Financing The Stone: How The Cannabis Industry Is Going Digital

~9 min read

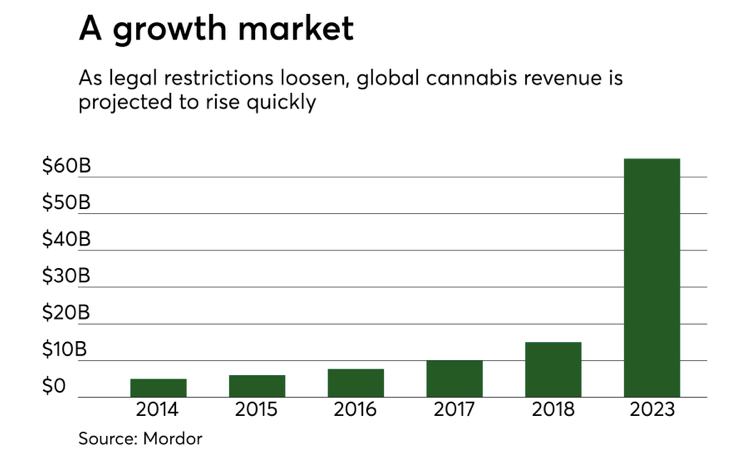

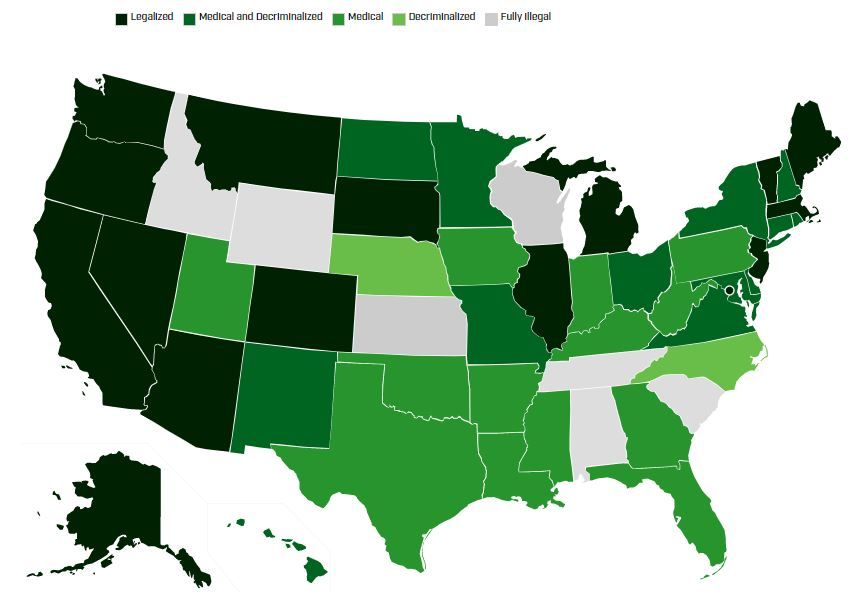

November 4th, 2020 was a decisive victory for the legal cannabis movement. 15 U.S. states have now legalized marijuana for recreational use, and nearly all U.S. states allow for at least some form of medical marijuana. But federal prohibition — and decades-old international anti-narcotics treaties brokered by the U.S. — have made banks wary of opening financial accounts for marijuana-related businesses legally operating under state law, and credit card companies refuse to process cannabis-related transactions. This has left cannabis-related businesses woefully underbanked and overly reliant on cash for transactions. If this sounds familiar, it should come as no surprise that fintech companies have swept in to repair the broken cannabis finance system -- and made some inroads into a ~$20B industry along the way.

Under these circumstances, cannabis startups were thrust in similar positions as small businesses in Sub-Saharan Africa prior to the Fintech revolution — financially excluded, and prone to cash theft. Like what happened then, tech companies are filling that market gap, broadening payment options for customers and facilitating banking options for cannabis-related businesses. Operating high-risk businesses under such a heavily scrutinized, complex, and evolving regulatory landscape has led to a unique digital ecosystem offering a variety of solutions wedding Regtech with Fintech to an unprecedented degree — legally facilitating transactions and maintaining compliance through completely digitized transparency every step of the way. Beneath federal prohibition’s shadow, the (regulatory) sunlight that tech partners facilitate has enabled the cannabis industry to grow and expand nevertheless.

