Are The Mechanics Behind Medicine Markets Mangled?

~6 min read

Between the lofty, and somewhat ambiguous, Sustainable Development Goal of 'Good Health and Well-Being' and its more measurable, digestible sub-section targets, improvement of health-related outcomes across the board remains a central feature of multilateral and national bodies' forward-looking plans. And while advancements in treatment have defanged many of the world's most devastating killers (like cholera, malaria and tuberculosis), asymmetrical access to medication has spread the burden of disease unevenly across the world. Locks on importation licensing, volatile pricing, inconsistent supply by domestic distributors, patchy financing for pharmacies and hospitals and last-mile challenges for end-patients all contribute to inefficiencies in the formal pharmaceutical market. The introduction of digital portals and payments, however, is adding some much needed transparency and reliability to this fractured marketplace.

A DALY Dosage

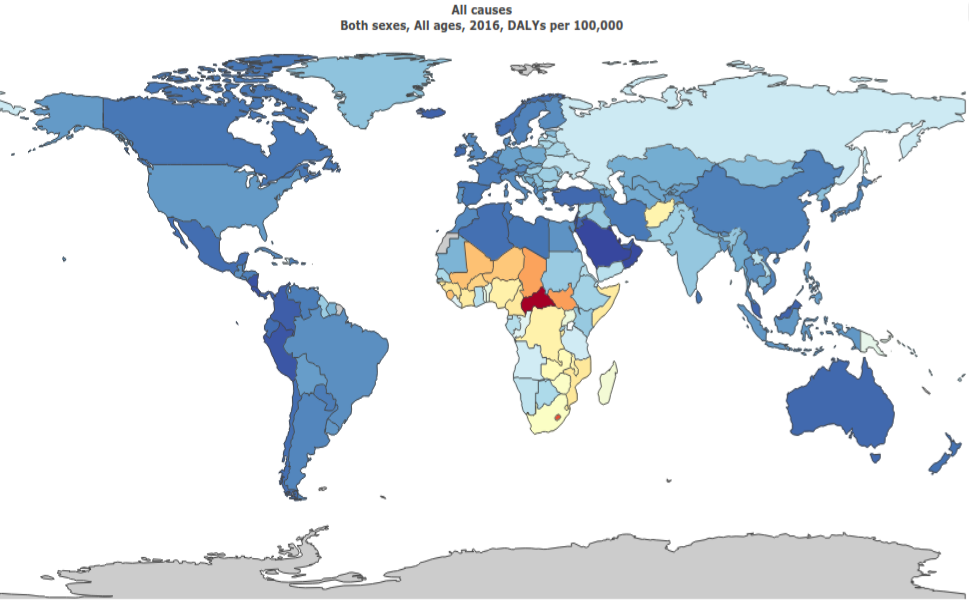

Each of the world's regions must wrestle with a different basket of illness cause, frequency and severity. The most common form of standardized comparison is the disability-adjusted life years (DALYs) metric, which represents the loss of years of full health due to sickness or early death. This better conceptualizes the burden of disease than mortality, as it also takes into account the impact of long-term, chronic conditions in addition to those that cause premature death.

Source: Institute for Health Metrics and Evaluation, Global Burden of Disease Data

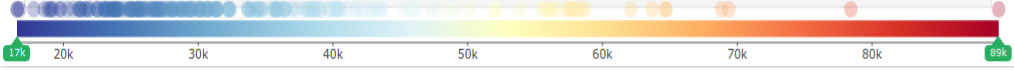

Source: Institute for Health Metrics and Evaluation, Global Burden of Disease Data

