Buy Now, Pay Later: Free Credit, Or Debt By Design?

~8 min read

Consumers have been weathering uncertainty since long before COVID-19. Today, many are being judicious about how they spend, but merchants need shoppers to spend, and shoppers need ways to stretch their budgets. One e-commerce solution has quickly accelerated during the economic downturn, and is making inroads in retail as well: Buy Now Pay Later (BNPL). In broad terms, BNPL solutions provide up-front purchases for customers who pay the BNPL provider the remaining balance over a fixed period of time — in many cases, fee- and interest-free (at least initially)

Essentially, these are loans. But how money is generated from that loan makes all the difference. Far more than credit cards and traditional loans, BNPL models tend to disproportionately rely on merchant fees for revenue, not user-generated fees; if everything is paid on time, there are typically no fees or interest. Attracted to BNPL’s massive benefits to conversion rates and sales, merchants don’t mind the fees — especially during an economic downturn with less money in people’s pockets. Yet BNPL’s core mechanic — breaking down purchases into smaller amounts to be paid over time — presents a double-edged psychological sword. At its best, BNPL offers the opportunity for meaningful flexibility and access for financially distressed people wary of or unable to access traditional credit. So far, the emerging digital BNPL ecosystem has veered in that general direction. But as with any loan scheme, improper design or risk assessment of BNPL services can warp a promising financial tool towards sinister ends.

COVID Now, Recovery Later

Even before COVID-19, the BNPL space was seeing impressive growth, in large part from millennial and Gen Z shoppers wishing to steer clear of debt. But the rapid integration of BNPL options into ecommerce sites has quickly made emerging behemoths out of leading BNPL startups. Melbourne-based Afterpay saw its value increase from $100 million four years ago to over $12.55 billion, signing up more than 1.6 million new active users since March in the U.S. alone. Quarterly revenues are lapping pre-COVID earnings. And considering the numerous benefits of BNPL offerings to merchant sales, it makes sense. Data from Klarna, a leading Swedish BNPL company, suggests increases in online conversion can exceed more than 30% and average order size can increase by more than 45%. Major ecommerce and retail players are quickly adopting these services to keep revenue flowing.

BNPL’s acceleration comes at a profound time for consumers credit-wise. A July survey said 62% of those with credit card debt wouldn’t be able to make minimum payments in the next three months if the pandemic continued. The same survey revealed credit card spending to be down compared to last year, with the employed using the opportunity to improve their debt situation while the unemployed are likewise spending less. In this time of economic uncertainty, credit card companies are also pulling back themselves, lowering many customers’ credit limits.

Re-emerging today as a fintech descendent of in-store credit, Buy Now Pay Later has been around in various iterations for decades. But as online shopping hit its stride during the pandemic, so did digital BNPL options,. Leading BNPL options usually allow customers to pay for purchases in several installments, typically four, without interest or fees, and automated payments — the deferred debit model, a customer-friendly version of BNPL which has emerged in recent years.

Relief Now, Repercussions Later

The uncertain terrain has made BNPL an attractive option for consumers and merchants alike. One July survey found over a third of U.S. consumers have used a BNPL service. Australia in particular has seen BNPL usage surge as other measures of payment have fallen. One survey found that spending on BNPL apps grew by 22% in the first week of May compared to February — at the same time that ATM withdrawals fell by 32%. 36% of surveyed consumers in May said they had used BNPL for the first time during the pandemic.

It was only a couple years ago that established credit players were doubting BNPL apps would continue to succeed during an economic downturn. At least so far, these prophecies have proven quite wrong. Companies have reported slightly rising defaults since the crisis began, though typically remaining lower than 2%.