Blazing A Regulatory Trail

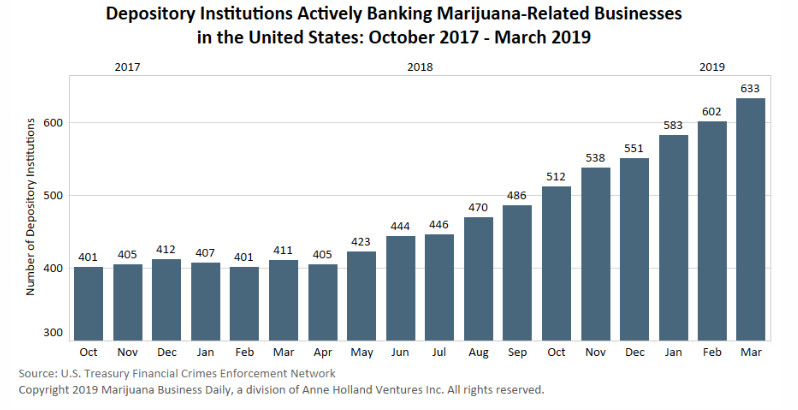

The U.S. may not be the furthest ahead in the legalization movement — Uruguay and Canada have already legalized cannabis, with plenty of other countries decriminalizing cannabis and hosting medicinal programs — but as a leader in digital cannabis markets and a central element to the global banking system, its fight will be most instructive for how the cannabis industry and its application of digital finance tools might develop. The modern-day legalization movement started in the states in the 90’s with medical marijuana reform, and it broke through when Colorado became the first state to legalize marijuana for recreational use in 2012, with the first recreational stores opening up in 2014. In 2013, the Department of Justice under President Obama released the Cole Memorandum, which directed U.S. attorneys to not target cannabis markets in legalized states with strong regulatory and enforcement mechanisms. An accompanying Financial Crimes Enforcement Network directive in 2014 outlined how financial institutions can engage with cannabis-related businesses in legalized markets, requiring advanced customer due diligence and for financial institutions to file a suspicious activity report for all transactions they process for a cannabis-related business. However, the Cole Memo didn’t end prohibition, and the memo was rescinded by the U.S. Department of Justice in 2018.

Source: DISA Global

Even with a path to full legalization outlined and clear evidence of marijuana's medical value established, few banks opened their services up to cannabis-related businesses early on. Businesses were thus limited in payment options and forced to handle large amounts of cash — while simultaneously meeting strenuous regulations and compliance measures. When Colorado legalized marijuana in 2012, it set up a “seed-to-sale” track and trace regime, which mandates tracking all marijuana from the moment it is planted to it being harvested, transported, tested, distributed and sold, with accompanying verifying data. Metrc, an Agtech company with experience in similar technologies, stepped in to provide such services for the state government and cannabis-related businesses. As recreational and medical markets have expanded, track and trace has become standard practice across the industry, for which Metrc has become the leading technology supplier. Metrc’s data software ensures proper quality control, prevents aversion to the black market, and creates a completely transparent view of the entire chain of supply until it is sold. Metrc’s software is designed to meet the needs and requirements of the different state markets, all of which follow varying characteristics and laws.

“We want to be the single source of truth – whether it’s in terms of state government auditing, a [financial] institution that wants to minimize risks, we want to be there to solve that trust problem.”

Bronwyn Flores, Communications Manager, Metrc

Metrc’s software itself does not deal with payments or enterprise resource management, but as the foundation for most states’ regulatory apparatuses, Metrc’s open API is integrated with “about 1000” APIs from other companies doing such work — laying the groundwork for a digital ecosystem implementing Regtech alongside Fintech.

