Post-SVB: Are Emerging Markets Digital Banks’ Oasis?

~8 min read

As funding goes dry and rising interest rates threaten some fintechs predicated on cheap money, the recent collapse of several banks including Silicon Valley Bank (SVB) has rocked fintech and much of the banking industry. In developed markets, digital banks, running on thin margins and relying on high growth, have struggled to reach sustainability, with layoffs and restructuring becoming the norm of late. Yet in the emerging market context, the digital banking sector — some spectacular failures notwithstanding — offers signs of surprising resilience.

Seeking Safety in The West — And What’s Uncharted In The Rest

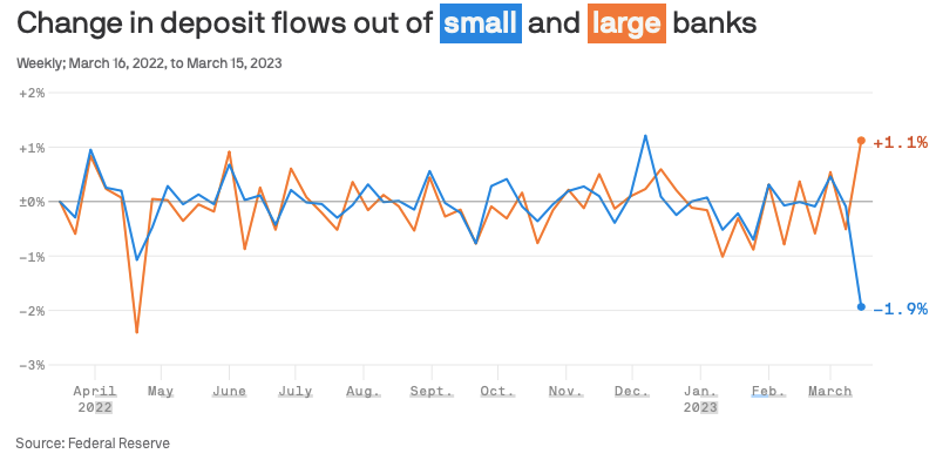

Since the collapse of SVB, there has been the noted transfer of deposits in developed markets away from smaller banks and towards bigger, incumbent banks seen by regulators as “too big to fail.” One Gallup poll in late April found that 48% of Americans were concerned about the money they held in deposits at financial institutions.

The continuing trickle-down effect and stress on smaller banks — even those with otherwise healthy balance sheets like Credit Suisse — are to a large degree psychological. A recent research paper found that social media fueled the bank run on Silicon Valley Bank. In this era where online perception becomes financial reality, digital contagions can jump across borders and regions, altering the outlook of big banks and challenger banks in emerging market contexts. Florian Kemmerich is the managing partner of Bamboo Capital Partners, an impact-oriented VC firm with a focus on emerging markets.

“If you would have asked me three years ago, I would have said the big banks have a problem to survive in the long run, that they're too expensive. But since… SVB, we have learned within a very short period of time that people can panic, withdraw their money, and then the smaller banks cannot withstand that. And that basically changes the market dynamic.”

Florian Kemmerich, Managing Partner, Bamboo Capital

This panic comes as the fintech and wider tech sector are mired in a prolonged funding slump. According to CB Insights, the funding drop has been more precipitous in emerging markets than the U.S. and Europe, with Q1 2023 funding in Asia, Africa, and Latin America plummeting by 27%, 30%, and 54%, respectively, since the previous quarter.

