Pandemic-Proof? Revisiting Remittance Rails

~9 min read

Succeeding in the money transfer industry is no mean feat, and requires mastering the ins and outs of a dynamic, yet opaque system of financial interconnectedness. Indeed, for emerging remittance players plotting a path from traction to growth and scale, the competitive landscape can be daunting to untangle, particularly through the current uncertain circumstances and future global economic recovery. This week’s Insight revisits the fundamental structure of the global remittance market, from ‘rails’ to ‘assemblages,’ in order to better understand the consolidation dynamics shaping the birth and evolution of tomorrow’s remittance success stories.

Problematic Predictions

In April 2020, the World Bank issued a migration brief with an ominous tone that warned the remittance community to prepare for the worst - a tumble in global flows down to 80 percent of 2019’s record highs. In the months since, it has become clear that the pandemic has in actuality influenced remittance flows quite unevenly. Migrants sending money home have proven more resilient than expected; transfers from the U.S. to Brazil broke records in October 2020, well into the pandemic. Digital-first platforms specializing in Africa, the region initially expected to experience the most drastic remittance trough, reported spikes in overall activity that have provided a measure of needed optimism during bleak times - particularly as second, third, or n-th waves of surges and responses sweep the planet.

With its update last October, the World Bank’s predictions pivoted towards a narrative of a slower, but longer remittance depression extending through 2021, while completely reshuffling its view on which global regions would be hit the worst. Most experts still agree that the medium-term prognosis, however, is not great; remittance flows to Sub-Saharan Africa are projected to decline by 8.8 percent, amounting to US$44 billion in 2020, followed by a further decline of 5.8 percent, to $41 billion in 2021. This is because remittance flows in large part mirror human flows. No amount of digitization or intuitive user experience will compensate for a structural decrease in the number of migrants allowed to work abroad, as far as the cross-border money transfer market is concerned.

So what can the global community of policy-makers and development stakeholders do to protect this vital source of financial support to the most vulnerable? Short of concrete integrations with the global vaccine distribution - expected to begin in the first quarter of 2021 but as of yet light on implementation details - the storyline for policy-makers may sound a bit like ‘back to basics.’ Foster innovation and competition, streamline and reduce regulatory barriers for users, and aim for a reduction in average costs for customers down to 3 percent. It is perhaps under our current conditions of basic uncertainty, with respect to the pandemic, however, that a review of the fundamentals of money transfer can be most helpful in tracking true north through the turbulent times ahead.

Remittance “Rails” Revisited

Fundamentally, a remittance is a transfer of value from one point to another. In the old days, the only way to get value from one place to another was to physically transport it (think caravans crossing the Sahara with salt and gold). Even today, with cash as the ultimate store of value, the physical transport of stacks of bills forms a crucial component of tying the international financial system together - often in the form of millions in bank notes discreetly sharing cargo space in commercial airlines. But as the global financial system became increasingly connected with innovations in telecommunications in the 1970s, the physical movement of stores of value took a backseat to accounting records.

