Small Scale Series: Tiny Markets in West Africa

~9 min read

When it comes to fintech, scale sells. Any start-up seeking sustainability requires a measure of scale in a given market, and investors take note. In Africa, the sheer size of Nigeria has propelled homegrown and foreign fintechs to jump into the market, hoping to capitalize on the masses of unbanked and underbanked customers. Yet what happens to the tiniest of markets? Are they left behind, or does innovation find a way where it’s least expected? In this week’s Insight, we explore this question from the perspective of several tiny markets in West and Central Africa.

Big Fish Feed First

Lack of scale is far from a death knell alone for an aspiring fintech hub. The Baltic states have utilized innovative regulatory regimes, such as Estonia’s pioneering e-residency program, to become an exporter of tech and fintech products. With only 9 million people, Israel has also become a fintech powerhouse thanks to its pool of tech talent, innovative culture, and strong foreign investment, becoming testing grounds for fintech products later exported around the world.

“The Israeli entrepreneur has to think about how to scale, because he's basically targeting foreign, massive markets... So I think we’re no longer just Start-Up Nation; we’re Scale-Up Nation.”

Nir Netzer, Chairman, Israeli Fintech Association, and Founding Partner, Equitech Group

Having foreign investment pour in and homegrown products flood out is the dream for any small market fintech hub but achieving that requires excellence regarding the other fundamentals involved in creating a thriving digital financial services sector. Those fundamentals — such as political stability, a good economy, an enabling regulatory regime, an innovative, entrepreneurial culture, a young, tech-savvy population, financial literacy and sufficient electricity and digital connectivity — don’t just come out of nowhere, and they determine to a large degree just how much progress is made across markets. But especially when it comes to attracting investment and cultivating sustainable financial solutions, small market size poses a major barrier, including in West Africa.

“Unfortunately, small countries are usually remembered last. And because of their unique nature, at times, it's very difficult to have homegrown products coming up early enough to be rolled over to other countries.”

Wycliffe Ngwabe, Country Lead, UNCDF in Sierra Leone and Liberia

According to Ngwabe, a multitude of issues makes creating sustainable digital financial services in Liberia and Sierra Leone difficult. As poor countries with populations of only five million and eight million people, respectively, Liberia and Sierra Leone’s governments don’t have enough government revenue — with more than 70% of their revenue spent in administrative costs alone — to provide initial investments to the private sector or make infrastructure improvements. Donors and investors alike tend to target larger countries, according to Ngwabe.

“The markets are quite small, so sometimes it's really difficult to develop a viable solution that could drive uptake. And that, of course, impedes the appetite compared to other markets like Ghana, Nigeria, Côte d'Ivoire, Senegal.”

Wycliffe Ngwabe, Country Lead, UNCDF in Sierra Leone and Liberia

Finding Footing in a Small Space

There are some ways to circumvent the issues of scale early on in a small market’s development. G2P payments are often the first step taken in small countries lacking in private sector solutions. This was seen back in 2015 in Sierra Leone with Ebola payments, and it’s one of the avenues prioritized in The Gambia now. But G2P payments are often a dead-end route for ecosystem growth, with retention low and participants largely looking to cash out whenever possible.

Remittances are a natural bridge to larger, prosperous economies elsewhere. Some of the early success stories in Sierra Leone revolve around the remittance space. In the more challenged Gambia, where remittances comprise a large share of GDP, UNCDF supported Pay365, a local remittance provider, but it didn’t take off because the cash-intensive society still sought to collect remittances in cash. Niania Dabo, Country Lead for UNCDF in The Gambia, nonetheless believes that remittances are one area that can kickstart digital financial services and a shift away from cash.

“If work and focus is given in that area, where it's simplified, it's made easier for people to not collect their remittances in cash, maybe paying it directly into a bank account or directly into a mobile money, and allowing them to use it as when they need it, that could be a game changer.”