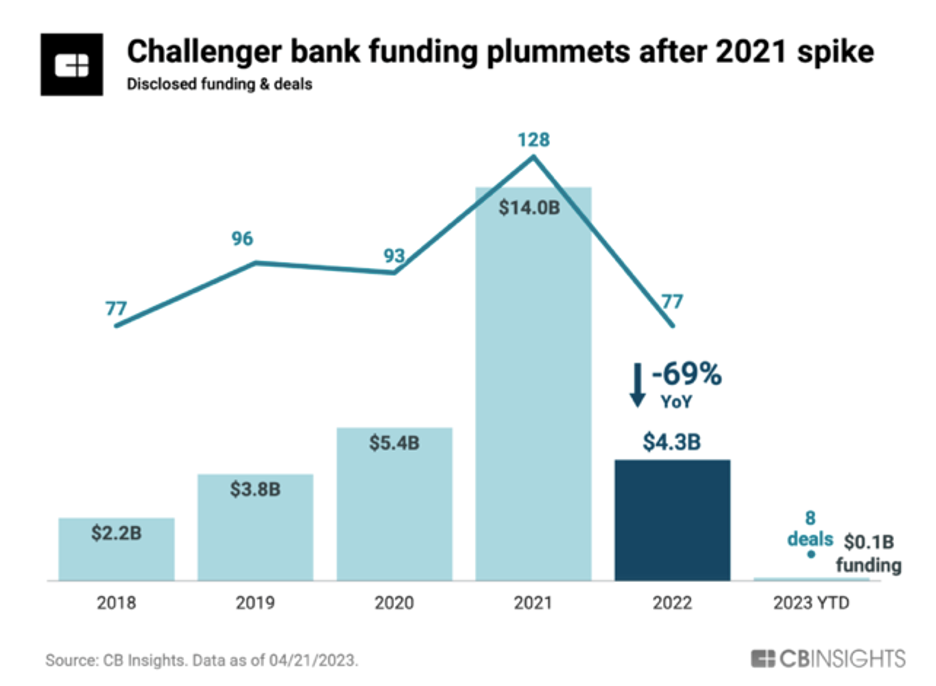

The digital banking sector has been hit particularly hard, with a 64% quarterly drop in Q1 2023 — and raising $4.4 billion in 2022 and Q1 2023 combined after 2021 alone saw $14 billion raised for challenger banks.

Questions linger regarding the path to sustainability for challenger banks, impacting industry leaders in Europe like N26, which saw its valuation drop from $9.2 billion in 2021 to $3 billion, and Revolut, which had its valuation fall by 46%.

Challenger banks in Western markets operate in a saturated landscape where fees from incumbent institutions are already low, making it necessary for neobanks to distinguish themselves with a superior tech stack and fees approaching zero — a formula that fueled growth early on but now struggles with increased interest rates and a lack of continued funding to sustain razor-thin margins.

This has already led challenger banks like N26 to initiate layoffs and provide slightly less favorable rates for customers in a drive towards profitability and sustainability.

In markets like Africa, however, digital banks are engaging in relatively untapped markets where simultaneously it is still possible to reap higher margins.

“In Africa, they're not competing with the banks because the banks’ reach is much smaller, and the way to grow is through technology. Therefore, fintech approaches have high success. Not necessarily because of a lower fee, but because of the access and affordability itself combined.”

Florian Kemmerich, Managing Partner, Bamboo Capital

And when it comes to the SVB implications, Kemmerich believes the calculus in emerging markets is different.

“If you want to protect your capital and have some yield, you will go to the big banks, because you don't want to take the risk of money being wiped out… [but] that is a much smaller portion of people in emerging markets. In emerging markets, it is rather, ‘how do I get access to finance overall, at a cost I can pay so that I actually can generate revenue?”

Florian Kemmerich, Managing Partner, Bamboo Capital

Doing More With Less

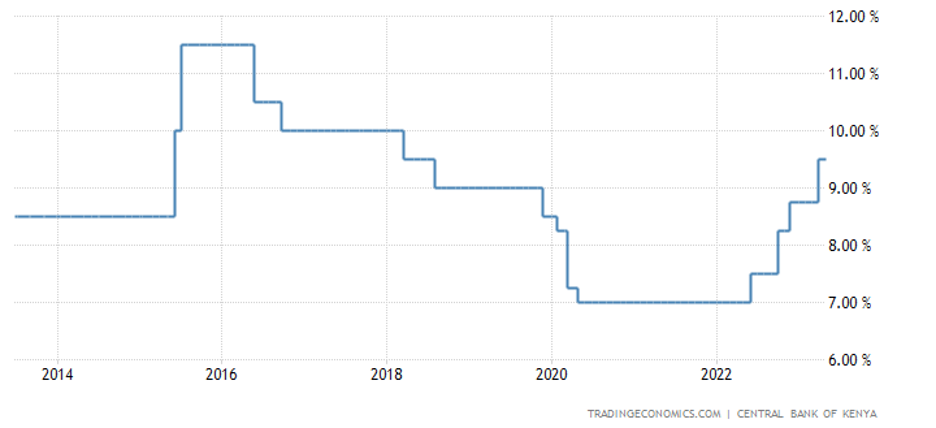

With much of the population still unbanked, digital banks in emerging markets express confidence in achieving requisite growth despite the wider turbulence. Changes in fiscal policy, for one, have been less pronounced. While challenger banks in the West previously drove favorable terms in part on the backs of near-zero interest rates, many neobanks in emerging market contexts have always been operating in higher interest rate environments.

