Rwanda: Land of 1,000 Digital Contradictions

~9 min read

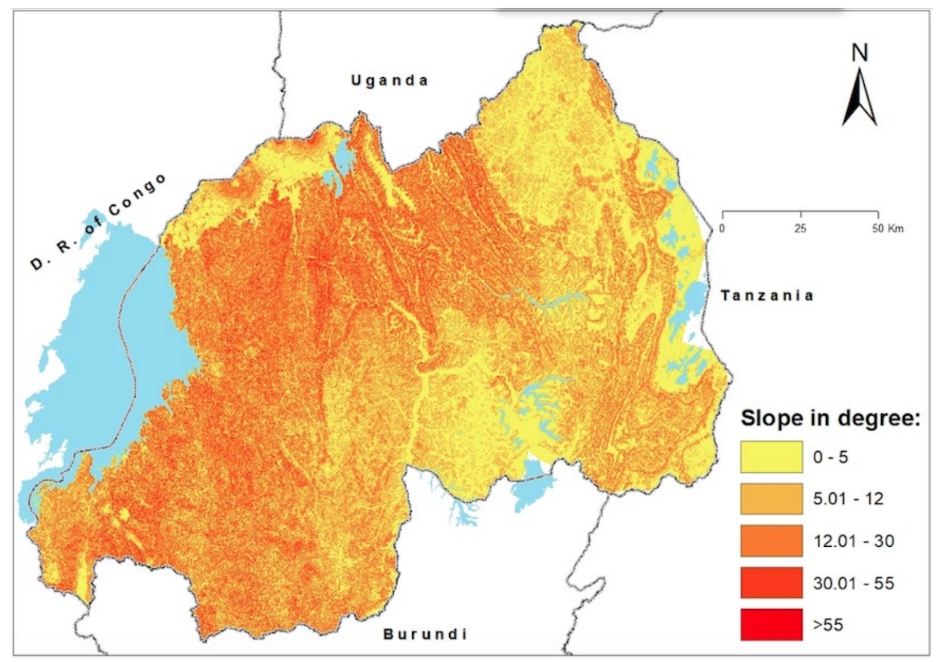

Small, mountainous and land-locked, Rwanda’s rugged topology subtly influences all facets of life for its almost 13 million inhabitants, from producing food, to transportation, to doing business. Geography is only part of what gives a society its character, however, and no discussion of Rwanda can ignore the political violence whose grim apotheosis in 1994 shook the world. Since then, of course, Rwanda has become the “darling of development,” and macro-economic growth has remained both high and steady. Such success is in large part thanks to a ruthless commitment to progress articulated by Rwanda’s strong-handed administration, including heavy branding as not only a tourist destination but also as a hub for innovation and investment. But how successful are such efforts to incubate innovation beyond the city limits of Rwanda’s carefully manicured capital, Kigali, and how much learning can meaningfully be transferred across its cultural and juridical borders? This week’s Insight weighs the promise and limitations of excellence on paper against the market realities of a land holding as many contradictions, it sometimes seems, as hills.

Source: Rwanda Transport Development Agency (RTDA)

Rwandan Relativity

There’s often an inherent tension between the dynamic complexities of any place and the image it projects from afar. The United States, for example, is often perceived as a land of abundance and privilege, and it can easily be reduced to such in the eyes of denizens from states the World Bank terms “Low and Middle Income Countries” (LMICs). Yet such simplifications obscure deeper insights, such as the fact that there are nearly triple the number of “impoverished” Americans (34 million, or 10.5% of the U.S. population) as Rwandans of all income levels.

