Fintech’s Funding Bonanza: A Bubble Or Warranted?

~10 min read

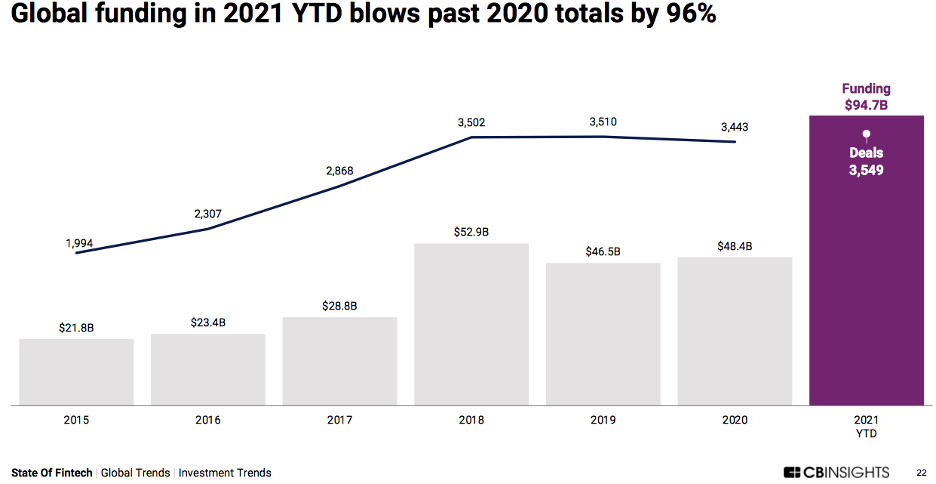

Funding and valuations have skyrocketed across tech sectors, yet arguably none stands out more than fintech. One in every five dollars from venture capitalists has gone to fintech this year. According to the latest CB Insight report, in the first nine months of 2021, global funding in fintech already reached $94.7 billion, nearly double 2020’s total of $48.8 billion. Across the board, at all stages and across regions, valuations are often in multiples of two, three or more what investors would have seen 18 months ago. Unicorns — originally coined as such because of the supposed rarity of a $1 billion+ valuation — are now being made nearly every day, with the 101 new fintech unicorns through Q3 this year nearly equaling the number of fintech unicorns in the market overall just a year before. Valuations dozens of times more than revenue are becoming increasingly the norm, not the eye-popping exception (though eyes most certainly still pop). The unprecedented funding environment begs the question: is this a bubble? Or are these jaw-dropping valuations and funding rounds commensurate to current and expected growth in fintech markets? As Charlie Boles, senior associate on Speedinvest’s fintech team, puts it, “it’s equal parts insane and rational all at once.”

Nobody has a crystal ball, and the unleashing of capital across the board at inflated valuations will surely yield quite a few investment duds. Yet certain factors unique to fintech suggest that while particular warnings signs are surely ahead — and with some correction likely in order — the digital transformation fintech is overseeing may very well validate some of the previously unthinkable funding rounds taking place.

