Blockchain-Based Payments in Kenya: A Square Peg in a Round Hole?

~9 min read

If you were to conduct a quick Google search on how many crypto owners there are in Kenya, you would get a widely recurring number: about 4.58 million owners. This makes up about 8.5% of the population, higher than the percentage of crypto owners in two evolved crypto markets, the US (8.3%) and Nigeria (6.3%). For context, the total population in Nairobi per the 2019 census was 4.4 million people. Yet a media publication specializing in blockchain and crypto technology news in Africa came out to say the 4.5 million number is likely quite a stretch, relying on assumptions based on a correlation between country scores from a different report estimating the number of users in the country. Separating fact from fiction is always a difficult task in assessing blockchain-based payments amidst the current feverish environment — and Africa’s leading fintech hub is no exception. Lacking reliable figures, one needs to look beyond the data and into the streets to truly understand the blockchain-based industry in Kenya, which is finding intriguing promise and possibilities met with regulatory limitations and fraud fears.

The Crypto Underground

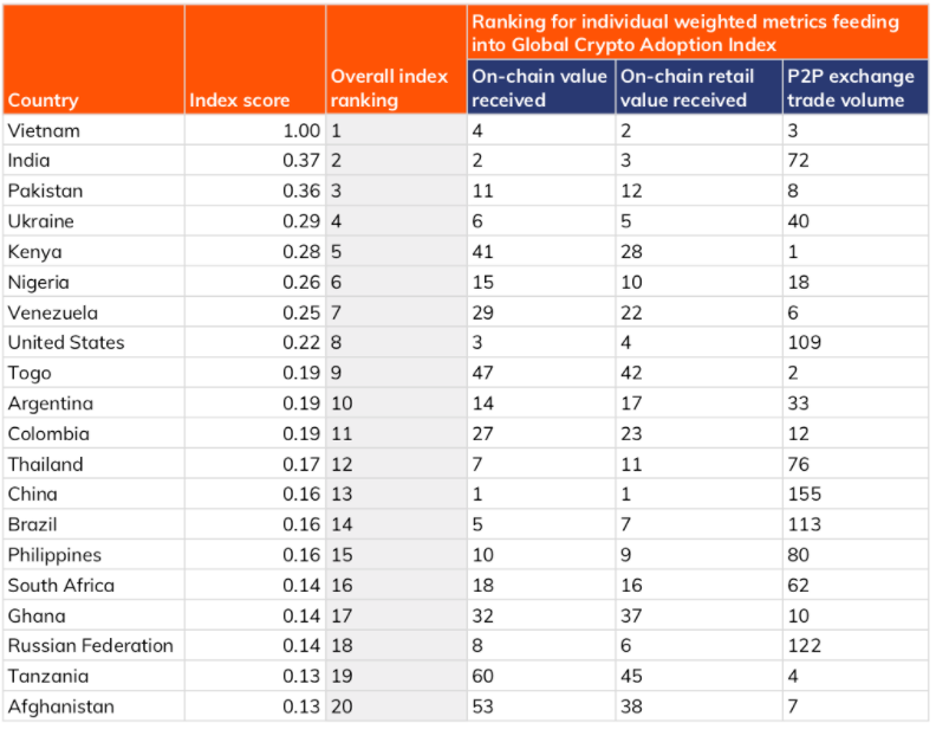

When one first gains an interest in cryptocurrency in Kenya, they are most likely to come across P2P platforms like Paxful, Binance and LocalBitcoins as their first points of contact. These platforms have made it easy for Kenyan citizens to take part in the world of crypto globally by enabling P2P transactions. The convenience of P2P transactions has catapulted Kenya’s crypto adoption rates, as the country ranks 5th globally in crypto adoption according to Chainalysis. 2021 especially saw a surge in users, with LocalBitcoins reporting 17,000 active users on their platform. Google Trends also reported an increased search rate for the term ‘cryptocurrency’ in Kenya, with most interest coming from the capital city, Nairobi.

The 2021 Global Crypto Adoption Index Top 20

Source: Chainalysis

Apart from searching online, Kenyans also took to social media groups, looking to learn more through a plethora of discussions and questions being shared with other social media users.

To answer: no banks in Kenya currently accept Bitcoin. Crypto remains unregulated in Kenya and unrecognized as a legal tender, limiting its accessibility and use in the country. Banks have issued warnings over the buying and selling of crypto through bank credit and debit cards.

