Japanese Fintech: Teach An Old Dog New Tricks?

~6 min read

The world’s third-largest economy and oldest populace, Japan’s economic and financial path is unlike any other. Peaking in 1990 before the digital age took root, Japan’s 30-year economic stagnation bleeds into digital innovation. The prevalence of cash in everyday transactions is evident in the sheer number of cash-only ramen shops and ATMs dotting the country. Once upon a time, Japan was credited for commercializing mobile wallets back in 2004. But since then, Japan’s fintech industry has experienced gradual growth, and nowhere near the pace of other advanced economies. Considering its risk-averse culture, did Japan peak too early — and can its fintech prospects rebound nonetheless?

A Different Kind Of Evolution

Throughout its history, Japan’s unique culture, language and systems of governance have evolved, in part, due to its geographical isolation from the rest of the world. This has given rise to the "Galapagos Syndrome," where solutions and innovations are optimized for the domestic market but struggle to gain traction elsewhere.

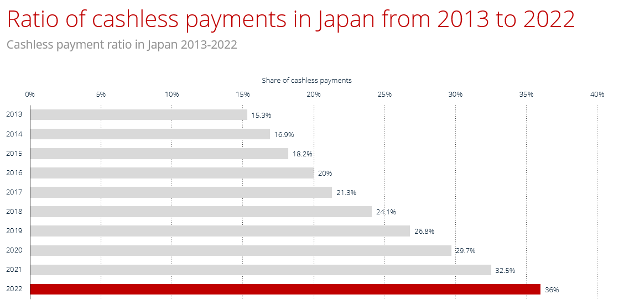

With an aging society and risk-averse culture, the Galapagos Syndrome has pushed Japanese fintechs towards the laggard end of the innovation curve. Today, cashless payments account for only 36% of all payments in Japan, a significant increase since the pandemic but far behind neighboring countries like South Korea (94%), China (83%), and Singapore (60%).

Source: Statista, Meti.go.jp

Dr. Seki Obata, a finance professor at Keio Business School, emphasizes culture and demographics — with an average age of 48 — first in explaining Japan’s fintech limitations.

“The phrase 'digitization or die' does not hold true in Japan. Even with the rise of digital payments, the Japanese people have [a] strong attachment to cash. This is particularly evident among the elderly, who hold a significant portion of the country's wealth and therefore wield substantial influence over financial practices [and development].”

Dr. Seki Obata, Professor of Financial Management, Keio Business School

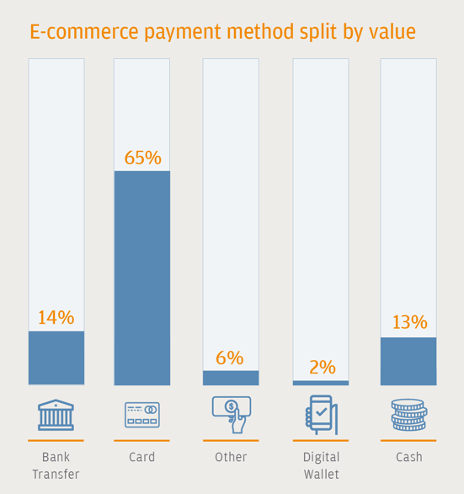

Such characteristics influence the proliferation of e-commerce options to offer payment options for users to pay in cash when their online orders are delivered at their doorsteps. Going strictly cashless is a tightrope avenue to pursue.

Source: J.P. Morgan Global Insights Japan Report

Given the conservative cultural norms in Japan, innovation and consumer adoption of cashless solutions are bound to progress incrementally. Seeming half-measures of e-commerce serve as an intermediary step before fintech companies can possibly take the baton and go further.

That further development is seen in solutions like Paidy. Paidy allows customers to simplify the entire billing process by centralizing all their bills from various Paidy-accepting merchants over a month to produce a consolidated bill payable at the end of the month. Customers can pay in cash at convenience stores or link a bank account to do automated payments.

Such tailored solutions mitigate the typical issues of cash-based services, but without digitizing altogether. Only through hybrid solutions might the hordes of resistant Japanese customers slowly come around.

Crawling When Others Dare To Run

No matter the incremental steps taken, Japan’s culture might prevent the country from ever catching up to fintech pioneers.

“Japan is a risk-averse society. It will take generations to change that. For young founders, fear of being seen as a failure when building a startup translates to founders and businesses alike taking a conservative approach to meet the needs of consumers that conceptually can’t operate without cash [yet].”

