Pandemic-Fueled Digitization: Who Remains Excluded?

~9 min read

Digitization catalyzed by the coronavirus pandemic has dominated the headlines and minds of business leaders for the past several months, delivering optimistic growth statistics and figures across markets and industries. Microsoft CEO Satya Nadella shared his view a few months ago that “we’ve seen two years’ worth of digital transformation in two months.” But as there has been a sharp increase in adoption and usage of digitally delivered services, a growing digital divide has emerged between those individuals and companies with the requisite resources to take advantage of digital transformation, and those without. As digitization swallows various market segments, the question begs: are those crossing the digital threshold representative of those who were already bound to naturally adopt digital services, and if so, what happens to those left even further behind?

As global lockdowns continue to compel digitization of diverse services, unconnected populations will find it increasingly challenging to survive the ‘new normal’ of our increasingly digital world. From education and healthcare to retail and finance, digital has been promoted to the preferred form of distribution and payment, forcing essential goods and services out of reach for the digitally excluded. This unique situation has put fintech on a pedestal across emerging and developed markets alike, with experts and governments pontificating that digital finance can democratize access to financial services, but little research has been done to assure that while some cross the digital divide, vulnerable populations those without the necessary resources do not fall further behind.

As discussed in a recent Mondato Insight, prior to Covid-19, the combination of mobile connectivity, identification and finance to bring the world’s poor into the financial system, but the pandemic may have presented additional, increasingly complex challenges for ‘analog’ segments. In light of Covid-19, are new tools and approaches required to appropriately address those excluded by an increasingly more digital world?

Foundations For Digitization

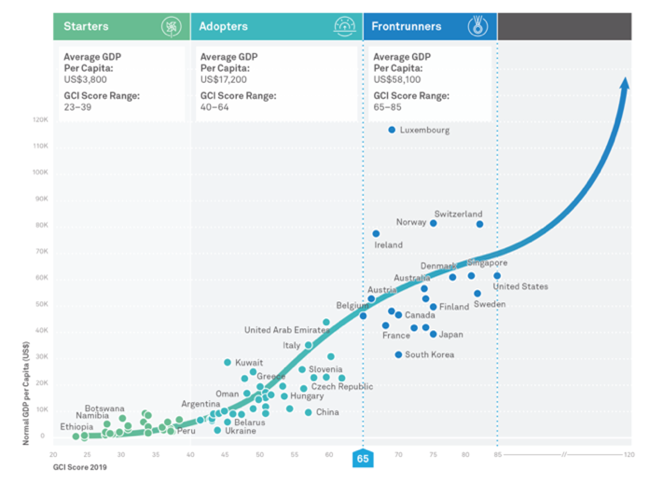

While digital transformation has the power to help businesses respond to the ‘new normal’ created by the pandemic and job creation and global economic output, it can also create new forms of digital divides, exacerbating the separation between ‘digital-ready’ and laggard markets. With connectivity as a fundamental prerequisite, more developed economies, as well as more urban segments of a given population, are better able to reap the benefits of digital services. And the issue applies to developed countries as well as emerging economies. The Commissioner of the FCC, the telecommunications regulator of the United States, admitted that the “pandemic has exposed really hard truths…and demonstrated that our digital divide is very real and very big…COVID has brought broadband from nice-to-have to need-to-have.”

One example of potentially damaging effects is the expansion of e-government services. The United Nations recently released a report that 22 percent of the 193 member states increased their e-government development, having leveraged the pandemic to advance their digital government policies and programs. Alongside these gains, governments must also find alternate forms of distribution and delivery of government services to ensure those without digital means can say informed and access these services.

Digital education services suffer similar challenges; while global school lockdowns require remote learning, those without proper access risk falling further behind. The phenomena coined the ‘homework gap’ is worsening learning inequities across the globe. With more than 154 million children without Internet access in Latin America alone, hundreds of millions of people globally risk falling further behind their peers in developing basic, as well as digital, skillsets.

And in line with government and educational services is the delicate situation of the financially included. An uptick in digital payments does not necessarily translate into previously excluded individuals gaining access. The Indian government tracked digital payment activity as part of their COVID response and found extreme contrast in the rate of digital payment adoption across states. Wealthier states like Telangana and Andhra Pradesh, characterized by higher income levels and better access to banking and Internet infrastructure, were mostly responsible for the nationwide rise in digital transactions. And while smaller, tier 2 and 3 towns did experience a notable rise in digital payments, data shows that rural states with limited connectivity and high rates of informal sector employment lagged behind even further, highlighting that spikes in activity were generally concentrated in already well-served areas.

COVID19 has clearly expedited digital transformation, most notably by digitizing services like education and healthcare, as well as payments. But studies have found that rapid digitization presents significant challenges for traditionally underserved and marginalized groups, particularly for those who lack the necessary skills and resources to successfully participate in the digital realm. With these shortcomings exacerbated by Covid-19, it is important to better identify the characteristics of those being pushed over the ‘digital threshold,’ as well as those who have not, in order to develop new initiatives that respond to their needs.