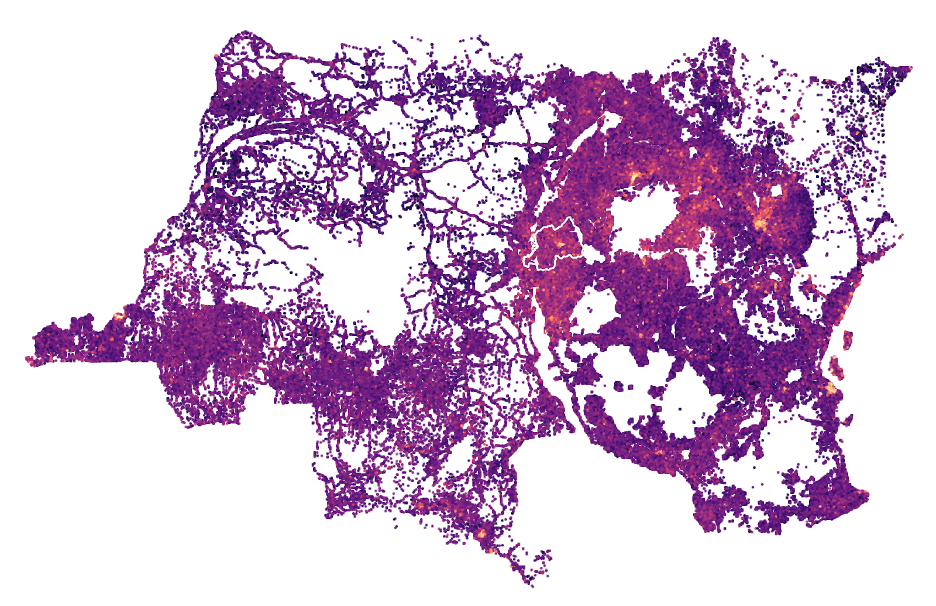

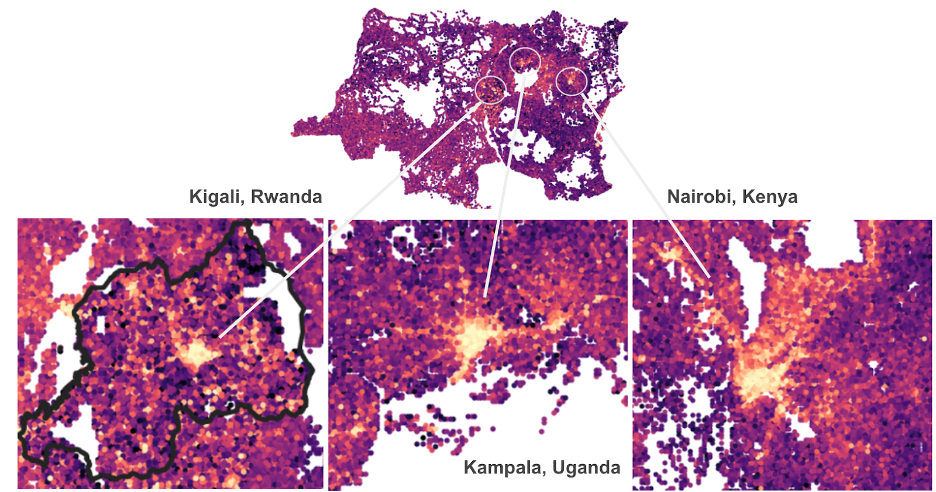

Of course, with wealth as with physics, everything is relative, which is precisely why it can be so challenging to make meaningful comparisons across contexts. Rwanda is 13 times larger than Mauritius (perhaps its closest analog as “the Singapore of Africa”), but 90 times smaller than the Democratic Republic of the Congo, its resource-rich, stability-poor neighbor to the west. State of the art research tackling this challenge of basic comparability offers a more nuanced snapshot of Rwanda’s wealth in regional context:

Relative wealth in populated areas: Rwanda, Burundi, Congo (DRC), Kenya, Uganda and Tanzania (darker = poorer). Visualized in QGIS using data from Micro-Estimates of Wealth for all Low- and Middle-Income Countries, April 2021. Estimates generated at 2.4km resolution by applying machine learning algorithms to vast and heterogeneous data from satellites, mobile phone networks, topographic maps, as well as aggregated and de-identified connectivity data from Facebook, calibrated using nationally representative household survey data from 56 LMICs, then validated for accuracy using four independent sources of household survey data from 18 countries.

At first glance, this data immediately reveals a noticeable concentration of wealth centered in the capital of Kigali, suggesting consumption patterns across the Rwandan territory comparable to those of nearby centers of wealth including Kampala and Nairobi. Yet closer inspection offers insight into one of the country's enduring contradictions: regional averages notwithstanding, the country appears flecked with noticeably deeper pockets of poverty in close proximity to its econo-administrative capital than its neighbors.

