Can Africa Leapfrog Towards Open Banking?

~11 min read

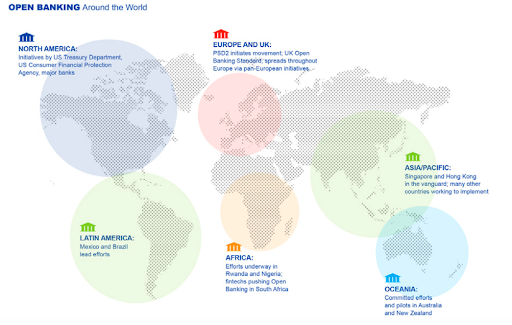

Open banking is seen in some circles as the next great leap forward in digital finance. By allowing application programming interfaces (APIs) to seamlessly connect data throughout the financial system and unify individual profiles, open banking promises to enable individuals and businesses to more easily access an array of products best suited to their needs, lowering costs for financial institutions and consumers alike and thereby facilitating innovation and inclusion. Europe has led the way in open banking through initiatives like the EU’s second payment services directive (PSD2), with countries in Asia and the Americas following suit. Yet in Sub-Saharan Africa, the regulatory frameworks for an open banking future are largely yet to materialize.

Despite its many benefits, the alternative path to financial inclusion many Africans have taken through digital financial services has its shortcomings, like data silos that render telco- and fintech-driven products limited in their insight and personalization capabilities — issues that open banking in theory may do quite a lot to overcome. But many financial institutions in the region still struggle with digitization efforts, let alone modernizing banking architecture conducive to an open API-driven system. Although a rapid “leapfrog” towards an open banking-driven financial ecosystem may not be in the cards in Africa, forward-thinking financial institutions and supporting tech companies are laying the groundwork for such a transformation to take place, facilitating cloud-based architecture that already can elicit many of the benefits in limited form that open banking provides.

Not Quite Ready For The Big (Open) Stage

An open banking framework, for all its advantages, also comes with vast security and privacy concerns that can only be addressed through proper regulation of an open banking regime as well as robust data protection standards. Even regional fintech leaders like Kenya have been slow to implement data protection laws, and the only African country yet to legislate open banking frameworks is Nigeria, which launched a regulatory framework earlier this year that establishes principles for data sharing across the banking and payments ecosystems. This legislation was preceded by Open Banking Nigeria, a private sector initiative that facilitated unified API standards across the country’s banking system.

While Nigeria has positioned itself as potentially one of the first African countries to embrace and benefit from open banking parameters, the fact remains that it will be a multi-year undertaking to reach the market. As seen in early adopters like the UK, which initiated its shift towards open banking in 2016, implementing open banking frameworks can take several years from when it is first legislated and done in stages, starting with non-sensitive data sharing before progressing to bank account data and eventually more sophisticated financial products at a later stage. Along with Nigeria, countries like South Africa, Kenya, Uganda, Rwanda and Ghana are among those in the region viewed as best-positioned for open banking adoption — but it will be a long journey for these regional leaders, nonetheless. CGAP Regulatory Expert and Senior Financial Sector Specialist Ariadne Plaitakis, who co-wrote a CGAP research paper on open banking last year, estimates it may take five years for true open banking to launch in the region.

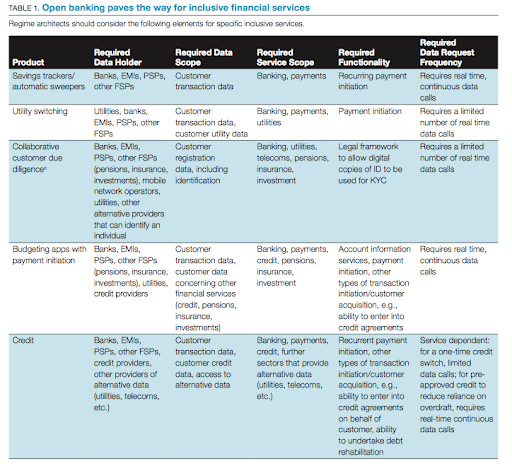

Source: HID Global

“I think there are a lot of prerequisites for it to take off. The legal framework is important, but you have to make sure that the right financial services/ products, the right types of data and right entities are part of the regime of the framework…You should include in the scope whichever are the main institutions that are serving and creating a digital trail for the low-income population, which could include not only e-money but non-finance providers such as telecoms and social media. And you may wish to include more sophisticated financial products, such as insurance, investment and pensions, in order to facilitate use cases for the low-income populations.”

