Not All Fintechs Will Weather The Current Shock — And That’s A Good Thing

~9 min read

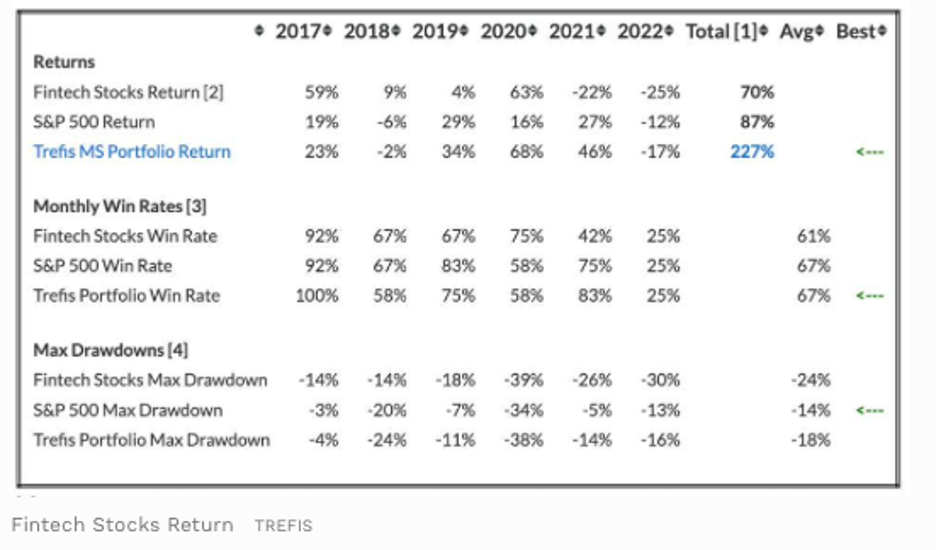

Fintech may be among the worst-hit sectors amidst the recent market downturn, but that says nothing of the sector’s long-term potential. The dot com crash 20 years ago served as a necessary course correction from rampant speculation — driven by then-low interest rates and flush liquidity (sounds familiar?) — on any company with a name ending in .com. The giants to emerge from the rubble, like Amazon, went on to define the transformation ushered in by web 1.0. As digital technologies continue to penetrate, specialize and mature on the cusp of web 3.0, we are witnessing a similar process taking place: already, trillions of dollars in stock value has been wiped out this year, as the Nasdaq is mired in a bear market. This market downturn, coupled with a stubbornly high-inflation environment and suddenly rising interest rates, presents newfound challenges that fintech has never really had to face before. Yet the shift in investor focus from (unfounded) growth potential to profitability will serve as a harsh yet necessary push to better align business models with customer needs and improve investment strategies. If the dot com crash presaged Internet supremacy, the current challenges are a harsh prerequisite for a transformed digital economy to come.

Separating Panic From Discernment

For any talk of long-term gain, the short-term pain cannot be discounted. Inflation has been high across the world, yet the U.S. faced 8.5% in inflation in March, the highest in 40 years, falling just slightly to 8.3% last month. Central banks around the world have scrambled to raise interest rates, shattering the seemingly pristine investment environment that fueled eye-popping funding rounds and valuations last year.

As Mondato Insight discussed last year, a course correction in investor activity was a long time coming even before the recent Ukraine-influenced supply chain shocks and market tumble. The previous glut of job openings has given way to significant layoffs; more than 15,000 lost their jobs in tech in May alone, and the list of recently downsizing companies include a who’s who of erstwhile tech darlings: PayPal, Klarna, Bolt, Bitso, Robinhood, Lemonade, to name a few. Indeed, even industry leaders with proven, sustainable business models, like Amazon and PayPal, have seen their stocks drop — plunging 33% and 70%, respectively — amid disappointing quarterly revenues.

But such dramatic selloffs portend more to wider selloffs than a direct indictment of such companies’ business models and portfolio; even as the pandemic’s acceleration of online shopping wanes, Amazon continues to see its and highly profitable AWS expand, for instance. Yet if negative fiscal and economic environments put more pressure on company balance sheets, it only increases the necessity for companies to substantiate returns after years of burning through investor cash.