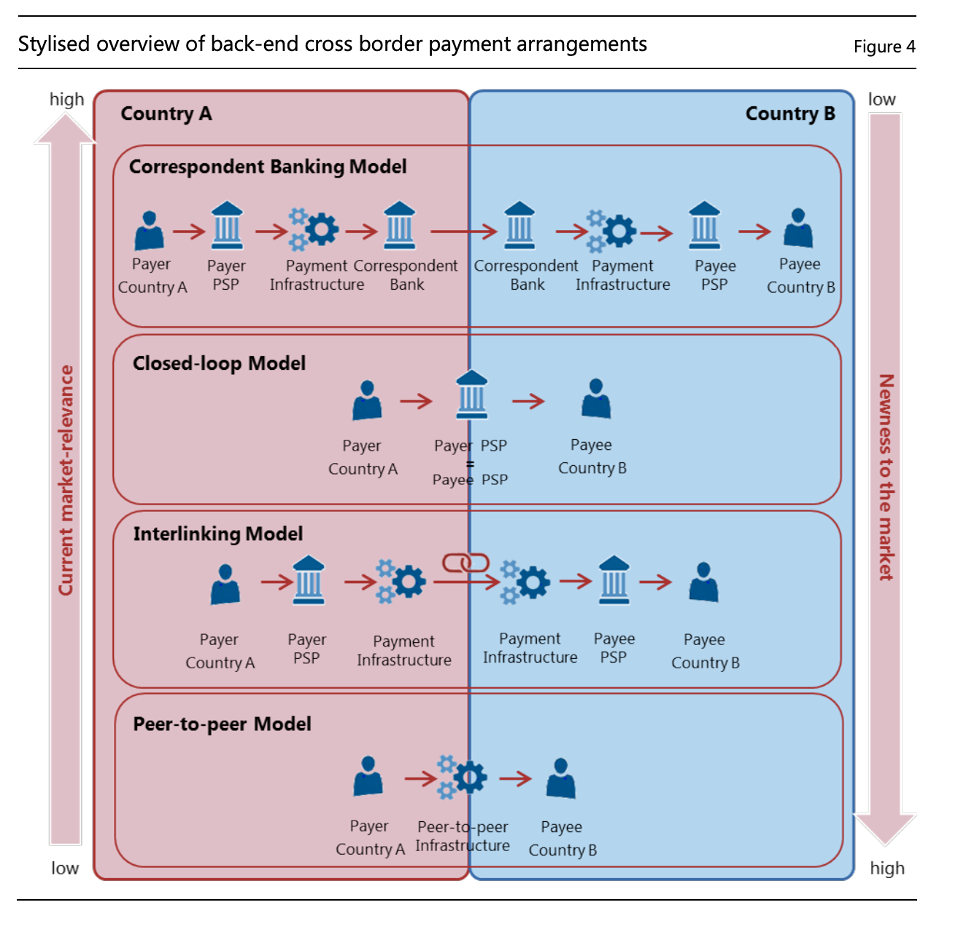

Thus was born the SWIFT system, a messaging protocol that banks and other kinds of financial institutions use to securely track the flow of money from account to account. The SWIFT messaging system is still the fundamental way in which money transfers are initiated across borders, and though it has evolved significantly with technology, its fundamental architecture hasn’t. When analysts refer to banking or payments infrastructure as the "rails" upon which money transfer operators innovate, it is a bit of misnomer that obscures the ways in which efficiencies are identified and exploited. That’s because transfers that originate in one country and end in another are anything but point-to-point - depending on the particularities of the sending bank in the country of origin, its international footprint and institutional arrangements, there may up to five ‘layers’ of banking networks tracking a single transfer from origin to destination - each taking a cut (and time) along the way.

Source: Bank for International Settlements (2018)

The “rails” upon which cross-border flows are predicated have been more accurately characterized as “assemblages” - different legs of a journey tied together by a trusted, if inefficient, communication protocol. The international banking system is perhaps less accurately described with metaphors evoking hard infrastructure like “rails” than by the ‘soft infrastructure’ of “language” - a language that provides directional instructions through infinite combinations of transit points and the codes that provide safe passage through each successive transit point’s gate-keepers.