Ariadne Plaitakis, Senior Financial Sector Specialist, CGAP

In Africa, Plaitakis views solutions like mobile money as a must-have to include for any open banking regime in a place like Kenya, along with microfinance. As Plaitakis describes, open banking ecosystems can look quite different depending on the institutions involved and conditions set. Is there total reciprocity in data sharing between institutions? And among data that is included, does it incorporate banks, fintechs, community savings organizations and — extending beyond into open financing possibilities — data holders like telcos and even big tech?

How regulators decide to facilitate secure data sharing and among which parties will decide much of how the balance of power shifts among these different entities. In a possible iteration of Africa’s open banking ecosystem, where financial data is liberally shared between institutions, it can even be foreseeable for data-rich big tech companies like Facebook to dominate financial payments and products fields as they combine externally derived banking data with swaths of personal data they possess to create fintech behemoths. But the more encompassing an open framework regime is, the more complicated and multi-layered the regulatory process must be.

This uncertainty over how open banking regulatory regimes will look has strongly influenced the shape of efforts by financial institutions eager to embrace open banking principles. The Co-operative Bank of Kenya has been an early banking institution to facilitate the transition to cloud-based architecture. However, its efforts to utilize open APIs to expand its suite of products to customers is stymied somewhat by questions over how the regulatory roadmap will truly look like, with potential partners slow to come on board.

“The thing that is lacking is that bit of regulation. There isn’t an unwillingness [among potential partners], but it’s because of the uncertainty that most of them are hesitant. The regulator in Kenya is starting to say we want to start monitoring the microloan providers, so if they are initiating certain businesses, we actually need to sit on the data knowing there are some uncertain risks, like regulation, which [will] bind you [for] five or ten years to come.”

Charles Kinyanjui, Head of Digital Integration & E-commerce, Co-operative Bank of Kenya

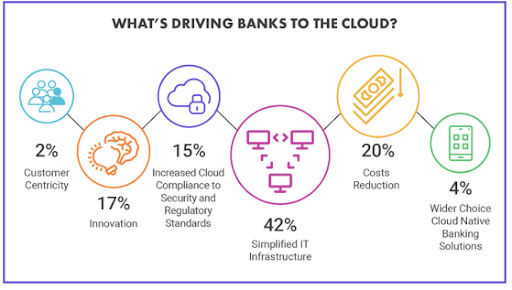

The Future Is Uncertain — Yet The Future Is Cloud

Without the regulatory frameworks to initiate truly free data sharing and seamless tech stack layering, some fintechs and banks are migrating towards a cloud-based architecture that in the interim can be a vehicle for bilateral data sharing agreements with partnering entities, while fostering the infrastructural capacity to operate in a true data-sharing future. A lack of API standardization means that financial institutions may need to develop specific APIs for each partnering entity, diminishing the saved costs of a simplified, standardized framework that Nigeria has already made significant progress on. However, by offering specialized financial products in areas like lending through third-party providers, financial institutions can save costs, which subsequently means lower fees for their customers.

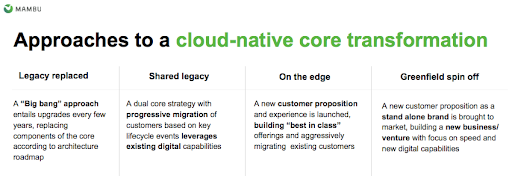

If there is a leap to occur in the African context, then that leap would be driven by cloud-based architecture. A transition to the cloud can be lengthy and costly for financial institutions, especially among older, more traditional banking institutions. This infrastructural and piping revamping can take various characteristics depending on a financial institutions’ starting point and envisioned endpoint, which also varies based on the regulatory framework such entities plan for.

