The Dangers of the One-Click Buy Paradigm

~9 min read

The fintech revolution has centered around the idea of making payments frictionless, painless and flush with options. The drive towards frictionless spending is founded upon the idea that people want payments to be fast and painless — and businesses subsequently see increased conversion rates and revenue per user. Yet amidst the glorification of the one-click buy paradigm, lost in translation is how the meat is made: to a surgical degree, companies are mitigating or removing the psychological safeguards that prevent people from overspending. As consumer debt rises, businesses succeed yet consumers suffer in the long run, creating a cascade of effects towards individuals and the marketplace. This week’s Insight looks into the mechanisms of the psychological designs driving the digital payments revolution, and whether commercial fintech can save itself — and its customers — from its own worst impulses.

No Pain, Revenue Gain

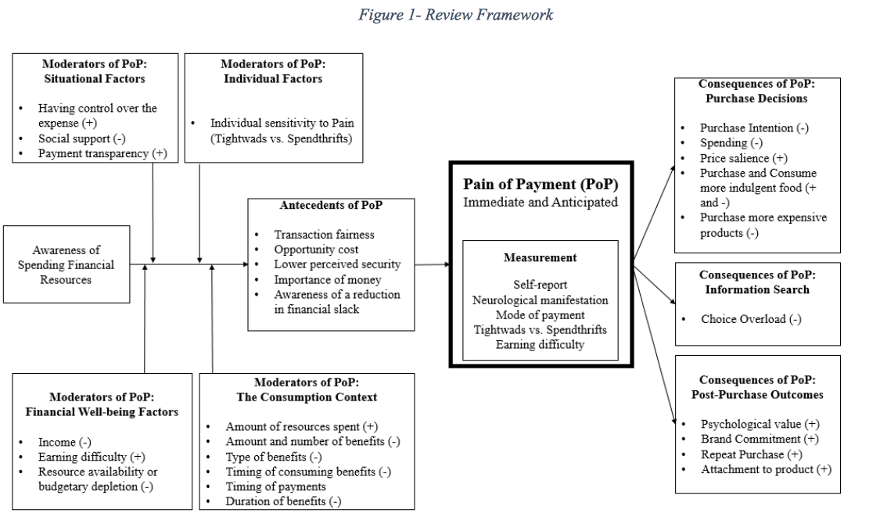

The concept of “pain of paying,” first advanced by scholars almost 25 years ago, underpins much of how digital commerce has transformed payments. When people pay for things, there is a certain pain felt, or a “moral tax,” as behavioral economist Drazen Prelec coined it, that is experienced. Although the exact nature of this phenomenon is yet to be completely understood, scholars agree the pain of paying mechanism serves to prevent overspending and impulse buying. Yet several factors can impact to what degree the so-called pain of paying is felt. Individuals vary — depending on to what degree they are “spendthrifts” or “tightwads” — by how much they feel such pain. Situational factors, like to what degree they feel they are in control of making such expenses, also impact the pain of paying felt. A third factor is price transparency; pain of payment will be felt greater when consumers are more aware of resources lost. The fourth factor is the consumption context, such as how expensive a product or service is, the perceived fairness of such transactions, the salience of perceived benefits, as well as the utility of a purchase and the time of payment according to the perceived benefit.

Source: Reshadi, 2020

Different payment mechanisms interact with these factors differently. The more tightly coupled payment and consumption are, the greater the pain that manifests; likewise, if payment and consumption are “decoupled,” less pain is felt. Studies have consistently shown credit cards lead to higher spending. By delaying payments to a later date and on aggregated terms, credit cards remove the pain of paying at the moment of purchase, and it obfuscates the specific costs when paid as one monthly bill, leading to higher spending. One dramatic example was a study carried out by Prelec that found when MBA students were tasked with bidding on seats to an NBA game with either credit card or cash, those who used credit cards spent on average US$61 in their bidding, while those utilizing cash bid only US$20 on average.

