Open Banking in Nigeria: Are Grassroots Efforts Enough?

~7 min read

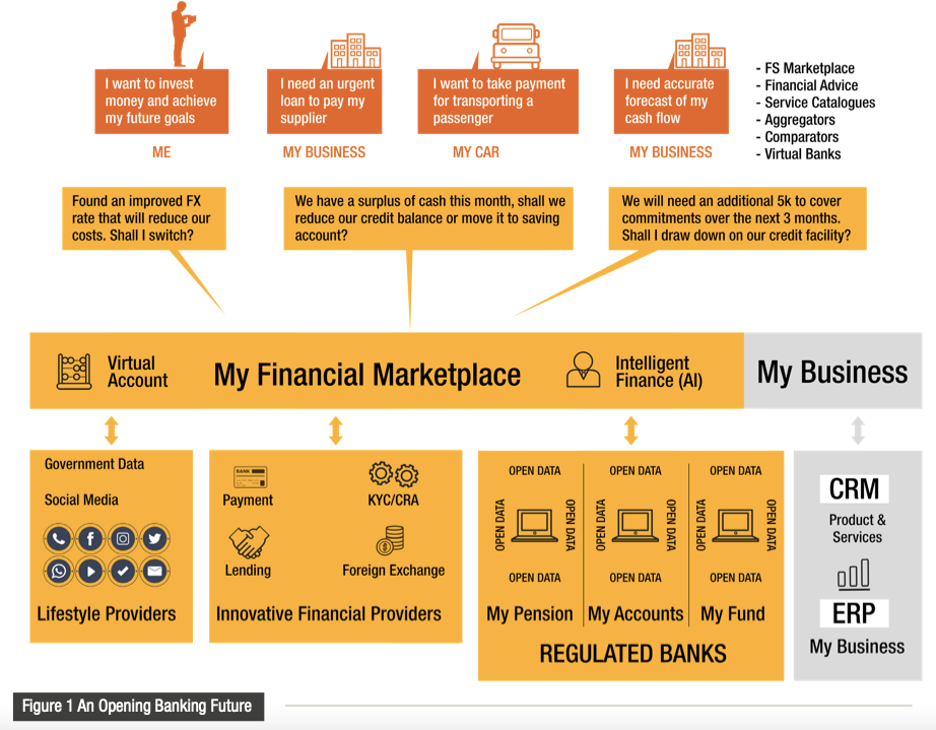

After several years of slow progress, some of the earliest examples of open banking frameworks have begun to bear long-prophesied fruit in certain developed markets. Now, open banking has reached an implementation stage among some of the early emerging market forerunners. And though promise lies ahead, ongoing issues plaguing one of these pioneers, Nigeria, offer invaluable lessons of the comprehensive buy-in and effort required to engender open banking’s catalytic transformation.

Making Theory Happen

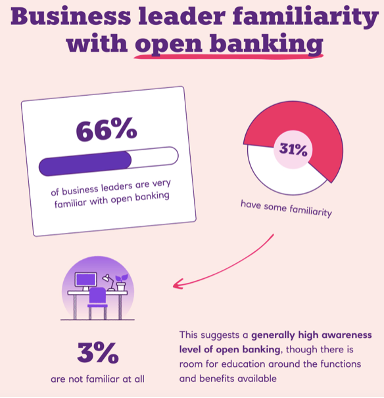

Though it took years of tweaking to the system and public education efforts, the UK’s open banking framework is beginning to show its true potential to elicit greater efficiencies across the tech ecosystem, benefitting businesses and customers alike. A recent Payit survey revealed the extent open banking has been adopted by vendors — and the effect it’s having. 68% of businesses surveyed were now using the open banking frameworks. Payit found those businesses who were already utilizing open banking were spending 8% less on payment processing than those yet to adopt open banking. While open banking users spent only 44 hours and 36 minutes per month on operational tasks, non-users were spending an additional 12 hours and 33 minutes. In all operational aspects of managing payments and maintaining security, the benefits were manifold, freeing up resources to innovate further and utilizing privacy-protected data to create more personalized solutions.

