CBDCs: The Answer To Cross-Border Inefficiencies?

~7 min read

Central Bank Digital Currencies (CBDCs) are a bit of a Rorschach test, depending on the central bank and regime seeking to deploy them. In a place like the Caribbean — among the few places to already attempt a CBDC launch — it can be a measure to overcome poor banking infrastructure spread out across island economies offering thin margins. In China, CBDCs are under rigorous experimentation as a potential centralizing force to oversee their monetary system — and a possible reroute away from the dollar-based foreign exchange system. And though CBDCs are yet to be successfully implemented, stakeholders are eyeing them to solve the most intractable problem in financial services: the inefficiencies and high cost of cross-border transactions. But with daunting technological challenges and even larger gaps in laws and standards to overcome — and thorny issues of sovereignty riddling the delicate terrain — will CBDCs unite cross-border payment rails, or will they fragment them further?

Come Together

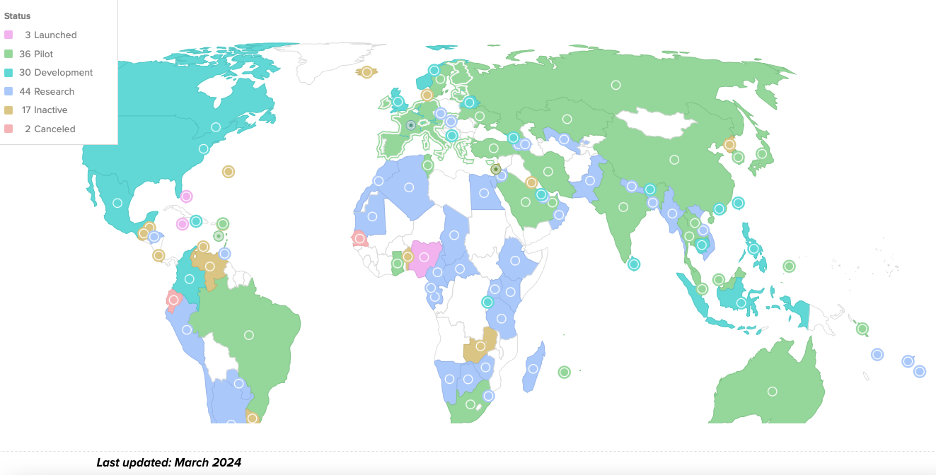

Be it for whatever purpose, research into CBDCs continues to intensify since the pandemic, when countries realized the need to dramatically update its centralized payment mechanisms after citizens sometimes had to wait weeks to receive stimulus payments. According to Atlantic Council, 134 countries are now actively exploring CBDCs, up from only 35 in May 2020. 19 of the G20 countries are in advanced stages of development. 11 countries are in the pilot stage, and three countries — Bahamas, Nigeria, and Jamaica — have launched CBDCs already, if with limited success.

Source: Atlantic Council

Source: Atlantic Council

Though the domestic experiments engender plenty of intrigue, it is the experiments and discussions underway to utilize CBDCs for cross-border trade that can transform how central banks relate to one another on a fundamental level.

For all the improvements made in the cost, speed and reliability of payments during the digital era, cross-border payments remain the fintech revolution’s white whale. The correspondent banking system — in which banks hold foreign currency accounts with other banks — undergirding the cross-border transactional system has reinforced stubbornly high costs and long settlement times.

A 2020 FSB roadmap endorsed by the G20 countries outlined a range of goals and steps for states to take to improve cross-border transactions. “Factoring an international dimension into CBDC design” was one of 19 specified focus areas.

Since then, collaborative projects between central banks to facilitate cross-border transactions under a CBDC infrastructure have been underway. Under a cross-border CBDC scheme, banks can transact directly with each other using different CBDCs without the need to hold foreign currency accounts with correspondent banks. CBDCs can be transferred directly from the sender to the recipient in another jurisdiction. By cutting out or minimizing the presence of intermediaries as in the correspondent banking system, transactions should be cheaper, faster, and with reduced settlement risks through a transparent, trustless digital ledger technology (DLT) infrastructure.

Such a system completely changes how financial service providers relate to one another in a cross-border sense, while changing how FX is carried out. Project Icebreaker, a joint project between the BIS and the central banks of Israel, Sweden and Norway, tested the feasibility of conducting cross-border and cross-currency transactions between different experimental retail systems. Breaking down the cross-border transaction into two domestic payments — facilitated by a foreign exchange provider active in both domestic systems — the infrastructure automatically selects the FX provider offering the best rate, offering a measure of competition that didn’t exist before.