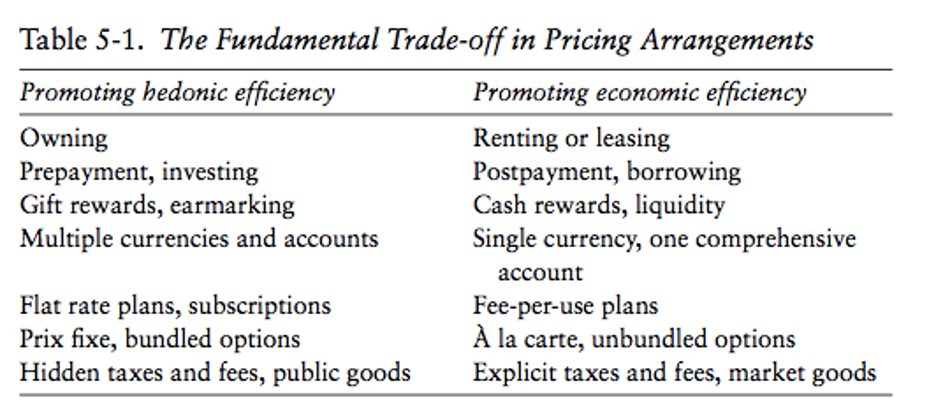

In his paper “Consumer Behavior and the Future of Consumer Payments,” Prelec unveiled a theory of payment design seeking to address what customers would optimally want from payment arrangements. According to Prelec, consumers want to (1) enjoy goods and services as if they were free (i.e. the moral tax is eliminated), (2) be able to justify any payments with specific and salient benefits, and (3) preserve financial responsibility and control. This optimal payment design is contradictory, however: arrangements that reduce the moral tax also make it difficult to track expenses, reducing financial accountability. And if the moral tax is necessary to regulate spending, then eliminating it will encourage overspending.

The frictionless spending paradigm extolled by ecommerce and payment companies promotes the first two components of Prelec’s model to the detriment of the third. Rather than promoting economic efficiency for customers, the frictionless payment model seeks to promote hedonic efficiency — the most pleasurable payment experience.

Source: Prelec, 2009

Certainly, consumers on the whole want payments to be easy and relatively painless. One survey found that 73% of customers desire to process a transaction instantaneously, and 92% expect a fast, frictionless experience that is also secure and trustworthy. However, it isn’t immediately salient to consumers the extent to which their psychological safeguards are being disarmed through design — and what the consequences may be. George Loewenstein is one of the leading behavioral economists who helped pioneer and develop the pain of paying concept.

“The central dilemma is that the mechanism that prevents you from overspending also prevents you from enjoying that spending. Of course, it would be wonderful not to experience pain. But people who don’t experience pain lead short lives because they injure themselves and they don’t realize it. So the pain mechanism is a very important mechanism, and it’s devastating not to have it.”

George Loewenstein- Co-director of the Center for Behavioral Decision Research, Carnegie Mellon University

One experiment found that while those who pay by cash overestimated their expenses by 9%, those who paid through contactless means underestimated how much they spent by 5%. But it isn’t simply the relative lack of transparency that causes issues. Rather than preserving psychological safeguards, digital payment designs often seek to reinforce reward pathways for consumers to spend. One recent study looked into the neurological underpinnings of credit card spending, weighing the competing theories of whether credit cards “release the brakes” on expenditures or “step on the gas.” The study confirmed that participants were more willing to purchase higher-price items with credit rather than cash, thus spending more overall. When investigating this phenomenon neurologically, the researchers found that the neural signature associated with credit purchases is not price-contingent — i.e. prices are out of mind in contrast to cash purchases. Further, the study correlated previous research which suggested the mere presence of credit card logos induces a desire to purchase, with neural reward pathways activated. This Pavlovian conditioning mechanism — producing neural pathways similar to addictive behaviors — renders the payment experience as not necessarily painful, but in fact producing positive feelings associated with forthcoming consumption.