Dr. Hitoshi Suga, Professor of Entrepreneurship and Global Business, Keio Business School

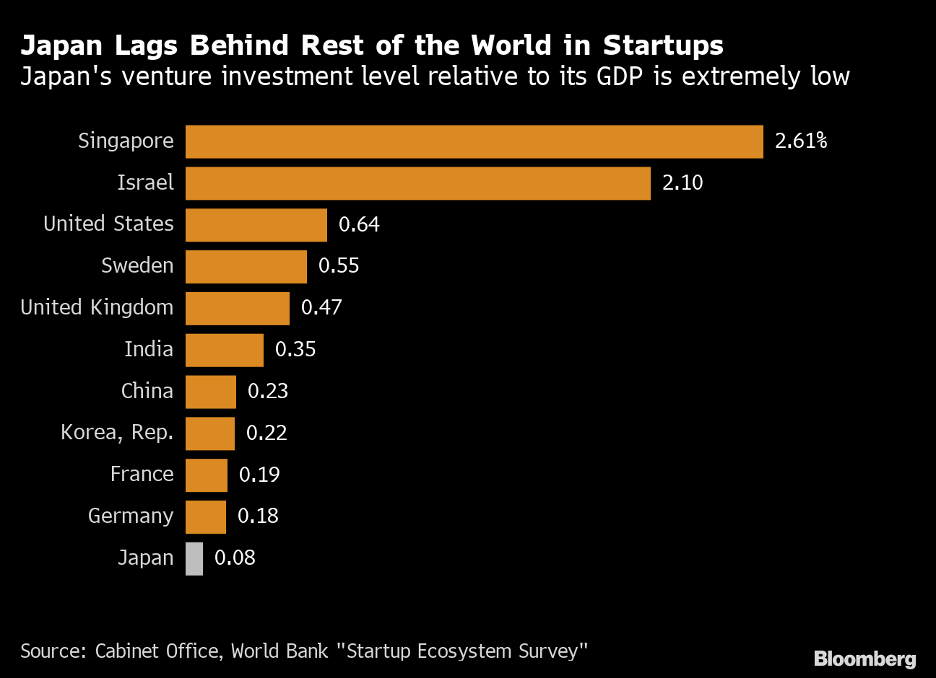

As Takeo Kikkawa explains in a recent journal article, earlier Japanese disruptors like Sony, Toyota, Nippon Steel, Canon and Seiko managed to produce “some of the world’s highest-quality products” in their markets, maneuvering to high-end markets with little room for growth. Yet while American companies saw people leaving companies and taking venture capital to commence “new waves of disruptive growth,” Japan’s economic structure and norms prevented the same kind of labor and venture capital mobility. While the country profited handsomely in its earlier boom, it failed to lead into the next wave of disruption.

In contrast to the Japanese ecosystem, Israel's start-up culture has become a global phenomenon, characterized by an ethos that celebrates risk-taking and encourages entrepreneurship. This approach has resulted in an explosion of successful tech companies, including 39 Israel-based unicorns. Israel’s outward approach is in contrast to Japan’s isolated market of 125 million, where adapting to consumers' comfort levels may provide solid returns, but with a firmer, lower ceiling.

Source: Bloomberg

But fixing digital market shortcomings becomes more difficult without a population prepared for transformation. According to a study conducted by Matsui Securities, 81% of Japanese consumers said they were not confident in their knowledge of finance. However, the Japanese entrepreneurial approach means that systemic challenges like subpar financial literacy rates are not addressed head-on; rather, solutions are too often mere mechanisms of analog acquiescence.

The Long And Winding Road

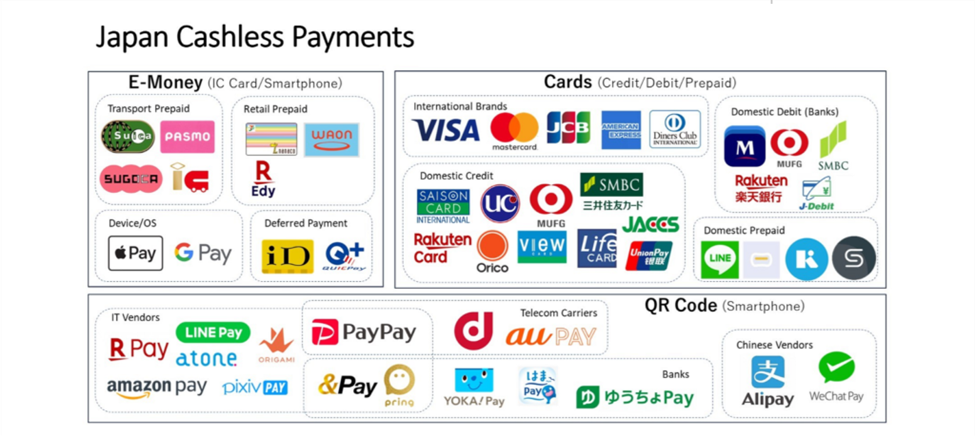

Criticism shouldn’t wholly dismiss the progress and potential of Japan’s sector, with an advanced economy and large population of 125 million. At this juncture, Japan does boast quite a few fintech solutions, and the consumerist-heavy culture has coupled with rebounding tourism from digital-native neighbors to fuel some recent adoption in areas like QR code-enabled payment solutions.

