Data, Diversify, Distribute: Emerging Optimization Models

~8 min read

2020 brought with it a 12.7 percent increase in the number of registered mobile money accounts, bringing the final count to 1.21 billion accounts. Transaction values also grew as customers began using their accounts more often and for more advanced use cases. However, many mobile money operators have struggled with the long-term viability of thin margins while managing complex agent networks to deliver their products. As digital finance stakeholders build capacity and increasingly serve previously excluded or underserved populations, optimizing the distribution of these services may be crucial in operating a profitable, thriving digital finance business.

In this week’s Insight, we explore specific issues and considerations for managing an agent network, particularly as products and use cases become more targeted and complex.

More Money, More Problems

According to the GSMA’s 2021 State of the Industry report, there are 5.2 million unique agent outlets globally that digitize US$500 million per day. In 2020, the number of registered and active agents grew by 14 and 18 percent, respectively, and registered accounts and transaction volumes grew at essentially the same rate. The GSMA posits this impressive growth was due to both supply and demand factors, with the pandemic serving as a catalyst for digitization among governments, providers and end-users. But despite the impressive growth, only 55 percent of agents were considered active in the past month, highlighting an opportunity for improved agent performance and profitability.

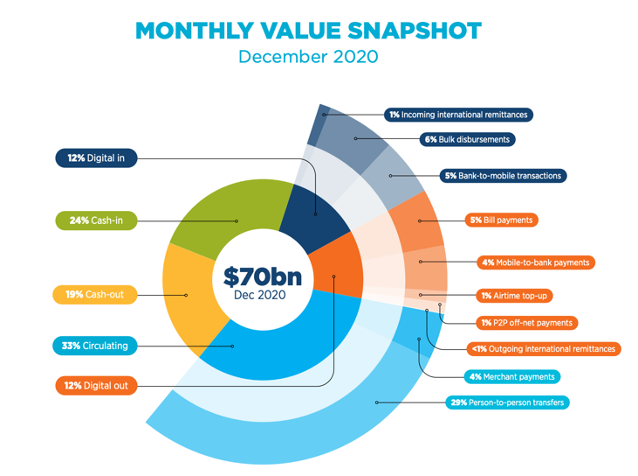

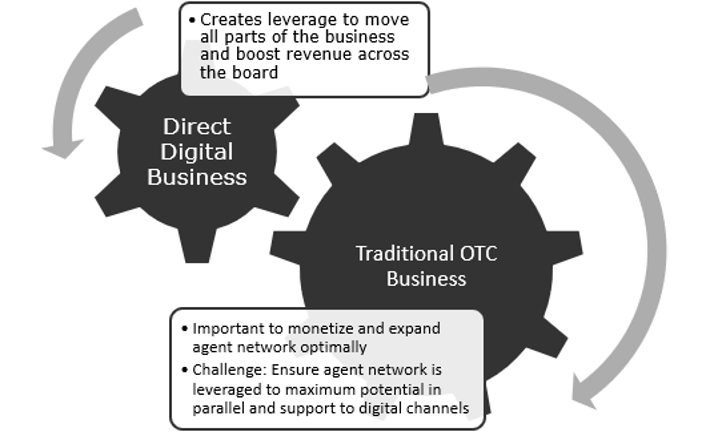

But while growth of digital transactions dominated the headlines, cash-in / cash-out (CICO) still represents more than 40 percent of agent activity, making over-the-counter (OTC) transactions essential to a successful mobile money business. Across emerging markets, agent-assisted OTC is the preferred method of transacting, primarily due to a lack of financial and technical literacy, as well as the historical habit of interacting with an agent. Although many providers initially pushed the OTC model to achieve volume, it can weigh heavily on provider’s profitability, making it more difficult to transition to mobile money or digital wallets at later stages as customers become accustomed to OTC transactions. But if agents are trained and managed properly, OTC interactions can serve as an onramp for customers to register and learn about more advanced use cases or digital-only transactions. The person-to-person interactions that OTC provides presents an opportunity to enable OTC customers to build familiarity with mobile money use cases over time.

Source: GSMA State of the Industry Report, 2021

In markets like Pakistan, supply-side incentives like mandated biometric SIM registration have worked to shift OTC customers to digital in the past few years. Although the State Bank of Pakistan reported a decline in the share of OTC transactions, OTC still dominates. Ammara Batool, Head of Channels and Development for JazzCash, one of Pakistan’s leading mobile money providers, explained that while there is a steady growth in digital transactions on a monthly basis, OTC is still substantially more significant than digital channels. For this reason, JazzCash is planning to double their agents over the course of the next year to broaden geographic reach and deepen penetration into existing areas.

Even for markets that are experiencing a more rapid transition to digital, investing in robust OTC channels serve as important groundwork for building digital businesses. OTC agents play a critical role in introducing digital products to more analog customers.