Comfortably Numb

In light of the typical 70 percent cart abandonment rate, Amazon’s introduction of the one-click shopping option — with its ability to decrease cart abandonment and increase purchase amounts — was hailed as transformative, providing Amazon a critical advantage over competitors in the early years of ecommerce. By removing the pain still remaining in the online transaction process of entering in credit card information and the like — which, in essence, reminds consumers of the forthcoming resources lost — the one-click shopping option became an industry-wide goal to strive towards. Rather than viewing impulse purchases as a dangerous threat to consumers’ financial well-being, the profits-driven model has rendered such increases in impulse buying as a purported benefit to businesses, in spite of the fact that Americans already spend on average US$5,400 each year on impulse purchases.

The seamless transaction process that Amazon pioneered has fundamentally altered how consumers perceive and relate to the online purchases. An Amazon heavy shopper orders several makeup accessories each day, describing the most pleasurable moment being when boxes arrive at their door. They don’t know which box is which — nor do they even necessarily remember ordering each one. The behavioral economist Avni Shah has done research which reveals that the higher the pain of payment in a transaction, the more details people will remember about the transaction. In the case of the one-click shopaholic, the decoupling of transactions and consumption have allowed for ecommerce companies to warp how consumers perceive the boxes arriving at their door.

“It doesn’t feel so bad, it’s over credit card, it’s online, so you’re not feeling the whole pain of payment experience. But then what you do feel on the flipside afterwards is you get this huge rush of pleasure when it comes the next day. Even though you paid for it, it feels like a gift has come. With Amazon, it’s not that conscious of a connection because the payment and pleasure experiences are not that connected.”

Avni Shah - Research Fellow of the Behavioural Economics in Action Research Cluster

Even for those companies who are singularly profit-driven, the implications of this diminishing of mental accounting mechanisms are not entirely favorable. Shah’s research has also found that purchases with a higher pain of paying strengthens the connection consumers have with the given brand or product. While Amazon doesn’t care whichever brand is sold from their platform, individual product or service companies may struggle to truly distinguish themselves and cultivate loyal customer bases in the dematerialized landscape.

Considering most studies on pain of paying have focused on credit cards’ malign psychological effects, far more research is needed to understand the implications that digital transactions in particular have on the pain of paying dynamic. Shah has a working paper yet to be published which suggests mobile and online payments reduce the pain of paying even further, with credit card payments eliciting more spending online than in-person.

“My mobile phone, or an Apple Watch, I think of that as a timekeeper or activity device. My phone is a social device. My computer is my work device. So I’m not being reminded of the outflow or purchase aspect of it as much. I am finding there is a difference even within the same payment forms as people are thinking even less of the purchase and spending a bit more when it is your mobile phone. And they remember the details of the transaction less so than when using the credit card itself.”

Avni Shah - Research Fellow of the Behavioural Economics in Action Research Cluster

A Fintech Reckoning

Reducing the pain of paying is not necessarily bad, nor have treatment or applications of these concepts been entirely predatory by fintech companies. Though automated payments can be a slippery slope, automated savings can likewise induce needed saving by reducing the pain of setting aside money. Spending patterns online could also be tempered by digital financial service offerings like Wealthsimple, which makes it easier for people to create different accounts to budget for various expenses and monitor spending habits. This essentially materializes the double-entry mental accounting process first espoused by Prelec and Loewenstein, which states that customers tend to open a mental account for each purchase they make to track the benefits and costs of that purchase. In terms of company practices, not all companies obfuscate payment processes to an extreme degree; some credit card companies and banks send reminders after completed transactions, which helps maintain a pain of paying mechanism. As Shah points out, in very certain cases, online purchases may actually encourage more responsible spending. Shopping for groceries on Instacart, for example, would see people more likely to stick with a defined shopping list rather than in-person grocery shopping, where a “hot state” may encourage impulse shopping beyond the original plan.

