Australia’s Digital Economy: On The Precipice Of Transformation?

~10 min read

Buoyed by industry-leading initiatives like a rails-unifying New Payments Platform, optimists view Australia as on the precipice of financial transformation. Others, however, see doom and gloom regarding the prospect of true innovation, as the country’s oligopoly of banks assert their grip on Australian markets and consumer inertia prevails. Who will be proven right likely hinges on the success of Australia’s potentially most transformative policy initiative: the industry-transcendent Consumer Data Right (CDR) framework? The possibility for unprecedented disruption and democratization of data contradicts all the trends and balances of power existing before in Australia — with incumbents none too happy. The ongoing battle will offer key clues regarding whether open banking — and extending beyond into open finance and open data — can in real terms disrupt financial services and elicit competition in countries where oligopolies have long dominated financial services.

Big Banks, Small Markets, Fintechs

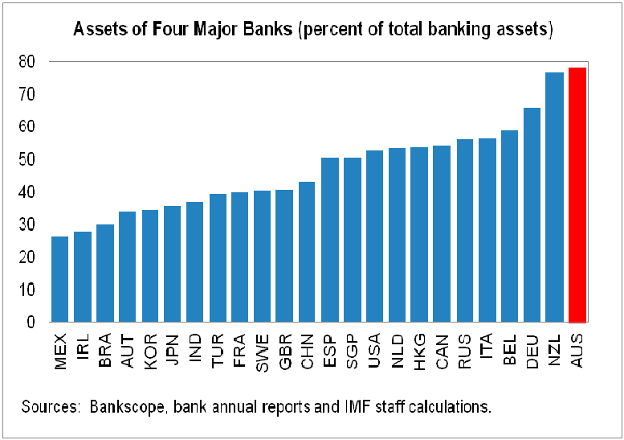

For decades, Australian regulators prioritized a tight credential system for licensing banks, valuing deposit protections over competition. Subsequently, Australia’s “Big Four” banks — the Commonwealth Bank of Australia (CBA), Westpac, Australia, and New Zealand Banking (ANZ) and National Australia Bank (NAB) — came to dominate the vast majority of financial services.

Despite this dominance, Australian financial services can be quite tech savvy in some regards, like the ubiquity of tap and go cards. Several of the big banks initiated fintech incubator programs several years ago, though they often produced more hype than true disruption, according to industry insiders. Yet with opaque pricing models and the mistrust of alternative financial service providers, legacy institutions have managed to preserve their approximately 80% market share while swallowing up subscale challengers and debanking companies — like crypto firms and remittance providers — that incur risk and fall out of the purview of the banks’ main moneymakers: lending and mortgages.

“Australia’s banking situation is characterized by pretty efficient banks offering very good customer service. There’s not enough competition, so its relatively expensive. On the customer service side, they don’t leave a lot of space for fintechs to improve on things."

Ross Buckley, Scientia Professor in Law, University of New South Wales

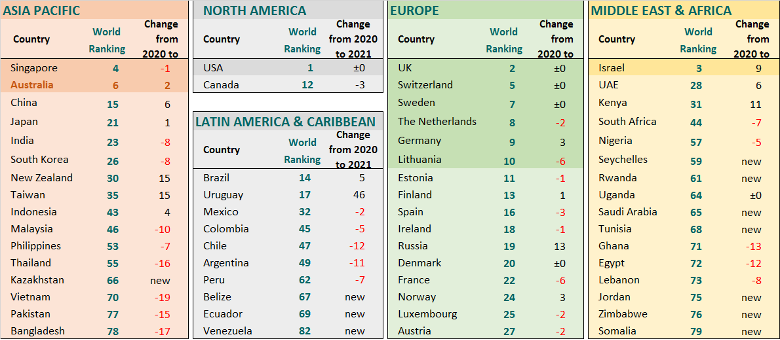

In spite of these fundamental challenges, Australia’s fintech landscape is lauded internationally, with the recent 2021 Global Fintech Rankings placing Australia 6th globally. Legacy intransigence notwithstanding, Australian fintech has seen impressive growth in the past five or six years. FinTech Australia estimates Australia grew from a A$ 250 million industry in 2015 to a A$ 4 billion industry by 2020. As a young country, Australia saw almost 60% of digitally active adults adopting fintech by 2019, a jump from 13% just four years prior, according to Statista. The independent fintech ecosystem is growing alongside valuations, with one estimation putting the number of currently active Australian fintechs at 718, up from 701 a year ago, while the average deal size increased from $7.5 million in 2018 to $19.1 million by the end of 2020.

Source: 2021 Global Fintech Rankings, Findexable

Yet surface numbers indicating growth belie the issues fintechs face in raising capital and carving out market share independently of the banking titans. Although one report found 82% of fintechs met or exceeded capital raising expectations this year — versus only 57% in 2020 — some of the less optimistic executives in the sector have cited capital raising remaining as a chronic issue in Australia that holds back the sector. Australia has far less of a risk appetite than in the United States, for example. Following the implosion of Xinja neobank, regulators have tightened the screws on new neobanks to turn to earlier revenue-generating models, while the shallow pool of Australia VCs and other investors are less willing to burn through cash compared to elsewhere.