“NCBA Bank does not approve cryptocurrency transactions done using your Card or transact with institutions trading in virtual currencies.”

Excerpt from an email by NCBA Bank, as shown on BitcoinKE

Users have, therefore, taken to transacting among themselves, sending money between individuals through M-Pesa, as well as bank transfers and PayPal in exchange for their preferred cryptocurrencies. The government has, for the most part, turned a blind eye to the individual P2P transactions that occur on international platforms like Paxful and Binance and wallets such as Bread and Green Wallet. Transactions facilitating local crypto trade are done on separate platforms. If a Kenyan wanted to buy Bitcoin, for instance, they can go onto Paxful, browse for a seller, and, after agreeing on a payment method such as M-Pesa, the Bitcoin would be put in escrow to allow time for them to conduct the transaction on their phone, sending money to the seller directly with no links to the crypto platform. The crypto user can then get back on the platform to confirm payment and have the coins released to their account. In a matter of minutes, the transaction is complete, and the bank or M-Pesa is unaware of the exact purpose of the transaction — a loophole that enables widespread crypto trading despite the lack of recognition of cryptocurrency as legal tender in Kenya.

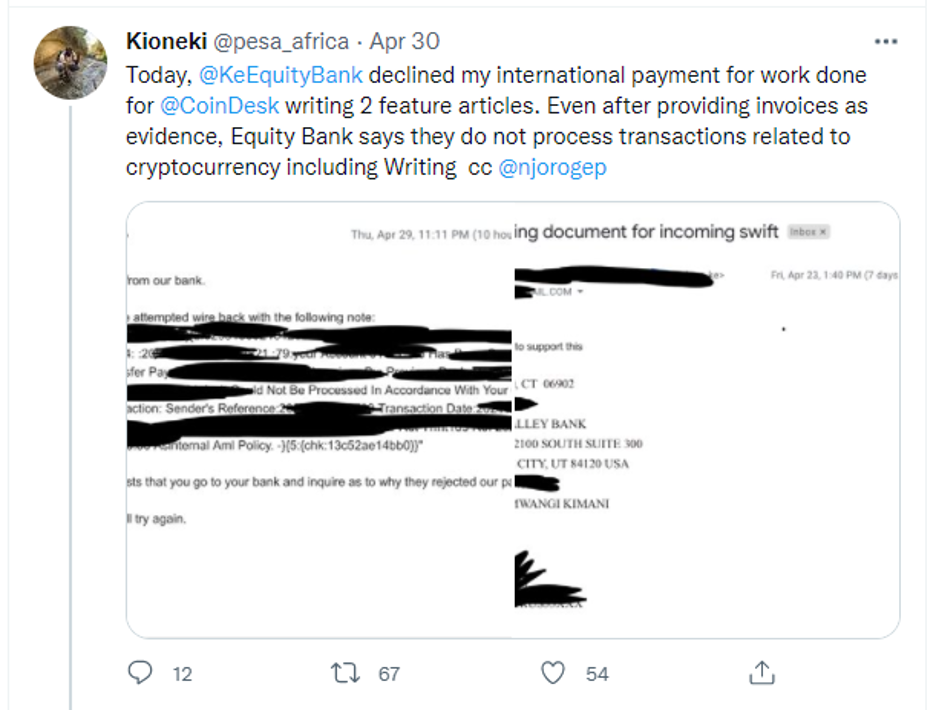

Considering the current regulatory hurdles, one would expect financial institutions to block such transactions. But institutional enforcement is spotty, as some transactions fly under the radar of these Kenyan banks, succeeding on platforms such as Binance. For a Kenyan bank account holder with Absa Bank or Standard Chartered Bank, for instance, they may by chance successfully link their card to Binance or KuCoin and transact with no qualms. At the same time, there are reports of some transactions being flagged and even blocked, even when it isn’t prudent. An affected individual took to Twitter to narrate his experience with Equity Bank, a Kenyan bank that failed to process his payments for his writing services rendered to CoinDesk, a news site that specializes in digital currencies. A lack of updated and clear guidelines by the Kenyan government on handling cryptocurrency is mostly to blame for the differences in financial institutions’ methods of handling these interactions.