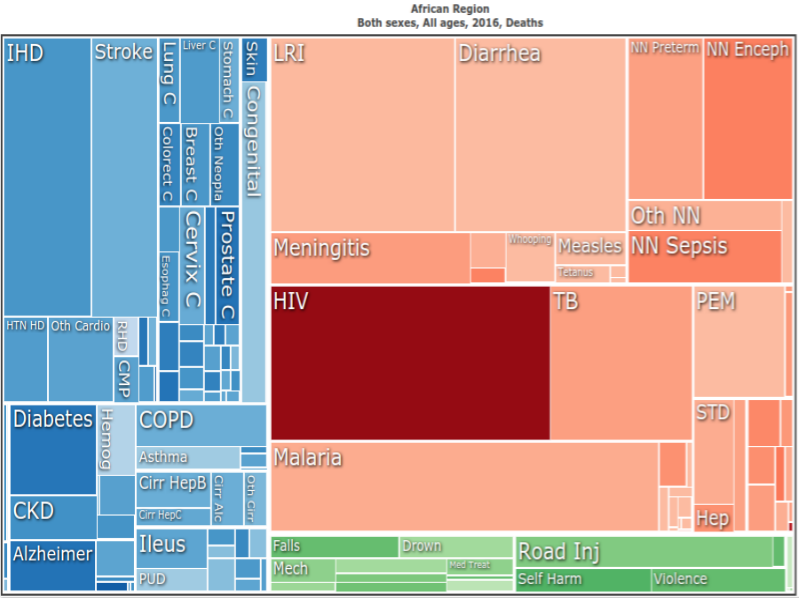

Africa, despite achieving a 44 percent decline in DALYs from 2000-2016, still bears the brunt of the burden. As of 2016, it scored 587 DALYs per 1,000 inhabitants, nearly double to that of the healthiest cohort's 270 DALYs, the Western Pacific. The underlying roots of Africa and the Western Pacific's DALY count, however, are qualitatively distinct from each other. In Africa, a markedly high 61 percent of DALYs stem from communicable, maternal, neonatal and nutritional causes, most of which are preventable with the appropriate drug regimes. In contrast, more than 80 percent of Western Pacific's DALYs are due to slow-moving noncommunicable diseases like cardiovascular complications, cancer or diabetes (see below).

Source: Institute for Health Metrics and Evaluation, Global Burden of Disease Data

Source: Institute for Health Metrics and Evaluation, Global Burden of Disease Data

One B2B E-Portal, Stat

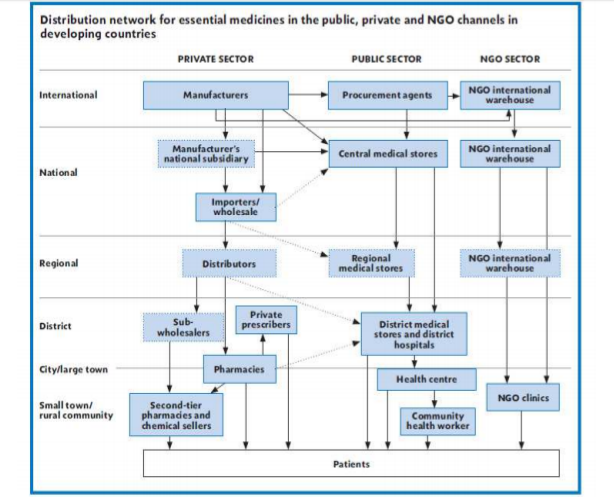

The smooth running of drug import, sale and distribution is a matter of life or death consequence then, especially in Africa. But, current mechanics are leaving the medicine market vulnerable. The industry's supply chain in emerging economies has an increased number of intermediaries, with good ownership potentially exchanging a number of hands before reaching its final destination. All of those switches are openings for either price jumps or counterfeit swaps. The customers might ultimately end up with an overly expensive dose or a dose of something else.

Source: World Health Organization 2015

Source: World Health Organization 2015

According to Vivian Nwakah, Co-Founder at Medsaf (a business-to-business e-pharma startup), simplifying the supply chain in a country like Nigeria is no easy endeavor. With 70 percent of Nigeria's medicine imported and most indigenous manufacturers reliant on at least some external raw materials, there is no getting around coordination with stakeholders outside the country. Importers bring in pharmaceuticals approved by the regulator, which are then ferried around to distributors, who each bilaterally negotiate with the importer over details like price and quantity. Ergo, no two distributors have the same inventory or pricing structure.

In some messier instances, sub-wholesalers act as another broker between distributors and second-tier hospitals or pharmacies. Either scenario still results in the same prognosis: a disjointed, decentralized ecosystem where pharmacies and hospitals must shop around (which often includes the underground market) to fill their shelves with the correct orders at the best price.

