Fintech And The Era of Digital Public Infrastructure

~7 min read

When Anit Mukherjee arrived in Washington, DC in 2013, a friend suggested ordering something called Uber to pick them up from a late dinner. In the 11 years since, ride-hailing apps like Uber spread across the world, in emerging and developed markets alike. The platform revolution was upon us, and the Edisons of our time had company names like WhatsApp and M-Pesa. Wonder gave way to possibilities. Possibilities gave way to investment. Investment gave way to transformation. But soon the shortcomings emerged. While the private sector-driven “Uberization” of so much of the burgeoning app economy gave rise to a few tech giants — some of whom evolved into monopolies in an unfettered environment — many startups otherwise scraped by with narrow to non-existent margins propped up by flush VC money of the 2010s. Digital fraudsters and thieves ran amok.

The post-Covid investment crash illuminated empirical realities of a profit-driven (yet profit-poor), VC-sustained mirage. As digital markets mature, reaching those left behind becomes essential to growth on the business side and aspirations of universal inclusion on the consumer side. Under these push and pull pressures, an alignment shift is underway. If the earlier era saw “open banking” — an interoperability between financial businesses to access financial data and work in sync together — as the aspirational goal for the digital finance revolution, a new aspirational phase is underway: the transformation of digital rails as a public good itself, with movement across the vast digital corridors and destinations enabled by public infrastructure.

A Paradigm Shift

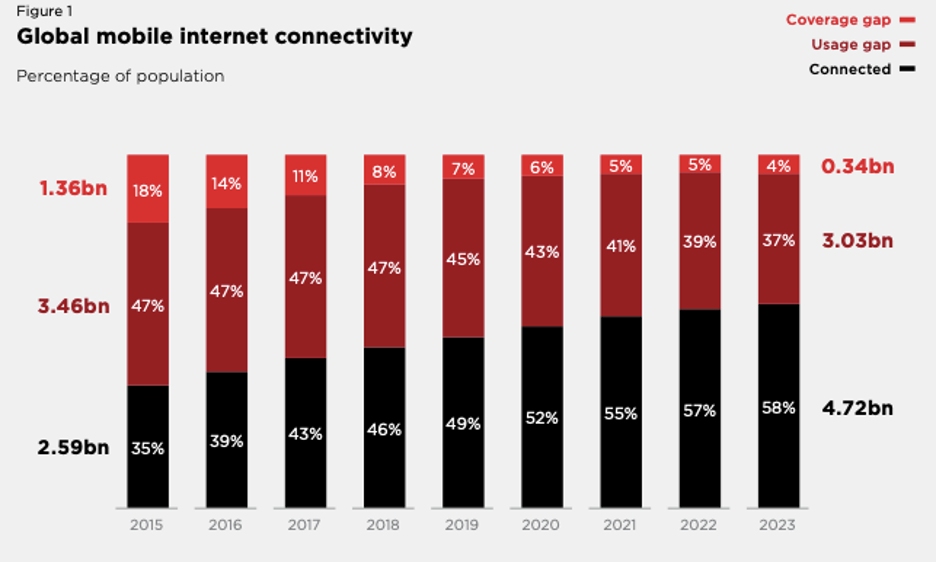

Now over 15 years into the push for digitalization and financial inclusion, progress continues in absolute terms — but the relative gains are diminishing. According to GSMA’s most recent mobile economy report, by the end of 2023, 5.6 billion people — 69% of the global population — were subscribed to a mobile service, an increase of 1.6 billion people since 2015. Mobile internet users over that same time increased by 2.1 billion to 4.7 billion users, or 58% of the global population.

However, while the rate of global mobile internet connectivity averaged 3.3% increases year-over-year from 2015 to 2021, that rate has halved since.

Source: GSMA

Source: GSMA

Though the coverage gap has come down to only 4%, the usage gap remains stubbornly high due to lingering issues of affordability and digital literacy.

By now, the lower-hanging fruit has been picked by the private sector, which focused on underserved yet well-equipped consumer populations within domestic markets and across untapped emerging regions. But if M-Pesa served as the model in those unripe early years, it is now India’s digital tech stack that provides the roadmap for what comes next.

Anit Mukherjee was involved in India's Aadhaar biometric system from its inception as well as the ensuing direct benefit transfer programs that positioned millions of Indians to climb out of poverty. Mukherjee recalls 20 years ago when India was fragmented across more than a dozen mobile markets, charging data rates for users and roaming charges from one state in India to the next. The national ID system was disjointed and inaccessible to millions of Indians, especially those of poor and remote backgrounds.