Finding Its Niche

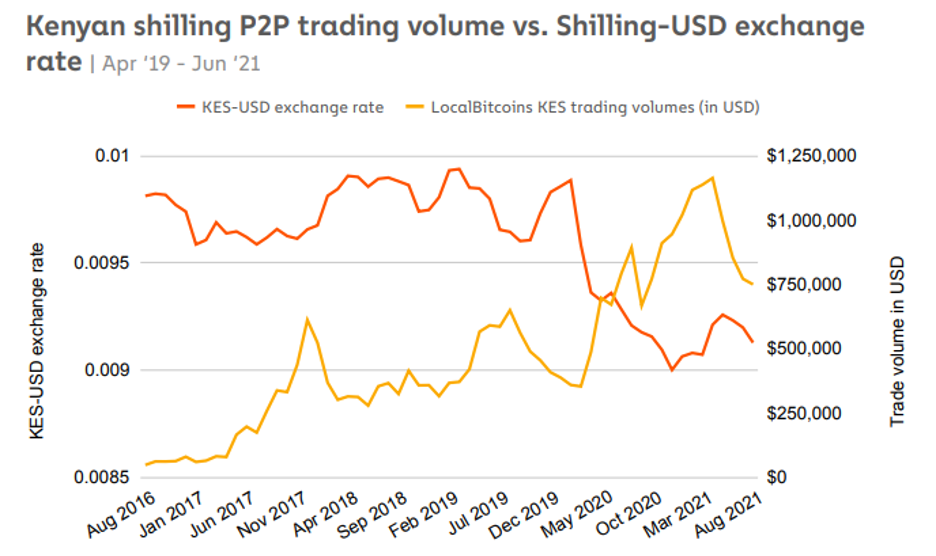

In this muddled operating environment, crypto remains far from the mainstream in Kenya, but certain use cases are bubbling to the surface. P2P trading has experienced an uptick as the Kenyan shilling’s value drops, with interested parties choosing to invest in crypto in a bid to maintain the value of their assets. The decentralized nature of crypto means that interested parties can trade crypto on different trading platforms like Paxful, or HODL in personal wallets as savings, without pegging it to the weakening Kenyan Shilling.

Source: Chainalysis

Others have taken to crypto to transact internationally, using the loopholes present in the movement of cryptocurrency to buy products and services online and receive payments for work done.

“It’s cool to be paid via Bitcoin. I actually love the method over PayPal, [which] can freeze your account for no reason. Exchange at Paxful [is] just the best.”

Ian, Freelancer (Facebook post)

For Ian and many other freelancers offering their services online, P2P crypto trading offers an option to receive payment. Whereas payment platforms like PayPal limit some accounts — sometimes permanently in Kenya and with no recourse for appeal — crypto offers an alternative payment service that allows people to access their payment in KES above the exchange rates of the day. Accessing the money is limited, however, to P2P platforms like Paxful and LocalBitcoin, where users like Ian would need to then trade their cryptocurrency for cash. Once they are paid in Bitcoin, for instance, they can log onto the trading platforms and sell their coin through different payment methods such as mobile money, internet banking and even through Pesalink, a real-time bank-to-bank transfer service in Kenya. Compared to the higher fees seen in other money transfer services like PayPal’s 4.4% transaction fee, these P2P platforms charging 1% fees offer superior rates for users.

When it comes to the local market, popular cryptocurrencies like Bitcoin and Ethereum have limited transactional use within the confines of the country. A handful of establishments accept crypto as payment methods, including Healthland Spa in Nairobi and a local restaurant, Betty’s Place that is located in the Mount Kenya region in Nyeri. To pay through cryptocurrency at these establishments, a client would simply transfer the coins into the establishments’ wallets. The two have yet to face issues with the authorities for including crypto as a payment option, despite it not being legal tender in the country. For the time being, the insignificant number of establishments including crypto as a mode of payment allows them to remain under the radar of the authorities.

The local market does, however, have a community-based cryptocurrency known as Sarafu that is used among several low-income neighborhoods. The Community Inclusion Currency (CIC) was introduced in several communities in Kenya by the Kenyan Red Cross, the Danish Red Cross and Grassroots Economics, serving as a voucher system in select communities in Kenya who may need assistance to afford necessities where money is scarce. Anyone can use this Sarafu as long as they have a Kenyan mobile phone number. To use it, one needs to register with the system, join together with their ‘Chama’ members, or their informal pool savings and investment group, and use their group to launch their Sarafu currency that is backed by the group’s savings and used for trade internally. This currency would then be distributed among the members in the form of loans, and it can be used in establishments that accept it within the community. Sarafu tokens can be transacted through USSD, making them accessible to people with feature phones. With the government quietly tolerating this specific use case, businesses are able to incorporate Sarafu payments as well and can use the same tokens to stock their establishments from other community members in the voucher system. Sarafu has made large strides, with Grassroots Economics reporting close to $900,000 USD worth of trading in Sarafu in 2020.

