Blockchain’s Emerging Opportunities in Emerging Markets

~10 min read

If futurists’ predictions about the paradigm-shifting impact of digital ledger technologies — more commonly known as blockchain — are realized, the past few years are likely to mark a critical inflection point. Intertwined yet distinct from the cryptocurrencies built on top of them, the explosion of digital ledger technology (DLT) use-cases since 2018 has begun to yield a new generation of success stories. But even if we finally accept that blockchain technologies have crossed the valley of death and into the mainstream, how game-changing are these technologies really beyond Silicon Valley, and does the evolution of use-cases in emerging markets seem poised to follow that of richer nations? This week’s Insight dives into a few of the more promising applications in Africa through the critical lens of ‘trust’ — how much is needed and what kinds — in sussing out the fads from the future of the fast-evolving blockchain sector.

From 4000 BC To Third Gen

For the uninitiated, a quick review of the history of blockchain may be instructive in framing our current inflection point. The computing processes underlying blockchain technologies go back to cryptography research in the 1970s, which were focused on developing efficient protocols for coordinating a trusted ledger among multiple participants in low-trust environments. In this most basic formulation, blockchain is simply a system of record keeping, an activity humans have innovated and improved for at least as long as the written word in Mesopotamia as far back as 4,000 BC.

Fast forward to 2007, and the world is tipping into a global financial crisis. It’s fair to say that this is a particularly turbulent period in world financial history; while the subprime mortgage crisis in the U.S. spreads to wipe out trillions of dollars in value around the world, the first iPhone is released, and Safaricom launches M-Pesa in Kenya. Worldwide, trust in global financial intermediaries crumbles like sand castles in the rising tide, while new tools of connectivity and freedom portend a smaller-scale, human-sized direction for personal finance: more accessible, more trustable and more ethical.

A year later, at the height of the crisis, the still-anonymous programmer known as Satoshi Nakamoto publishes a ground-breaking white paper and mints the first bitcoin in early 2009. Its popularity grows principally among tech nerds and shadowy black market participants, as it gradually enters the mainstream consciousness.

The 2014-2016 period saw a second generation of blockchain emerge, with Ethereum emerging chief among them thanks to its emphasis on smart contracts. Our current period can be described as the third generation, with a proliferation of blockchain startups either choosing from a wider array of existing blockchain platforms ‘off the shelf’ or even creating new ones entirely — all racing to develop the right combination of trusted security, operational stability, and, most importantly, a growing and dedicated community of users.

Source: BitInfoCharts

Which brings us to today: earlier this year, amidst another once-in-a-lifetime global shock, the total value of Bitcoin crosses one trillion dollars, half the market value of Apple. Andreeson Horowitz, one of the world’s most successful venture capital firms, announces its third crypto-focused fund worth US$2.2 billion. And why not — their US$25 million bet on crypto-platform Coinbase in 2013 yielded the largest exit in the lauded firm’s entire history.

But enough about Bitcoin. The wild volatility of the cryptocurrency markets makes them, for most, a speculative game — though so-called stablecoins may maintain value better than developing countries’ fiat, like Nigeria (the country with the highest number of Bitcoin searches on Google) or El Salvador, the world’s first country to approve Bitcoin as legal tender. To understand the long-term potential of blockchain, one must go beyond the turbulence of the latest fads, or rather look under the hood to see which problems really call for a blockchain solution.

In Blockchain We Trust?

Jocelyn Weber Phipps is the Director at the University of California’s Berkeley Blockchain Xcelerator, among other blockchain-focused incubation initiatives. Directing one of the largest and oldest programs of its type, Phipps holds a uniquely multifaceted perspective on blockchain after seeing cohort after cohort of entrepreneurs build up the ecosystem.

For the skeptical investor, she doesn’t see such much discernable difference in risk among blockchain-focused companies relative to ‘regular’ fintechs — after all, the failure rates of startups of all stripes is around 90% (21.5% in the first year, 30% in the second year, 50% in the fifth year, and 70% in their 10th year).

“A lot of the ICOs and blockchain-based companies that were launched during the hype cycle of 2017-18 and failed in the past couple years did not have good fundamentals for a startup or were simply taking advantage of the hype for quick money. But the subsequent correction has had the positive effect of "weeding out" the ones that really didn't have a viable business. So it comes down to the founding team and execution, but also timing: do they have the right technology combination to be viable in the right time-frame?”

Jocelyn Weber Phipps, Director of Berkeley Blockchain Xcelerator

Beyond these three critical ingredients — team, product-market fit, and market timing — she emphasizes the critical role trust plays in developing a scalable blockchain use-case: many challenges simply don’t call for a blockchain-solution, and investor hype around the technology may sometimes create the temptation to try to jam a square block(chain) solution into a ‘round’ market gap, so to speak.