Source: Payit

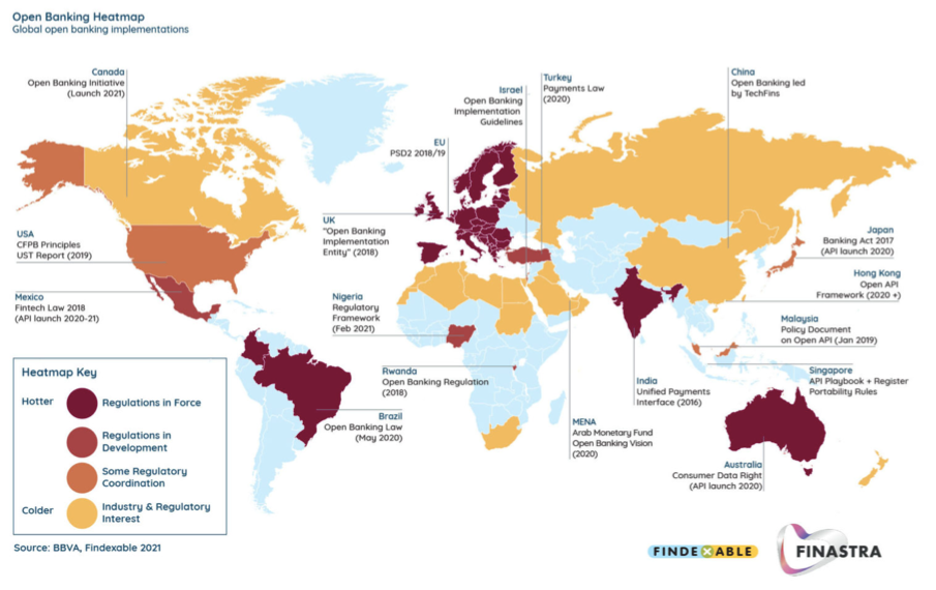

As empirical evidence of open banking’s benefits comes to light, the question becomes if — and when — the same adoption and benefits spread elsewhere. It was as far back as 2021 that Mondato Insight was pondering whether fintech leaders in Africa could make that plunge into open banking as well. In that time — and now — the reality is that there is still not a fully operational and implemented apparatus for open banking on the continent.

But so is the case in most emerging market contexts. Through its account aggregators (AA), India is one of the early examples to get an open banking framework operationalized, proving itself to be top of class in emerging markets when it comes to realizing the efficiencies of a unified, consensual data-sharing infrastructure. In this case, however, India can build on its strong government-centered infrastructure founded upon its United Payment Interface (UPI).

Nigeria became the first country in Africa to sign into law its open banking framework, but it did so through a much different path than its peers in Europe and India. Unlike the UK, which took a government mandate approach, the open banking crusade in Nigeria has been primarily driven by the private sector, with its greatest proponents not being government entities but the willpower and “grunt work” of individuals like Adedeji Olowe, a trustee at Open Banking Nigeria, a non-profit of like-minded Nigerian fintech stakeholders seeking to foster a fully operationalized open banking framework.

“We knew that friction was Africa’s problem,” Olowe told Mondato Insight. “And so while open banking in the UK was created as a punishment, we saw this is not a punishment — if we have something similar in Nigeria, it's going to be a blessing.”

In 2016, the World Bank ranked Nigeria 170th out of 190 countries when it came to the ease of doing business. Without proper central governance or standards laid out, Nigeria seemed ripe for standardization and subsequently improved efficiencies that open banking promises.

Lacking the billions of dollars invested by countries like UK to usher its open banking framework forward, the efforts started in 2017 by Olowe and others were far more grassroots in nature. Getting the various institutions on board for an initiative that would democratize data sharing across the financial spectrum in a future open data regime required constant lobbying and efforts from advocates like Olowe to get all stakeholders on board. Olowe won over the support of institutions across Nigeria’s vast ecosystem. This includes incumbents — as holders of most of the consumer data, often the most difficult to get on board a truly democratized data environment — who came to view open banking as a potential boon in cash management collections from corporate customers.

There isn’t a single full-time employee at Open Banking Nigeria, and Olowe says he designed the technical API standard himself. The entire initiative to lobby and design the forthcoming open banking framework was run by volunteers. While the UK initiative costed the government up to 3 billion pounds, Open Banking Nigeria spent a maximum of $20,000, according to Olowe. “We don’t have the money to spend millions of dollars on consultants,” he said. “We did it because we know the many benefits reducing friction will bring to all.”

Fighting Friction In Going Frictionless

But no matter the persistent advocacy on the private sector side, open banking’s complex requirements spanning privacy protection and consensual data-sharing in legal and technological terms demands buy-in from regulatory authorities as well.

In February 2021, Nigeria established rules for data sharing, and in 2023, operational guidelines were enshrined into law. On paper, Nigeria’s open banking framework is potentially even more robust than Europe’s is, incorporating non-financial institutions to provide the capacity for a true Open Data regime to move forward. However, while it’s been a year since open banking was formalized into law, its implementation has stalled — almost exclusively due to inaction from Nigeria’s central bank.

