Price To Win: How Pricing Can Set A Fintech Apart

~10 min read

What’s in a price? This deceptively simple question quickly unfolds into a question of “value” — a much more protean concept, as elusive as it is omnipresent in everything from startups’ pitch decks to CEOs’ quarterly earnings reports. Between the concept of price and value lies a vast body of knowledge and experience attempting to characterize (and influence) the relationship between buyer and seller. The science and art of price-setting, however, has in recent decades been structurally altered both by the digitization of money and the digitization of business in general. As organizations the world over emerge from the initial shock of the global pandemic to rethink their core value propositions, the question of how a price is born remains essential.

A Price Is Born

“Dynamic pricing” — where prices change as a function of supply and demand in real-time — may be best known for its modern, online platform iteration (airline tickets or Uber’s surge pricing). From a certain perspective, however, this used to be the only way to do business. After all, throughout most of the history of commerce, prices were determined on the basis of a negotiation — typically a haggling process between buyer and seller, often in the context of an ongoing relationship, mediated through the exchange of bartered goods, and later, the exchange of money.

Fast-forward to the beginning of the Industrial Revolution. With the emergence of mass-production techniques, buyers increasingly purchased their goods not from individuals but from corporate organizations fixated on profits through the efficiencies of standardization. The price tag was reportedly invented in the 1870s, ushering in the dominance of the ‘take-it-or-leave-it’ basis of market prices set by the seller. Though, arguably, this shift represented a shift in the balance of power in favor of sellers, it has its origins in the Quaker concept of fairness: one price for all customers, after all, has a certain ‘fairness’ to it.

But what, after all, makes a price ‘fair,’ and does it matter? Beyond the ethical implications of such a question, managerial sciences have decisively shown how important fairness (or at least, the perception of fairness) is for businesses to successfully and sustainably keep existing customers and acquire new ones. In essence, price is the dividing line between the value captured in a transaction by a buyer and the value “appropriated” by the seller. Where these lines lie, of course, is rarely transparent, obscuring the picture of who got the lion’s share of the value between buyer and seller — and begging the question of how to turn profit politely.’

But in a world where more and more of the ‘products’ we consume are digital-only ‘experience goods’ and most everything else is digitally mediated at some point or another in its lifecycle , do these rules still apply? After all, beyond their initial development, digital products have marginal production costs, since they can be replicated near infinitely. In a moment where even what was traditionally analog has become digital thanks to the global pandemic, how should businesses take the opportunity to realign their pricing strategy with their value proposition? And as digital finance and commerce expands in emerging markets, do these same processes translate across diverse contexts and cultures?

Pricing Goes Digital

To answer these questions, it is necessary to take a detour through Silicon Valley from 1990 to today. The rise of the digital-born economy was preceded by the early tech giants — the likes of Xerox, Microsoft, and Oracle – some of whom are entering a second act even after decades of profitability. In our cloud-dominated world, it is worth recalling that Big Tech was undeniably hardware-focused in its early days. Need data processing services to manage your client information? Better make room for data center facilities on your premises, not to mention office space for the IT staff you’ll need to hire for troubleshooting, and engineers to maintain the power and cooling systems required to keep the servers humming.

As a company, the price of ‘acquiring’ such capabilities was substantially CapEx-dependent. As the internet matured, however, the dominance of up-front installation costs plus significant one-time, life-time user licenses began to give way to more flexible offerings. Today, a company adding technical capabilities to its core business, whether products or services, is often an on-demand and fairly customizable phenomenon. Subscription-based models offer scaled-down or up versions of the core digital capability on a time-bound (yearly or bi-yearly) or even pay-as-you-use basis. This pricing innovation makes capabilities previously available only to billion-dollar corporations equally available to startups or individuals, plus the inherent flexibility means that a solution can scale with a firm’s services, transforming the vendor-buyer relationship into something more like a partnership.

This new paradigm promotes transparency to such a degree that much of the sales cycle is in fact automated. Instead of dealing with sales reps or consultants, buyers can use tools like Oracle’s Cloud Cost Estimator to build-a-business; they pick what they need and how much they need of it, then receive an estimate instantly. The rub is that the innovation in pricing that the digital revolution has wrought has subsequently changed business strategies, up to and including product design itself — one could say that the line between the product and the pricing has blurred. Hence, the rise of “anything as a service.”