Utilizing Metrc’s open API, a variety of companies have stepped in to provide solutions to overcome the challenges of the tightly regulated yet ever-shifting industry. On the banking side of things, the earlier crisis has subsided somewhat, as credit unions and regional and community banks have stepped in to provide banking services. Companies like Dama Financial help connect cannabis-related businesses with banks — many of whom don’t advertise such work — willing to service them, along with other services particular to the industry.

Though credit card companies shy away, cannabis-related businesses manage to employ a variety of payment methods. While cash reigns onerously supreme, one popular tactic has been installing cashless ATMs at dispensaries which dispense vouchers as payment. Though popular, these ATMs often round up to the nearest $5 on top of fees, which requires cash reimbursement. Other companies like Flowhub integrate Metrc’s software to adhere to compliance measures while facilitating point of sale purchases through alternative measures like debit cards – which, as a bank-to-bank transfer, remains kosher.

Many cannabis-related businesses are taking a step further to allow for bank transfers utilizing third-party software. Such payment options like Hypur Pay and CanPay require customers to register through their system, download the mobile app, and check in at a dispensary through the app. If the point of sale mechanism is integrated, then the customer simply enters a four-digit code to check out.

Hypur, the leader in this niche, has worked for the past five years to find and recruit banks willing to do business with the industry. Hypur’s software platform audits a cannabis company in its entirety, sifting through documents and state licenses, financial statements, tax returns, property leases, and other company information. Such software, which can be integrated with other point of sale options, greatly reduces the compliance time needed for a bank — it can take up to 20 hours for a banker to do a single marijuana business's paperwork — to service a marijuana business. By accounting for every dollar made, apps like Hypur facilitate the trust needed for banks to work with cannabis-related businesses.

As these foundational applications ascend in earnest, the digital ecosystem taking shape mirrors other digital markets. Apps like Hypur integrate with cannabis ecommerce outlets like Jane and Dutchie, which also performs delivery services. These services work within the fragmented nature of the state markets, like Jane, which launched an “indirect-to-consumer” module that connects consumers to brands popular in their state, and then identifies nearby dispensaries offering said brands. By integrating with the API of payment processors like Hypur — which are integrated with the API of compliance software like Metrc’s — these digital marketplaces uphold compliance measures as the industry expands and diversifies.

Puff, Puff? Pass.

Digitization is certainly positive, but the industry still grapples with hurdles amidst federal prohibition. Even with the progress made, only 700 out of 10,000 banks and credit unions in the U.S. currently serve marijuana businesses, and banks typically charge $750-$1000 per month to service such high-risk businesses. The payments sector, though rapidly advancing, still faces issues. Eaze was initially a big player in the ecommerce and delivery space in California, and for a time it managed to construct a workaround to accept payments from Visa. But this soon resulted in a lawsuit, and that option vanished. The company elicited more controversy recently after two IT professionals were indicted this year for disguising cannabis purchases for other products to trick banks. And some cannabis-related businesses have even created shell companies to disguise the nature of their transactions to financial institutions.

Any market, legalized or otherwise, incorporating the American financial sector is impacted as long as federal prohibition continues as is. The cannabis industry in Canada was legalized two years ago, and although the industry has steadily seen digital advancements similar to the U.S. as American and homegrown companies enter the market, cannabis-related businesses in Canada have also struggled with payments because credit card companies with multinational links still fear running afoul of regulators in the U.S. and elsewhere. Stories in Canada percolated last year of banks suddenly closing cannabis business accounts out of fear. While there’s been positive changes recently — delivery giant Dutchie began processing Visa and Mastercard payments in Canada in April — the international prohibition regime renders the struggle an uphill battle even in legalized countries.