The Public, The Private, And Progress

Governments have been working to respond to the crisis, and approximately 340 cash transfer programs across 158 countries have delivered aid to 1.1 billion first-time recipients. Among the beneficiaries of these programs, which include around 140 million informal workers, the majority of these payouts were delivered via digital means. While this generates a significant opportunity for onboarding previously un/under-served individuals and may welcome first-time users through what is classified as a digital transaction, it does not necessarily translate into enduring financial inclusion for the recipients. Without digital training and literacy, digital delivery of cash programs may offer little to no lasting value. In order for these one-time payments to transition into more meaningful digitization of payments and inclusion, additional systemic initiatives must be undertaken.

The World Bank’s Global Findex estimated that 1.7 billion (or 31% of all) adults were ‘unbanked’ in 2017, nearly half of whom reside in just seven economies. According to the survey, the most commonly cited reason was lack of funds, while the second most common was affordability of banking services -- neither of which have been obviously eased by the pandemic.

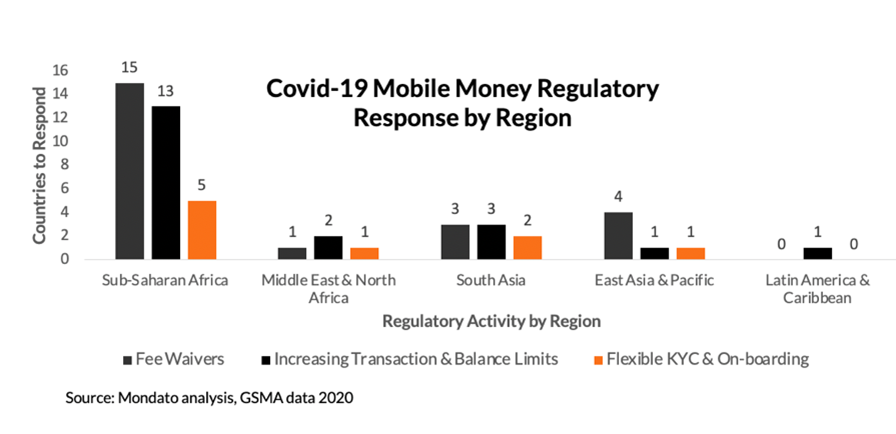

One approach to addressing affordability witnessed during the pandemic was a combination of price cuts and fee waivers for connectivity and digital financial services. Mobile operator Vodafone, for example, has been offering free connectivity for vulnerable segments and health services for all, as well as free data for essential workers. Regulators across most of Sub-Saharan Africa and Asia Pacific enacted fee waivers for mobile money and other digital payment transactions. But many such initiatives have an end date, which will likely disincentivize new users to continue using digital tech services.

Temporary price cuts will not engender lasting usage, and so approaches to lower costs long-term will be required to ensure the longevity of newly found digitization, which is where public-private sector collaboration becomes essential. Governments can offer policies that ease financial burdens in the form of tax reductions for specific sectors, as well as use universal access funds to subsidize end-user costs, particularly for marginalized groups and small and medium-sized enterprises.

Beyond the need for devices and connectivity, a study recently found that another dimension driving the increasing digital divide is digital skills and literacy. In the American city of Philadelphia, in addition to providing devices and free Internet services, a program hired ‘digital navigators’ to help with digital literacy training and general questions. Another possible intervention is the creation of ‘digital equity offices,’ which are already popping up across the United States, that bear the responsibility of ascertaining and tracking the status of more localized digital divides in a coordinated approach.

Many regulators announced that the increased transaction and balance limits offered as a result of Covid-19 will remain permanent, with African regulators taking the lead among emerging markets in offering prompt reforms for mobile money services. The National Bank of Rwanda (BNR) cited “the need to ensure financial sustainability of digital payment services” as the justification, exhibiting recognition that enabling a digital finance ecosystem beyond the pandemic will require more long-term policies.