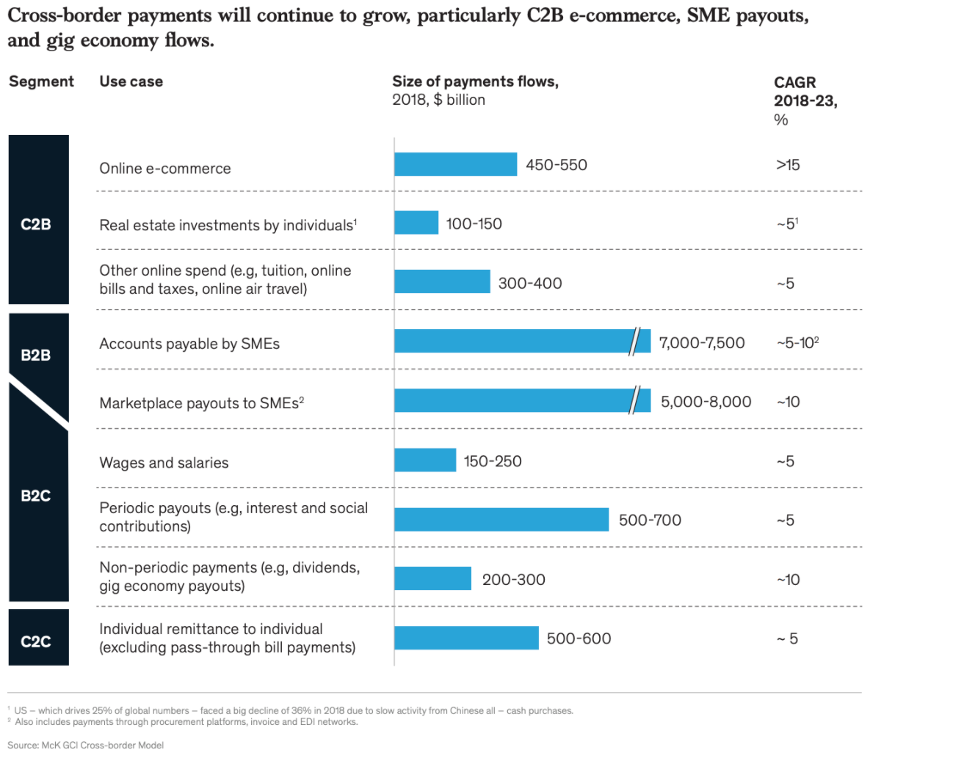

Part of the opportunity in the value transfer space - not just international person-to-person (P2P) remittances, but domestic remittances, as well as the opportunities in transfers between customers, businesses, and even governments (P2B, B2B, G2B, etc) - is in building off and around the assemblages which, for regulatory reasons among others, remain integral to the business operations of most money transfer operations.

Source: McKinsey Cross-Border Payments Report (2019)

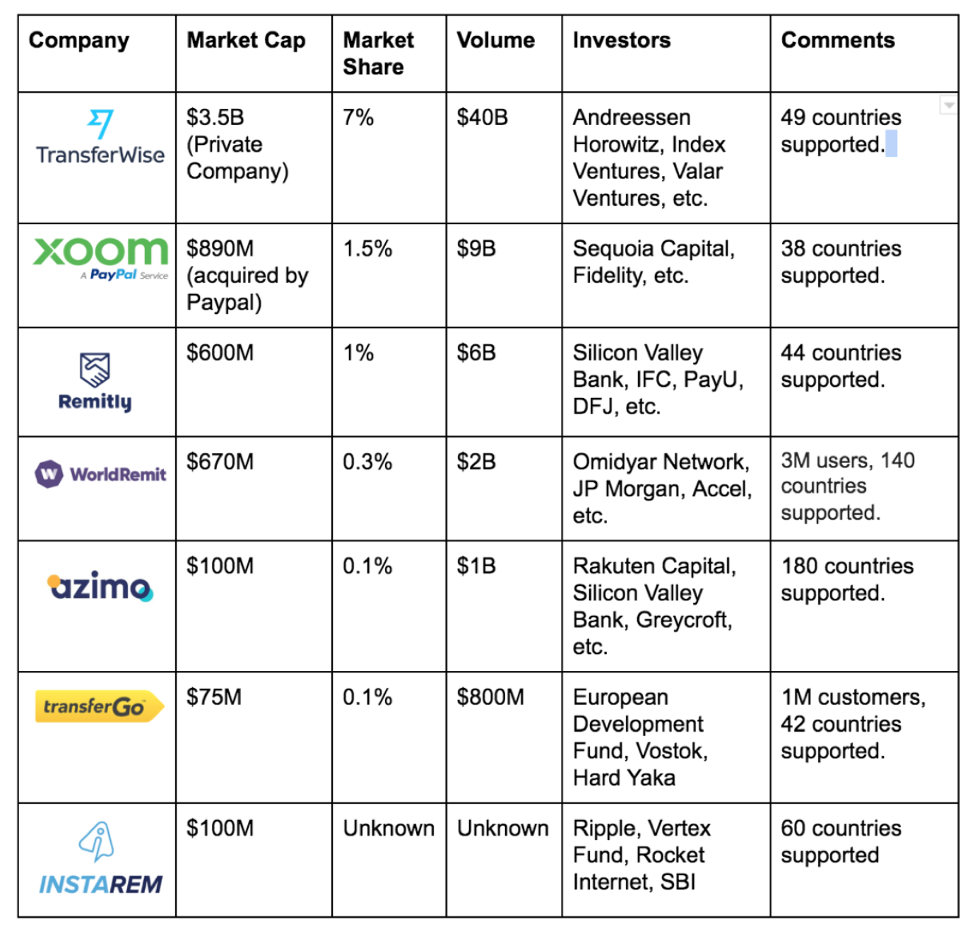

Witness TransferWise, which has in the recent years of the ‘Cambrian explosion in payments’ emerged as one of the most successful fintechs innovating in the transfer space by blending aspects of the hawala system with bank-grade regulatory compliance. Beyond raising successive rounds of millions in venture capital, TransferWise has reportedly achieved profitability on a model predicated on achieving the scale and operational efficiencies needed to get a high-volume, low-margin transfer business in the black.

TransferWise is just the tip of the iceberg. The money transfer ecosystem is rapidly densifying, and the opportunities to identify profitable niches appear to rise exponentially with each additional node in the system: lowering barriers to entry, widening partnership and acquisition opportunities, and whetting investor appetites for opportunities in a sector seemingly experiencing both rapid and long-term disruption. Last and certainly not least, this densification brings players in closer competition with one another, increasing the odds of consolidation wherein bigger players strategically swallow up smaller ones to more rapidly gain market share and growth.

