The Data Debacle: Insights Falling Through The Cracks?

~5 min read

Even as DFC products - like mobile money - become a more important commercial component of the margins of mobile network operators (MNOs) and banks, there are just as many cautionary tales as there are success stories, as discussed in a previous Mondato Insight. These flops, stretching from South Africa to Albania, prove that poor revenue and disappointing uptake have become frustratingly common among these services.

The future of these services depends on a thorough understanding of consumer behavior in order to predict future trends. Knowledge is power, and in this instance, knowledge is data. Can a more intentional data analytics process prevent these failures? Why aren’t all DFC providers implementing data science? And for those who have, which approaches are worth emulating and which have fallen flat?

While it’s no secret that “Big Data” is invaluable, extracting its value is no easy feat and requires significant foresight, investment and determination. DFC providers in emerging markets are certainly intimately aware of the complexity that comes hand-in-hand with the space. And while the industry may be in agreement that data-driven insights will inform the future of DFC, few have successfully pioneered and executed comprehensive data strategies.

Unraveling the Potential

Financial service providers, at long last, are conceptualizing digital offerings as more than a social impact initiative; a report by Accenture estimates that financial institutions could claim a tidy 380 billion in additional revenue through outreach to the unbanked, predominantly through digital means.

That ‘intuition’, it seems, is already playing out in real time. Last year, a number of MNOs found that mobile money added a much needed boost to Average Revenue Per Unit (ARPU), which has been on the decline as voice business stagnates, in part, due to the heightened popularity of OTT services. Both Airtel Tanzania and Sonatel in Senegal saw an average of 10% of ARPU coming from these services. Though it may seem like a modest contribution now, it is anticipated that these services will eventually overtake more traditional sources of ARPU. If this growth is ever to materialize, however, there must be increased adoption, as well as active users to lay the foundation for value-added services.

In order to stimulate usage of DFC services, which will in turn improve financial inclusion and profitability of these products, more robust attempts must be made to understand consumers. Data is the most comprehensive resource to disentangle market dynamics. More thoughtful data segmentation, as well as intentional supply- and demand-side data collection, have the power to improve the business case for DFC products through optimized and apprised product development and delivery mechanisms.

Many firms already have the data they need to guide strategic decision-making; they just need to learn how to mine it appropriately. For example, the GSMA concluded that a major systemic barrier to connectivity and DFC for women was the lack of gender-disaggregated data tracking. The Reserve Bank of India proved this theory correct when it introduced gender-segmentation for bank reporting, making room for new partnerships and products tailored to women which nearly doubled the amount of credit issued to women over a 3 year period.

