Agentic AI and the Remaking of the Financial Services Stack

~9 min read

Agentic systems — the next big technological leap in AI — do not simply assist decision-making: they evaluate, select, authorize and execute across systems within user-defined constraints. In payments, banking, and commerce — industries whose legacy economics depend on friction, delay and behavioral inertia — that shift transforms incentives, margins and power distribution on a fundamental level. No longer are humans making decisions on every economic transaction pertinent to their lives — as emotional and informationally incomplete that decision-making apparatus often is. Rather, agentic decision-making promises to be purely data-driven in an optimized manner. And while agentic commerce offers caveats to consider, what this presents to the financial services ecosystem is a stack-level reordering in which value migrates toward those who control intent, orchestration, execution and trust.

A Whole New Infrastructure

With agentic AI, the most consequential changes do not occur at the financial rails, which is relatively uninterrupted by agent takeover. They occur where intent is formed, mediated and executed.

Model and platform providers are positioning AI agents not merely as conversational tools, but as transactional movers and shakers. In recent months, a flurry of AI agent protocols has been released by companies jockeying to serve as the vital protocol in communicating with agentic AI across ecosystems, often building on preexisting strengths. Google’s work on agent-to-agent communication standards and native payment authorization, found in its AP2 Protocol, reflects an effort to keep economic activity close to search and discovery. OpenAI’s shift toward persistent, tool-using agents similarly reframes chat as a locus of intent rather than retrieval, found in its Agentic Commerce Protocol (ACP) created in partnership with Stripe. Visa created its Trusted Agent Protocol (TAP) at around the same time that Mastercard created its own agentic commercial protocol. Across the board, the overlying idea remains constant: control the point of intent, and distribution follows.

Beneath these interfaces, orchestration infrastructure has emerged as a structural bottleneck. Much like early cloud platforms, this layer is mostly invisible to end users — but it determines which services are reachable, composable and trusted.

“The way that agentic [commerce] should work… is that it should work as a layer that sits on top of the existing infrastructure. And as new protocols come to market, whether that be [Know Your Agent], etc., we will comply with all those protocols on behalf of the specific merchant.”

Scott Hendrickson - Chief Revenue Officer, firmly.ai

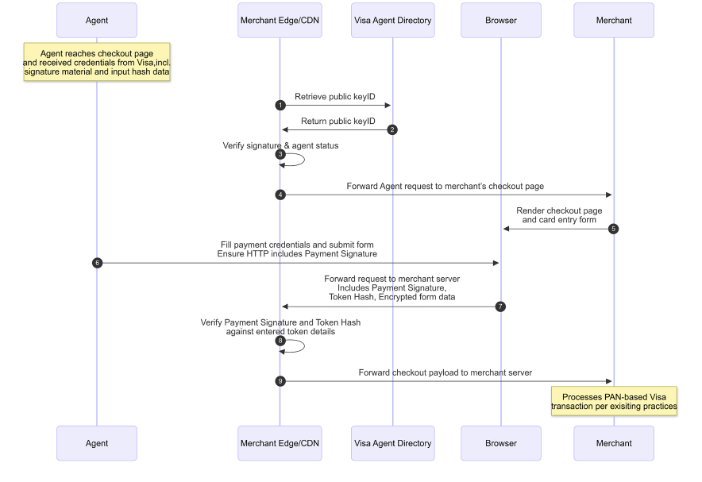

Payments is where autonomy meets institutional gravity. Networks and processors have responded cautiously, not by proposing new rails but by encoding existing safeguards into agent-compatible frameworks. Visa’s Trusted Agent Protocol exemplifies this approach. By emphasizing cryptographic mandates, agent identification, and evidentiary chains, Visa is attempting to preserve liability allocation and dispute resolution in a world where transactions may be initiated without a human click.

Source: Agent Verification for Payments, Fintech Wrap Up

Source: Agent Verification for Payments, Fintech Wrap Up

Acquirers such as Stripe and Adyen are pursuing parallel strategies, embedding agent identity signals, tokenization, and intent verification into familiar authorization flows. The objective is adaptation without fragmentation. Autonomy is permitted, but only within guardrails the system already understands.

From Assistance to Autonomy

For more than a decade, innovation in financial services optimized access without altering agency. Mobile banking, embedded payments, and API-driven fintech made interactions faster and smoother, but the final action — authorizing a transfer, selecting a card or choosing a merchant — remained human. While concepts like nudging sought to take a data-based, psychology-informed approach to improving individuals’ financial decisions and behavior, legacy economics continued even as customer experiences improved.

