Is Libra A Global Answer To Financial Inclusion?

~8 min read

In case you missed it, Facebook is developing a cryptocurrency; it’s called “Libra”. The coin’s official debut is still a speck on the horizon, slated as it is for sometime in 2020, but that hasn’t dampened the frenzy of coverage since the release of its whitepaper last month. The whitepaper portrays Libra as a crypto which will deliver on “the internet of money.” This means that the coin is not just a new global digital currency, but an inclusive one at that, designed to address the needs of the unbanked and poor. It’s a project so ambitious, so far-reaching, and involving so many moving parts that a tech giant like Facebook might be the only party able to pull it off. But this fact begets another question: given everything we know about Facebook, are they really the right company to make the long-sought-after dream of global financial inclusion come true?

A Noble Purpose

Libra’s stated mission is, at heart, an inclusive one. Its whitepaper states as much up front: “Libra’s mission is to enable a simple global currency and financial infrastructure that empowers billions of people.” It goes on to remind readers that 1.7 billion adults worldwide remain unbanked, as well as of the dropping costs of smartphones and messaging services. If technology products and services alike are becoming more affordable, why haven’t the world’s financial services providers followed suit?

This is the basic question at the heart of Libra. Facebook’s proposed answer to that question is to create a blockchain-based solution with global reach and the support of Silicon Valley heavyweights. It’s not Bitcoin — Libra can’t be mined, and as a “stablecoin”, its value is intended not to fluctuate. It’s not M-Pesa, either — the coin’s global aspirations mean that it has to work for all users in all markets, unlike siloed, regional mobile money providers whose services often lack interoperability. In truth, the world has never seen a financial product like Libra before, so it should come as no surprise that the product has elicited its fair share of skepticism.

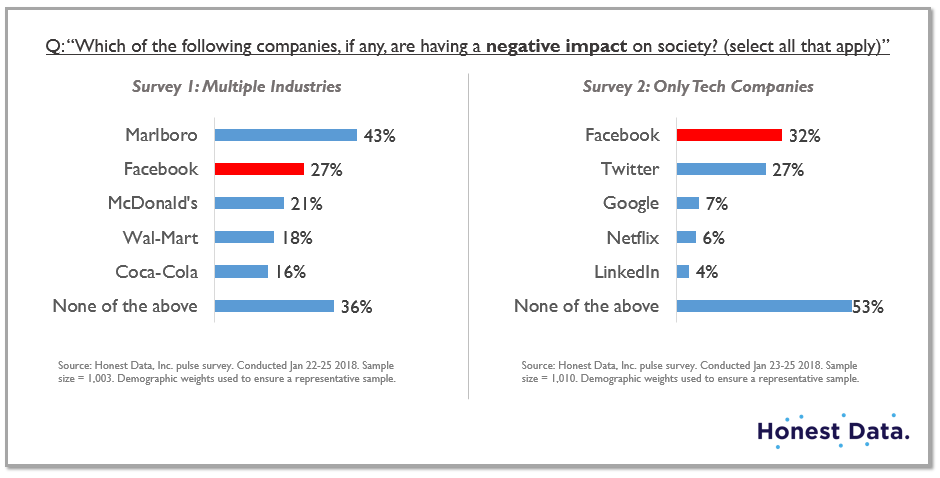

Public trust in tech giants has eroded in recent years, and Facebook in particular has been plagued by scandal after scandal, ranging from shady data-selling operations and enablement of election interference in the U.S. to deadly violence in Myanmar and data breaches in Europe. Critics worry that handing Facebook the keys to the payments castle may pose a risk to consumers given the company’s track record.

Perhaps Libra is the company’s attempt to make good — to win back the public’s trust by engendering a tangible social benefit. As of now, however, the perception of Facebook as a massive, amoral, data-obsessed corporation has led observers — including Facebook co-founder and former spokesman Chris Hughes — to question whether it is the right custodian for a project aimed at the greater good. But Facebook, always one step ahead, has taken steps both technically and organizationally to argue that Libra and the Libra Association are something new, and not mere feudal subjects.

Technical Measures

One such measure is Libra’s reseller mechanism. Resellers are vendors licensed by the Libra Association (the non-profit established by Facebook and partners) to distribute Libra to end users. End users pay resellers in “fiat” (any government-issued currency), and in exchange the reseller obtains Libra from the Libra Association and deposits it into the end user’s wallet.

The importance of resellers to the Libra ecosystem is guaranteed by Libra’s very design. Libra is programmed such that units of Libra are created and destroyed exclusively via reseller purchases and sellbacks, respectively. End users cannot purchase Libra directly from the Association, and the Association itself cannot mint or destroy Libra unless it’s at a reseller’s behest. In other words, the association cannot directly interfere with the Libra economy, and reseller demand is intended to be the primary driver behind Libra.

Reseller demand is (at least in theory) shaped by end user demand, which depends on how useful Libra is — and how good it is at solving the problems it promised to solve. If Libra turns out to be less-than-useful, demand will crash and the currency will fall into disuse. Neither Facebook, nor its partners, nor the Association will be able to manipulate the supply of Libra as long as they are independent from resellers, so demand (and therefore also utility and benefit for end users) is fundamental to Libra’s success.

Libra’s technical paper states that the reseller mechanism was included in the design to “support higher efficiency,” but also to foster trust: “users do not need to worry about the Association introducing inflation into the system or debasing the currency: for new coins to be minted, there must be a commensurate fiat deposit in the reserve." This is typical of “stablecoin” models like Tether (USDT) and Gemini Dollar (GUSD) according to Curtis Oh, Head of STO Business at Shift Markets, a cryptocurrency exchange platform. Stablecoins, Oh explained, are backed by a fiat currency or basket of assets, similarly to how the British Pound Sterling and United States Dollar were once backed by gold reserves.