Applied Use Cases

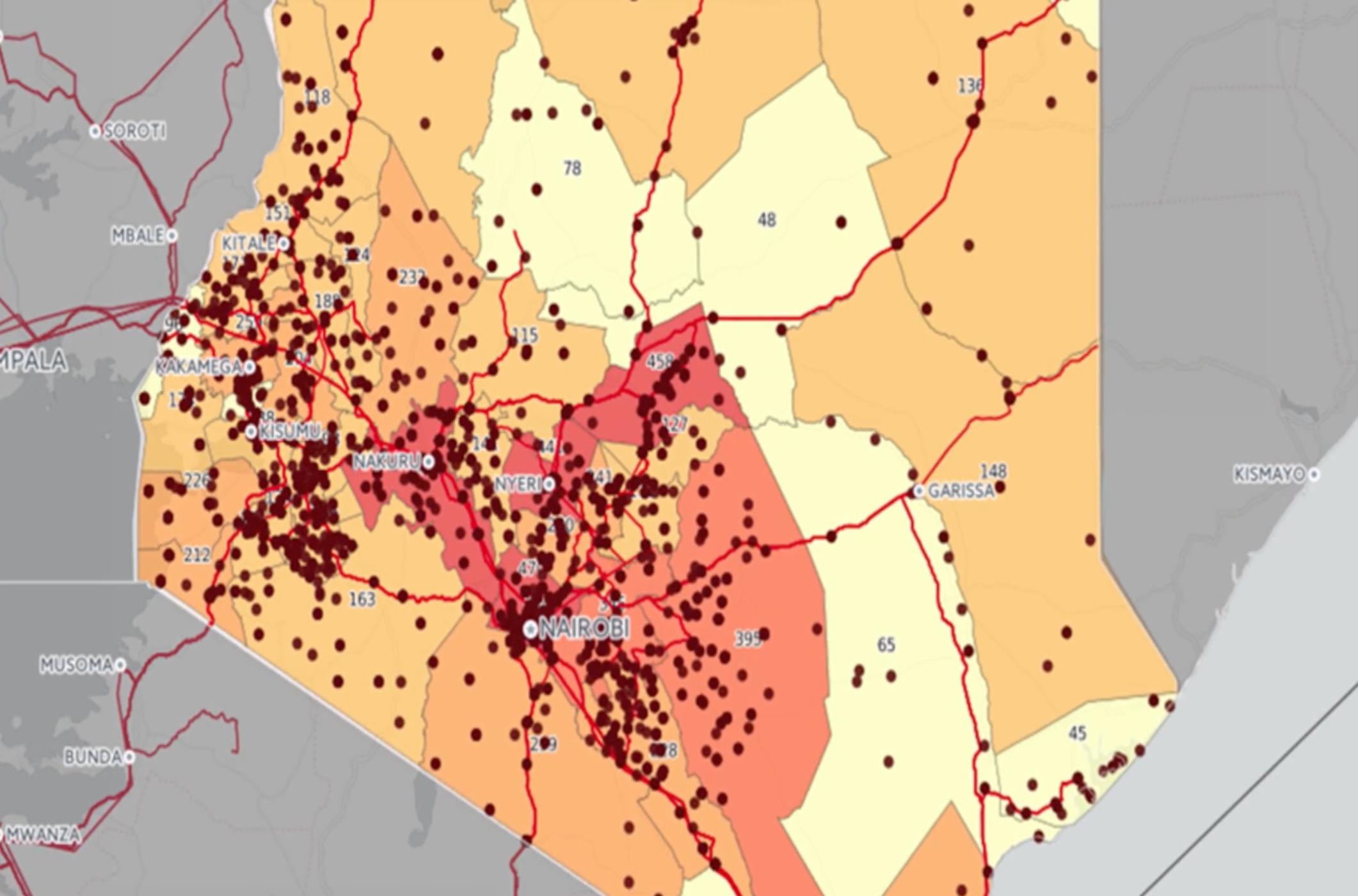

HIP Consult, Mondato’s sister consultancy that specializes in broadband connectivity, developed a data analytics and visualization platform, InfraNav, to optimize commercial, operational and strategic decisions. InfraNav leverages unique data algorithms to simplify market context and advise wherein lies investment opportunities to boost digital inclusion across emerging markets. Through digitizing and visualizing a sleuth of data inputs, from infrastructure to socio-economic indicators, decisions that were previously made at random are rendered more transparent and systematic.

From a non-profit or social enterprise standpoint, data science ensures that projects or donor funding will be managed efficiently, and their impact more tangibly measured. The establishment of quantitative, 'for success' metrics creates linkages and correlations between investment and impact. For instance, what direct consequence will a specific investment have on female literacy rates? These insights help to evaluate performance as well as steer planning for the future.

As proof, both institutional and private investors are now using big data to identify momentum, value and profitability, and then layer the data-driven exercises with human judgment. Not only is it now the norm for investors to scope out data to make investment decisions and deals, but many also require the companies they invest in to have a data and analytics strategy in place as well.

More Data, More Problems

As far as industry prestige is concerned, most consider the World Bank’s Global Findex the ‘most comprehensive database on financial inclusion’ with insight from over 140 countries and 150,000 interviewees. While the Global Findex is an unrivaled starting point for benchmarking markets, the granularity of these data sets are fairly high-level, somewhat outdated (2015) and difficult to scale.

Official statistics in developing countries aren't much more refined, and can lead to incomplete, ‘ancient’ or biased data due to poor governance standards or inadequate resources to reach informal or rural inhabitants. Traditional data collection, historically, has not properly captured unbanked or off-the-grid individuals. Alternative data sets offer financial institutions the means to define new segments and develop products for these unbanked populations, and in turn, provide to them access to financial services.

Some firms, too, are capitalizing on this gap, and are formulating creative ways to generate accurate data. Companies like Bamba, Premise and Optimetriks incentivize the submission of quality data and then use it as a jumping board to design services to respond to this need.

From Transformation to Privacy

While most DFC-related organizations are aware that big data holds potential to be a vital asset, organizational structure and budget constraints stand in the way of unlocking its benefit. Even though digitized data is easier to aggregate, companies must be willing to undergo a digital transformation in conjunction with investing in new technologies to fully reap the advantages of data-driven insights.

For many organizations, this presents a major challenge since many invest in data science without proper organizational restructuring. As holistic data digestion and integration often requires management to pave direct routes from the data scientists to decision-makers, buy-in from top executives is a must, otherwise nuggets of wisdom might fall through the corporate cracks.

This structural issue is only compounded by a lack of funds or hesitancy to invest in a new system. Committing to renovating a data analysis system is expensive, and organizations need to be patient for their return on investment. Although the initial price tag may be high, the capital and operational expenses will likely bear out increased revenue, lower OPEX and improved brand image (i.e. more tailored propositions to customers).

Defining new protocols within an organization as how to collect, manage and share data is also essential, especially while consumer protections and privacy concerns are shot into the limelight across developed economies. These topics have quickly overflowed into emerging markets, and governments and regulators worldwide are working to balance the need for data sources with consumer protection principles.

There Is No Plan B

Data can be a powerful tool to deliver commercially viable DFC services and increase financial inclusion in the markets that yearn for it most. And in this digital age, there are innovative technologies that can gather and examine information more quickly and efficiently than ever before. That said, while there are many success stories, the raw promise of data has yet to be fully realized. Systemic and cultural challenges that persist within organizations, for one, have derailed data initiatives, and banished them to 'the pipeline.'

While the initial investment may not have a quantifiable return, the alternate option seems to be failure, as evidenced by the many mobile money deployments or other DFC operations that have turned to dust. There is no Plan B: the urgency to experiment with data technologies to inform product development and consumer segmentation is, for all due purposes, here to stay.

Image courtesy of InfraNav.

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Does Demonetisation Work?

Keep Calm And Carry On (Using Contactless)