Investors have dramatically pulled back amidst the sudden uncertainty. In Q1 2022, VCs invested $70.7 billion in U.S.-based companies, a 35% decline from the previous quarter, and fintech saw an 18% drop in funding in that timespan.

Some of the more aggressive institutional investors from last year have receded as they lick their wounds. Udayan Goyal, Managing Partner at Apis Partners, described to Mondato Insight last year sitting on the sidelines as such investors overbid real market value. Six months later, Goyal describes the sudden liquidity constraints as offering opportunities for well-valued investments not present before. Nonetheless, Apis is advising its portfolio companies to have sufficient contingent capital to weather the downturn, expecting the slump to only deepen before they improve over the next 18 months.

The investor shift from valuing potential growth to profitability is necessary if fintech is to make a deeper push into mainstream acceptance and competition. Already, the process is underway as companies with flashy ideas, yet uncertain business models are weeded out.

“There have been a number of what I would consider unsound models that have risen with the rising tide. And obviously now we're seeing that getting corrected.”

Udayan Goyal, Managing Partner, Apis Partners

Separating Pretenders From Contenders

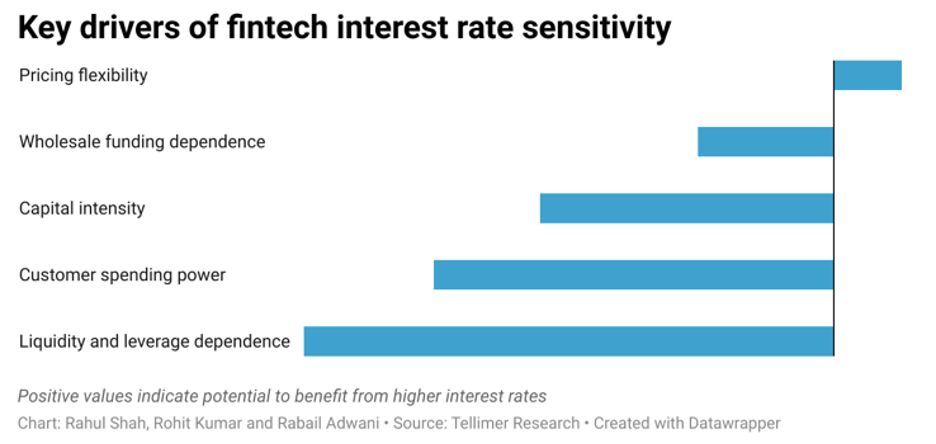

Beyond the souring investment climate, the evolving fiscal conditions will challenge fintechs only accustomed to a high liquidity, low-interest rate environment. Yet the companies and sectors to emerge from the carnage will have proven themselves resilient even when the going gets tough.

Already, we have seen some spectacular crash and burns, the most notable of which was Fast, whose one-click checkout solution saw $120 million in investment, only for it to close shop after burning through cash while struggling to distinguish itself from competitors like PayPal and Shopify. Few of the hardest-hit companies and subsectors come as much of a surprise. Lacking in sound business models or clear evidence of profitability, it can feel like the emperor has finally been revealed to have no clothes (or sufficient revenue streams).