Source: Mondato analysis, 2020

Serving Rural Communities

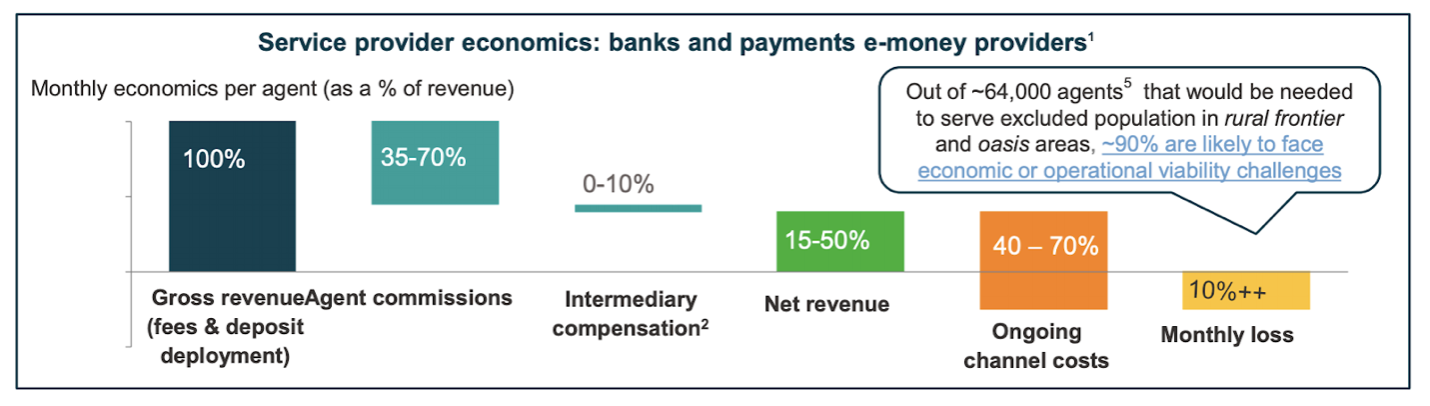

As businesses expand and the “low hanging fruit” segments are sufficiently served, identifying expansion opportunities becomes critical, particularly as it becomes difficult to outmaneuver competition without possessing a first-mover advantage. With this maturation, agent networks must expand into more remote areas, where a majority of the world’s financially excluded people reside. Expansion into these areas requires higher investment with a promise of lower transaction volumes, making the business model for this expansion particularly challenging. While the number of OTC-enabled agents has grown significantly in urban areas, operations in rural areas remain limited.

In Indonesia, a study found that while agent numbers have risen dramatically, the percentage of economically viable agents remains low. Dealing with limited digital literacy and low smartphone penetration, rural customers are disproportionately not yet ready to go digital. If traditional agent network economics are unsustainable in such markets, then adequately serving rural populations requires a fundamental business model shift.

Source: CGAP / MSC, 2020

Expansion into rural areas will be a critical component to achieving more ubiquitous financial inclusion — as well as growing mobile money customer bases — so enabling rural agents to generate more revenue will be essential to making digital financial services more accessible to their customers. New models are being tested to confront this challenge. Providers have been experimenting with providing additional nonfinancial services like delivery and transport in order to offer a wider menu of revenue-generating services per customer. Banks in Colombia employed this model — with the initial support of government subsidies — by identifying agents that could deliver both financial and nonfinancial services of particular value to rural populations. By offering a more diverse range of products, transaction volumes, agent revenue and viability were improved dramatically. In the least densely populated municipalities where the model was tested, agents experienced three times more transactions per month, with four times the value, compared to the legacy model.

Incentivizing for Success

Even in urban areas where transaction volumes are higher, if the agent lacks awareness or incentives to promote more advanced, non-OTC services, the majority of end-users will simply stick to CICO transactions. With agents as the main interface with customers, robust recruitment, training and incentive programs serving agent networks are necessary to effectively launch and distribute financial products. These programs should aim to validate and build agents’ understanding of the products as well as their respective commission structure to appropriately onboard or deepen end-user relationships.

There are various ways that providers train and incentivize their agents. Indonesia’s BTPN uses a gamification platform called SUSAN to enable agents to receive tips and rewards related to performance. Though tracking and rewards applications are quickly becoming best practice, studies have found that there are still critical gaps between provider policies and agent realities, with liquidity management cited as the major weakness of most networks.

Mobile banking service provider Wing Cambodia requires agents to be full-time service providers — and exclusively. In addition, agents are expected to meet strict capital and training requirements to ensure optimal productivity and management. Though the intensive prerequisites can lead to more of a lag time needed to deploy additional resources in more competitive or marginal areas, it mitigates cash flow and performance issues later on.

Agents will only make the extra effort to grow their business if they are properly informed and rewarded. Building customized commission structures to incentivize agents to push the right products to the right customers can be a difficult task, requiring collection and evaluation of agent data in addition to appropriately managing technology and liquidity requirements.

Unsurprisingly, COVID only accentuated these challenges.