Cultivating The Underserved

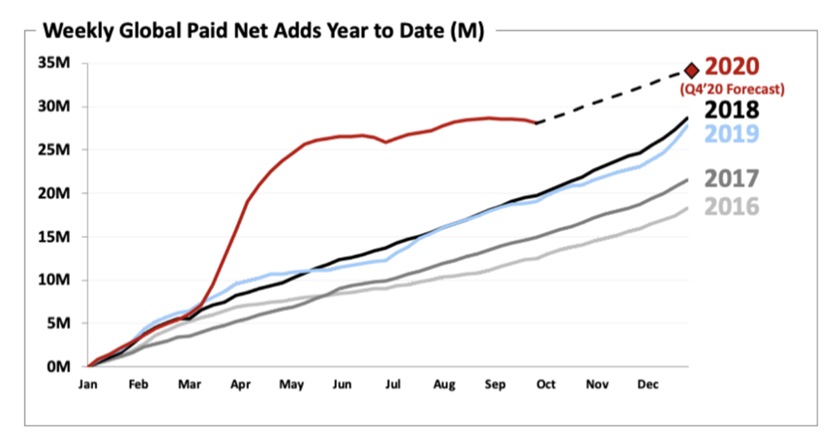

Last month, Netflix released a letter to shareholders reporting a unsurprising, yet massive surge in net subscribers as the pandemic took flight. But between May and August, subscriber growth stagnated almost entirely. While Netflix shareholders have no need to worry, particularly since couch streaming will continue to be a safe activity amid ongoing virus concerns, perhaps the experience of Netflix is descriptive of a COVID-triggered phenomenon where the trajectory of digitization was expedited, as opposed to broadened.

If this theory holds true for related digital finance industries like e-commerce and digital payments, it is important to consider how much of the spike in growth we’ve seen this year is the start of something new, generating previously non-existent interest, versus a pull forward from a trend that was already set to take place, onboarding segments that held all of the prerequisites to digitize in the near term, and cultivating a need to continue to drive digitization for un/underserved consumers.

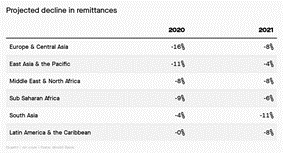

Meanwhile, global adoption of digital payments accelerated by between 5 and 10 percent during the course of the pandemic, taking digital payment penetration to 67 percent globally, according to a World Economic Forum report. Though many new players are adopting digital payment technologies, industries like payments and finance may not see a net gain from its impressive digital growth. Global payments revenue is expected to fall by 7 percent due to a restructuring of supply chains and cross-border trade. For remittances, though slightly less dramatic than initially expected, a 9 percent drop in cross-border payments globally is expected for 2020, though this includes a whopping 21 percent decline for remittance flows to Africa.

In some markets like Kenya where mobile money services are pervasive, transactions initially experienced an upward trajectory, but Central Bank data showed that the majority of transactions consisted of cash transfers and payments for loans, as distressed workers turn to mobile loans during this difficult time. Among adults in Kenya who have lost income due to the pandemic, 64 percent are borrowing money and/or using credit to make ends meet, and this has been primarily through digital means, marking the increased transactions as a temporary event rather than a continuous trend in usage. European-based online remittance provider Azimo also reported a 200 percent increase in new customers during the first few months of the pandemic, but the World Bank and other experts agree that this is a result of the diaspora sending money to family members who need it, and the adoption influx will flatten, if not decline, by the end of 2020.

For many companies, the pandemic revealed existing weaknesses. In the digital lending space, repayment moratoriums implemented by many governments have increased credit risks, putting strain on undercapitalized lending companies. Indian fintechs reported trying to help consumers and small businesses access funding, but they see a liquidity crisis coming, and a similar tale can be told in Indonesia. While fintechs leverage alternative credit mechanisms to extend loans to previously excluded borrowers, experimental determinants of credit worthiness may be dangerous to the economic situation of those borrowing. International organizations have warned against debt relief for borrowers, urging instead to maintain ‘credit discipline,’ but in practice, it will be difficult to keep in check.

As businesses readjust their business models and pricing, new customer segments may become more commercially viable as reforms make cross-border payments more efficient, accessible and affordable. In low-income countries, only 32 percent of the population is deemed as having basic digital skills, and even in developed countries this number only jumps to 62 percent. As many digital service providers may see their uptake experience a Netflix-esque flatline, those that can find strategies to address digital literacy deficits at fair prices can create a new segment of users.

Ready For Impact?

Needless to say, the recent shift towards digitization has certainly unearthed new opportunities for stakeholders of the digital technology sector. From operators that have seen high mobile subscriber rates and data usage to mobile money providers that reported upsurges in activity and customer segments. On the other hand, the digitization activity characterized as growth for many may also create a risk of substantially exposing the digital divide, which is set to increase by 47 percent, as the realities of the world’s most vulnerable are eclipsed from focus, worsening the implications and economic situations of those falling further behind.

COVID has sparked a dependency on technology that creates challenges for those without adequate access or skills required to appropriately leverage digital products, services or technology. While the digitalization ignited by the pandemic can bring many out of financial inclusion, it can also intensify inclusion discrimination for marginalized groups and present additional short-termism and market concentration.

Both private and public sector actors will need to take action through monitoring and investment in order to lower costs while promoting digitization across sectors, as well as segments. A combination of cross-sector collaboration, regulatory reform and shifting business models must be employed to deliver the necessary skills, financing and technology needed to serve the widening digital divide.

Image courtesy of Hobi Industri

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

From Ride-Hail To SuperApp, By Way Of Fintech

Financing The Stone: How The Cannabis Industry Is Going Digital