Agentic AI collapses that separation. When fully realized, the lifecycle of commerce — discovery, comparison, authentication, payment, financing, post-purchase management — will compress into a continuous, machine-mediated workflow. The user’s role shifts from operator to author of preferences, constraints and risk tolerance.

The agentic space is still in the very early stages of taking shape. But people are already seeking out AIs to carry out similar functions; of the 2.5 billion prompts made in ChatGPT per day, 2.1%, or 53 million, are shopping queries.

And so at this junction, AI offers the technology for the fintech revolution to realize its latest iterations’ primary goals: embedded financing, frictionless transactions, and optimized decision-making.

By enabling agentic AI — autonomous AI systems that can not only process and suggest, but execute functions for humans — to take care of all aspects of our financial wellbeing and investments, the paternalism of nudging of yesteryear gives way to streamlined and optimized automations of financial tasks we either don’t care to do or aren’t very good at.

“We often make decisions on some form of emotion, because we have some emotional attachment to a brand, or we like a particular brand, or because Chase sponsors the U.S. Open, and we like tennis… But an agent doesn't think like that. An agent is going to look at data. So, it starts to become an incredibly data-centric world in which our agent will assess the fit of a particular product for us or a particular service for us based on the data and based on comparative analysis.”

Udayan Goyal - Co-founder and Managing Partner, Apis Partners

When transforming the execution layer from a human-driven one to an agent-driven protocol — and one that will often be an AI agent interacting with another AI agent — products and services no longer compete primarily for human attention, but agent selection. The marketing approach of an insurance provider no longer makes a difference — the pricing and fit for an individual’s data-driven preferences and needs is what matters, decided by the AI agent.

Under such parameters, Goyal views any financial service product that isn’t sufficiently differentiated as being on the agentic chopping block. Users no longer use a financial app, let alone a banking branch. Retail banking loyalty no longer matters when the product fails to differentiate itself from other products out there. Asset managers become vulnerable because an AI agent can do that itself; in fact, investment and asset trading becomes a dynamic, continuous market dictated completely by agent-to-agent interactions. Payments, lending and insurance all become completely automated and controlled by AI agents that find the most optimal solutions for its customers.

Finding Compatibility Over Disruption

Fundamentally, there is a difference in how this transpires for financial service products and commercial products. As Goyal sees it, financial service products are inherently digital by nature — data-driven, with aesthetics being irrelevant. That obviously isn’t the case in the agentic commerce space, where products are still firmly in the physical domain.

In this sense, the time frame for full customer embrace of agentic commerce to its automated extremes is longer-tail than the relatively straightforward dynamics of agentic AI-driven financial services.

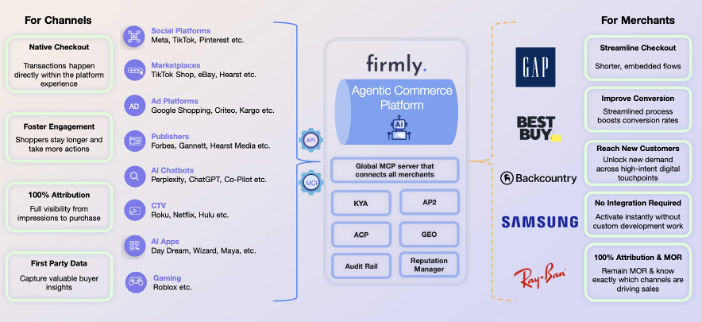

Firmly.AI is performing the crucial middleware in agentic commerce that seeks to connect platforms with merchants using agentic protocols. For merchants, agentic commerce reintroduces a familiar challenge in a new form: fragmentation. No retailer can afford to integrate separately with dozens of agent frameworks, execution standards and runtime environments, each evolving independently.

Rather than forcing merchants to adapt to agents, firmly treats the merchant’s existing commerce stack as the system of record. That stack is then exposed outward through a standardized, machine-readable interface against which agents can transact.

Source: firmly

Source: firmly

The result is portability. An agent can add items, apply promotions, select shipping and place an order regardless of where it originates from. Execution moves, but ownership does not. The merchant remains the merchant of record, with data and customer relationships remaining as they were.

“The communication touch points might be changing over time versus what maybe they're used to, but the data and the relationship still sit with the merchant, because if you're shopping, you're buying a product with Best Buy. And you know that you're checking out with Best Buy, and if you have returns or exchanges, you go to Best Buy to do that; you're not going to the platform.”