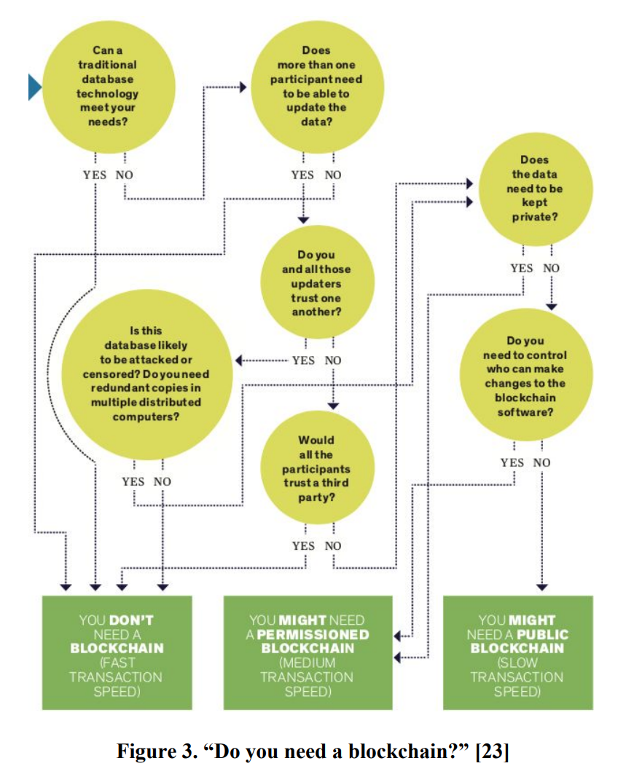

As the flow-chart below illustrates, the type of trust needed indicates what kind of blockchain might be appropriate for a given challenge — public, permissioned (more centralized control) or, indeed, not a blockchain at all. The trade-off between these options is typically in transaction speed, which increasingly becomes an issue as a blockchain solution scales, depending on the need. High-volume trading, for example, requires high trust but also lightning speeds; tracking shipments in a supply chain, however, may tolerate much higher latencies.

This helps explain why ‘blockchain-market fit’ is so important. Ethereum experienced significant network congestion and consequent high transaction fees earlier this year as all the use-cases built on top of it tested the network’s capacity to handle the traffic. In today’s third generation of blockchain development, developers can select amongst a much wider galaxy of blockchain technologies as a foundation that matches their use-case requirements, again principally driven by the types of trustless permissions needed and the transaction speed requirements for the specific use-case.

Such analysis of the fundamentals of a blockchain-based solution or company is quite necessary to analyze its long-term potential, given the enduring paucity of real impact metrics reported in the still-maturing industry, and the general lack of sober post-mortem reflections amid the graveyard of failed crypto-ventures.

Leaf Global Fintech is one of the Xcelerator’s graduates whose use-case, more than most, clearly calls for a blockchain solution: the cross-border/remittance challenge. Active since September 2020, their user base is small yet sizable at 6,000 customers with transaction volume in the hundreds of thousands, mostly in dollar amounts too small to be convenient through, for example, Western Union.

As Mondato has described before, the global interbanking system is perhaps less akin to smooth ‘rails’ than rough ‘assemblages’ — a deeply fragmented set of national banking systems whose tectonic plates, separated by regulatory fault lines, are expensive and ponderous to cross. Such a system, riven by high fees and multiple disparate actors using different accounting systems, seems the perfect use-case for blockchain technologies, since the existing banking systems have set the bar so low. Yet the regulatory moats protecting these banking systems are wide; remittance costs remain persistently high at between 7-10% of value sent for the poorest markets, despite targeted focus from international stakeholders to get down to 3%.

Leaf’s solution is a blockchain-based wallet — built with stablecoins’ pegged to Ugandan, Rwandan, and Kenyan fiat currencies — whose principal user base consists of displaced populations of the East African diaspora. Although principally targeting refugees, the solution responds to the needs of anyone whose networks are inherently spread across national borders — and no, existing mobile money solutions are not sufficient:

“Imagine if Venmo charged 6% to send money to a friend — that’s the state of mobile money in many countries, especially for small amounts.”

Tori Samples, CTO of Leaf Global Fintech

Leaf presents an interesting example of how important it is for the technology underlying the product to match the use-case: it is built on Stellar, a blockchain specifically designed for cross-border payments. It is designed to work seamlessly with central banks and regulatory authorities, which has historically been difficult for Bitcoin and Ethereum. There’s no ‘mining;’ rather than proof-of-work or proof-of-stake, Stellar uses the Stellar Consensus Protocol to verify transactions, making it less computationally ‘expensive’ to transact.

Some other key blockchain players to watch for in the cross-border space are Ripple, a blockchain platform, and Aza and Abra, which are built on separate blockchains — but given the direction of the industry, the underlying blockchain technology used may constitute less and less of a company’s secret sauce. For Leaf, for example, it only takes three days to set up a stablecoin integration for a new national currency; the real challenge is in developing the right partners in-country to handle regulatory exigencies and hold value in a partner bank. Leaf, like so many other blockchain-based solutions, is simply one layer in a vast network, trying to solve a specific part of a dynamic puzzle.

It Takes a Village

In disentangling the blockchain from the crypto, the recent NFT phenomenon offers another perspective on the promises and possibilities of decentralized finance and distributed ledger technologies for charting new territory in digital finance and commerce. Put simply, NFTs (Non-Fungible Tokens) apply the verifiability of blockchain to digital products, a similar spin on what blockchain can provide to supply chain visibility or mineral traceability.