However, the COVID pandemic is accelerating the legal apparatus and cannabis’ digital ecosystems by necessity. Deemed essential by many U.S. states since March, cannabis businesses have faced the same pressures as other industries to go contactless despite the cash-heavy nature of the industry. In Los Angeles, tax authorities suspended collections by cash to maintain social distancing, leaving underbanked cannabis businesses out in the LA cold. The city ultimately partnered with Dama Financial and its “CashToTax” platform, which arranges for cash to be picked up at businesses by an armed courier and brought to tax collectors. On the customer side, while the stigma of marijuana has made cash as sticky as the industry’s product, recent surveys by Hypur revealed a likely pandemic-driven spike in enthusiasm for digital payments. The pandemic has also pushed states to relax regulations, like allowing cannabis delivery services or telehealth visits. Since the pandemic began, Metrc has implemented “hundreds” of system updates to incorporate changing regulations in various states, informing businesses of the latest updates in real-time.

Beware "Walmartization"

Although the digital space is accelerating during the pandemic, without federal and international resolutions to prohibition, the regulatory landscape will likely remain as fragmented and precarious as the market itself.

“Those nuts and bolts aren’t yet totally there. We would love to see something that speaks to how these markets will truly operate. If it’s not the federal government setting their own rules, then at least a clear outline of how they will allow US states to continue as before, similar to the Cole Memo. Even if it would be just like a full recognition allowing states to do the good work they’re doing — none of that has really been addressed.”

Bronwyn Flores, Communications Manager, Metrc

In the states, there are two proposed pieces of legislation to improve the situation. The MORE Act would decriminalize marijuana, impose a 5% tax on cannabis products, make Small Business Administration loans and services available to cannabis-related entities, and establish a process to expunge marijuana convictions. Another piece of legislation, the SAFE Banking Act, would create a safe harbor for regulated cannabis-related businesses to engage with financial institutions.

Such legislation, which has languished in the Senate, would enable the cannabis industry to mainstream digital payment options and better access needed financial services, clearing the way for further investment and expansion. The election of Joe Biden portends a friendlier Department of Justice than had been under the Trump Administration, with the restoration of the Cole Memo or similar measures likely. However, if Republicans maintain the Senate, passing legislation will be difficult even with broad public support. The possibility remains that expanding cannabis markets to red states will encourage their politicians to support local industries. Cory Gardner, the recently defeated Republican Senator from Colorado, originally came out against his state’s legalization initiative, but as the industry developed over the years, Gardner became a key Republican advocate for the industry in Washington, D.C., co-introducing the SAFE Banking Act.

Those in the industry still see federal legalization as somewhat far off, however, and until then, state markets will continue to develop and evolve. While European countries like Spain and the Netherlands have decriminalized cannabis and allow for “cannabis clubs” to accompany a burgeoning MedTech startup scene, the lack of a fully regulated market limits the development of digital ecosystems even in places like the Netherlands, giving North American start-ups a significant advantage. Consolidation is noted in the U.S. industry, with advocates fearing a “Walmartization” of the industry especially once federal legalization does pass and mainstream companies aggressively enter the space. But as seen in the turbulent paths of once-industry behemoths like Eaze, the picture on the ground is messy. To advocates, that isn’t necessarily bad in the industry’s early stages.

“I do think there’s certainly some consolidation. But there’s an equal resistance to the movement towards Brand X. That could be one of the silver linings of [legalization] happening state-by-state — it gives the local operators more of a chance to carve up their niche.”

Nick Zettell, Cannabis Advocate and Consultant

Budget shortfalls and a slumping economy during the pandemic are encouraging states and countries to open up their cannabis laws, setting up 2021 as a potentially significant legislative year in the legalization movement. But no matter the trajectory or legal status of any cannabis market, digital technologies will play a role. In Israel — which may legalize cannabis next year — Telegram channels are famously used as a conduit for connecting consumers with illicit weed dealers, a network referred to simply as “Telegrass.” Even after the arrest of Telegrass’ founder last year, the digital marketplace continues to thrive during the pandemic, essentially on software autopilot. Whether facilitating illicit transactions or enabling complete transparency and compliance under legal markets, digital solutions will undergird the 21st century cannabis industry. It’s now up to lawmakers to decide how these digital solutions will be used — in the shadows, or in broad daylight.

Image courtesy of Matteo Paganelli

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Pandemic-Fueled Digitization: Who Remains Excluded?

Price To Win: How Pricing Can Set A Fintech Apart