To both implement the data migration process towards cloud architecture and receive approval from regulatory agencies in the interim, innovation-minded financial institutions partner with third-party tech platforms. Mambu is a true software-as-a-service (SaaS) cloud banking platform that has already worked with banks and financial institutions in Africa and other regions around the world to facilitate this migration process. Mambu offers a suite of models to assist banks in transitioning to a cloud-based, API-friendly architecture through its “composable banking” approach, in which financial institutions can select the nature of transformation suited to their needs. While a complete transformation in banking architecture can be more costly, lengthy and offer solutions less tailored to a financial institution and its customers’ needs, composable banking allows institutions to modernize their systems in a targeted, tailored and agile way.

Source: Mambu

Subsequently, in the African context, Mambu sees its services as best suited for neobanks as well as Tier 2 or 3 banks that desire to modernize specific units to meet their customers’ needs. Such financial institutions benefit from the ability to enable deeper segmentation and present a wider, personalized array of products to their customers.

“If you start [connecting with third-party] products, how is the current system going to maintain that? Cloud technology gives you that agility and scalability to really answer to that very quickly. With the way our solution is built with open APIs, we give our customers the ability to plug in, plug out [with] whatever fintechs they want to, when they want to. All [of] our APIs are publicly published, so it’s easy to get [third-parties] into their solution.”

Jaco Fourie, General Manager, Mambu Africa

One notable example of this in action is Mambu’s work with TymeBank, a digital bank in South Africa. TymeBank employs a hybrid model, consisting of an app, a debit card, and close to a thousand kiosks across the country already, where the majority of its onboarding of over 7,000 customers per day takes place through partnerships with local retailers. Tyme utilized Mambu’s composable model to integrate APIs throughout its physical and digital system.

“As a modern bank, we’ve realized that we need to be more in the customer’s life than just a bank... If you can sell it and it’s a digital product that the customers love, we try to sell it through the banks’ application, thus keeping their attention. While the core banking system is important, our tech stack is built around this microservices architecture. The core banking is a vital service for managing accounts, but we manage the customers’ relationships to all these other services. And Mambu is one of the few products that lets us do that.”

John Kane, Chief Innovation Officer, TymeBank

As Kane notes, transitioning to a cloud-based architecture allowed TymeBank to reduce its cost of delivery while going from zero customers two years ago to over 3.3 million customers currently, partnering with third-party providers in areas like lending and vouchers instead of building out the tech stack themselves. This reduction in costs is pivotal in the banks’ drive towards zero fees, a significant element to financial inclusion efforts.

Source: Finastra

South Africa is likely the country in Southern Africa best prepared for an open banking regime, considering its higher levels of banked population, the sophisticated suite of products already offered by leading banks, and the eagerness to enable APIs among digital and some retail banks. However, the current activity in South Africa related to the API and cloud architecture space, though regulated by South Africa’s data protection framework (“POPIA”) enacted this July, does not qualify as a true open banking regime as defined by CGAP’s Plaitakis. As elsewhere in Africa, much of the activity in the API space deals with payment initiation services, which may allow payments through third-party providers but fails to facilitate data sharing by itself. While customers by contrast can connect with any third-party provider under a truly interoperable open banking scheme, banks are able to facilitate their own ecosystem of products through bilateral agreements, as is the case at Spot Money, another neobank in South Africa with its own “open API marketplace” that includes retail banking, digital financial service providers and other fintech providers via direct integrations.

Overall, digital banks face a less arduous journey to become cloud-based, and especially in Africa, where some retail banks are still undergoing various steps of digitization. Many of the Tier 1 banks remain content with their offerings and lack the appetite for core transformation. In South Africa, one of the leading retail banks to adopt APIs more aggressively is Nedbank, which has partnered with third-party providers to augment its offerings for customers and develop unique value propositions. Through the aggregation of various partner services, Nedbank embeds financial services products across multiple industries to realize a more integrated and seamless delivery to its customer base, reducing time and cost to serve and to most importantly innovate quickly, according to Chipo Mushwana, Nedbank’s Emerging Innovation Executive.

Mushwana notes the difficulty some smaller fintechs have in accessing the technical know-how to integrate with APIs, causing delays in reaching the market. In the current interim sans regulations, retail banks like Nedbank must choose to assume greater risk, with the anticipated payoff of becoming a market leader as a true open banking regime takes shape.