Source: Medium.com / Proof of Capital (2019)

“Ramp”-ing up Growth

For newcomers or fledgling money transfer operators looking to get in on the action, the paths to grow vary tremendously by segment, geography, and timing. Fundamentally though, paths to scale are, firstly, to grow organically through increasing user-base & strategic partnerships, and secondly, to get financed, acquired or absorbed by a larger player in the space, whether by a ‘strategic’ or traditional financier (commercial bank, venture capital, or for more mature players, private equity.) In either case, the formula for success remains roughly the same: demonstrate traction and strong growth.

What gaining traction often boils down to is making it easier to accept cash and pay it out - to ‘on-ramp’ and ‘off-ramp’ money value in ways that are frictionless and inexpensive for customers. In this sense, transfer innovators are themselves acting as creative ‘assemblage-makers’ - identifying under-exploited corridors linking specific demographics (both by geography and use-case) and connecting them in the most efficient way possible, whether through or around the existing ecosystem of players defending their own positions.

Two general strategies seem to have generally characterized the growth strategies of players in the transfer space in recent years: that of the generalist and the specialist. Traditional fintech challengers have opted for the generalist approach of the old-guard leaders of P2P money transfers with which they compete, like Western Union and Ria: develop a strong customer brand relationship and win market share in as many active corridor markets as possible. Here we find operators like WorldRemit, Azimo, and Remitly principally competing on price through operational efficiencies like saving money on brick-and-mortar infrastructure by offering digital-only on-ramps.

The key to this strategy appears to execute piecemeal growth within and across transfer segments and geographies — without biting off more than you can chew. Setting up new corridors can be expensive, and in emerging markets, critically relies on securing the right partnerships for last-mile distribution, where undeveloped digital economies privilege cash-out networks and, increasingly, mobile money wallets and their interconnections.

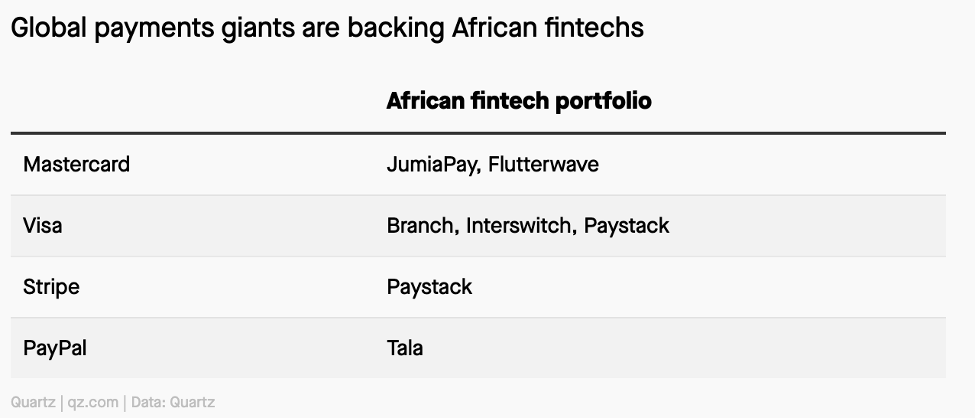

Specialist remitters, on the other hand, appear to hone in on one core value proposition with an eye towards acquisition-oriented exits. Witness Xoom, which was acquired by PayPal in 2015 as a shortcut to consolidating PayPal’s distribution strategy - essentially adding a strong ‘off-ramp’ to its transfer infrastructure. Recent financing activity indicates that payment giants from Visa and Mastercard to old guard players like Western Union are eager to snap up promising specialists, either to fast-track a desired regional presence or to acquire valuable IP or technology in other parts of its business.

This type of consolidation, which analysts witnessed sweep Europe’s payment space and which appears to be picking up steam in Africa and other active remittance markets, reflects the jockeying for position among the “whales” in the global payments space anticipating a future of finance and payments which may fundamentally diverge from the one we see today, intimated in particular by the promise of distributed ledgers as challenging bank supremacy as the ultimate store of value for customers, businesses, and even governments.

Source: Quartz Africa (2020)

The key for specialists, in turn, seems to be ‘don’t get distracted.’ Rather than grow organically by aggressively acquiring new customer segments, specialists focus on developing defensible ‘moats’ and dominating a particular niche - whether use-case or geographic, as in the WorldRemit acquisition of SendWave for US$500 million late last year. As an alternative to being acquired by a large player as recompense for such efforts, evolving with a sticky user base also offers the possibility of growing organically through upselling, and also reveals itself to be a winning strategy; having mastered its particular niche, TransferWise is reportedly considering evolving towards a neo-bank model by monetizing on its unique understanding of the financial needs of its customers, after years of perfecting its transfer operations.