In the land of a thousand hills, such persistent poverty at the base of the economic pyramid is sometimes difficult to reconcile with attractive indicators of “Doing Business” on paper, rankings which Rwanda routinely tops in African sub-categories such as “getting credit” and “registering property.” Yet for entrepreneurs looking to test innovations in African markets in a “safe” environment, such realities should not be underestimated. Despite notable progress over the last two decades, Rwanda remains a country where almost half the population lives under the international poverty line — a country where the vast majority of the population handles less cash with their own hands over the course of a year than the exchange-adjusted equivalent of 1,000 USD.

History Matters

It’s important to remember the unique context in which Rwanda emerges and the factors that have driven its trajectory. Perhaps the simplest analogy that frames the country’s development over the past 25 years is the impact of WWII in Europe. The singularly rupturing event of 1994, in which an estimated 800,000 were murdered in less than 100 days, similarly represents a ‘reset’ point from which the current organization of the country departs.

At the same time, it is equally important not to discount the importance of the preceding historical context. Rwanda’s ‘colonial’ period — originally ruled by Germany in the late 19th century, then the Belgian monarchy and Catholic Church until a rushed separation from Burundi and independence in 1962 — was characterized by a transformation of socio-economic designations into formalized ethnic identities that laid the foundation for several decades of increasingly organized political violence.

Many today still associate Rwandan demographics with the infamous socio-ethnic categorizations of Hutu and Tutsi, which along with the Pygmy populations bordering modern day Congo, constituted the most recognized social categories in Rwanda. Prior to the colonial period, however, these categories (a largely taboo subject in the territory today) were largely fluid and economic in character: crop-growers were Hutus, herders were Tutsi, and a switch from one activity to the other could engender the concomitant change in nomenclature.

There are at least two takeaways from this (radically oversimplified) history that illuminate Rwanda’s uniqueness vis-a-vis its digital finance landscape. The first is that the importance of the country’s geography should not be underestimated; with almost everyone living along or between hills, and a large chunk of the national territory protected wilderness, Rwandan population density is second on the continent only to — once again — Mauritius. Where resources are scarce, in life as in business, common spaces become all the more contested, from the social relations between herders and crop growers, to the thoroughfares where mobile money agents congregate.

The mountainous terrain also means telecom tower construction and maintenance is more challenging; basic issues of network functionality persist in particularly hilly parts of the country, like the southeast border region of Rusizi, where agents’ ability to manage float is complicated by poor road and network connectivity.

The second is culture. For reasons beyond the ambition of a market-oriented view of digital access, the average Rwandan’s cultural traits are distinguishable from their neighbors’, inviting caution in assuming a Congolese customer demographic will embrace the same products or services as their Rwandan counterparts. Rooted both in their serious history and animated by their administration’s uncompromising march forward, Rwandans are known to dutifully abide by the law. So when the government proclaims theirs will be a cashless society by 2024, it deserves to be taken seriously.

Leapfrog to Hypermodernity?

Such seemingly timeless features — pre-colonial social structures, landscape topology — still inform the rhythms of daily life today. Though telecommunications, the great reducer of time and space, permeates the country as on the rest of the continent, the growth of mobile money in Rwanda remains a mixed story of rapid growth against structural limits. More than 80% of Rwandan households are mobile subscribers, with just under 15% owning smartphones; the use of digital financial services by adults is estimated at 46%, though almost 90% in one recent study prefer to use cash.

These trends may soon require revision thanks to the pandemic, however; contact-free transactions in Rwanda have spiked over the last year, as they have around the world. But the story is a bit more interesting in the Rwandan republic: with swift and strict lockdowns announced in early 2020, the government mandated the complete removal of mobile money fees during lockdowns, and recent re-introduction of fees do not seem to have dampened these gains. In fact, Airtel Rwanda, the country’s fast-growing but second-largest operator, recently announced the elimination of all P2P transfer fees in its network in a “price-to-win” bid to capture some of the momentum that has propelled, roughly, a doubling in transactions and volumes between 2019-2020 for MTN, its main competitor.

