Bridging the Digital Divide: A DRC Deep Dive

~10 min read

The global pandemic has accelerated digitization — particularly in the way the world transacts. But despite the boost in digital inclusivity this entails in emerging markets, we are also witnessing the gap between those benefiting from digital services and those who cannot remaining large — and in certain contexts it is widening. What will it take to bridge the digital divide? To unpack and unravel the digital, social and physical infrastructure layers needed to fertilize the digital seeds growing through the cracks of traditional banking systems, this week’s Insight dives into the heart of Africa’s awakening digital giant: the Democratic Republic of the Congo.

Between Covered and Connected

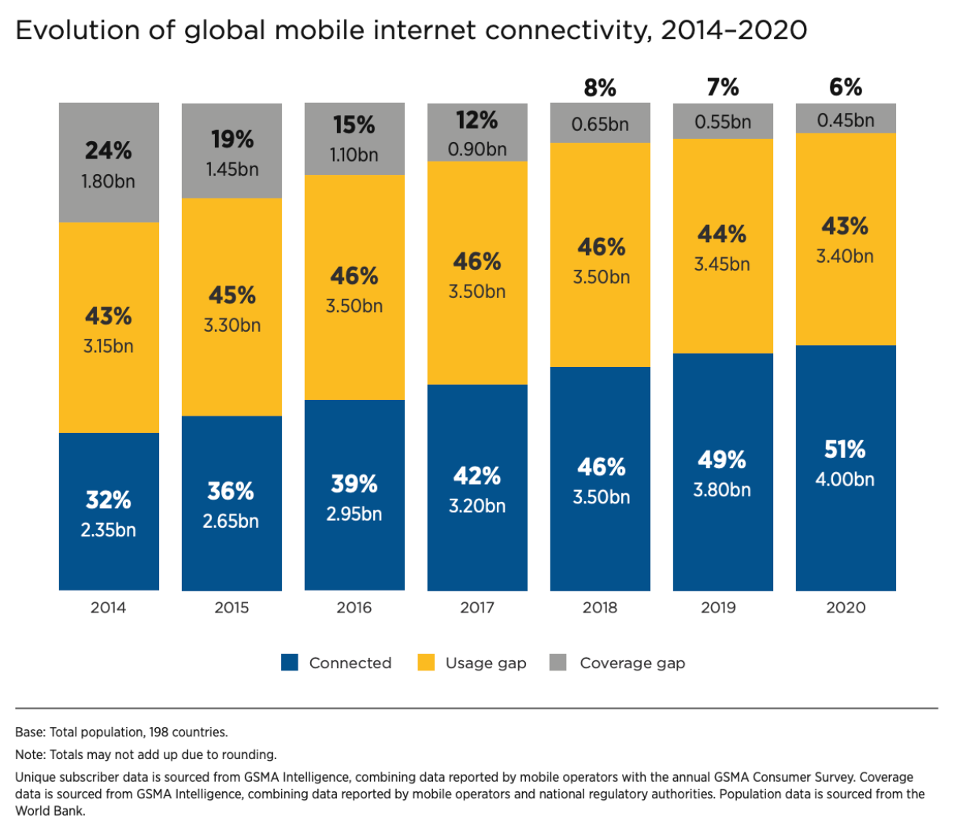

According to the GSMA’s State of Mobile Internet Connectivity 2021, almost a quarter of the world’s population did not have mobile broadband coverage in 2014. Flash forward to the end of the decade, and that figure dropped to less than six percent. This represents a significant achievement and further evidence that we are entering a new phase in human history where the entire planet’s population is digitally connected to one another via the 1s and 0s that make digital modernity possible.

But two problems present themselves from this seemingly good news. As access widens, those whom it has not yet reached become all the more disadvantaged relative to their more fortunate peers. The spaces and peoples which are yet to be reached are already among the poorest, most remote, or most marginalized, and the status quo of incrementally increasing coverage along a logic of the “next-most” profitable village to connect means that the worst off remain last in line for the global fruits of digital inclusion.

Secondly, between coverage and usage yawns the chasm of uptake and adoption — which has remained stubbornly fixed at an average of nearly 45% of the world’s population, or around 3.5 billion people, year after year.