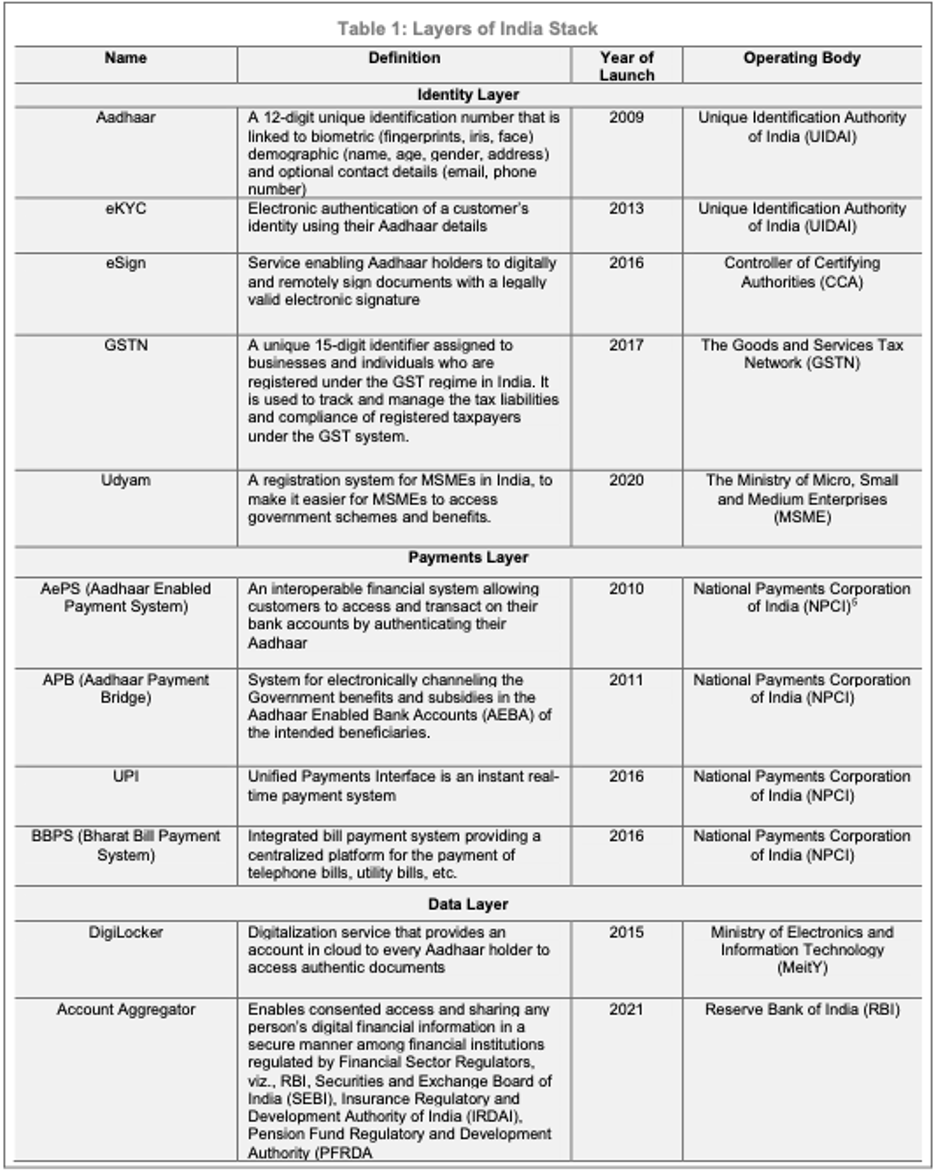

Starting with the implementation of the Aadhaar biometric ID system, the foundation for a public digital highway system was laid methodically, digital brick by brick. 15 years later, the mobile market is unified, mobile data costs almost nothing, and India’s digital public infrastructure spans multiple layers.

Source: IMF

Source: IMF

In Mukherjee’s estimation, India’s “guided innovation” model struck a middle ground between the model pushed by the United States of unfettered innovation and the European model prioritizing tight regulation over risky but high-potential innovation. The idea being: a publicly driven, protocol-based approach will enable efficiency and inclusion, while lowering operational costs for private operators so that the benefits of digitalization can affordably reach the masses.

India’s digital tech stack has now matured to broadly encompass three layers: unique biometric ID (Aadhaar), interoperable payment systems led by the Unified Payments Interface (UPI), and data exchange protocols like the Account Aggregator. In such an interoperable, interconnected and intertwined systems straddling not only finance and commerce but health, education and beyond, the goals of these efforts fundamentally change.

Nearly four years ago, Mukherjee spoke with Mondato Insight about the “JAM Trinity” model in India predicated on mobile connectivity, access to the financial system and possession of a digital ID. But according to Mukherjee, the scope has shifted further.

“People are still going back to that [trinity] of ‘ID’, ‘payments’, and ‘data exchange’, but the maturity of these digital economies demands now something like ‘ID management’, ‘digital assets management’, and ‘transactions network management’.”