“Without a proper regulatory regime in place, we do not have a framework to define clear liabilities and accountabilities between the TPPs (third-party processors) and Nedbank, and as a result, we assume most of the risk, [so] we choose to be cautious. Our relationships with third parties are managed contractually and will differ based on the services consumed. This actually gives us more flexibility in how we deal with and manage our relationships with TPPs.”

Chipo Mushwana, Emerging Innovation Executive, Nedbank

Possibilities And Perils Across The Value Chain

How open banking will impact financial ecosystems in Africa is still uncertain, yet experts mostly agree that under an encompassing data sharing regime, retail banks may be the ones to lose out as their hordes of valuable data is shared with more agile fintechs and digital banks. Yet among legacy banks, those who embrace cloud architecture early on may be those who can reassert their role in a more collaborative ecosystem, where competition will be a matter of finding one’s niche rather than necessarily dominating business end-to-end.

Along with its national retail footprint, Co-operative Bank of Kenya comprises thousands of local SACCOs that together own the majority of the national bank. The bank’s efforts to digitize local SACCOs in an advisory role and transition them to a cloud-based architecture aren’t complete, yet they have started to see some of the benefits both within their internal ecosystem and the wider Kenyan ecosystem. According to Charles Kinyanjui, Head of Digital Integration & E-commerce at the bank, about 80% of the cooperative bank’s third-party access services currently deal with payment initiation services, with key potential Kenyan partners like the Talas and M-Pesas of the world yet to be integrated. However, Kinyanjui views the banks’ future role as both a banking platform and a banking-as-a-service in the wider Kenyan ecosystem, utilizing its unique advantages in community-driven banking.

“Telcos are very advanced. Like you take a Safaricom, they can have us for dinner, that’s okay. But if you are looking at close collaboration, you are able to build with such entities. Then it will bring also the element of disruptor banks, the neobanks and challenger banks that want to set up locally. We need the comfort of assurance on some level that the other sectors of the economy are not going to pull away and turn into a bank level of an entity [by themselves]. It’s a bit of making sure that you’re sitting on the right side of the table — making sure that you’re within the fintech space, you’re within the telco space, ensuring you have those synergies built into them.”

Charles Kinyanjui, Head of Digital Integration & E-commerce, Co-operative Bank of Kenya

Cloud architecture also allows for more data sharing within the cooperative ecosystem at the local level, with Co-operative Bank of Kenya viewing its cloud architecture as a pivotal step towards personalizing services. In areas like transport, agriculture and housing, the local cooperatives in Kenya Co-operative Bank’s network who have transitioned to the cloud are able to pool resources together to gain more granular industry data insights that better track costs and savings in order to implement reforms. Once a comprehensive data sharing regime is in place, the benefits are expected to multiply, allowing fintechs and third-party providers to unify data sets and offer personalized products for cooperatives at the micro level, according to Kinyanjui.

To reiterate, a personalized tech stack spanning an integrated digital financial ecosystem will take time. Data sharing rules will determine how exactly customers benefit as well as the marketplace share that different financial entities establish under a transformed ecosystem. Yet undoubtedly, cloud-based architecture will be a necessary asset for any company looking to save costs and provide personalized solutions to customers. The personalization of services that open banking unleashes will drive innovation in areas like SME financing, BNPL and microloans; as a Mondato Insight recently described, digital lenders in the continent view open banking as the solution to the industry’s high interest and default rates — a consequence of incomplete or one-dimensional data sets undergirding alternative credit scoring.

Source: CGAP

As African financial institutions keenly anticipate forthcoming regulatory regimes, the spectrum of possibilities in this space remains vast. But among those financial institutions that invest in modernizing or transforming their infrastructure to account for the cloud-based, data-sharing world to come, they will be well-positioned to carve out their niche among the plethora of third-party services likely to proliferate in a transformed ecosystem.

Image courtesy of Riccardo Annandale

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

The Gig Economy’s Next Frontier: Africa

From Seed To Table: How Fintech Will Optimize Food Systems