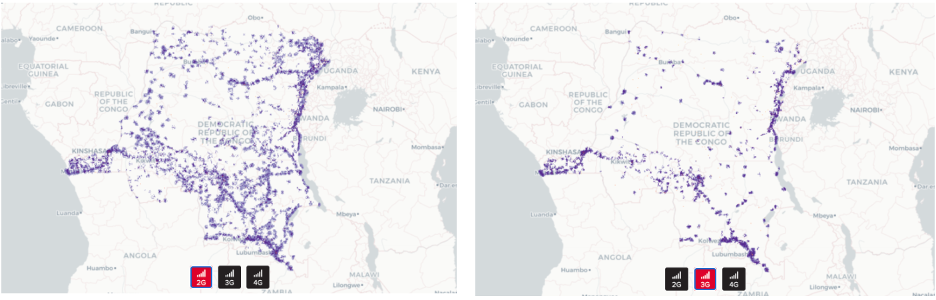

Source: GSMA 2021

These trends are most worrisome on the African continent. Though 2G and 3G networks have radically expanded over the past decade (reaching 90%, according to the GSMA in 2018), only 70% were covered by a 3G network and 34% by a 4G network. These are critical steps along the ladder of digital modernity, as they translate to access to next-level digital services beyond the basics of USSD-enabled mobile money and into the realm of FinTech, AgTech, HealthTech, EdTech, and all the “Techs” that so often constitute the frontlines of the UN’s 17 Sustainable Development Goals.

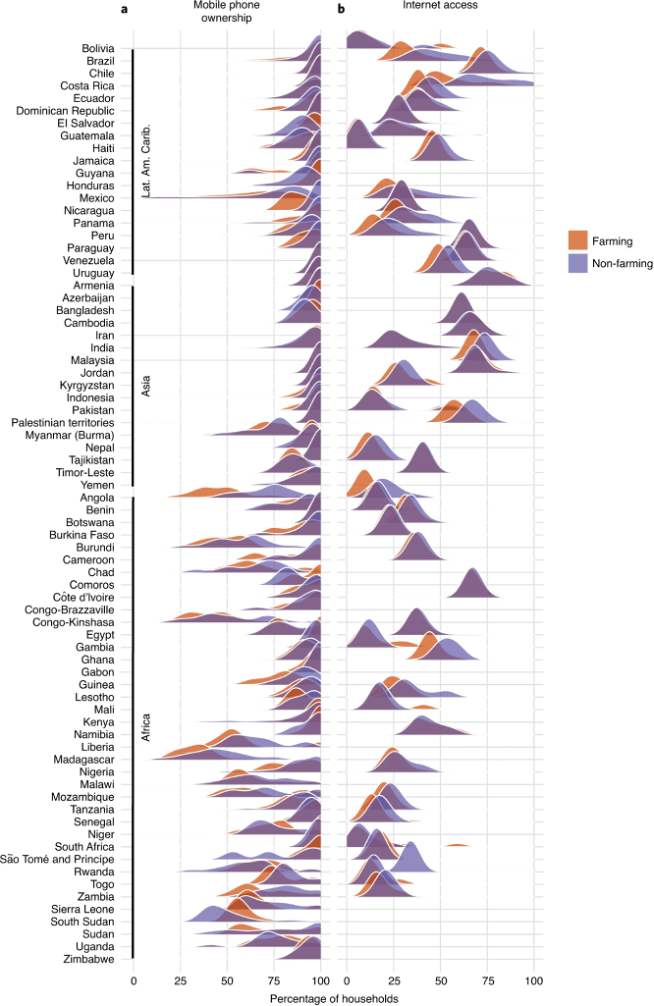

Indeed, a recent journal article in Nature Sustainability on the global divide in data-driven farming highlights the cross-cutting importance of digital inclusivity to achieve broader growth objectives, as well as the uneven rates of access and usage of the digital services that unlock them. The analysis highlights differences in household ownership of the mobile handsets, which represent the first step to modern connectivity for much of the developing world. Although ownership of mobile phones by many households, whether engaging in subsistence farming or other economic activity, is at or close to 100% in much of Asia and Latin America, countries in Africa like Angola, Madagascar, Burundi, and the Democratic Republic of the Congo (DRC) show averages for mobile phone ownership (of any kind of device) of roughly 30-50%. The analysis, conducted at a subnational level, reveals an even more dire situation with respect to Internet usage among a similar cast of characters on the continent.