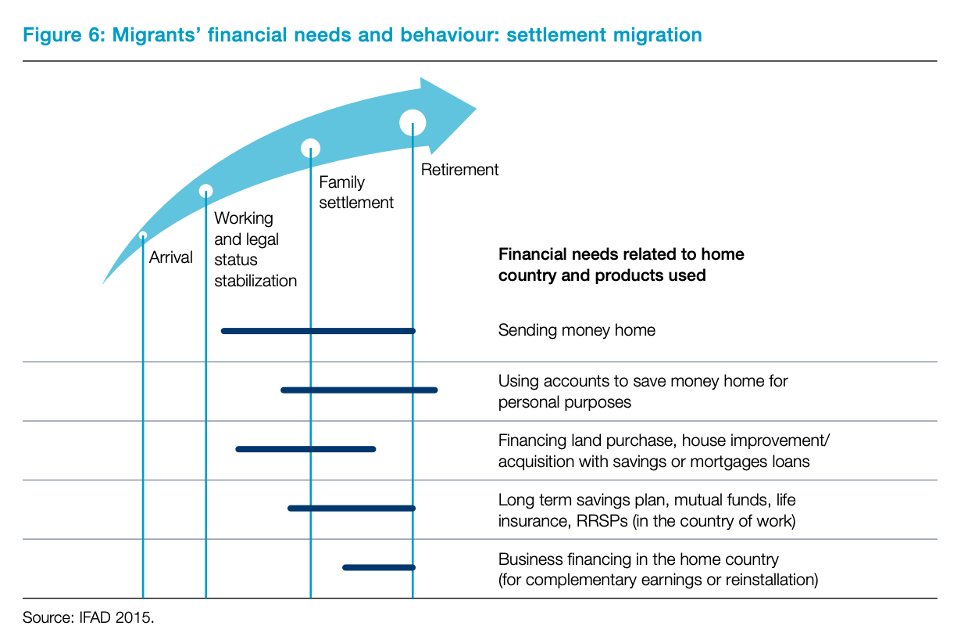

Source: IFAD / World Bank (2015)

Of course, these two tracks are extreme simplifications, and considerations vary wildly by specific use-case and corridor. The advent of ecosystem aggregators like Thunes offers an insight into the specific considerations of achieving growth - with technology players whose raison-d’être is to serve transfer operators through technology and proprietary networks, operators can experiment with new corridors more easily, testing out their hypotheses on which use-cases or corridors might be attractive, from targeting the international cruise-line and vessel crew employee market to localization efforts of silicon giants like Airbnb in frontier economies.

"Most remittance players seek to optimize their networks, but direct, end-to-end corridor building is inefficient and hard to manage. Partnerships with the likes of Thunes makes their lives easier by providing access to a global interoperable membership network and advanced technological capabilities. Rather than manage 30-40 partners, countries, risks, compliance, AML, management, and working capital concerns, we expect the value proposition to increasingly privilege a single partnership that streamlines the process of cross-border money transfer. This will result in greater speed and operational efficiencies allowing the partner to focus on their core business."

Andrew Stewart, Global Head of Networks, Thunes

Accelerating Consolidation Ahead?

The pandemic is far from over, and the future has never been less clear in terms of how the remittance market itself will be affected. While predictions for activity may be slowing down, consolidation activity may be just around the corner, infusing the sector with new dynamism as the world’s cash inexorably digitizes. Finding innovative ways to reduce friction for users, for example by experimenting with zero-fee transfers or by developing deep market knowledge at the last-mile of the off-ramp, will remain critical no matter the business segment.

In this sense, it is perhaps important to note that remittances aren’t just about dollars and cents - nor, indeed, just about ones and zeros. Indeed, the definition also encompasses a form of value transfer closer to intellectual property in the form of 'social remittances,' which represents the “ideas, behaviours, identities and social capital that flow from receiving- to sending-country communities,” including innovative ideas, valuable transnational networks, knowledge, political values, policy reforms and new technological skills. Such transfers may indeed be more “liquid” than transfer-laden money transfers through the pandemic, and be just as critical to getting support to those who need it most during periods of global crises. Another lens to consider, perhaps, in understanding the assemblage formation unfolding as new remittance players are born, grow, swallow or get swallowed by others, and ultimately, evolve with the social and technological infrastructure of money itself.

Image courtesy of Christine Roy

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Have the Stars Finally Aligned for Middle Eastern Fintech?

Minding the DFS Gender Gap: Battling Social Norms to Level the Playing Field