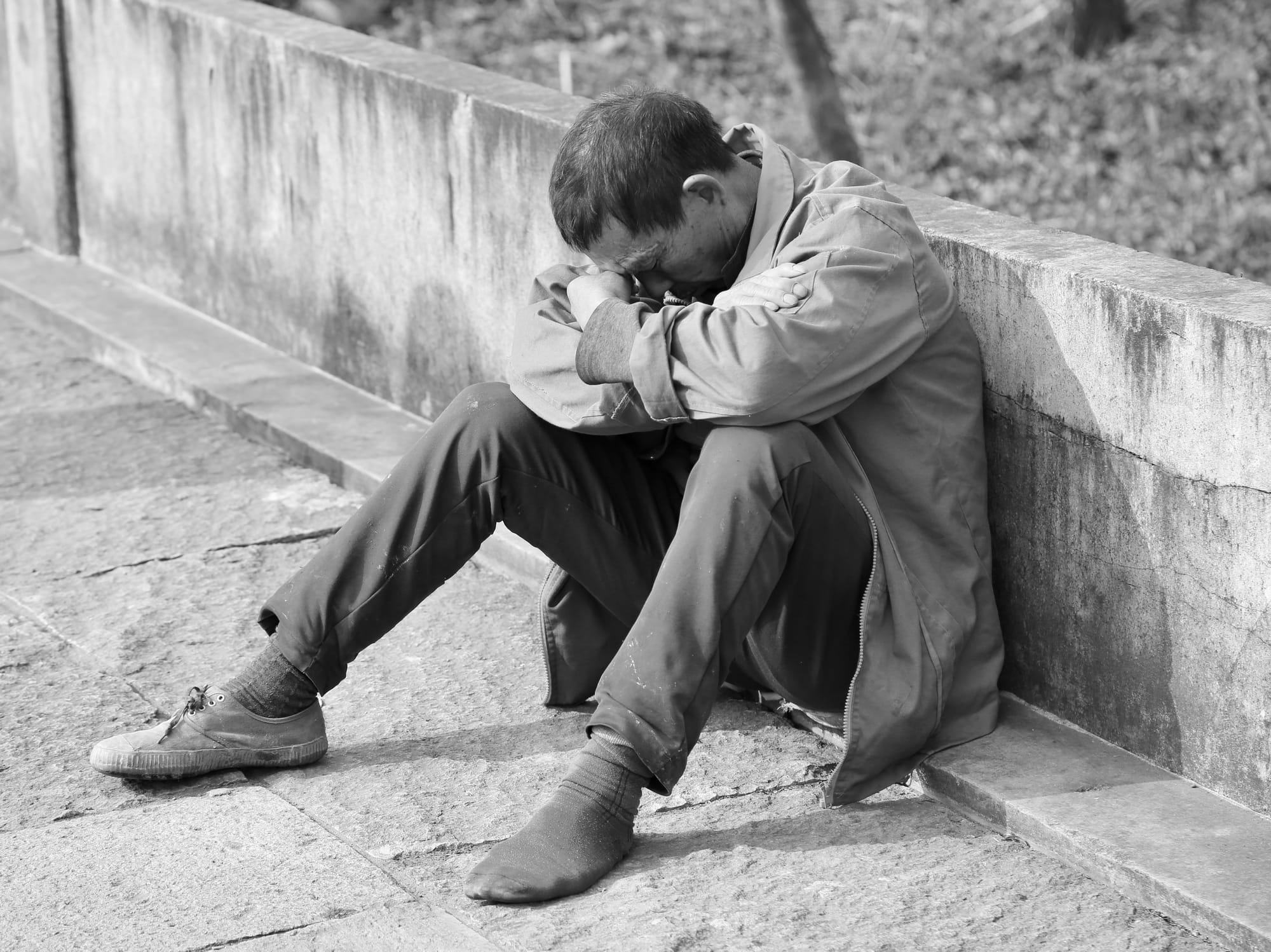

Under Control: Emerging Markets in Crisis Mode

~6 min read

Financial services targeting customers at the bottom of the pyramid (BOP) such as mobile money, and emerging payments, such as digital wallets, are usually not profitable in the short term. Such services not only have significant set up costs but also heavy ongoing capital expenditures such as customer acquisition costs. Considering these costs and limited short-term benefits, Mondato Insight asks, in our second part of our two-part series on the financial crisis, how will a slow macroeconomic environment affect digital finance and commerce (DFC) in emerging markets?

Last Time Around

As DFC was just developing when the 2008 financial crisis hit, there is not much empirical information available to evaluate that crisis’ impact on access to finance in emerging markets.

However, effects did vary by region, type of institution and business model. As observed by Mayumi Ozaki, Finance Specialist from the Asian Development Bank, “In general, if a country was less integrated into the international capital market, it was less affected. Similarly, financial institutions that had more local funding sources (i.e. member savings, etc.), rather than international commercial borrowings, were less impacted.”

To grasp how the DFC industry would react to a new downturn, we have taken a look at the demand and then the supply side, as related to telco and bank offered services, of DFC in emerging markets to try and evaluate their vulnerability.

Mature MNO Mobile Money Programs Should Weather the Storm

The majority of mobile money providers recognize the need for long-term investment in their service. Mobile money is an operating expenditure (OPEX) heavy business, although capital expenditure (CAPEX) is not negligible. MNOs usually invest six to eight times the revenue the mobile money unit generates in the start-up phase, and only the mature businesses can be expected to generate meaningful revenue. Further according to a GSMA study on mobile money profitability, early stage mobile money (1-2 years) divisions have very little revenue, less than 0.5% of the total MNO revenue, and in the high-growth stage (5-4 years), revenue grows to about 5% of the total MNO revenue. Only in the mature stage (after 5 years) is mobile money business revenue significant, making up about 15% of total telecom revenues.