Source: Nature Sustainability (2021) The global divide in data-driven farming

The authors highlight several strategies for closing the digital divide, including, among others, a need for innovations in three critical areas of “last-mile” infrastructure: energy supply, cell tower design and backhaul technologies, which organize the ‘interconnection’ points between a distribution network and the global connectivity infrastructure, principally through satellite connections or undersea cables. They also advocate for cheaper handsets (like smartphones under $100), innovative mechanisms for making data cheaper and interim solutions like those based on existing, low-bandwidth solutions, such as SMS advisory services.

Such a list of solutions is helpful to frame the scope of the challenge, but it can quickly become overwhelming when taken all at once. After all, investments are not made in the abstract but are rooted in the specificities of a given market’s opportunities and challenges — and the DRC is a prime example.

Diving into the DRC

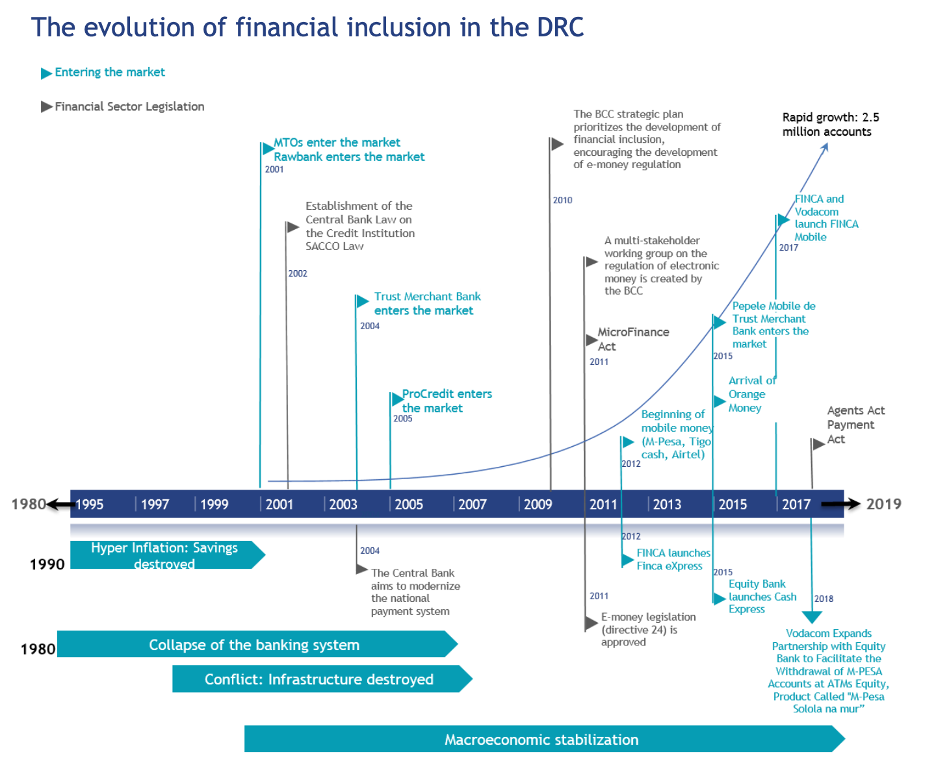

The Democratic Republic of the Congo (DRC) is among the largest countries on the African continent, both by landmass and by population. It is estimated that just 14% of the Congolese (here, referring to the population residing in the DRC/Congo-Kinshasa, not neighboring Republic of the Congo-Brazzaville) have an actual bank account, driven by a systematic collapse of the formal banking sector in the 1980s and 1990s brought on by a combination of hyperinflation, corruption and the destruction of the country’s telecom infrastructure amidst several decades of political instability and conflict.

In the aftermath, conditions have been ripe for telecom operators to leap ahead of banks in becoming the dominant force in increasing financial inclusion, with mobile money subscriptions growing 20% annually over the last decade.