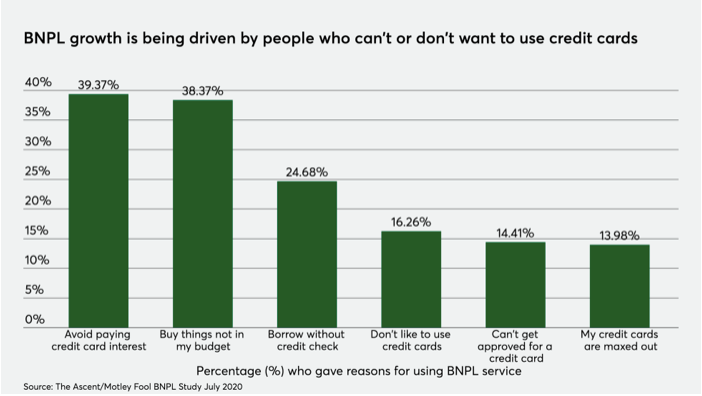

A slight rise in defaults can make a difference in an industry relying on thin revenue margins, but it has been more than supported by the massive influx of new users wary of credit cards. A July survey revealed that BNPL growth is spurred in large part by those who can’t or don’t want to use credit cards. Among those surveyed, nearly 40% used BNPL services to avoid paying credit card interest — with nearly 39% using BNPL to buy things not in their budget. A quarter of those surveyed wished to borrow without a credit check, 16% didn’t like to use credit cards 14% couldn’t get approved for a credit card — and 14% were maxed out on their credit cards.

Veronica Katz, the Chief Revenue Officer for the U.S.-based BNPL company Sezzle, estimated about half of the company’s customers have an aversion to using credit, while the other half have difficulties accessing credit. The cautionary tale of digital loans would suggest that extending credit to people with little to no credit check would be a recipe for debt disaster. But along with no interest fees, leading BNPL services tend to cap late fees; whereas the average credit card debt is around $3,500, the average outstanding Afterpay balance in Australia is around $200.

Thanks to the short-term payment windows of many of these BNPL services, providers can be nimbler to market changes. Some leading competitors like Klarna have tightened their risk portfolio during the economic downturn, performing credit checks and rejecting more applicants to ensure applicants will repay their debts. As BNPL providers carry much of the risk of delinquent payments, this risk-tightening is understandable, especially as the crisis prolongs. But Sezzle’s Katz celebrated its BNPL products as offering a critical aid to financially distressed customers during these times.

“We are not going to give you more money than you are prepared to pay back. And if you don’t pay back, then we are not going to continue lending you money. We have incredibly high loyalty and repeat usage, and people want to use our system, so that is really the penalty if you use our system; we are not hurting your credit. And we are not charging you interest, right? So I think there’s a really good value proposition for the consumers.”

Veronica Katz, CRO, Sezzle

By not relying on the credit scoring system without conspicuous interest terms, such BNPL products offer the financial access that digital credit promises — without the runaway debt that can follow. Alternatively, Sezzle is also piloting a new program called Sezzle Up, which allows customers to use Sezzle’s program to slowly build their credit score “with training wheels,” as Katz puts it. Sezzle and other competitors have worked with financially distressed customers during the crisis, such as implementing repayment holidays.

To Buy Is To Pay

Like several competitors, Sezzle performs no credit check to allow smaller purchases on its simpler plans, slowly increasing customer limits once a purchasing history is established. But as an industry tailoring to many who have run afoul of credit bureaus in the past, the potential for consumer harm remains. According to a July survey, U.S. consumers used BNPL to buy electronics 44% of the time, followed by clothing and fashion items at 37%, furniture or appliances 33% of the time, household essentials 31%, and groceries 22.5% of the time. It’s a mixed bag for why people opt for BNPL solutions. Those using BNPL to buy groceries, pay utilities or household essentials reinforce just how critical of a tool flexible payment options can be for financially distressed customers. But obviously, they’re not always used that way. That can certainly be fine for financially stable shoppers wishing to space out bigger purchases, but if exploiting customers’ present bias to surgical ends, the possibility remains for irresponsibly crafted BNPL services to facilitate impulse buys beyond someone’s means. One survey last month suggested 20% of Buy Now Pay Later users view the service as a way to “buy now, worry about it later.”