Niania Dabo, Country Lead, UNCDF in The Gambia

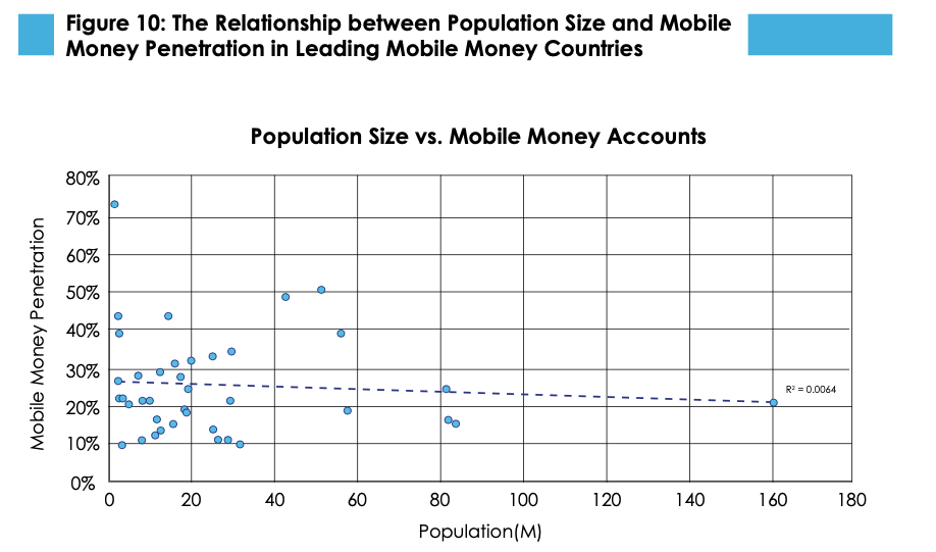

What has proven to be the most stable method of introducing early fintech products in small West African markets are solutions from mobile network operators (MNOs). Mobile money, lending and savings products are simply value-added services with the built-in scale of the MNO’s subscriber base, easing the pressure to find early success. In Sierra Leone, MNOs Orange and Africell have both launched mobile money ventures, and in Liberia, MNOs like MTN Lonestar and Cellcom have helped propel mobile money account ownership to 36% of the adult population.

Source: UNCDF

Settling For Leftovers — Or Less

Especially following COVID’s acceleration, more digital financial solutions are emerging in these tiny markets, but often as expansions from companies originating in neighboring — and now saturated — markets. As Ngwabe puts it, being a follower rather than a leader decreases the benefits that fintech provides to a country’s economy, with solutions being imported rather than exported. But after earlier failures to ignite a purely homegrown fintech ecosystem in Sierra Leone, Ngwabe now views partnerships and expansion from elsewhere as a viable path forward in overcoming the issues of scale impeding early-stage fintech startups. Ngwabe sees the potential for more locally tailored solutions to emerge after that initial start.

“What we're encouraging in these two countries is can you identify those unique market failures and come up with a solution that can address those challenges, apart from just having off-the-shelf products and services coming in from other markets?”

Wycliffe Ngwabe, Country Lead, UNCDF in Sierra Leone and Liberia

While Sierra Leone and Liberia have benefitted from spillover products flowing from saturated neighboring markets, the case is not the same for The Gambia. Other than Wave, almost no digital financial products have reached The Gambia from elsewhere yet. According to Niania, the country is still struggling with fundamentals — and it’s even smaller population size at just over two million people — that make any kind of foreign investment or consumer adoption even more difficult to come by. Niania says Gambia’s situation is “totally different” from Sierra Leone and Liberia, and it begins with culture.

“Sierra Leone, Liberia, Senegal, Nigeria, Ghana, they have a strong entrepreneurial sector. They have a lot of street vendors, so even though we're neighboring countries, the dynamics are not the same in The Gambia.”

Niania Dabo, Country Manager in The Gambia, UNCDF

With Gambia’s fintech sector still in its earliest stages, there are four areas Niania emphasizes as requiring improvement for the country’s sector to progress: access, usage, affordability, and financial literacy. More than Sierra Leone or Liberia, The Gambia is a cash-intensive society, and insufficient infrastructure development has made data particularly expensive for Gambians, which keeps the poor populace from adopting digital solutions like mobile money. The Gambian government recently opened a Ministry of Digital Economy, however, and with investments in a new national switch coming to fruition by 2027, Niania is hopeful that access and affordability will be improved in the coming years — and with that, a stronger transition to digital solutions.

“We've seen during COVID, when the population was given free data, when support was provided through mobile money, we've seen it work. So affordability is critical for The Gambia.”

Niania Dabo, Country Manager in The Gambia, UNCDF

Growing Gabon

Improving these market fundamentals can allow for even the smallest of markets to develop successful fintech solutions, with the potential to export. A bit further south along the west coast of Africa lies Gabon. Despite its small market size of two million, Gabon has made further strides in its fintech development than most of its tiny regional compatriots. Gabon’s advantages begin with its post-colonial history containing far more political stability than Gambia, Sierra Leone or Liberia have enjoyed. This has carried over to a higher economic level and the highest connectivity rates in the region, with 91% of the country having access to electricity compared to less than a third of that rate in Sierra Leone and Liberia, according to the World Bank. Higher government revenue compared to its poorer neighbors has allowed the Gabonese government to make significant contributions to private sector initiatives like Sing, a tech incubator, and it has created a more enabling regulatory regime.