Interest Rates in Kenya, last 10 years

Source: Trading Economics

Beyond interest rates, favorable conditions remain so that even new neobanks can emerge in the generally challenging environment. Fingo Bank recently expanded its fintech operations to become the first neobank in Kenya. Though the “low fees producing rapid growth” model is now catching up to European neobanks, Fingo Bank CEO Kiiru Muhoya sees a path for that model to bear fruit in Kenya and the region.

“The African banking sector [is] more profitable than European or American banking sectors. African banks make significantly more money on deposits than European or American banks; with double digit percentage interest annually, they make more in transaction fees and interchange fees.”

Kiiru Muhoya, CEO, Fingo Bank

Fingo offers lower fees than incumbent competitors in Kenya, but this is only relatively lower than the high fees in Kenya, Muhoya notes — facilitating higher margins than what’s possible in Europe or the U.S. This, combined with Fingo’s lean 15-person staff, sets the young neobank on a less arduous road to sustainability than Western counterparts, he says.

Much further along in its maturity, TymeBank expanded its operations last year from South Africa to The Philippines, relying on its kiosk-driven model to reach nearly seven million customers in South Africa, according to Karl Westvig, the Group CEO of Business Banking at Tyme. TymeBank also aggressively diversified by purchasing last year Westvig’s Retail Capital, expanding TymeBank’s portfolio to now comprise 40-45% of high-margin lending.

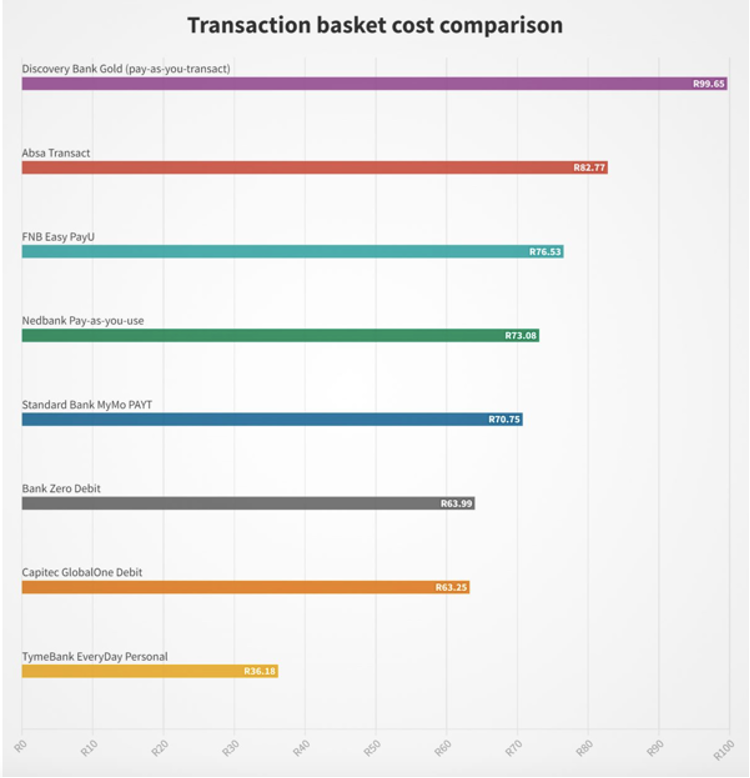

Similar to Fingo Bank, the high-fee environment in South Africa allows TymeBank to offer lower fees than competitors while still generating enough revenue to avoid unsustainable terms of service, setting TymeBank on a path to profitability in six to nine months, says Westvig.