Price Rediscovery

The ‘anything as a service’ model has in fact become ubiquitous in recent years, diffusing outward from Silicon Valley toward emerging markets and the inventive offerings unique thereto. Consider Hazina, a pre-seed startup solving a characteristically African problem in Lagos — the lack of quality user research. Hazina targets this gap for consumer packaged goods (CPG), one of the largest consumer segments on the continent. Where huge multinationals like Nestle or Unilever in developed markets have fine-tuned metrics on user preferences that drive marketing and pricing strategy, in most emerging markets the user research process is often carried out through one-off customer trial campaigns in supermarkets, observing shoppers’ behaviors, or even pitching them free offers on the spot. Hazina plans to solve this problem by aggregating free samples of products, packaging them into boxes, and delivering them to hundreds of thousands of vetted ‘samplers’ to collect granular and quality feedback that can inform not only CPG’s product and marketing efforts, but also their e-commerce sales channel.

Sam Darko, one of the firm’s co-founders, reflects on the big picture of Hazina’s “as a Service business model,” focusing firstly on sampling as a service with a few big accounts before building off traction into B2C groceries as a service, B2B & B2C e-commerce as a service (supporting brands develop an end-to-end direct to consumer sales channel) and distribution as a service (leveraging competencies in delivery and logistics from the first three.)

“CPG is the largest consumer sector, but shows extremely slow uptake for e-commerce. And the reason is trust. If you get past the first trust hurdle by delivering products for free, then you can start offering them e-commerce.”

Sam Darko, Co-Founder, Hazina

In essence, start by serving a need, then pivot as needed to improve profitable monetization. With the inherent ‘intangibility’ of digital products, and the mind-shift that is needed before the “X as a Service” model becomes widely understood, proving traction is the surest way to convince investors the opportunities for monetization, for their part, are tangible.

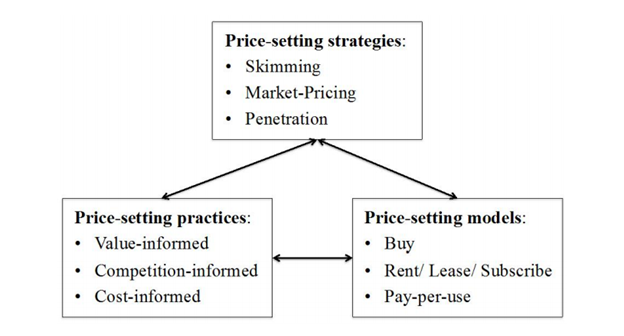

When any given product can be packaged as a service, the pricing possibilities feel near endless. Recent research on best practices on digital born firms shows that successful pricing managers must act as ‘integrating forces’ on two levels: by applying a structured and disciplined price-setting process with regular reviews, and by mediating between corporate financial goals and the local market reality. For digital financial services -- a sector in which adoption can be mystifying at the best of times – pricing is among the most important things to get right. Michel Neubert, a researcher at the International School of Management in Paris, lays out a framework to conceptualize the complexities of price-setting by fintech firms with three basic interlocking elements: pricing strategy, pricing practices, and pricing models.

Source: Michael Neubert, ISM International School of Management

Based on the particularities of a firm’s situation, a combination of price setting strategy and practices result in the appropriate model for a customer segment. For example, a “skimming” strategy focuses on early adopters of new products, testing the upper limits of a market’s willingness to pay and working downwards. Conversely, a “penetration” strategy right off the bat aims to capture market share through low - or even free - pricing.

This last model has been the approach undertaken by Nala - a fintech whose first product offering automates USSD mobile money transactions across SIMs through a smartphone app, enabling seamless & data-free mobile money operations as well as transparency over inter-account usage at no cost. Benjamin Fernandes, Nala’s founder, explains the niche Nala is looking to carve out for itself. Like Hazina, however, a pivot is always right around the corner, aiming to convert trusted relationships into additional, profitable use-cases:

“In Africa, collecting payments is a nightmare, even with a baseline mobile money layer. At least 5 more layers need to be built for doing digital business to be seamless. That’s why you see so many fintechs - so many startups begin in education or health, but then there’s just a huge need from fintech just to collect payments. So you evolve from healthtech to fintech very quickly.”

Benjamin Fernandes, Founder, Nala

Price setting practices aim to drill down to a number. Value informed pricing aims to line up the price with the perceived value of customers — but in new markets or where little data exists, engenders significant over- or under-pricing risk. Competition-informed pricing works where similar products are sold and price can be adjusted up or down based on quality, convenience, or other factors, while cost-informed pricing builds a price from production costs up and tacks on a profit margin.