The teams behind these coins exchange units of their crypto — validated on a public blockchain — for fiat currency, which is kept in reserve. Interest on this reserve (the management of which has led to controversy for some stablecoins) is used to pay for the team’s operations. In the case of Libra, the reserve will be comprised of “low-volatility assets, including bank deposits and government securities in currencies from stable and reputable central banks,” the interest on which will fund the Libra Association’s operations and, eventually, pay dividends to investors. Facebook will likely capture a piece of this interest revenue for their troubles, on top a small fee for each Libra transaction.

But the real prize for Facebook, Oh thinks, could be the shopping data obtained by running a payments network. Facebook has stated that Calibra, the arm responsible for managing Libra’s transaction data, will not share information with Facebook. However, experts have noted that this statement is not necessarily bilateral, and that Facebook could share social data with Calibra. Transaction information could be the right ingredient to supercharge Facebook’s already-powerful data mixture of Facebook, Instagram and WhatsApp. With Calibra’s shopping data added to the mix, Facebook might have the e-commerce firepower to take on Amazon and Google (or any other challengers, for that matter).

Democratic Measures

Though the reseller mechanism does technically take power out of Facebook’s hands, it’s backhandedly also a profit driver for the company, and enables them to harvest untold amounts of data from users. Along similar lines, the Libra Association itself is at least in part a PR endeavor. It describes itself as “an independent not-for-profit membership organization… [whose] purpose is to coordinate and provide a framework for governance for the network and reserve and lead social impact grant-making in support of financial inclusion." Facebook didn’t need help to launch Libra — the firm had over $10b cash on hand at the end of 2018 — but creating a nonprofit with partner organizations to manage the currency and reserve projects equitability and portrays Libra as a collective effort for the collective good by the best and brightest in Silicon Valley.

It’s a positive spin on what is essentially a fintech cartel. Of Libra’s 28 “founding members”, just four of them fall into the “nonprofit and multilateral organizations and academic institutions” bucket; the group’s other constituents are VCs, tech firms (including both Uber and Lyft), payments providers (both Visa and Mastercard!), crypto organizations and telcos.

Perhaps many of these groups are already stewards of the global financial and tech ecosystem, and trusting them with Libra (should the project take off) would in effect change nothing for consumers, given the power they wield today. Nevertheless, Libra concentrates and consolidates that power, and places more data and more control in the hands of few. New members are welcome, Facebook says, and their aim is to grow the association to at least 100 members before the currency’s official launch. However, tickets to the party start at $10 million, and observers have noted that it’s not known how much of the project Facebook, or any of the other founding partners, actually owns. Equity in the actual Libra venture is divvied up in the form of Libra Investment Tokens on a separate blockchain; anyone holding these tokens “owns” part of the Libra ecosystem and earns dividends, after overhead is accounted for, from interest on the Libra Reserve.

The Libra Investment Token is not easily obtained, as the requirements to join the association are prohibitive to all save the most elite from the worlds of business, development and academia. What Facebook and its fellow founders have created in Libra is a tool with the potential to bring about the financial inclusion outcomes that the development, fintech and digital finance community have always strived for. Libra could very well become the definitive global answer for payments — it has the technical sophistication, the funding, the team and the product-market fit to make good on its grand promises.

However, it’s worth remembering: for all the social impact Facebook claims to be interested in creating, the company’s actions haven't always resulted in outcomes for the greater good. Moreover, Facebook may already hold too much power; the company was fined $5 billion last week — the largest fine ever levied by the U.S. Federal Trade Commission — and happily shrugged it off. If the United States government is not able to adequately punish the corporation when it fails to protect consumers' data, that could be a sign that placing additional trust in Facebook and giving them access to our financial (in addition to our social) lives is not worth the risk.

Ask Not What Bitcoin Can Do For You

Facebook’s early announcement of Libra has given them a chance to respond to public feedback. Critics (including the U.S. president) took shots at Libra on the basis of privacy concerns, data sovereignty and its potential unintended consequences. David Marcus, who heads up Calibra for Facebook, struck a conciliatory note in his response, promising that the association plans to work with regulators and other stakeholders in the run-up to its release.

The association, he goes on to state, will be run democratically; Facebook will not have any privileges beyond those enjoyed by the other members. “Bottom line,” he writes, “You won’t have to trust Facebook to get the benefit of Libra.” You will, however, have to trust the Libra Association and the wealthy, powerful groups who make up its ranks. As much as they purport to want to save the world, Libra is without question also an effort to control the world (albeit in partnership with other powerful organizations). At least they changed the coin’s original name.

Libra’s proponents likely believe that, at this time, Libra is the only project and team capable of delivering on global financial inclusion. They may be right. But other groups — and in fact an entire fintech industry — are making real progress toward financial inclusion. The concept of a cryptocurrency for the world, moreover, is not new. It’s Bitcoin. Curtis Oh views Libra as something of a “step backward” for the crypto community; where Bitcoin excels in decentralization, lack of reserve and permissionless, democratic access to its network, Libra sacrifices these benefits for scalability and efficiency. Oh thinks that the payments world should think carefully before discarding Bitcoin and other cryptos for Libra’s flashy promises:

“Apart from the miracle that is Bitcoin, there hasn’t been any party that has come close to what Bitcoin has done. The fact that it has gotten this far is strange, and no one has been able to replicate it.”Curtis Oh, Head of STO Business at Shift Markets

In some sense, Libra is Facebook’s effort to do exactly that. In their version, however, transactions happen on a network they run, according to rules they’ve developed, and to their ultimate financial gain.

Image courtesy of NeONBRAND

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Sex Work: Safety In Digital?

Nudging And Financial Health: A Force For Good?