Spurred by the fintech revolution, financial inclusion in Gabon has increased from 19% in 2011 to 66% in 2021, according to the World Bank. Led by MNOs like Airtel, mobile money usage reached 57% in 2021, with 41% of Gabonese adults using the Internet or a mobile phone to pay bills and 69% doing so for utilities.

This environment has made it possible for homegrown fintechs to grow even with the constraints in scale. SingPay is a Gabonese B2B payment solutions provider, utilizing regional switches to facilitate transactions for businesses and cutting the time it takes for companies to be authorized and link APIs from mobile money providers. This year, SingPay has 200 recurring customers, up from 150 the year before, with 3800 transaction corridors via SingPay. This growth is being fueled domestically — and through expansion beyond Gabon’s borders, which now totals 10% of its total transactions.

CEO Yannick Ebibie envisions SingPay’s growth taking place in two areas: expanding beyond payment solutions to include finance management solutions, and through expansion beyond Gabon’s geographic borders.

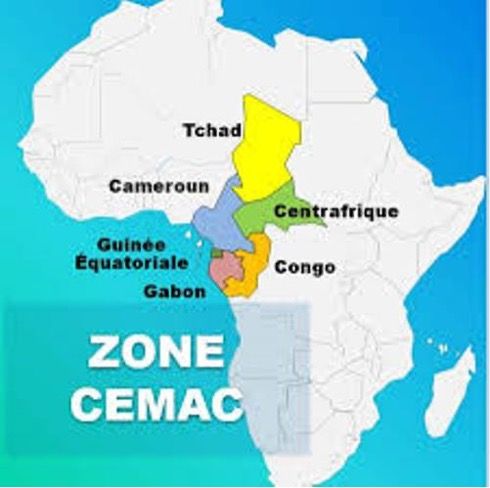

“We're not looking into only Gabon as a market, but the overall CEMAC region, which includes over 200 million people, and up to seven countries using the same currency.”

Yannick Ebibie, CEO, SingPay

SingPay is now partnering with a fintech company in Cameroon as well as one in Rwanda and Congo, enabling both parties’ easier access to their respective markets.

The key ingredient to doing so? Regional integration.

Out Of Many, One (Larger) Market

Whether in Gabon or Gambia, fintech stakeholders all point to cross-border market integration as essential if tiny countries are to shed their limitations in scale and develop robust digital financial services. The Mano River Union expands Sierra Leone and Liberia’s markets to include neighboring Cote d’Ivoire and Guinea, adding another 46 million people. The Economic Community of West African States expands that further, and the African Continental Free Trade Area promises to offer the greatest market integration, though operationalization is still progressing, according to Ngwabe.

“The solution lies in cooperative markets — trying to look at the market as a whole, not really these geographical boundaries. Of course, some governments will never allow that. But that is the only solution for the private sector to work.”

Wycliffe Ngwabe, UNCDF Country Lead, Sierra Leone and Liberia

Some government officials fear Integrating with larger, more mature markets may only exacerbate the tech trade imbalances already emerging in places like Sierra Leone. But doing so also facilitates easier access to the kind of scale that homegrown fintechs need to prosper. Ebibie praises the opportunities afforded by Gabon’s membership in CEMAC, but he believes more work is needed from regulators to standardize regulations across the region, along with private sector initiatives driving partnerships.

Source: APA News

“In terms of the whole CEMAC region, we need to have more exchange and collaboration, especially between fintechs and the traditional banking system to see how as an ecosystem we can make the region a fintech superpower.”

Yannick Ebibie, CEO, SingPay

Domestically, Niania Dabo says companies also must work synergistically in these less-than-ideal circumstances, partnering where it suits them and avoiding cannibalizing one another for the modicum of customers available.

In spite of the barriers present in The Gambia, Sierra Leone and Liberia, Dabo and Ngwabe remain optimistic. Considering the lean operations of fintechs, Ngwabe pegs the number of customers needed for regional start-ups to break even at 5000 — eminently achievable within the smallest of markets. And even in a country like The Gambia, with its cash-heavy culture and economic situation where people must choose whether to “buy food or… buy credit,” Niania sees steps such as the government’s new Ministry of Digital Economy and its recently launched National Financial Inclusion Strategy as signs that the country is serious about digital transformation.

Not all tiny markets in the region will be like Gabon exporting solutions elsewhere. Some will be followers, and others will take more time just to get the basics entrenched. But as broader market integration and interoperability deepens, the tiny markets seemingly left behind by fintech’s early years will gain momentum – with supply eventually catching up to the unrealized demand, one way or another.

Image courtesy of Dan Roizer

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Japanese Fintech: Teach An Old Dog New Tricks?

Regulation: Time to Ask for Permission And Not Forgiveness