Finally, what results is a pricing model, which fundamentally determines whether the consumer is buying a product or a service. In some senses, the entirety of pricing models can be summarized as a trade-off between selling consumers a product up-front and renting consumers the product, with an option to own (aka lease-to-own, or if no transfer of ownership, then subscription).

If the broad trends in SaaS spill into digital services in general, then we should expect a massive shift from up-front ‘purchase’ to on-going ‘subscriptions’ — a trend we are already seeing take hold in emerging markets. Per-user, per-feature, and freemium models are ubiquitous, to name just a few, but PAYG is perhaps a standout model in emerging markets specifically, starting with telco airtime purchases, evolving into energy, and now spilling into everything from biodigesters to laptops. For existing or aspiring fintechs, riding the “anything as a service” wave is certainly one of the most widely anticipated disruptions to the way we consume financial services, particularly as tech companies continue to make inroads into ‘traditional’ financial services.

Dynamic KYC

Two key insights from empirical literature evaluating the pricing practices of digital services companies are particularly germane to fintech and digital financial services. The first is that pricing models should be grounded in customer centricity, and should be frequently reevaluated as an iterative process.

Customer centricity is a business model that companies follow where the customer experience is its main product. In a 2017 empirical study comprising 63 fintech startups principally from Southeast Asia and Africa operating in payments, money transfer and lending space, the degree of a company’s customer centricity emerged as the single most significant variable on company success: “all else being equal, a 1-unit increase in Customer Centricity Score leads to a 31% increase in Active Customers — and a 7% increase in Annual Revenue.” As the ‘anything as a service’ model continues to proliferate and competition in the financial services space intensifies across most markets, the importance of this element is becoming clearer.

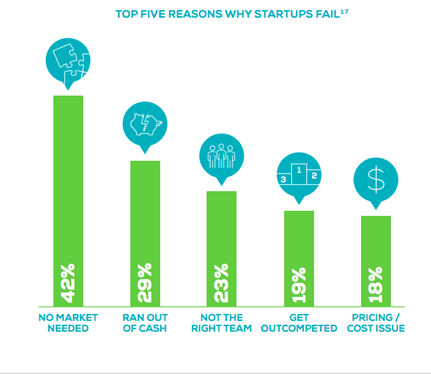

Customer centricity is particularly important for early stage startups with ‘disruptive’ — aka untested — ideas, since the most common reason that startups fail is simply that the market doesn’t exist for the product they are offering.

Source: WE4F

This is a piece of advice well-adopted by the Nala founding team, who invest significant time in developing a sense of community among their users, inspired by Fernandes’ IDEO user-research practicum at Stanford Business School:

“When we learn, what do we think users like. So for example we enable other features — save money on bills — requests are sourced from customers. Folks feel like they are cofounders with us in building this product. That’s a huge variant, especially important in Africa.”

Benjamin Fernandes, Founder, Nala

Secondly, the pricing process itself needs to be iterative and revisited frequently. For early stage companies or new products in particular, a user journey may have to begin with a freemium version where value is proven and traction is built before finding a suitable monetization practice aligned with the use-case. Once value is established, a whole slew of pricing techniques and levers can be employed to learn more about customers’ usage patterns in such a way as to make transactions frictionless and grow market share.

Furthermore, value drivers change over time, so it’s important to revisit the price-to-value proposition and keep fine-tuning the product, removing features that are irrelevant and introducing new options to accommodate customers’ changing and evolving needs. Indeed, when enough granularity on user intelligence has been built, a whole new pricing scheme may be appropriate, and only through a combination of customer centricity and willingness to continually reimagine how to monetize their product can companies develop the flexibility to evolve with their customers. To borrow an always-relevant turn of phrase:

“The key to success is realizing that price is not an end in itself, but an instrument to balance perceptions of value and fairness in an ongoing relationship.”

Journal of Revenue and Pricing Management

Because of the inherent dynamism, there are few magical formulas for determining the right price for a digital product. A rule of thumb among successful fintechs leveraging customer centricity offers some guiding principles for making the numbers work on paper: aim to maximize ‘customer lifetime value’ by minimizing ‘customer acquisition costs.’ For the latter, it comes down to executing a strategy as efficiently as possible. For the former, it’s that, as well as a return to the fundamentals: whether you package your offerings as a product or a service, keep them coming back.

Image courtesy of Roman Synkevych

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Financing The Stone: How The Cannabis Industry Is Going Digital

Let Us Not Forget: The Internet Is A Human Right