Medsaf hopes to shorten the supply chain for retailers, sourcing from domestic manufacturers when possible and collaborating with importers where required. Its selection of medications are neatly arranged on its e-portal with straightforward pricing, guaranteed availability and traceable authenticity (as of now, through QR codes) that estimates to cover 70 percent of an average pharmacy's needs. The company's partnership strategy, too, acknowledges the 'interconnectedness,' so to speak, of e-commerce, logistics and financing.

"We embedded ourselves with a logistics company that has opened a branch at our facilities. Once Medsaf receives an order and inspects it for quality control, the shipment is packaged and processed next door which allows us to maintain a high degree of control. Medsaf has also pursued a partnership with the fintech Lidya that crafts financial products specifically designed to cover pharmacies' or hospitals' gaps in cash-flow, without which could have derailed their ability to restock medicine." Vivian Nwakah, Co-Founder at Medsaf

The last point is particularly relevant to fintech and digital finance as innovative debt financing solutions may alleviate the 'sickly' spiral of debt bogging down supply chains.

Hospitals and pharmacies rack up credit with distributors as they wait in earnest for prescriptions to be filled and compensation from insurers. Distributors, in turn, are hampered with a backlog of open receivables on their balance-sheets. Too much debt carried by one pharmacy may poison its relationship with distributors (and therefore, its access to medication). Too much debt owed to one distributor could fold its whole operation for a week, a month or indefinitely. And while market forces will help ensure that a flatlined distributor or pharmacy is replaced, the timelines of patients are far too sensitive to accommodate either high-turnover or narrow selection because of working capital constraints.

Pharmacy To The Home

Beyond supply chain innovation, enterprises are tackling problems plaguing retail. MYDAWA in Kenya, similar to Medsaf in Nigeria, buys its merchandise from either manufacturers or authorized importers to sidestep distributors which cuts prices by 20 to 40 percent. MYDAWA continues one step further in the progression, and its mobile app serves directly the final customers, patients.

Capitalizing on Kenya's exceptionally high smartphone penetration (with the reach of mobile internet at 90.4 percent of adults), the ubiquity of M-PESA (which captures well over 80 percent of the country's online transactions) and Safaricom's open APIs, the app is a mobile-first, mobile-money first design. As the middle class in Kenya grows, so too will MYDAWA's payment instruments, with the integration of other mobile money offerings and credit/ debit cards up on the drawing board.

Reminiscent of the sticky spots intrinsic in business-to-business interactions, MYDAWA has also had to adapt to roadblocks in the credit and logistics space. Aware that unpredictability or seasonal cycles may affect many of its patrons' earnings, the app has created a microloan program, up to 20 USD, to smooth individual or familial income gaps. As for delivery, given the delicate nature of health and medicine, MYDAWA has taken a unique approach to safeguard that the offline services of an e-retailer are as professional as those of a brick-and-mortar provider.

"We currently use motorcycles to deliver our drugs and non-pharma products. The Pharmacy & Poisons Board (PPB) recently awarded us a second licence, which is a first for an e-retailing pharmacy. This ground-breaking licence allows us now to deliver prescriptions directly to homes or offices. To ensure that the standard of care is maintained, we do these home deliveries using Pharmaceutical Technologists (Pharmtecs) who are fully qualified, licensed and regulated by the PPB. In a sense, rather than the patient going to the pharmacy, we are bringing the pharmacy to the patient." Tony Wood, Managing Director of MYDAWA

As Telemedicine advances, and secure communication channels are erected, frequenters of e-pharmas in developing countries may not even be required to upload proof of subscription via mobile, but instead have it submitted online by a remote physician. Access to medication would no longer be determined by variables like infrastructure or proximity to urban centers. This, coupled with a agile, price-fair supply chain as a result of consolidators and payment mechanisms that are pervasive irrespective of socioeconomic status, would leave little excuse as to why Africa shoulders such a hefty portion of the world's disease burden. A spoonful of digital certainly seems to help the medicine go down.

Image courtesy of Ryan Adams

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Keeping Customers At The Center of Digital Finance

Digital Donations: Is Cash Still Tops For Tips?