Under cross-border CBDC-enabled systems, digital wallets gain further importance by expanding their roles in adhering to compliance mechanisms across jurisdictions.

“The digital wallet providers will be requested by regulators to provide the proof and guarantees that the transactions will be made in a safe, compliant way, and also that personal data is protected when processing the payment in the terminal.”

Fabricio Polido, Professor of Law, Federal University of Minas Gerais

China’s Project mBridge stands out for its technical design that allows for offline usage — a critical component if CBDCs are to take over as the predominant 24/7 foreign transactions and settlement mechanism — and the sprawling participation that now includes about two dozen observing central banks across continents. Started more than three years ago alongside the BIS and central banks of Hong Kong, Thailand and the UAE, Project mBridge is well into its pilot phase, now reaching 260 million digital wallets to cover 200 transactional scenarios. Project mBridge recently added Saudi Arabia — a close oil trade partner with China — as a full participant after reaching the minimum viable project stage. Project mBridge is now primed to become the first functioning blockchain-based payment platform involving state authorities.

United In Disagreement

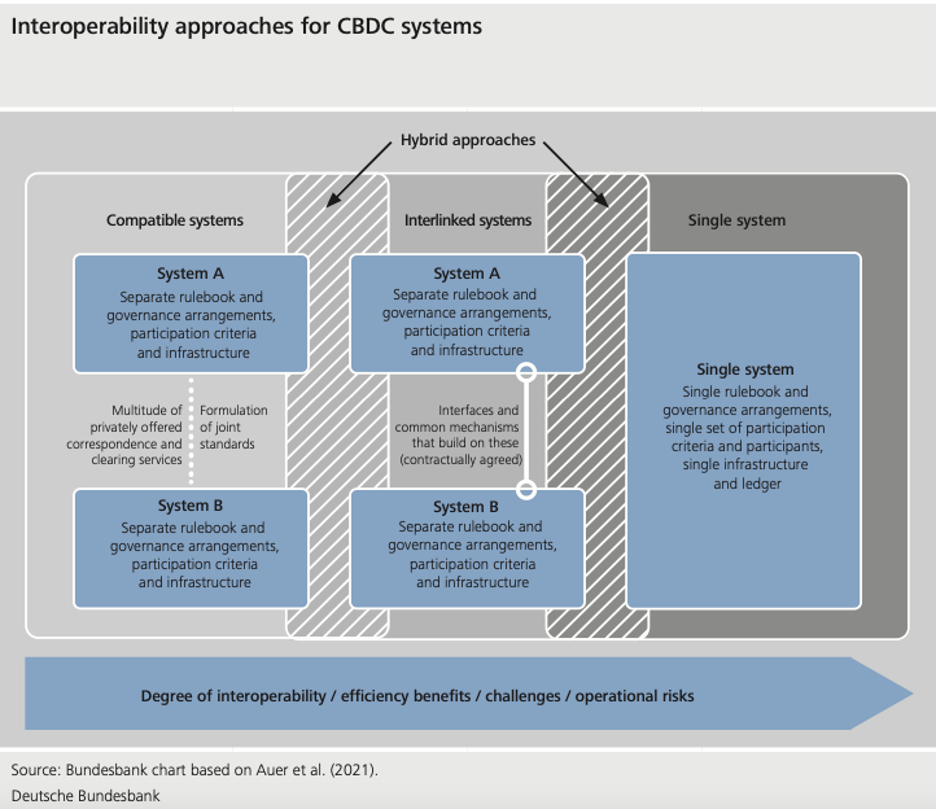

But under what design model exactly this new cross-border system will be carried out across jurisdictions — and what governance model would be employed — is still being debated and tested. From the theoretical standpoint, competing models offered by the IMF, BIS and SWIFT include differences over whether and how to integrate existing financial structures within a centralizing architecture, or whether CBDCs themselves are even exchanged. But at least ideally, the three models promote a single operator of an “inherently global system” in order to provide the greatest efficiencies and benefits — if coming as well with the greatest systemic risks and sovereignty issues to be sorted out.

“If we ever want large-volume and trustworthy cross-border CBDCs to be developed, we need a concurrent development of standards, both regulatory and technological, that countries can agree upon. And this is the hard task.”