In particular, the Central Bank of Nigeria has failed to establish a single API standard — the most basic necessity for an open banking framework to work. As Olowe puts it, the voluntary efforts of the private sector have positioned the central bank to operationalize open banking without paying “a single dime”, but the central bank still hasn’t.

Source: PwC

Instead, the Central Bank of Nigeria has been distracted by the unfolding economic crisis in Nigeria, where inflation has reached nearly 30%, spurring protests across the country. This also coincided with a change in leadership at the Central Bank of Nigeria – forcing the open banking advocates in the private sector to renew their lobbying efforts they first started in 2017 to get all stakeholders aligned with their vision.

Amid the delays, questions linger of what governmental agency exactly will drive, implement, and oversee the open banking system-to-be. Yinka David-West is associate dean at Lagos Business School, where she leads the Inclusive Digital Financial Services Initiative. David-West believes such implementation issues are symptoms of a wider problem in which authorities are yet to leverage the various opportunities emerging in the tech scene — whether it be open banking, artificial intelligence, or cross-border instant payments — with a clear direction.

In the open banking case, there is still missing the institutional cooperation and coordination in Nigeria to “eat, sleep, breathe” the nascent data regime. “Who owns that infrastructure, who builds it, who manages it, etc. — we haven't quite defined that yet,” said David-West.

“What’s the pathway towards creating digital public goods, and how do we ensure that there are the motivations and incentives to bring that pathway forward? That clear pathway needs to be mapped out. Otherwise, we're going to continue doing the same things across different sectors rather than looking at it holistically.”

Yinka David-West, Associate Dean, Lagos Business School

From Olowe’s perspective, the promised efficiencies, and savings — and its potential to synergize with the highly successful instant payments regime that has already achieved widescale adoption in Nigeria — of open banking should be one palliative solution to the economic turmoil roiling the country. But open banking (and naturally its next-step evolutions the Nigerian framework aspires to, Open Finance and Open Data), with all its potential for catalytic transformation of a disjointed, opaque ecosystem like Nigeria’s (and Africa in general), requires comprehensive buy-in from all partners — especially in a market-driven scheme like Nigeria’s that relies more on carrots than sticks.

A Turning Point?

In the meanwhile, private solutions like Mono, Okra, and Stitch offer alternative solutions to provide APIs for businesses in Nigeria and across the continent. But these private sector initiatives are merely patchwork solutions compared to the potential efficiencies, savings and innovation that a mature open banking infrastructure can unlock.

Olowe, the leader in the open banking crusade for nearly seven years now, is also the founder of Lendsqr, a SaaS loan management software platform. He believes a fully-functioning open banking regime will enable the digital lending industry in Nigeria — among other fintech subverticals — to rid itself of the predatory behavior and low penetration that non-bank fintechs have mustered until now. Though Nigeria stands out for its high-growth tech ecosystem and enormous scale of 213 million people, these are issues shared not only in Nigeria but plenty elsewhere, too. While the patient success of the UK and Australia offer limited lessons to take for emerging markets seeking to expand into open banking, Olowe views the Nigeria experiment as providing a much deeper understanding for other countries in similar positions.

“I keep telling [the regulators]: if you guys don't executive this thing well, it's a shame because not only are you failing Nigerian, you are failing 1.4 billion Africans.”

Adedeji Olawe, Trustee, Open Banking Nigeria

Indeed, other countries are anxiously following the stalled Nigeria experiment. The candidates discussed by Mondato back in 2021 still remain the same — among them, South Africa, Kenya, Ghana and Rwanda — to pursue open banking frameworks in the near future.

Source: Findexable

Surely, what David-West calls the “deep orchestration” required for open banking and beyond is a challenge in these contexts. David-West does not believe that simply building out the open banking framework is sufficient in itself in a place like Nigeria; along with that buy-in required, there needs to be the central regulatory authority to oversee such matters, as well as comprehensive public education of the nascent technology and the novel opportunities and risks it can bring. Although data protection rules are essentially a prerequisite for any open banking regime, improper enforcement or oversight still risks potential abuse from third-party vendors participating in the data sharing feast.

But it is instructive to remember just how long it took even the UK’s open banking framework to hit its stride; as David-West frames it, these early predecessors are instructive not in knowing which is the “right” framework, but in the salience of a “test and learn” approach that contextualizes the framework to fit the specific market demands.

Image courtesy of Emmanuel Ikwuegbu

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Fintech And The Era of Digital Public Infrastructure

Gen AI In Emerging Markets: Is The Hype Warranted?