While these competitive dynamics in the mobile money sector (principally through telcos MTN and Airtel, as well as at least 10 other small mobile money licensees, like MobiCash) have driven a large share of impressive increases in financial inclusion (from 33% in 2012 to 65% in 2016) most fintechs appear to have longer to go to prove their financial viability.

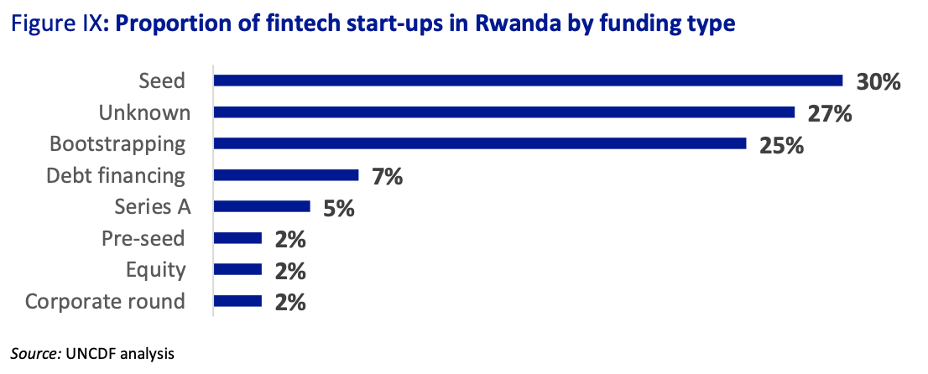

Source: UNCDF, 2019

Part of the reason is due to limited disposable incomes, as previously described, but another may simply be the natural course of time it takes for a young ecosystem to yield fruit. Case in point: of the 44 fintechs surveyed in a 2019 report on the Rwandan fintech landscape, more than 80% were still in the infancy of their funding lifecycles, indicating that most fintechs in the country are probably not yet profitable, and some pre-revenue.

Of Sandboxes and Launchpads

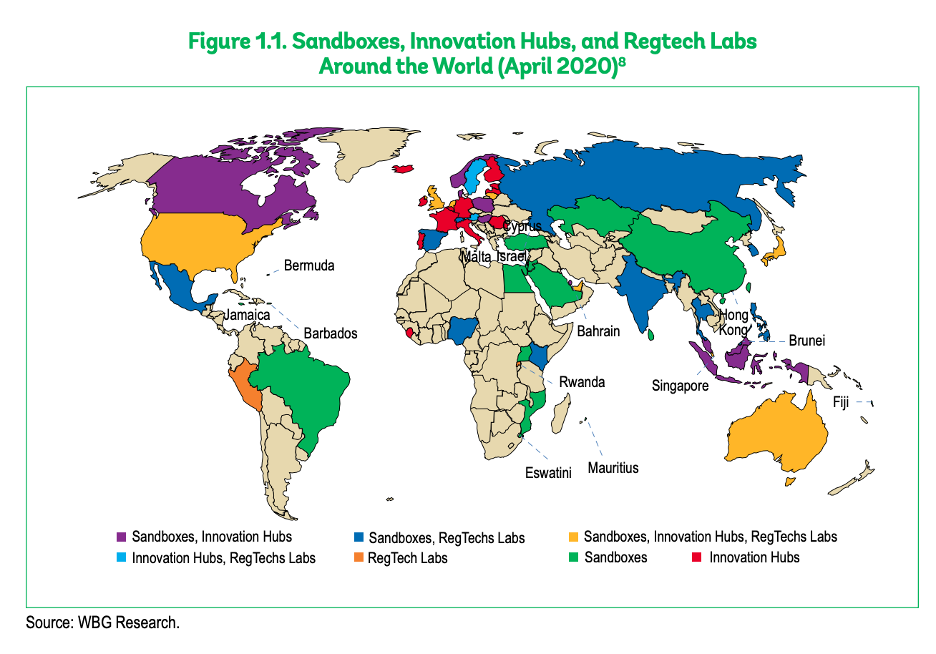

In the last few years, several African countries have looked at regulatory innovation as a lever for catalyzing further financial inclusion through fintech incubation. According to the World Bank, at least 57 countries operated 73 fintech sandboxes in 2020, which provide an opportunity for industry and regulators to co-design the rules of the game in a way that allows the sector to grow in a safe environment (as Mondato has detailed before).

