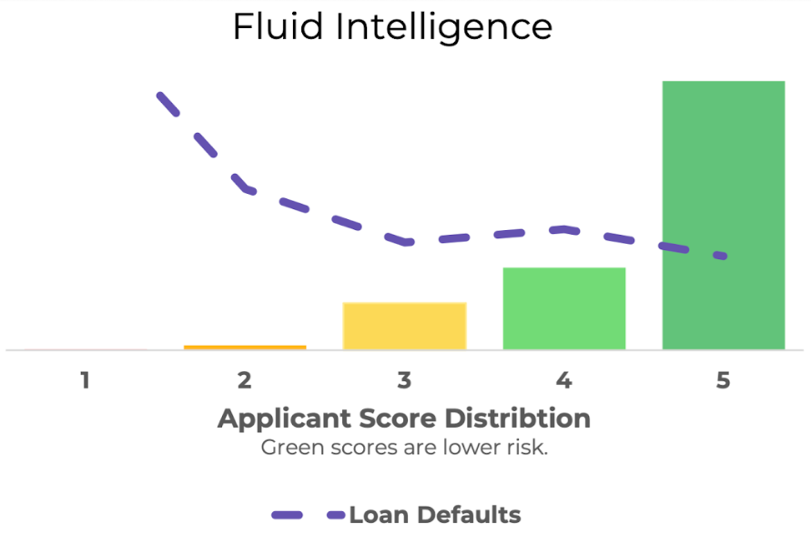

But there are nuances to how several traits impact lendee behavior. Something like fluid intelligence — a trait that involves logical thinking and memory of images — exhibits relatively consistent default rates among those that achieved a score between 3 to 5, the highest. Yet for those whose fluid intelligence scores are as low as 2 or especially 1, the default rates skyrocket. A trait like optimism provides the strongest repayment rates when someone exhibits a modest amount— not overly optimistic they’re not realistic, nor too pessimistic that belief becomes a self-fulfilling prophecy.

Source: Begini

Understanding this nonlinearity within certain traits — and the underlying relationships between separate traits — is fleshed out through machine learning capable of finding deeper features and patterns. Begini continues to evolve their generic model as more data across geographies flow in. With more time and data, more granular patterns can be discerned through deep learning.

There is no singular “model borrower,” with different character traits interacting with one another in innumerable ways. More detailed understanding, as more data is gathered and crunched, will yield multiple avenues to find promising thin-file borrowers that are otherwise rejected. But in terms of character traits, the data suggests the “model borrower” to look like a conscientious, honest individual with a high locus of control — a belief in controlling one’s own fate — alongside a balance in optimism, moderation and life satisfaction.

“The psychometric assessment is not magic, but the data validates our hypothesis that the behavioral information can correctly [predict] credit risk.”

Catherine Chen, Head of Data Science, Begini

A Second Lease On Loans

Putting psychometrics into practice allows for various pathways to both meet the desires of a given lender and tailor offerings to a particular customer base. Once repayment data starts coming in from a client, Begini can analyze the data and create a custom build attuned to the characteristics of their customers, a process that Chen has found to double the prediction rates for loan repayment. Understanding the personality profile of a given client can also allow for alternative payment methods and approaches to customer relations that better match the character traits of that given applicant.

A customer exhibiting troubling levels of present bias, for example, can receive virtual rewards in a gamified setting to stave off irresponsible spending. Those possessing lower levels of fluid intelligence can be given increased reminders of payments needing to be made and further assistance calculating financial status and patterns. Generative AI-powered chatbots can intake customer data on optimism levels to keep customers even-headed — offering positive words of encouragement for the most pessimistic, and conveying words of caution to the overly optimistic.

Psychometric data isn’t the end-all-be-all in provisioning thin-file cases. Device data can also be used in combination with the psychometrics as a behavioral footprint, if different from social data. Applicants with financial apps in their phones are more likely to be good borrowers than those who have gambling apps, for instance. Some mobile money data can be helpful as well — if done carefully, according to Hume.

When other data is lacking, psychometrics may take the lead. In Honduras, access to credit is limited to only about a quarter of people, with smartphone penetration likewise insufficient. However, according to Jacobo Santos, head of analytics and risk management at Solvenza, this has made psychometrics a perfect solution to meet the needs of the Honduran market, which has many thin-file applicants operating in informal markets.

Solvenza is one of several companies operating in tandem to provide essential, yet expensive, items for people mostly operating in the informal economy, including motorcycles, ATVs, TVs and smartphones. With Solvenza serving as the credit provider for these customers, the goal, says Santos, is to ultimately provide straight cash to poor Hondurans in the informal sector — and the only path he sees for that to happen is through psychometrics.

“It's going to be the main source [of data] for us now. The whole history behind a good [credit] score [is] not aligned. But with this alternative data, you see the real behavior of people."

Jacobo Santos, Head of Analytics and Risk Management, Solvenza

In the case of Solvenza, which began with a pilot and will be heading towards a full launch of psychometrics, psychometric evaluations were given to 500 applicants otherwise rejected for loans. Of those, 25% received loans thanks to their psychometric scores alone — right in the ballpark of the 15% to 30% “rescue rate” Begini typically finds its clients approaching.

Though Solvenza incurs a higher risk with these individuals, lending terms are adjusted to retain more favorable rates compared to the other last resort options available for these highly marginalized populations, who are often fishermen or farmers. Starting at a conservative cutoff for providing “rescue model” loans, Solvenza is waiting for more results before rolling out psychometric assessments on a wider scale.

Impartiality Towards Our Partial Selves

According to Santos, customers enthusiastically opt for this second chance at loan origination, with them often surprised by how “easy” the assessments are. Rather, it’s Solvenza’s own employees that have been skeptical of approving loans to customers regardless of their financial statements — and without human judgment and all its biases involved.

Such a radical departure from traditional lending towards a psychometrics-based, nearly automated decision-making process divorced from a person’s financial history can seem far-fetched on first impression. It will take time and establishing a record of success to convince the naysayers.

To get there, proper execution will be what matters. Failing to account for cultural differences can perpetuate exclusion of marginalized populations. Using psychometrics in a punitive manner — like rejecting applicants who otherwise would receive a loan — rather than as a second-chance tool invites dystopian possibilities. Enough data needs to be gathered and analyzed in a sophisticated enough manner to provide meaningful patterns and tailored solutions.

However, through proper design like Begini’s model, such risks can be mitigated. Breaking through the glass ceiling of automating lending decisions in a way that leaves applicants feeling seen rather than ignored isn’t easy. Automated lending decisions require a truly 360-degree perspective of an individual that accounts for both financial behaviors and tendencies. Through psychometrics, the possibility now exists for that to happen — and with services customized not only to the size of their wallet, but the shape of their personality.

This article was published with support from Begini.

Image courtesy of Nguyen Dang Hoang Nhu

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Sanctions And CFT: Recent Palestinian And Russian Case Studies

Inclusion Through Gig Work: A Tricky Venture