Scott Hendrickson - Chief Revenue Officer, firmly.ai

This distinction is critical. As firmly’s CEO Kumar Senthil explains, previous waves of embedded commerce faltered when platforms attempted to assume merchant-of-record status, alienating retailers and inviting regulatory complexity. Agentic commerce works only if execution can travel without disintermediating existing roles. Portability becomes the organizing principle — eschewing disruption in favor of compatibility at scale.

Adapt, or Die

Banks face a sharper and less forgiving transition than merchants. Agentic decision-making directly targets business models built around opacity, delay and behavioral inertia. As autonomous systems gain adoption, traditional financial institutions begin to lose their salience. Goyal subsequently views agentic AI as only strengthening Apis Partners’ central thesis that “distribution will shift to non-financial brands”.

There might be ways for banks to remain relevant in an AI-driven landscape, but it will require adoption to the transformed terrain faster than what they are indicating so far. This includes introducing standardized pricing, transparent eligibility rules, predictable reward structures and clean APIs. With such changes, margins compress, but distribution remains intact. Going all in on agentic AI would include embedding payments, credit and treasury capabilities within regulated trust environments where agents can operate safely and at scale.

Credit card companies already showed how this can be possible in shifting business priorities and systemic functions as technology progresses. At least conceptually speaking, Identity infrastructure, compliance processes, underwriting model, and access to capital are all potential contributions from banks inside agentic workflows. Banks that utilize these capabilities may serve as contributors to autonomous value chains rather than endpoints at the edge of them.

“Agentic commerce creates new touchpoints where issuers can add value by approving agent permissions, issuing agentic tokens, and offering enhanced fraud detection and dispute resolution services… Banks that integrate with agent toolkits and provide clear consumer controls over agent permissions will be best placed to retain cardholder trust and capture value from new transaction flows.”

James Fry, Head of Enterprise Product, Worldpay

Firmly is in talks with several banks to bring the agentic shopping experience to within banking apps. But as Senthil highlights, what might be more crucial for the banks is to utilize the data they already have from customers — they know where customers shop, if not exactly what they shop — to partner with brands to personalize offers to banking customers, creating an agentic commerce play for banks as well.

In such instances, however, Senthil notes it is still in the early going of “evangelizing” these ideas with the banks.

Follow the Money

While the dramatically expanded functionality of agentic AI may seem at first glance ripe for potential abuse or scams, the developing architecture suggests a completely auditable trail of transactions that are further validated by the infrastructure layers’ emphasis on developing KYA protocols: Know Your Agent.

In this new world, it might be less likely to have unscrupulous providers scamming people because the agent is able to check the regulatory permissions of agents and talk directly with the regulator through APIs. Regulation would subsequently be dispersed in several areas, treating these AI agents as both fiduciaries and software products.

“The biggest regulatory question that's going to come out of this is: who actually carries the liability in these situations? Is it the agent provider? Is it the platform hosting it, or is it the regulated institution executing the transaction? And I think it's going to be kind of all of those.”

Udayan Goyal - Co-founder and Managing Partner, Apis Partners

Applying preexisting tech and financial regulations might quickly prove insufficient as agentic AI reshuffles how commercial and especially financial spaces look and perform. But this needs to come soon; model capabilities are quickly crossing the threshold for reliable autonomous execution. Infrastructure — from APIs to tokenization and real-time settlement— support high-speed decision-making, and sustained margin pressure across commerce and financial services will quickly make efficiency gains existential rather than experimental.

According to firmly’s Senthi, 2025 was “not even a crawl”, but more “like a pre-crawl year”. 2026 will be a “year of building infrastructure”, while 2027 is the year “you will see real volume coming in” for the agentic commerce middleware company. Goyal believes we are only one year away from agentic commerce becoming “pretty much daily stuff”, with its transformation of financial services being two years away. And with agentic AI commerce alone now being projected to top $180 billion annually, early-stage VCs are subsequently chomping at the bit, with projections for VC funding of AI agents to reach $6.7 billion for 2025.

These changes in consumer behavior will be iterative, as Goyal puts it — enlisting an AI to buy bedsheets or purchase basic groceries may come first, with more nuanced purchasing taking more time. In the meanwhile, much needs to be sorted out regarding whether agent protocols will be consolidated in some fashion, and the composition of the respective AI agent field; with early efforts from Big Techs alongside AI-native startups like Perplexity and its Comet agent, the early tea leaves suggest similar market dynamics as what we’ve seen so far in regards to LLMs.

However, the market winners and losers shakes out, agentic AI is coming, and likely faster than you think.

Image courtesy of Lukas

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

How DPI Determines the Shape of Sovereign AI

What It Takes To Be AI-Ready