Source: My Broadband

“[In terms of] the cost to open and operate a bank account in South Africa, we're about 20% of the large incumbent banks. We have a sustainable cost advantage across all the banks. So we don't need to have massive cross subsidization — we can generate enough revenue off transactions and value-added services.”

Karl Westvig, Group CEO of Business Banking, Tyme

Westvig and Aaron Foo, the head of strategy and special products at Tyme, say that there has been very little spillover from SVB’s implosion on its operations in South Africa and Philippines. In contrast to SVB’s high concentration of deposits, TymeBank’s retail customer base has seen little movement in deposits.

Foo says that even with the reduced funding environment, TymeBank is positioned to weather the storm, building resilience through tougher environments.

“In emerging markets, there is generally less capital available, and I think that has actually led to good results in terms of how we approach building business and strategy in a more disciplined fashion.”

Aaron Foo, Head of Strategy and Special Products, Tyme

A Cautionary Tale

Signs of fortitude in certain corners of the digital banking sector shouldn’t disregard the latent risks of the suboptimal climate, as well as the psychological impact that SVB has had on certain customer segments in emerging markets.

The primary cautionary tale of late deals with the woes of Nigeria’s Kuda Bank. Layoffs commenced in the fall just a year after raising $55 million at a $500 million valuation. A Hallmark News report last month shed light on the depth of Kuda Bank’s issues. Technical issues resulting in shutdowns of Kuda Bank’s network for several days in April saw customers unable to make financial transactions to their accounts, many of which temporarily suggested customers had no money left, causing an exodus of customers to other financial institutions.

The incident followed a string of worrying financial disclosures. Kuda Bank had rapidly gained customers by offering zero charges on transactions along with instant and unsecured loans. However, in September 2022, Kuda Bank declared losses of over $14 million in its 2021 financial statements — a 602% increase in losses from its 2020 financial year report. Losses mounted when non-performing loans reached 69% by the end of 2021, which compounded high operating costs of a large workforce receiving sky-high salaries, according to the Hallmark News report.

Stick To The Plan

The recent successes and, in Kuda’s case, missteps of digital banks in emerging markets suggest that the model promoted by most digital banks are not under threat in emerging market contexts — but the sustainable path is a disciplined one.

Low operating costs remain a critical lynchpin for digital banks to sustainably offer better fee rates than incumbent banks — a requirement that’s certainly achievable in the world of branchless banking.

Other advantages that digital banks have over incumbent banks — like a superior tech stack alongside a far more inclusive model — at the same time continue to prove their worth. However, financial inclusion efforts must be done responsibly, keeping non-performing loans at bay, for instance. The path to sustainability likewise requires expansion to include value-added services that increase revenue while boosting consumer appeal.

Offering zero or near-zero fees far below the market rate, on the other hand, might be a fool’s errand wherever they are.

If there is one direct effect of SVB’s collapse, it is the heightened sensitivity of digital banking customers in far-flung markets to the security of their deposits. The consumer shift in the West away from smaller banks towards larger incumbents seen as safer translates in emerging market contexts to the increasing importance of partnerships typical between digital and the incumbent banks.

Source: Axios

In the case of the upstart Fingo Bank, its credibility in safeguarding customers’ deposits in its very early going relies in large part on its partnership with Eco Bank, one of the largest African banks spanning 33 countries— a relationship that also provides Fingo Bank the kind of easy scale necessary to potentially achieve rapid growth.

“[Post-SVB], consumers are a lot more conscious of who has their money now and are very much looking at who is the blue chip [bank] in the market… if you're a standalone fintech without a long history, you get a lot more scrutiny, and you probably will be less favored. However, [partnering] with large banks, you still enjoy the same trust they have had.”

Kiiru Muhoya, CEO, Fingo Bank

All these signs suggest that unlike its developed market counterparts, the predominant digital banking model in emerging markets has a clearer path to viability: expand financial access to unbanked populations at lower (but not unsustainably low) rates, maintain lean operating costs, offer high-margin value-added services — and guarantee balance sheets through partnering incumbent institutions. The difficulty, however, lies in its execution.

Image courtesy of Zack Walker

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Small Scale Series: Island Hopping Across the Caribbean

Japanese Fintech: Teach An Old Dog New Tricks?