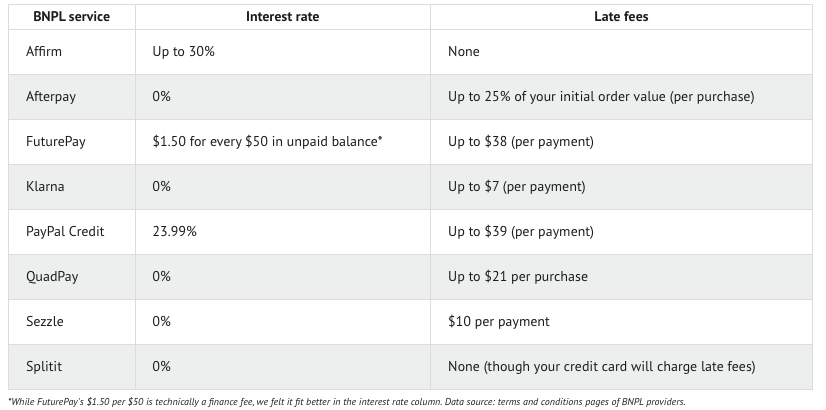

While some issues persist, the current numbers overall suggest the model does generally work in avoiding skyrocketing debt and encouraging more responsible spending. As with any evolving fintech solution operating under little to no regulations, consumer education and company transparency is critical if the model is to continue to work towards positive financial ends. In Australia, where BNPL has arguably accelerated the most of anywhere, lawmakers have been debating for several years now how to regulate the BNPL market. In 2018, The Australian Securities and Investments Commission found that one in six BNPL users had either become overdrawn, delayed bill payments or borrowed additional money because of BNPL arrangements. Not all BNPL services are interest-free and fee-free, and late fees can mount if they are not capped by providers. Medicine for the financially distressed can evolve into a dangerous drug.

Source: fool.com

In the July survey of U.S. consumers, 43% of those who used BNPL understood the terms completely. While frequently automated payment systems make repayment a surer thing, companies like Klarna and Sezzle emphasize the importance of continuing to educate consumers of the terms and expectations of these delayed loans. Without extensive regulations in markets like Australia and the U.S., the opportunity presents itself for BNPL companies with more predatory terms to emerge. So far, the leading competitors have largely steered clear of interest or crippling late fees. Leading BNPL company Affirm, for instance, makes 15% of its revenues from late fees, and such a figure is actually reportedly down from the 25% of its revenue that came from late fees two years ago; the company credited relying more on repeat customers with a demonstrated payment history.

Credit Where Credit Is Due

As such a potent tool, the Buy Now Pay Later model continues to grow and expand. Recently, Pay Pal recently threw itself

right in the thick of the BNPL market with its new “Pay in 4” installment plans, which allows customers to pay for products over four separate payments. In May, Chinese tech giant Tencent bought a 5% stake in BNPL provider Afterpay for $300 million, seizing the partnership as a vehicle to expand BNPL services into East Asia. Tencent also released this year its “Fenfu” credit feature, which allows its 1.1 billion WeChat users to buy now pay later on items ranging from fashion to meals to entertainment. Variants of BNPL providers are popping up in places ranging from Kenya to Indonesia, with its flexible payment options serving as a kind of cheap microcredit. The UAE has also started seeing its own BNPL products, as has the Indian market through companies like Simpl. But in these emerging markets, the business model has not as frequently adapted the consumer-friendly deferred debit model relying on merchant-generated fees.

Nevertheless, the potential use cases for such payment flexibility are vast, ranging from flights to soccer matches.In the UK, Flava, allows customers to purchase groceries on fixed payment plans. Zero-interest, no-fee flexible payment options can be a godsend for struggling families anywhere in the world to potentially pay utilities, groceries, or other essentials at no additional cost. As digital BNPL branches out to new markets in the world, the question remains whether such customer-friendly terms and transparency will continue to define the applications of this powerful fintech tool. For any BNPL service to consider itself truly financially accessible and healthy, it should strive to offer zero percent interest and no fees, with responsibly capped late fees — following the deferred debit model, essentially.

While brisk competition has so far kept Western competitors’ terms consumer-friendly, this may not always be the case when BNPL companies, unable or less eager to extract merchant fees, target consumers less aware or prepared for the terms of BNPL products. A largely unregulated market that may not administer credit checks of prospective borrowers can become a risky proposition leading to escalating debt and default rates which threaten the customer and merchant alike. Through greed or recklessness or both, things can go wrong.

For now, the consumer-friendly yet responsible terms of leading BNPL competitors present a promising transaction route for consumers who are either struggling financially or wish to avoid traditional credit. If done right, industry revenues can grow on the backs of merchants’ success — not people’s misfortune. But until the space fully matures, there still remains the element of “if.”

Image courtesy of Hanson Lu

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

The Bottomless Potential Of Central Bank Digital Currencies

What The 2020 U.S. Election Could Mean For Digital Finance