Linda Rebeiz is a multimedia artist from Senegal whose forays into the thick of the NFT market provide a window into the technology’s potential for creatives beyond the usual art hotspots in New York or Milan. Weeks of late-night research into the growing NFT art platforms on Twitter, Clubhouse and Discord over the last several months have accelerated her goal of becoming financially independent exclusively through her art by several years. She explains the process for ‘minting’ art pieces for sale:

“First you get a wallet. Then, on an NFT art platform like Foundation, you connect your wallet and tie it to your ledger. To ‘mint’ a piece you upload the digital file of your work and your unique ledger key is encoded into the file, so that whenever the piece changes hands, its movements are visible on the public ledger.”

Linda Rebeiz, Multimedia artist

One of the key advantages of this approach is that when someone buys and resells your piece, artists can get royalties from secondary sales — and the tokenization of each piece adds a layer of authenticity that is startlingly lacking in the ‘regular’ art market.

As a use-case in blockchain technology, NFTs really crystalize the essential value-add — where market challenges rooted in transparency, barriers to transact, and trust may be ripe for disruption, with significant value to be unlocked not only in streamlined efficiencies (projected at 20-50% reduction in operational costs pending industry-wide adoption, according to one supply chain management case study) but also in opening the door to financial access and inclusion for new user-segments.

Rebeiz describes a dynamism in the art space in emerging markets where the NFT possibilities have opened up avenues for monetization previously inaccessible to the vast pool of creative talent. Her perspective is bullish on the technology for artists like her, despite a recent slowdown in global activity that some have interpreted as analogous to the boom-bust cycle of ICOs in previous years.

“There are so many gatekeepers in the art world, and the challenges are even harder in the digital art space in the continent. When NFTs came around, it was the clearest way to make money — a different path to a career that was never accessible before.”

Linda Rebeiz, Multimedia artist

Next Gen: Implementation Over Design?

The challenge with understanding blockchain is that it’s like describing the evolution of the Internet in real-time — massively complicated, strewn with fascinating stories, wildly divergent uses from one case to another, and a difficulty in keeping the financial vagaries of speculatory investments separate from the underlying implications for digital finance.

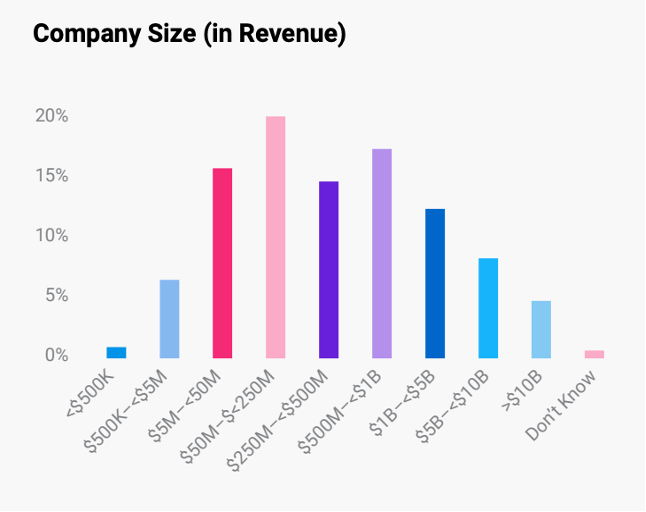

Like others, Mondato predicted in 2018 that supply chain and trade finance were among the highest potential use cases for blockchain technologies, given their key role in mediating the challenge of trust in complex, multi-stakeholder transactions, and indeed we are now witnessing increasing movement towards blockchain verification across such industries. Ripple’s 2020 Blockchain in payments, surveying 854 respondents across 22 countries in the payment space, affirms this trend, and further reveals that blockchain adoption is not just for start-ups anymore; large companies are diving into the blockchain fray and moving from pilots to execution. Among non-payment use-cases, supply chain management and trade finance indeed emerge as the most common applications, and what’s more, emerging markets lead adoption.

Source: Ripple, From Adoption To Growth: Ripple’s Blockchain in Payments Report 2020

Going forward, blockchain technologies appear to be evolving from their third generation in a way that may make the underlying technology, by itself, ultimately less important than the use-case it is applied to — particularly as new integrating layers gain traction and solve pain points like network congestion, transaction processing speed and interoperability across different blockchains.

It’s uncertain which areas are next in line for blockchain disruption, as questions remain: can corporations be held more accountable for their sustainability metrics through permissioned ESG blockchains? Can blockchain solutions move the needle on intractable challenges like global carbon markets now that the U.S. has returned to the Paris Agreement? When will blockchain-based cross-border solutions truly crack the remittance market at scale? There are certainly still too many solutions banking on blockchain hype alone. But if you’re trying to solve global problems where trust is an issue, you may yet be in business for a viable blockchain solution.

Image courtesy of André François McKenzie

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Digital Lending’s Self-Regulation: A Redemption Story?

The Dangers of the One-Click Buy Paradigm