Source: Microsave (2018) State of the Agent Network, DRC

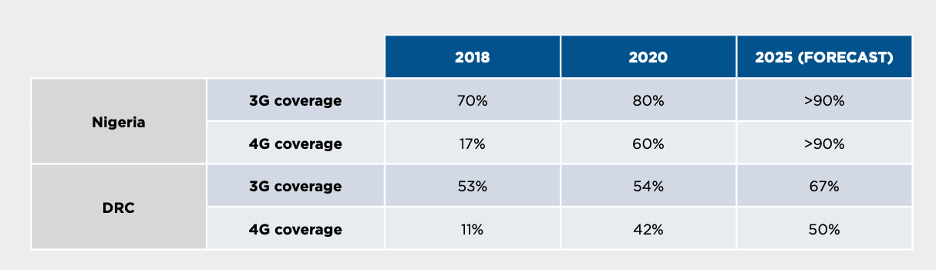

If these parallels immediately invite comparisons to another African giant — Nigeria — they are quickly tempered by the enormous gap that separates them in the digital arena:

Source: GSMA 2021

Indeed, whereas Nigeria captures the lion’s share of investment capital for tech companies on the continent year after year, the DRC’s digital finance ecosystem is practically brand-new; a 2018 report by Microsave and MasterCard identified only 12 fintechs in the whole country of over 80 million. And yet the three dominant telecom companies — Vodacom Congo, Orange RDC and Bharti Airtel — collectively represent a reported 35-40 million subscribers. These are not small numbers, and with the relative stability that has followed the country’s first democratic election in 2018 (its first since independence in 1960), digital seeds have already begun to race for the sun through the cracks of the old system.

Eastern Spotlight

The city of Goma, separated by some 1,000+ miles of dense Central African forest from the federal capital of Kinshasa on the west coast of the continent, is illustrative of at once the promises and challenges of bridging the digital divide in emerging markets. Approximately 70% of the world’s cobalt is mined in the eastern and southern provinces of the DRC — a critical material that, when combined with other metals like nickel and lithium, give the batteries in cell phones, laptops, and electric vehicles their stability and charging capacity.

The mineral represents a huge part of the national export account, despite the fact that it is largely mined by informal miners, known as creuseurs, who tunnel for the ore dozens of meters into the ground without proper equipment or safety precautions. It is one of the great paradoxes of the modern era that the physical manifestation of digital modernity — sleek cell phones — rests upon the hellish working conditions of Congolese miners (often children) who often must seek a mountaintop just to access 2G cell phone coverage.

Source: GSMA Mobile Coverage Webtool: 2G vs 3G coverage in DRC

Faysal Axam is the CEO of Faysal Company, one of Goma’s premiere fintechs. His company offers a “Tap and Pay” solution — a magnetic card that interacts with POS machines and interfaces with a virtual wallet. Initially rebuffed by banks for partnerships, Faysal sought to partner with the local mobile network operators, but here, too, traction was lacking, and it took almost a year and a half for Faysal to get their first mobile money integration license in 2020. Since then, Faysal’s customer base has grown to exceed 3,500 in the local provinces — a small number, but significant nonetheless in a country where the majority of the population lives on less than $2 a day. This inflection point came after a successful partnership with Orange, which across Francophone Africa is aiming to attract and incubate fintechs into its ecosystem. Axam attributes the success of local uptake to the fact that his solution is able to function even in areas where Internet connectivity is entirely absent. This functionality is enabled through a machine learning technique that complements the Orange API, which then transmits the codes and passwords that enable users to interact with the server and with one another even without an Internet connection.

“Once we started gaining traction and meeting other startups at events in Kigali, in Egypt…it was almost like a relief, to see that the same solutions they are building there, we are also building here…in some ways we are even ahead. The difference is that in Goma, we lack access to finance and investors. The security context is just a very serious challenge. It makes it harder for investors to trust, and there are many excellent solutions who can’t get continental or international exposure because of this.”

Faysal Axam, CEO and Founder of Faysal Company

These kinds of local innovations are critical to thriving in such a challenging operating environment. A former mobile money superagent for Orange describes the particularities of the business model in these provinces.