Anit Mukherjee, senior fellow on global economic and development policy, ORF America

What this entails goes beyond the simple eKYC benefits of digital IDs (like Aadhaar), or even the super cheap and interoperable efficiencies afforded by publicly-driven instant payment mechanisms (like UPI or, in Brazil PIX. Taken together, this infrastructure creates open, accessible and affordable digital rails spanning far beyond finance to include aspects like aid provisions and vaccination distribution.

Through this process, digitalization begins to transcend parochial ideas of open banking — it is now open data itself that becomes the lodestar.

Making The Unviable Viable

Exporting this model of open data transfer and management comes with the challenges endemic to the recipient markets. Variations of the India Stack model has been or is in the process of being implemented in countries as wide-ranging as Ethiopia, the Philippines, Sri Lanka and Togo. Many of them don’t share India’s advantages in such forays. With buy-in from the government and an enormous, young, tech-savvy population otherwise excluded from markets and government services, India was a prime candidate to advance these kinds of systems for low-cost public use on a sustainable, long-term basis.

By contrast, Mukherjee has recently spent time working with the Ministry of Digital Economy in The Gambia to bring the same kind of system there. With a tiny population “less than my neighborhood in Calcutta” as Mukherjee puts it, The Gambia is encumbered by numerous obstacles beginning with the poor physical ICT infrastructure and magnified by the tiny scale. Under such circumstances, what can possibly make a viable “open digital zone”?

In its Small Scale Series last year, Mondato Insight spoke with Niania Dabo, UNCDF’s country manager in the Gambia, about digitization efforts. The conclusion, ultimately, was that creating viable digital public infrastructures even in tiny scale countries requires market integration enabling shared infrastructures and markets on a regional (and beyond) scale. According to Mukherjee estimation, the same holds true across the board. Not only does market size matter, but the breakdown of siloed systems.

Making digital public infrastructure viable in a context like The Gambia thus requires a reorienting away from the private sector to a public goods-driven digital approach. Market integration, subsequently, becomes crucial in a tiny place like The Gambia.

“If you're asking about its economic viability in The Gambia, it is not viable. But if Gambia and (neighboring) Senegal can be one market, and 1.5 million people can service a market of 50 to 60 million people, then it becomes viable.”

Anit Mukherjee, senior fellow on global economic and development policy, ORF America

A New World (Public) Order

Such a shift towards a digital public infrastructure layer — upon which private innovation and commerce operates — elevates the public sector as essential in all matters of digital life. Recent government lawsuits against some of the digital monopolies formed by companies like Apple and Google during the free market-powered initial stages highlight the realizations among governments that the early benefits of unfettered innovation are reversing themselves in a maturing digital economy.

“In all the avant-garde countries that were build, build, build, build, build, now it's like, ‘oops, what's going on? Let's take a step back and see where those safeguards need to be put’.”

Anit Mukherjee, senior fellow on global economic and development policy, ORF America

Mukherjee is among those selected for the UN’s Digital Public Infrastructure Universal Safeguards working group, established last month. With so many countries of varying demographics, forms of governance and preparedness, creating an enabling, inclusive and safe digital public infrastructure will be crucial in staying ahead of the vast security threats that come with open data sharing. A complex venture of standardization and coordination is underway to build uniform rules, infrastructures, and protocols that had been ignored in a purely market-based approach.

During this shift, balancing the competing interests of innovation and secure regulations will be the main point of contention going forward. Figuring out the right mix of “guided innovation” and “reasonable regulation” will be the task for these ongoing endeavors, a balance that is still being judged, said Mukherjee.

This evolution in infrastructural implementation and adoption comes on the heels of the behavioral changes engendered by COVID – and the rapid efforts to digitize during that time.

Mukherjee doesn’t see these changes as all that different from preceding technological step change to take place – an initial discovery, an explosion of creativity and new ideas, consumer uptake giving way to unregulated monopolization or misuse, followed by government intervention to chart a more stable path — with prominent examples like nuclear power and the assembly line.

If the past quarter century of digital progression has exhibited the various stages of experimentation, growth, and now, to some degree, disillusionment, the ensuing reformation implies a restructuring of the digital Wild West that arrived with promise yet now struggles with cynicism.

“If you want your digital economy to expand, then the rules of the game need to become much more defined so you have open digital zones for data movement, for digital payments, even the digital movement of ideas.” — Anit Mukherjee, senior fellow on global economic and development policy, ORF America

Such demands manifest in an era where free trade has increasingly given away to protectionism, and supply chain disruptions encourage countries to develop more self-sustaining economies. As physical trade and exchange retrench deeper behind siloed processes, the digital revolution demands the opposite if it is to reach its full potential in fostering inclusion, efficiencies, and growth. Will public stakeholders accept such responsibilities and fully standardize and operationalize what would be the defining protocols of the second quartile of the 21st century?

How that question is answered will say much about the course that digitalization continues along next.

Image courtesy of Fabio

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Brazil and India Usher In The Open Finance Era

Open Banking in Nigeria: Are Grassroots Efforts Enough?