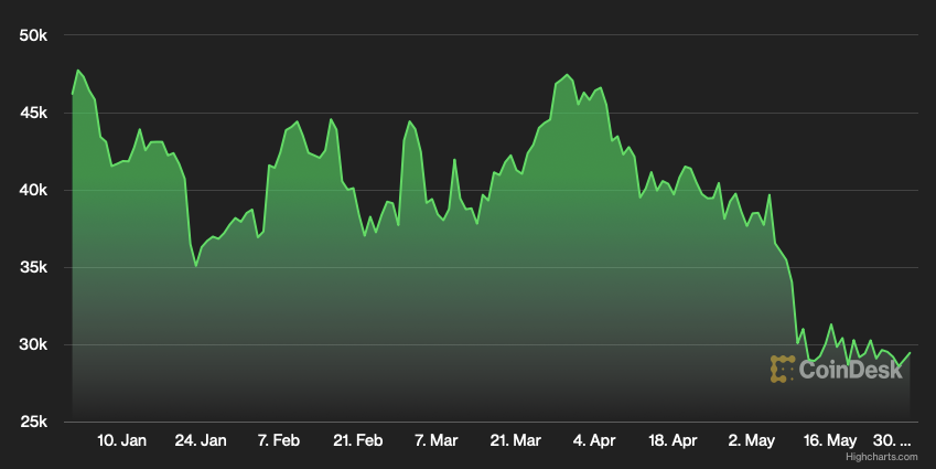

The shock to cryptocurrencies, of course, has grabbed the most headlines, as the unceasing hype machine — driven more so by high-profile celebrity endorsements rather than actual mainstream usage — has been revealed for what it is: business models driven by speculation more than actual utility for consumers. This is not the first time Bitcoin has plunged, but as Antonio Fatas, Professor of Economics at INSEAD, put it, this is the first time the crypto dip has persisted for so long after a plunge — significant considering crypto’s previously hyped utility as an inflation hedge. Institutional investors hadn’t been so deeply involved in cryptocurrencies as they had in earlier slumps, and their confidence may be irretrievably shaken. Supposedly “stablecoins” no longer feel so stable following Terra's crash. After this plunge, the dent in investor confidence can only be reversed by tangible reform and progress in the crypto space.

Source: Bitcoin valuation, 2022; Source: CoinDesk

“I don't think people are going to come back and say, of course, that's going to work in the future. I think people now want to hear a story, which is a little bit more solid, more convincing. They're not just going to accept a one-liner that says the future of money is in crypto. I don't think that's going to work anymore. I think you need to develop a proposition that is a lot better than that.”

Antonio Fatas, Professor of Economics, INSEAD

The search for a viable business model has also extended to the polarizing Buy Now Pay Later (BNPL) arena. On the one hand, there have been reports of BNPL companies seeing an influx of customers as their pocketbooks shrink and individuals seek to avoid credit with interest. Yet at the same time, the typical BNPL business model — no interest and largely no customer fees, with earnings accrued primarily through fees generated from the merchants themselves — relies on a plentiful retail environment to manage a high-wire balance sheet act.

By and large, BNPL companies have little price flexibility in this business proposition if they wish to maintain an advantage over traditional lenders; efforts to incorporate higher interest rates or customer fees would likely spell disaster. From Goyal’s perspective, BNPL firms will have to either find a partner and get bigger or be subsumed by a larger lender, which has already started to happen in cases like Afterpay and Sezzle.

“I would say BNPL companies, broadly, do not have a sustainable profit model. They're really going to struggle in this rising interest environment, as they're going to face both higher cost of capital and, obviously, in a deteriorating macro situation, greater credit losses — so they're going to get hit twice.”

Udayan Goyal, Managing Partner, Apis Partners

Neobanks Put To The Test

The transformed terrain that fintechs must now operate in presents a necessary challenge to the viability of fintechs borne out of low-interest environments that sought to compete with traditional providers through low or zero fees. Some investors, like Goyal, are cool on neobanks, as very few neobanks have managed to turn a profit up to this point. A more direct focus on sustainable revenue models over merely accruing customers may inch digital banks closer to traditional banks, who on the flip side are catching up in areas like digitization.

“A lot of these digital banks were too narrow to make money: I'll help you do digital payments. Okay, where are you going to collect your fees? So a lot of these digital banks are becoming broader so that they start resembling more regular banks. Can they survive? Of course they can if they are good at what they do. At some point, the bank will make money either through fees or through differences in interest rates between the loans that they gave and the deposits that they paid for it.”

Antonio Fatas, Professor of Economics, INSEAD

Neobanks can no longer burn through cash without immediate revenue streams, and this will likely encourage them to expand their offerings to services with wider profit margins. Alexander Weber, Chief Growth Officer of German digital bank N26, which was most recently valued at $9 billion, says the lean digital operations of the bank has cushioned it from some of the dangers of the market onslaught, and by not relying on external funding, they are not adversely affected by increasing refinancing costs as other neobanks may be. Its offerings of more traditional banking activities like lending will serve N26 and its customer base of over 7 million well, according to Weber.