“You don’t have any appetite to fund loss-making businesses without a sign of how they are going to make money. I think those days are gone. They want to see proper revenue models, proper sustainable business models. If you are reliant on raising money for regulatory capital purposes before you think about building a product and making money, it’s a hard ask in a small market like this."

Andy Taylor, CEO and Founder, Douugh

Strained for capital and starting up companies in a saturated small market of 26 million people, fintechs are challenged to find their niche in a relatively mature financial sector, with their fortunes greatly impacted by potential partnership — or rejection — of the big banks. Neobank Volt Bank became the first new fully licensed bank in Australia in 40 years. Its efforts to accumulate the necessary capital to operate a fully-fledged deposit-holding institution was hampered both by Australia’s lean VC environment and the wariness spurred by the pandemic, solving these funding gaps with smaller bridge investments by partners like AFG, Australia’s leading mortgage brokerage firm, and Pepper, Australia’s largest non-bank lender. Volt Bank founder and CEO Steve Weston related how their Sydney offices became an incubator of sorts for some fintechs squeezed out by the big banks, becoming their first clients.

“There have been struggles for fintech startups particularly with the fact that four banks in Australia represent 80% market share, so trying to crack a deal with one of those guys is not easy. That has meant that there’s a lot of really clever stuff built, some of which haven’t had the oxygen to prosper."

Steve Weston, Founder and CEO, Volt Bank

How to approach market penetration in a small, advanced market like Australia’s elicits debating views. Taylor’s Douugh, a financial app that helps customers manage their money assisting in areas of portfolio management, robo-advisory and crypto investment, launched its operations first in the U.S., with plans to return to their home market of Australia once their business model has been proven.

“The regulator won’t let you go live now without a viable business model. You can’t really run it like a traditional startup in that approach. You have to show that you’ll make money, and I think that’s the challenge. In such a small market as Australia’s, that’s very hard to do. You need scale. I think it’s very hard to get here, so that’s why companies like us are looking at bigger markets first because you can get the scale to come back and make it work."

Andy Taylor, CEO and Founder, Douugh

Like Taylor, many Aussie startups are looking to export, with 40% of fintechs generating revenue abroad. Others, however, believe there is still plenty of market share to be had, especially as technology threatens the big banking status quo. As one of the very few neobanks in Australia to not partner with a full deposit-taking banking institution, Volt must scramble to rapidly accrue subscribers to its banking-as-a-service model by partnering with third party companies while servicing sectors the big banks have rejected, like crypto markets.

“You don’t need to be the biggest [bank] in the country or fifth biggest [bank] in the country to actually have a very big, valuable business. If you had a startup bank that got to 1% market share in five years, they would be extraordinarily happy. And that sometimes is missed – the Australian banking market is very profitable. You go after those areas that are less contested by the big banks and where the cost of customer acquisition is lower."

Steve Weston, Founder and CEO, Volt Bank

A New Data Paradigm

In the first few years of its existence in Australia, fintechs were forced to partner or be acquired by legacy institutions or target the slices of the Australian market the big banks wouldn’t touch; the high customer acquisition costs for fintechs typically necessitate partnerships, according to Weston. The CDR may just disrupt that landscape completely. Australia’s CDR, as envisaged, goes far beyond the parameters of open banking in the EU or UK, which are limited to payment initiatives. The CDR framework, by contrast, encompasses 29 different bank accounts, with plans to roll out one by one data sharing in areas including but not limited to energy, telco, health, groceries, and pensions. It is, in essence, what open data acolytes have long championed.

Source: cdr.gov.au

The framework of the CDR itself is indeed without precedent in the world. No other country has released such a framework that seeks to enable economywide data-sharing. The CDR has already commenced with data-sharing in banking, with the big four banks mandated to enable data sharing last year and the rest of the banking sector joining the regime recently this summer. Initially, many banking institutions were unable to meet the required deadlines to facilitate API-enabled data-sharing, with extensions given by the government. Though the process was labored, accredited data holders have begun to bring use cases live. Adatree is an Australian regtech working with financial institutions to do the integration “grunt work” so companies can properly facilitate the API-driven data sharing. According to Adatree’s CEO, Jill Berry, these have been busy times for the company, as financial institutions scramble to join the CDR regime, proclaiming 2022 to be a “huge year” for CDR use cases going live.

“A year ago, we had 4[%] of the addressable market of bank-sharing data. Now, we have something like 96[%]. That is a gamechanger. So now companies are like okay, this is actually happening right now. There are use cases live. We are smoothing out a whole lot. Regulation has evolved, things are getting easier, so this is a good time to actually look into it. We’ve stopped teething — we are learning to run instead of walk."