Source: World Bank, 2020

Capital heavyweights like the World Bank and UNCDF have taken an active interest in testing this approach in emerging markets in recent years, helping Sierra Leone and Rwanda launch sandboxes in 2018, with at least five other African nations experimenting with the concept since then.

Rwanda’s digital contradictions are well-encapsulated by its sandbox experience. Despite being known for its administrative efficiency and regulatory innovation, coordinating true ‘ownership’ of the fintech sandbox has not been entirely smooth. Multiple government agencies with different priorities (the Central Bank and the Utilities Regulatory Authority, for example) are actively involved in shaping different parts of the sandbox, like eligibility, licensing and MOUs.

Secondly, getting fintechs to actually apply to the sandbox requires a bit of marketing, which critically involves translating the dry legalese into language fintechs actually understand and are compelled by. Aneth Kasebele, a digital finance expert who helped author the 2019 Rwandan fintech landscape report, describes some of the interdisciplinary challenges with effective operationalization of the sandbox approach:

“A lot of African regulators are quite enthusiastic about the process, but their backgrounds are typically legal or financial, not technological. There is frequently an enormous chasm in the imperatives, worldviews between regulators and fintech startups, particularly in their respective orientations towards risk and time.”

Aneth Kasebele, Digital Financial Services Policy Consultant to UNCDF

Such wrinkles will take time to iron out. A key challenge identified in the report is simply a shortage of multi-disciplinary talent that can help mediate the objectives of such disparate groups, lending support to the idea that maybe sandboxes should be more specifically thematically oriented (e.g. around remittances, or e-commerce, rather than fintech writ large). On the other hand, there are already so few fintechs at all, fewer still if one discounts all those who are really something else, like cleantechs, but find themselves drawn into embedded finance or consumer finance simply because the financial pain points are so incontrovertible.

Another limitation, however, is hard dollars and cents. CGAP analysis estimates that running a regulatory sandbox can require the full-time equivalent of 25 talented individuals and cost between 25,000-1 million USD per year to run.

Then again, this may all be part of the learning process. In the country’s marketing campaigns towards tourism, in its Smart City ambitions, its promotion of Manufactured in Africa phones, a recurring theme bubbling below the surface of bold ambition is a desire to attract interest, talent and know-how to a country that is, ultimately, a digital welterweight punching above its class. Rwandans are well-aware they are still an overwhelmingly agrarian economy, and their leadership’s vision to become a knowledge economy in short order requires massive ambition, drive and discipline — elements which it fortunately has in droves. But such a vision will simply require more time and more talent.

The years to come will see the first cohorts of Rwanda’s regulatory sandbox fintechs graduate or fail, with the close support and scrutiny of investors, government and development agencies. If Rwanda can prove its bona fides as a sandbox, it may indeed eventually aspire to be a regional launchpad for innovation, whether in fintech or beyond — but the list of companies that have alighted to greener pastures beyond its borders are to date limited.

Zipline, the health-drone wunderkind that lifted off in Rwanda in 2016, may be leading the pack with its recent expansion to Ghana and upcoming plans for the Nigerian market. Indeed, their experience will be uniquely instructive for the Rwanda-as-Launchpad theory, given that their drone solution to time-sensitive blood deliveries was particularly well-suited to the mountainous terrain that may — or may not — find analogous problems to solve in ‘flatter’ countries with different problems.

Several features of Rwanda as a market sandbox may be attractive for entrepreneurs looking to test their ideas or innovations (whether digital financial services or otherwise): some elements of geography, plenty of room for growth and innovation in improving access to and delivery of basic services like modern energy, clean water and financial inclusion. But transferability is a delicate task, and for all the breathtaking achievements achieved in Rwanda over the last several decades, one would be wise to exercise caution in interpreting successes from the land of a thousand hills as any guarantee beyond its borders.

Image courtesy of Reagan M

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Chinese Fintech’s “New Normal”: What Does It Mean?

Cryptocurrency: At A Regulatory Crossroads