The majority of telecom operators in emerging markets have launched a mobile money program, whether successfully or not. There are 271 mobile money deployments in 93 countries live at the moment. Most of the deployments are past the early stage (70% reported earning more than 1% of total MNO revenues), and now only have OPEX. As OPEX funds come from the mobile money revenue, an economic downturn should not have a significant impact on existing businesses, as long as adoption and usage remain stable or grow. The only negative impact could be “due to a lower intensity of the overall economic activities,” clarified Guntur Sugiyarto, a Senior Economist in the Economics and Research Department at the Asian Development Bank.

Investment in new add-on products such as insurance and loans, however, may be positively affected, depending on the business model and product. For example, during downturns, demand for lending services is expected to increase, as an economic slowdown makes it more difficult for individuals and small business to make ends meet. “There is a need for simplified small/medium loans with reasonable interest rates in Latin America. But they are risky” shared Mr. Sjögren, CTO at YellowPepper.

Emerging Market Banks Decrease Focus on DFC in the Short-Term

All banks are not alike, as banks have different target clients and operate in unique environments. However, all banks in emerging markets will be exposed, to some extent, in a crisis. “All will be effected by a slowdown, for as profits go down, banks will reduce the amount spent for many things including innovation and research,” told us Dr. Sugiyarto. Banks also tend to cut digitization budgets in hard times confirmed Mr. Sjögren. “When budgets are coming down, companies traditionally cut on perceived non-core expenses such as marketing and training, with innovation also being at risk,” adds Gwenaël Trotel, Head of Consumer Solutions in Standard Bank's Emerging Payments Group, in a recent interview.

There is an opportunity for digitalization as a vehicle for cost cutting. “African banks strive to address their customer needs via digital channels, as customers live more and more in digital ecosystems, and this is where the bank needs to be present and deliver services. Furthermore, these channels are far more efficient than bank branches in our context”, said Mr. Trotel. In comparison, physical and online branches are effortlessly accessible in Europe, but in many African countries, “visiting a branch can be very expensive and time consuming, and that is where mobile phones become important,” adds Mr. Trotel.

But Innovation Stays A High Priority

In a crisis, banks will be expected to continue to innovate, but will try to keep costs down. “Even if the economy slows down, banks will continue to innovate because it is a matter of survival, they cannot roll back innovation” shared Daniel Andrade, Mobile Solutions LAC at Visa.

Some solutions providers understand this, and should still be able to win business while helping their clients. “YellowPepper has been in Latin America for ten years and seen various markets going through crises. We manage such situations by offering good products and being flexible. We charge lower set up fees and partner with banks to decrease their exposure,” shared Mr. Sjögren.

On the other hand, some banks will look to develop products in-house or work with local companies versus international ones when there are exchange rate pressures, such as in South Africa at the moment. “Banks would look at innovation within the bank, tweak solutions in an innovative way and make sure they resolve real customer problems” confirmed Mr. Trotel. From a corporate perspective, banks are recognizing that Fintech collaboration is required to remain nimble in execution and delivery. This is further compounded by the current exchange rates that make it expensive to purchase technologies from the US and EU, “thus organizations start looking internally, developing their own solutions and/or working with Fintech providers from emerging economies,” adds Mr. Trotel.

Consumer Demand for Better and Faster Services Will Not Be Effected

Consumer demand is “very difficult to predict, for all the cost saving strategies as a result of a slowdown can change not only the level but also the pattern of consumption expenditure,” shared Dr. Sugiyarto. However, a crisis would not necessarily decrease the demand for better customer service and convenience via digital channels. It may actually increase it for certain types of services, especially those that decrease costs.

“Demand from customer will always be there. More than 30% of LAC banks’ customers are millennials. Banks need innovation to attract this segment of the market and they want mobile payments more and more,” stated Mr. Sjögren. Millennials want fast and convenient financial services, comparable to other technology that they use and definitely “do not want to go to the branch,” added Mr. Andrade.

Thus, no matter the budget cuts, customers will be expecting better services, that save them money and that are for free. “When times are tough, consumers look to doing things more efficiently and incurring less fees,” Mr. Trotel noted. “Solutions looking at decreasing cost would become more interesting, such as better priced domestic remittance or price comparison apps.”

On the merchant side, Mr. Trotel believes that QR code- based merchant solutions that do not use card point of sale terminals could grow in usage, such as Snap Scan, as merchants would not need to pay for terminals. Anything that saves the customer money would become more interesting to providers.

As we mentioned previously, demand for loans would be expected to grow as individuals and SMEs look to make ends meet. The loan environment has changed greatly since the last crisis in 2008 given the new alternative credit evaluation models and providers, including peer-to-peer lending. An economic downturn would show what models work and which ones do not.

No Strangers to Crisis Mode

While mobile money programs may not be strongly affected by a downturn, banks’ innovation and non-core budgets would be decreased in the short-term. However, providers are not expected to stop working on new services or improving existing ones, given that users have become more demanding, especially the millennials and mobile natives. But most importantly players in emerging markets seem to be prepared to make it work during a crisis, possibly as emerging markets are no strangers to crisis mode.

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Image courtesy of MattJP CC BY-2.0 / ![]() Print Friendly

Print Friendly

The Fate of Big Bills- a Catalyst for Digital Payments?

The Looming Impact of Alternative Credit: Do Banks Need a Lending Hand?