“Because the security situation is so poor in this region, merchants outside urban centers have a serious problem getting cash to and from the banks. Our role as superagents was thus to convert liquid into virtual in the city and travel to the villages with funds in our phone wallets. We would then exchange the virtual currency for cash at rural shops and businesses, who themselves don’t want to have to travel into the city with cash.”

Former Orange Money Superagent

The key here, however, is to keep the local cash local, leveraging the fact that since 2013 the government has increasingly shifted towards virtual payments for the more than 280,000 civil servants — nurses, teachers, etc. — which alone constituted a nearly 4% bump in formal accounts in the country. The superagent then redistributes the cash collected from merchants to these local civil servants, recouping the value of cash in the digital salary paid out by the government. Finally, upon returning to the city, the superagent exchanges the virtual cash for liquid fiat once more, having made commission on each exchange.

Such local innovations are a concrete manifestation of what innovation at the last-mile looks like: a sort of circular economy between virtual and physical cash that uses the telecom network as an intermediary to redistribute cash in rural economies in a way that both allows it to keep recirculating while mitigating the life-threatening task of doing business in conflict-prone economies.

Growing Seeds

Mukandama sadi Sadiki is the head of Orange’s commercial division for the North Kivu region, of which Goma is the regional capital and business hub. He is bullish about the opportunities in Goma not just for fintech, but for all startups. From the initial success of integrating Faysal Company into the network — the first such API integration in the region — he anticipates there will be a radical expansion in the coming years.

“We have lots of complexity here, North Kivu in particular. We have challenges in agriculture, health, problems related to all areas of life, but the youth in particular are converting challenges into opportunity. If something doesn’t exist, young people are trying to tackle the problem with Internet-based solutions…we’ll have many startups coming out from the dark to light up Africa soon. And not in the next 10 years, but tomorrow, today.”

Mukandama sadi Sadik, Responsable Commercial Orange Money, North Kivu

Both he and Faysal are excited about the potential for digitizing payment systems for local transport, with plans currently underway to replicate other African countries’ successes through such low-hanging fruit. They both agree, however, that a promising future can only come about with a better infrastructural coverage.

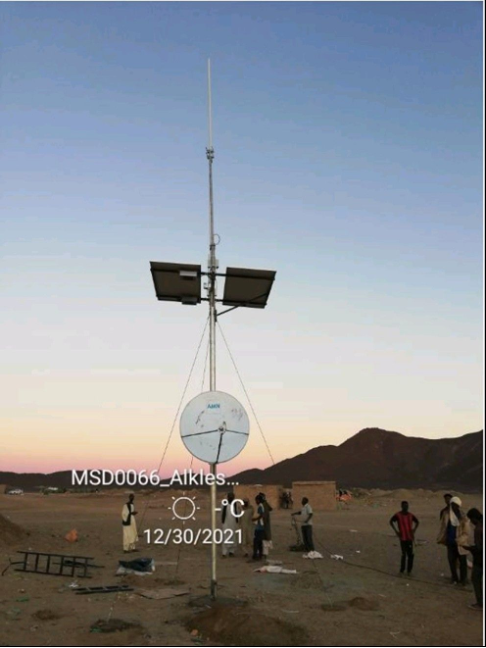

“Orange spends a lot of money to connect a rural community, and in our context, it is a risk. But we are looking to innovate, as there are now smaller systems available — [like] a single pole with a parabolic antenna for low-cost satellite connection powered by solar. We are piloting this technology for 2G at 100 sites with partners in the region to help us reach our 2025 target of 95% coverage.”