Another up-and-coming use case comes from a partnership between WFP, Celo Org and Corsali in a project incorporating blockchain technology in microwork. The project held a 2-week pilot program in Kibera, a slum area in Nairobi, in November 2021 in which participants were trained in performing microwork in machine learning. They are then connected to an online microwork platform where they can complete tasks and get paid in cryptocurrency through Celo mobile wallet, which they can later cash out through M-Pesa. This promises to elevate vulnerable groups including the young and unemployed by enabling them to earn an income, gain skills and learn the basics of cryptocurrency.

Despite these strides made in crypto and blockchain use, there have been numerous scams riding on the crypto wave, which is in turn negatively affecting the industry.

Investment or Scam?

A lack of information and misinformation regarding blockchain technology and especially crypto is common in the country, with many subsequently becoming extremely wary about the whole idea. The industry and its novelty have been used by crooks to lure unsuspecting Kenyans into get-rich-quick schemes, using industry terms that the locals may not really understand. Misinformation is easily spotted in conversations about crypto and blockchain technology.

“Imagine, not even the Central Bank regulates it. It's like trading in air, and for me it comes across as another MLM. Very Illuminatish. Let me handle dollars and shillings as I know them."

Mercy, Facebook user

“I lost money in 2017 [B]itcoin mining in a company called bitclubnetwork. Since then, the word gives me jitters."

Anonymous, Facebook user

The list of scams both local and international is endless, with more popping up frequently. One of the most prominent scams was Velox 10, a pyramid scheme that originated from Brazil where Kenyans lost millions of shillings to the scam in 2018 and 2019. Interested people could become members by paying $100 and could upgrade their membership into traders of Bitcoin by paying an extra $200, after which they could now ‘invest’ more money in buying Bitcoin and make 50% ROI. The company then went under, wiping away investments from unsuspecting Kenyans.

The lack of government regulations, as well as the ease with which blockchain-based businesses can enter the market and start to solicit investments from the public with nothing but a whitepaper, a website and what David Gitonga, founder of BitcoinKE, refers to as “Clever Tokenomics,” creates an environment for scams to thrive. One such alleged scam that employed “Clever Tokenomics” is Kenicoin. The company marketed itself as a multi-utility trading platform, starting as an Initial Coin Offering of tokens to investors. In its whitepaper, Kenicoin claimed that its coin was “backed by real businesses that make use of it exclusively as the only medium of exchange” and that it would have a limited supply of tokens, promising that the coin would increase in value by 3000% in the first 12 months following the ICO, based on the existing businesses that would use it exclusively. The existence of these businesses could not be verified on the ground, a red flag that led people to doubt Kenicoin’s legitimacy. Soon after, the Capital Markets Authority cautioned the public from participating in the ICO or trading the token. Courts later ordered the Capital Markets Authority to conduct investigations into the company in 2019.

BitcoinKE’s Gitonga and his team have exposed several scams purporting to be blockchain-based businesses looking for investors across Africa, viewing such vigilance as vital to warm up regulators to the crypto space. Companies with innovative ideas are limited in their reach due to the lack of regulation, and these scams only make it worse for the companies.

“The biggest obstacle for crypto projects is access to the mass markets. Especially in Kenya, where for you to access the mass markets, you need to plug into the existing financial infrastructure...through the bank, through mobile money. Currently, regulation in Kenya will not allow a crypto project to plug into the financial infrastructure. That is limiting mass adoption."

David Gitonga, Founder, BitcoinKE

The future of blockchain technology relies on the industry’s ability to achieve mass adoption. As more use cases manifest and get more buy-in from people in Kenya, the authorities will be pushed to regulate the industry and allow for an environment that is safe for the users and the creators of blockchain-based solutions. As it stands, however, the market is uncertain, with industry players choosing to find loopholes to bypass the illegalities as they await guidelines. Before the Kenyan market’s incongruencies can be sorted out, resolution is sorely needed.

Image courtesy of Thought Catalog

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Australia’s Digital Economy: On The Precipice Of Transformation?

Fintech’s Funding Bonanza: A Bubble Or Warranted?