COVID as a Stress Test

Many governments declared agents and their supply chains as essential services during the pandemic, and the resilience of these networks was critical to continued service delivery. “The pandemic was a black swan event that created the ultimate stress test for teasing out issues for distribution networks,” according to Mondato CEO Judah J. Levine. Already-established providers were better equipped to cope with increased demand and volumes, with many agents requiring additional support from their providers, but smaller, less sophisticated providers were forced to shut down or consolidate. Fee waivers and more flexible onboarding, among various other actions, were put into place by central banks in order to ease the burden, but some policy responses may risk the long-term viability of mobile money businesses and how their agents operate.

The first months of the pandemic brought a 70 percent decrease in agent revenue and more complicated liquidity issues in Kenya. PesaKit, a last mile agent network platform, responded by investing in a variety of activities to empower agents to continue earning income during the pandemic. PesaKit’s CEO Andrew Mutua discussed the approach during a webinar hosted by Mondato in September 2020. In addition to providing educational training on how to operate safely during the pandemic, float exchanges were made available to enable agents to meet customer CICO needs. Agents were also offered a 12-month cash insurance policy in the event that they tested positive with COVID or had to quarantine.

In South Africa, money transfer company Mama Money took a similar approach by starting a fund for their most vulnerable agents in order to pay them a stipend to get them through the lockdown. These types of efforts were essential for maintaining a resilient, robust agent network.

The light at the end of the COVID tunnel in sight, more mobile money activity and agent network growth brings with it the aforementioned challenge of efficient expansion strategies. As providers move down the socioeconomic curve, with more densely populated and obvious urban centers covered, providing services in more remote, or less commercially obvious areas calls for a scientific approach to expansion.

From Legacy to Cutting-Edge: Approaches to Optimization

Those managing the most successful agent networks are implementing real-time data and analytics capabilities to increase the efficiency and effectiveness of their agents. “Integrating technology into a broader business case is key to the success of an agent banking initiative,” according to the IFC’s digital services specialist Christian Rodriguez. His team found that successful integration of technologies that collect, monitor, and/or analyze agent networks is directly correlated with increased transaction volume.

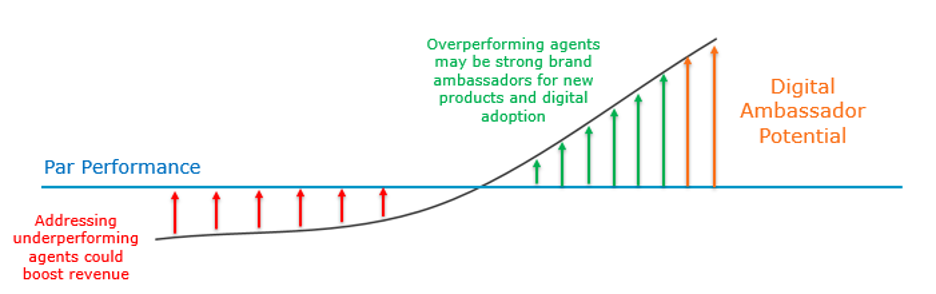

By recording and considering agent locations, activities and behaviors, providers can access data-driven insights that can help develop more customized agent management and expansion strategies. In addition, agent data allows for both agent and customer segmentation, making it easier for providers to design more tailored distribution for specific clusters or identify where a push from OTC to digital transactions would be most appropriate.

Recognizing the importance of optimizing distribution networks, Mondato developed in-house data analytics, artificial intelligence (AI) and machine learning capabilities as part of its strategy toolkit in order to better support providers in understanding and managing distribution networks. Mondato’s proprietary methods are leveraged to isolate where networks are succeeding, need improvement or would benefit from additional capacity or expansion. Analysis often includes, but is not limited to, a geospatial analysis of network positioning and coverage, which enables a profiling of segments and performance indicators, characterized by their relative value to the broader business.

Prior to introducing agent data, granular market segments can be created based on determinants like building and population density, as well as proximity to financial access points. This type of independent market assessment helps to avoid circular logic when segmenting the market, as any networks to be reviewed would be considered separately and would not influence the segments. Agent performance can then be reviewed and contextualized relative to their geographic positioning.

For example, an agent producing US$75 in revenue may be considered a strong performer in a lower demand segment, but a weak performer in a high demand area. With the contextual assessment of performance, current agent performance can be separated into brackets, and areas currently excluded or underserved can be analyzed based on the characterization of the given area. Benchmarking in this manner is done at a more granular level than typical province-level KPIs, allowing for a more accurate understanding of performance. Machine learning and AI techniques further segment agents and their customer’s transactions to determine where it makes the most sense to invest in a transition to more digital transactions.

Source: Mondato analysis, 2021

But the journey towards distribution optimization often begins with clear and standardized data collection, beginning with the agent. As agents become responsible for deploying a more diverse range of products and services, strategic and innovative approaches to data collection must be taken in order to monitor performance, as well as to produce insights to inform planning and expansion efforts.

Agent networks are challenging and expensive to maintain and grow, but if strategically implemented, technological innovations in data analytics and machine learning can assist providers in concentrating investments and growth to support a transition to digital while optimizing OTC distribution channels.

Image courtesy of NASA

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Will Vaccine Passports Exclude or Enable?

Can Personality Predict Loan Performance?