Mukandama sadi Sadik, Responsable Commercial Orange Money, North Kivu

Source: AfricaMobileNetworks

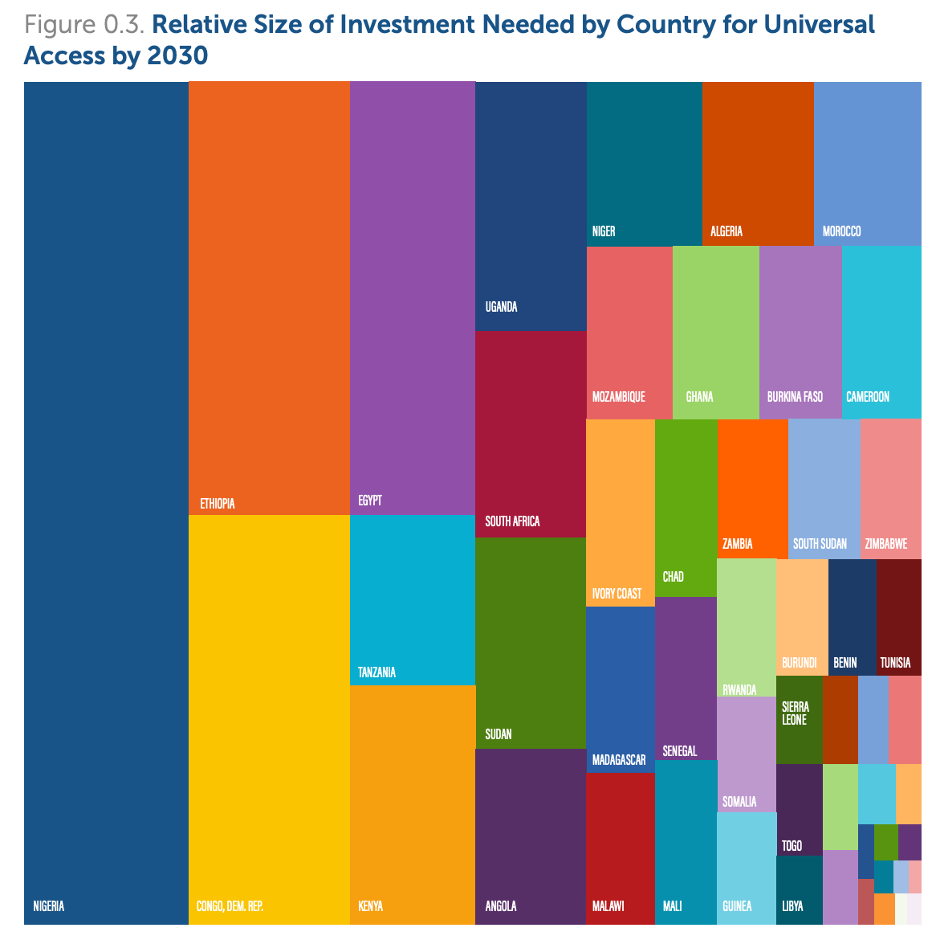

This is perhaps where the rubber meets the road: for all the talk of innovation and local adaptation, the clearest solutions simply require a lot of finance. The Alliance for Affordable Internet and Broadband Commission for Sustainable Development for example, estimates that up to $450 billion will be needed to bring universal, global coverage by the end of the decade, with more than $100 billion of this needed for Africa alone.

Pandemic Winter to Digital Spring?

Such technological innovation reflects the needs expressed both in academic literature and startups on the ground: to bridge the chasm between access and usage, improvements in coverage are a first step. The infrastructures powering these services are only one slice of the digital layers needed for a fertile top-soil to yield a dense and thriving ecosystem, but there are certainly no lack of seeds beginning to take root: startups like Flash, Okapi and MyExcellentCard, alongside incubators and remittance fintechs in the DRC, are beginning to thrive and take their place among their African peers as interest in the sector grows in the traditionally laggard francophone African markets as in their anglophone analogs.

These innovations are radically needed before the pandemic-fueled digitization momentum subsides. Recent research from the US-based National Bureau of Economic Research combining data from 250,000 individuals in 140 countries confirms what we already know: younger, better-off and employed individuals are able to switch from traditional to digital banking more easily during pandemic conditions. The authors highlight, however, that “these effects are larger for individuals in subnational regions with better ex ante 3G signal coverage, highlighting the role of the digital divide in adaptation to new technologies necessitated by adverse external shocks.”

In the DRC, as in other emerging markets where the digital divide between covered and connected persists, it is becoming increasingly clear that if we are to leverage pandemic momentum to foster a more inclusive digital modernity, it is cold, hard cash spent that is needed, not the least of which in poles, wires, panels and dishes: the material backbone of the digital layer from which the seeds lain by local innovators may spring.

Image courtesy of CIDRAP

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Instant Payments: A Key To Financial Inclusion?

Live Commerce: Is Culture A Deal-Breaker?