“Having built and scaled a successful business model as a bank in a time of negative interest rates means that given the lower cost structure and alternative revenues streams that are not dependent on interest rates, N26 is well prepared for an economic downturn. While we anticipate consumer spending to decline slightly, we anticipate this potential decline in revenues to be overcompensated by higher returns on the treasury and lending side.”

Alexander Weber, Chief Growth Officer, N26

While Weber expressed confidence in N26’s prospects, the tighter funding climate may prove a challenge to the unicorn that, in the most recently released figures from 2020, was still operating at a loss of €151 million, in spite of impressive consumer and margin growth.

As traditional banks benefit from the rise in interest rates and the additional revenue they will reap from net interest margin earnings, it will be incumbent on digital banks to distinguish the value they provide to customers. Australia-based Volt Bank, for instance, is at a far earlier stage than N26, as it only received its full licence to operate as an authorised deposit-taking institution (ADI) in 2019.Yet Nigel Bradshaw, Group Treasurer at Volt Bank, believes the company is prepared for the higher costs associated with higher inflation and wage increases, running a leaner digital operation than traditional financial institutions. Bradshaw also sees Volt’s Banking-as-a-Service (BaaS) offering as well-suited for the oncoming environment focusing on customer value and tailored solutions.

“Our BaaS business model generates non-interest fee income for us as our partners pay to provide banking products for them. If customers are spending less, this may be because they are looking to reduce costs or to save more, making Volt’s offering even more important in helping them achieve their financial goals.”

Nigel Bradshaw, Group Treasurer, Volt Bank

Cream Always Rises

While neobanks face uncertainty and sectors like crypto and BNPL contend with significant fiscal headwinds, the sudden prove-it mentality is a necessary step for fintech to transcend the hype machine — and there is still plenty of proven, present value in fintech propositions. Apis’s Goyal is now looking at companies that have proven their niche.

“I use the example of OakNorth — they use more automated structured lending to SMEs. Companies like that will continue to grow, whilst those that haven't found a profitable growth model will be consolidated. In this environment, you need to find a way to grow profitably with positive unit economics.”

Udayan Goyal, Managing Partner, Apis Partners

In their investment strategies, Apis is focusing on the subsectors offering salient solutions for clear problems and market inefficiencies, viewing positively subsectors such as personal finance, open banking, regtech, AI, machine learning, health tech and supply chain finance. Yet even in the case of sectors facing significant headwinds, like real estate, Goyal sees value in the companies that are transforming real estate sector to remove costs; automation is a safe bet regardless of the vertical.

This market downturn, after all, is taking place before digital financial services have even reached full market penetration, let alone maturation. This bodes well for areas like digital plumbing and digital payments, which again provide a clear benefit to customers yet have still significant potential for growth.

“When I look at the payment revolution that we've seen in many countries, and we still have yet to see in many other countries — real time payments, mobile payments at almost zero cost or zero cost for users, for merchants… that is a massive improvement in technology that has a value that shows up in the hands of the consumer immediately. That type of innovation will continue, and I can see side technologies that will link into these new payment systems.”

Antonio Fatas, Professor of Economics, INSEAD

Indeed, the more challenging fiscal and economic environment doesn’t fundamentally change the long-term trajectory for fintech and its innovative components. Less investment may be pouring into blockchain-based technologies and related Web3 projects than before, and adoption timelines may become more reasonable, but the potential solutions they may offer still appeal to crypto-averse investors like Apis’s Goyal, who values the transformative potential of Web3 solutions in the works. Many fintech solutions may be entering the trough of disillusionment along the hype cycle, yet a more critical eye towards proposed solutions will subsequently strengthen the sector and companies that prove themselves to be a solution for customers rather than a solution for investors.

Image courtesy of Sean Robertson

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Will Informal Savings Groups Survive Inflation?

Can e-Health Scale in Africa?