Source: Crowd Cast via FinTech News

The challenge, however, lies in achieving mass adoption and enthusiasm. The root of these issues is systemic and multi-layered, spanning far beyond the fintech horizon. To put it into perspective, Japan is a country where one-third of private households still use fax machines, according to a 2020 survey conducted by the Ministry of Internal Affairs and Communications. When it comes to digital adoption, the steep hill that graying Japan must climb doesn’t get easier with age.

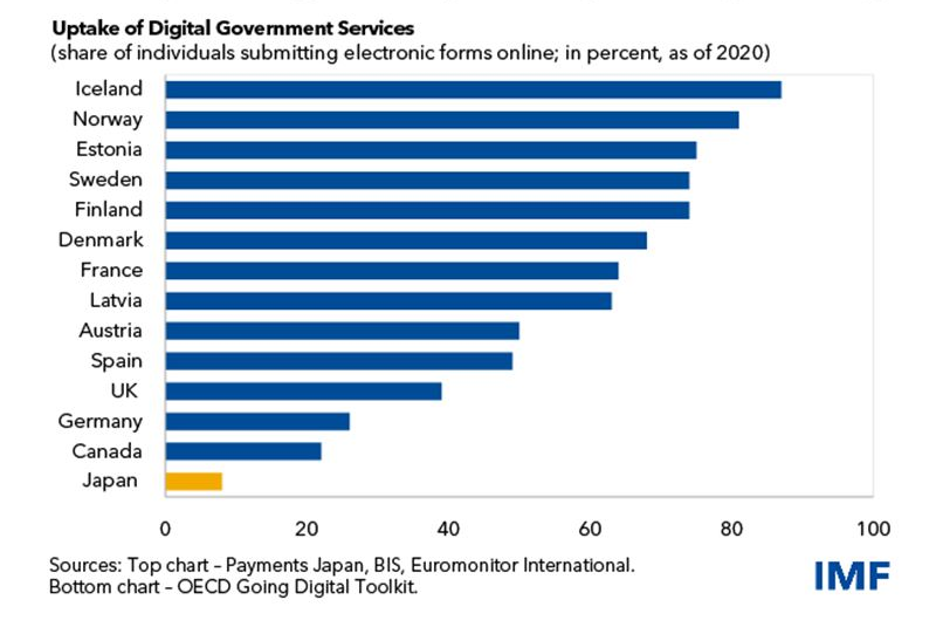

This catering to elderly preferences with obsolete technology manifests in basic government infrastructure, subsequently leading to underinvestment in innovative ICT. A whopping 80% of ICT spending is dedicated to maintaining outdated legacy systems, with over 1,900 intergovernmental procedures still requiring the use of storage devices such as CDs, mini-disks, and even floppy disks to conduct business. This reflects public norms; while the rest of the world has moved on to online downloads and streaming, in Japan, CDs still accounted for approximately 70% of recorded music sales in 2020.

Source: IMF

Grappling with proportionally few young people and stagnation now stretching 30 years, the financial services sector can feel in ways like what cutting edge was back then. One indicator Japan leads in the Asia-Pacific region is when it comes to credit card penetration, which stands at 68% domestically. While later economic ascendence in other parts of Asia and in Africa coincided with and fueled a leapfrog towards digital-native solutions, Japan’s peak just before the digital age mirrors its frozen consumer habits of today.

Are demographics and market economics therefore an inevitable destiny? Signs of increased uptake since COVID is encouraging, but Japan-specific limitations persist. Mass education and a doubling down by the government are necessary to shake Japan from its innovation malaise and overcome these obstacles. Considering the cultural and demographic factors, it’s not simply a preference for this to be done incrementally, but unavoidable.

As the IMF points out, such a large economy riddled with inefficiencies would benefit greatly from progress in providing and incorporating digital financial services. Japan’s unique characteristics and problems might render greatly slow such a trajectory, with the Japanese fintech story becoming a cautionary tale, or at least a bizarre one. Whether a course correction is in sight, though, likely relies on serious intervention to stem the demographic and cultural tide.

Image courtesy of David Edelstein

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Post-SVB: Are Emerging Markets Digital Banks’ Oasis?

Small Scale Series: Tiny Markets in West Africa