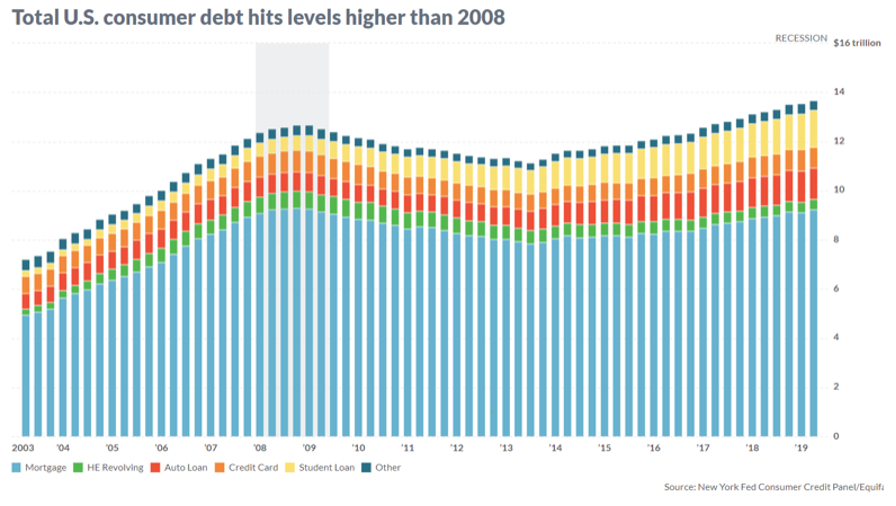

However, the instances of companies leveraging pain of paying reductions to facilitate savings or responsible spending mechanisms are far outweighed by the industry-wide drive towards frictionless spending that obscure payments in the immediate sense, especially in developed markets. While the mobile payments revolution has enabled poorer populations and SMEs in emerging markets to do business and perform transactions as they never could before — and as Loewenstein points out, it enables “tightwads” to spend money they otherwise wouldn’t to their own detriment — the application of frictionless transactions in developed markets has had the greater effect of inducing unnecessary spending — with potentially aggravated effects on the most vulnerable. Studies have shown that people who are poorer or less financially secure experience a higher pain of payment, an unsurprising finding. However, if the payment is increasingly disaggregated and obfuscated online, then financially strapped consumers are at greater risk of dangerous spending without transparency, immediacy, and the psychological defenses these transactional characteristics trigger.

Source: MarketWatch

In light of commercial success fueled by these tactics, the question becomes: will companies care to change? Policy interventions would certainly help in reining predatory practices designed to segregate the pain points of payments from purchases themselves. So would increasing public demand for accountability. Payment salience does encourage customer loyalty and connection to products, offering incentives for companies themselves to change. But at this point, customers and businesses alike are mostly silent on the downsides of frictionless spending.

This isn’t surprising considering the mechanisms that digital companies employ to reduce the pain of paying and facilitate more spending isn’t so clearly at odds with the wishes of customers; after all, seamless transactions and the hedonic benefits they provide is what people want. Yet the potentially devastating long-term effects on individuals’ financial well-being nonetheless will be felt as trillions of dollars in consumer debt escalates. Amazon all but perfected the seamless transaction in its path to global domination, and yet, despite making commerce more painless and accessible than ever, it is arguably the most hated company in the world. There is a difference between making things easier for customers and actually caring about their outcomes. No company aspires to be Amazon, but many aspire to emulate it. From a pure dollars and cents standpoint, that aspiration is obvious. But from a social good standpoint, the devil’s in the details — and when it comes to payment mechanisms, details mean everything.

Image courtesy of Cardmapr.nl

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Blockchain’s Emerging Opportunities in Emerging Markets

The Final Frontier of Content Streaming: Emerging Markets