Ananya Kumar, Associate Director of Digital Currencies, Atlantic Council

Deeper integrations should boost efficiency and ease of interoperability — but it also encroaches on aspects of capital controls that invites systemic risks, along with rulemaking oversight that normally fall under central banks’ sovereign purview.

“States and regulatory authorities issuing CBDCs, will be forced — somehow — to share parts of their authorities in order to make an authentic global framework for circulation of those different CBDCs, resorting to new technologies to optimize how border payments are made and how those exchange transactions are also concluded.”

Fabricio Polido, Professor of Law, Federal University of Minas Gerais

It is in this challenge that cross-border CBDCs demand for central banks to reconsider traditional notions of sovereignty. Creating a truly integrated architecture enabled by CBDCs requires a profound level of harmonization in technical standards and collaboration that will be difficult to achieve when sovereign states disagree on the global institutions in place — and what benefits such a scheme should elicit. Serving as a representative to the Brazilian government’s interests in conferences discussing cross-border CBDC schemes, Polido notes the difficulty of engaging with the United States on the issue. The U.S. is further behind than the EU and especially China when it comes to research and development of CBDCs, viewing them skeptically as a means to replace the dollar-based exchange system.

Certainly, China views cross-border CBDCs as a tool to orient the global financial system away from USD-based correspondent banking practices. The potential for CBDC-enabled systems to evade US-based sanctions has also long been postulated.

But if the U.S. doesn’t participate, it risks being left out of the design and implementation altogether of these nascent cross-border schemes.

“In these competing models, what is the role of the dollar going to be in the future? And then what is the entity that is going to be the hub of this large spoke model that’s considered? What is the entity that is trusted enough? And we should be cognizant that there are now 134 retail CBDCs, and about half of those countries are developing wholesale CBDCs. The question becomes: are you introducing more friction in the system rather than less by having so many different models, none of which can currently talk to each other?”

Ananya Kumar, Associate Director of Digital Currencies, Atlantic Council

Harmony or Disharmony

As with CBDCs in general, a prospective launch of CBDC-enabled cross border trade is slow, considering the potential systemic risks if not done right. Harmonizing laws and standards — including the ISO 200022 protocol — will be a critical factor. And countries with data privacy concerns, like in the EU and countries in the Americas that have adopted similar data privacy standards, count that as paramount among issues still to be sorted out across jurisdictions.

According to Polido, Brazil views DREX — Brazil’s piloted digital currency — as the third step in the country’s digital transformation, the first two being the implementation of the PIX instant payment system and the portability of user data. However, the launch of DREX was recently delayed due to continuing privacy issues. Nonetheless, the advances made in areas such as instant payments — which remains a work in progress in cross-border contexts as well, through initiatives like Project Nexus — only add to the developing tech stack that will encompass future cross-border payments alongside CBDCs.

Countries like Brazil that are straddling the competing blocs are notably sought after-guests in conferences like the ones Polido attends on his country’s behalf to discuss cross-border CBDCs. Lacking the global consensus and collaboration that is required to actualize the benefits of a CBDC-powered cross border transactional network, it will be the decisions of such proverbial countries in the middle that that will play a major role in deciding the shape and scope of the regimes to come — a repeating pattern of late, apparently.

But as stakeholders across countries and organizations continue discussions of what a CBDC-enabled future may be, the competing motivations of differing national economies and industries themselves are struggling over whether to actually overhaul the entrenched system — and to whom it favors. Crypto interests, for example, largely oppose CBDCs, viewing them as a centralized short-circuiting of the alternative they are already seeking to present to the financial system. Considering the boost to margins and settlement times, digital payment vendors view the potential advent of cross-border CBDCs with open arms. At the state level, Polido describes less innovative-friendly monetary authorities as viewing such innovations with suspicion.

“The international organizations are very willing to discuss [cross-border CBDCs], while there are national resistances, particularly from some countries that have a very centralized, traditional power in terms of regulation and ways to do banking.”

Fabricio Polido, Professor of Law, Federal University of Minas Gerais

All of this is to say that cross-border CBDCs is a prospect as ambitious as it is complicated. But barring some radical improvements in collaboration between the major powers, the CBDC cross-border schemes on track to be rolled out in the next few years will likely not achieve its full potential. In the platform era we live in, it may be the next technological innovation to fall short due to political grandstanding and misalignment.

Image courtesy of Shubham Dhage

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Can Digital Monitoring Unlock Climate Finance?

Betting on Chaos: Africa’s Thriving Online Gambling Industry