Jill Berry, Co-founder and CEO, Adatree

CDR enables customers to share their financial data so they can receive price quotes according to their usage or spending habits among products across the given sector, while making it convenient to switch providers with a few simple clicks. As UNSW’s Ross Buckley and colleagues discussed in their recent paper on CDR, home loans — which are prime moneymakers for the big banks — are the “most difficult product to switch while being the product with the highest savings potential,” as a typical customer pays a variable rate on average over $1,000 more per year they need to be paying. Legacy institutions rely on the difficulty of switching providers to charge loyal customers more than new customers. The Australian Competition and Consumer Commission had found that the big four banks’ high profit margins were not a result of superior performance, but due to the inability of other financial firms to compete. This oligopolistic nature extends to other industries such as energy — a sector expected to be incorporated into CDR next year — where an average energy customer in South Australia could save $442 on average by switching to a more cost-effective offer.

By processing applications far faster than legacy banks and typically with less or no fees, challenger institutions and even smaller credit unions are chomping at the bit to take advantage of CDR’s unprecedented transparency and ease of switching to finally steal some of the incumbents’ swaths of customers. The CDR offers a single platform for consumers to pick and choose among these offers, carving a space for banking-as-a-service providers like Volt to truly compete on an even level.

Some of the incumbents are moving to prepare and adapt to these new technologies and regimes underway. National Australia Bank acquired 86400, one of the new neobanks, and Westpac has also launched banking-as-a-service, with its third-party offerings including a partnership with Australian BNPL leader Afterpay. CBA is viewed as the legacy bank furthest along in innovative digital technology. Berry mentioned how Adatree has recently been involved in activating data sharing for Payble, a CBA-backed payments data firm. The CBA has also recently invested in Amber in the energy sector and Tangerine in the telco sector in anticipation for CDR’s expansion into those industries next year, hoping to capitalize on economy-wide data sharing rather than being left in the dust by more agile fintechs.

The Pitfalls of Inertia

Although more financial institutions are becoming accredited data holders and the first data-sharing use cases are online already, the fact remains that for most Australians, the transformative CDR regime is a complete unknown. A 2019 survey of 2,000 Australians revealed that only a quarter of people had even heard of “open banking,” with only 7% of those surveyed able to say confidently what open banking was about. Still lacking a government-led consumer education program and with its features unadvertised by legacy institutions, this lack of awareness has changed very little since then, as Australia’s news cycle is instead saturated by pandemic coverage.

Though a consumer education initiative — which UNSW’s Buckley views as critical — might yet be on the way, some still doubt that Australians’ inertia favoring legacy providers will quickly abate once the opportunity arises for cheaper options. Even after Australia’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services revealed widespread abuse by legacy institutions and prioritization of profits over consumer welfare — exemplified by the former CBA CEO’s response of “temper your sense of justice” to suggestions for the bank to stop selling bad insurance to customers — Australians still tend to only trust the bigger banks. Volt Bank’s Weston joked that despite all the complaining among the public regarding the big banks, Aussies before open banking would be “as likely to get divorced as we are to change our primary banking.” Can open banking put an end to this culture of consumer conservatism? Some industry players, like Harold Dimple, CEO of money remittance provider RocketRemit, are skeptical.

“[CDR] might have the potential to change, but if the populace is so apathetic on the whole, and incumbents are working hard to obscure it, I don’t know. Just because you have a glorious regime in place doesn’t mean it is actually used or picked up."

Harold Dimple, CEO and Founder, RocketRemit

Indeed, nowhere in the world has open banking – let alone the economy-wide data sharing the CDR promises — truly taken off yet to transform economies like the model evokes. Australia will provide the truest test of whether the vast customer benefits of convenient data sharing can trump customer hesitancy alongside legacy obstinacy and obfuscation.

Source: TrueLayer

Though customer awareness may be holding back CDR, it is difficult to imagine consumer conservatism permanently trumping the clear benefits that an economy-wide data sharing regime like the CDR provides to the masses. Experts like UNSW’s Buckley freely admit the full implementation and impact of such data-sharing regimes will be drawn out. Yet it’s important to consider that while the benefits and transformation of CDR is in direct conflict with market and cultural inertia, that very tension is the point.

“I don’t think many people in Australia outside the government realize how big it’s going to be. I’m not accustomed to seeing this degree of change driven by government. It’s really quite unusual. But it’s more than a regulatory reform. It’s crafting a whole new infrastructure to share data that wasn’t there before."

Ross Buckley, Scientia Professor in Law, University of New South Wales

Whether it be legacy institutions losing customers or adjusting their policies to better cater to consumer interests, change is coming to Australia’s digital economy, to the chagrin of profit-driven incumbents. Lack of customer awareness and incumbent fearmongering doesn’t endanger the model by itself — most likely, it only delays the inevitable.

Image courtesy of Michael Marais

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Fintech 2022: A Retrospective And A Preview

Blockchain-Based Payments in Kenya: A Square Peg in a Round Hole?