Show Me The Money

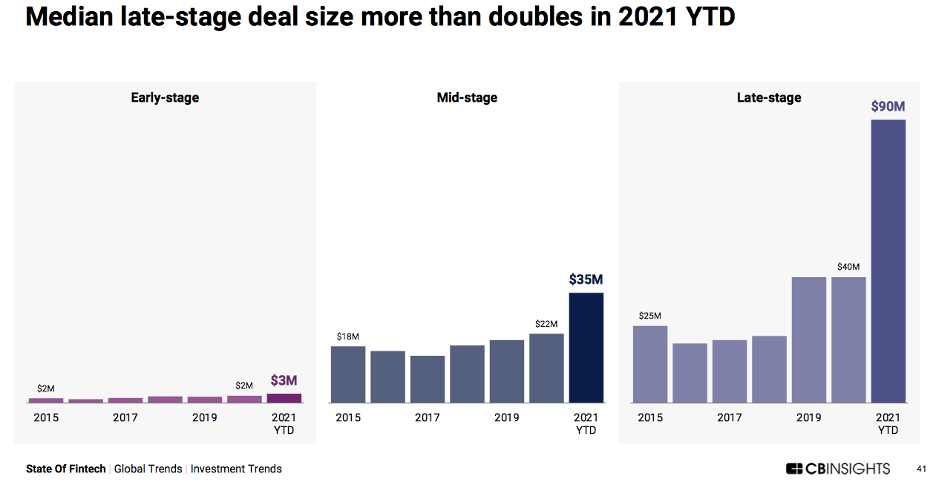

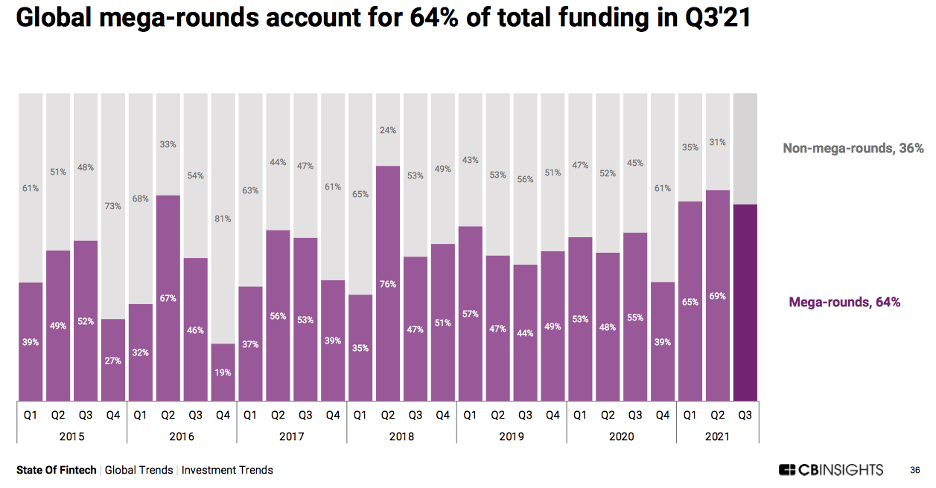

When peering into CB Insights’ latest Q3 2021 fintech report, the figures can be staggering across the board. The average global deal size has increased 78% this year from $18 million to $32 million, escalations that are seen in early, mid, and late-stage deals, which haven’t seen much change in their respective portion of deals overall. $100+ million “megadeals” have more than doubled already compared to last year, and the impressive figures are present spanning all sub-verticals, including banking, payments, lending and insurtech.

Why this is happening is the result of broader market patterns, yet it’s also supported by fintech-specific and region-specific factors contributing to these boom times. Along with low interest rates, U.S. stimulus funding — combined with pandemic savings and the democratization of investment through apps like Robinhood — has contributed to the broader hot market, with venture capitalists possessing $300 billion in overhang looking for a home, according to Udayan Goyal, co-founder and managing partner of Apis Partners.

A greater argument can be made for a wider asset bubble subsequently being created from the feverish investment activity — and as Goyal points out, a greater asset bubble burst elsewhere will likely permeate to fintech markets — yet investors believe that fintech’s tremendous growth during the pandemic is a harbinger for the digital transformation of financial services underway and to come. Mark Beeston, founder and managing partner of the fintech VC Illuminate Financial, founded the company in 2014 when he saw the beginning of a fundamental rearchitecting of the infrastructure of financial services, instigated before the pandemic by post-Great Recession factors including “unprecedented industry deleveraging [and] massive multijurisdictional regulation, turning a whole industry into a zero-tolerance compliance environment.” In his own words, “the existing stack is no longer fit for purpose.”

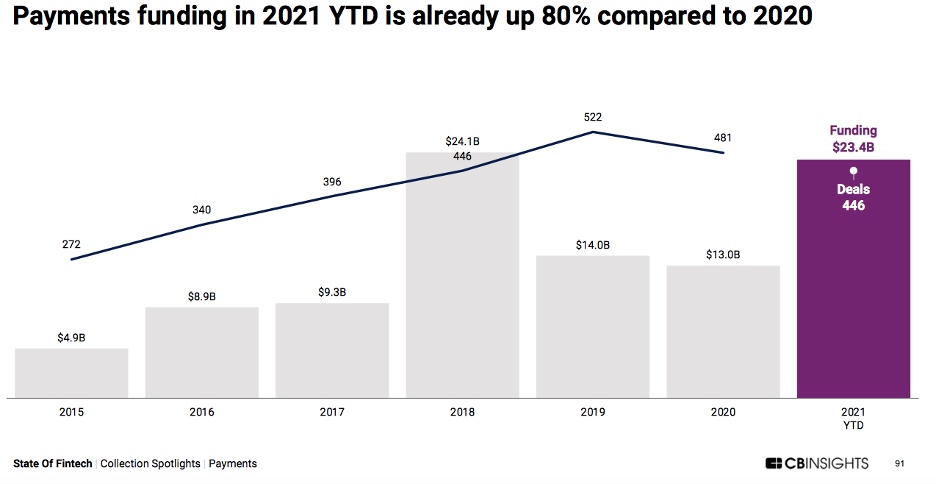

The much-discussed acceleration of fintech adoption during the pandemic is robust and sustainable, investors believe, as brick and mortar financial services give way to digital services across markets and demographics, including older populations that may otherwise have been hesitant to make the switch — rendering once-unthinkable valuations as the norm. Goyal cited low-code platform Appian as an example of a company whose sky-high valuations he initially viewed with shock — only for it to experience revenue growth of 44% in Q2 alone to prove the naysayers wrong. The maturation of digital financial ecosystems reinforce the respective subverticals, and this is most evidenced through the growth of digital payments, according to Goyal.

“Payments are a multiplier. If you have any ecommerce, any economy requires a payment player. So if ecommerce is tripling, payments are at least tripling, if not significantly greater because you have operational leverage and financial leverage in payments because they tend to be fixed cost platforms. So you can see how there’s so much growth coming in as a result of let’s say just ecommerce growth.”

Udayan Goyal, Co-Founder and Managing Partner, Apis Partners

If fintech has been anticipating a transformation of the financial services stack, then the significant growth of fintech companies during the pandemic is a signal for many that that moment is truly arriving. In this competitive, FOMO investment environment, investors are clearly betting on it.

“I think there’s a combination of factors that says we are on the precipice of another step change in productivity and technological change. If that’s true, those valuations are not only entirely justified, but look cheap. If that’s not true, then we are in for another dotcom bust.”

Charlie Boles, Senior Associate, Speedinvest

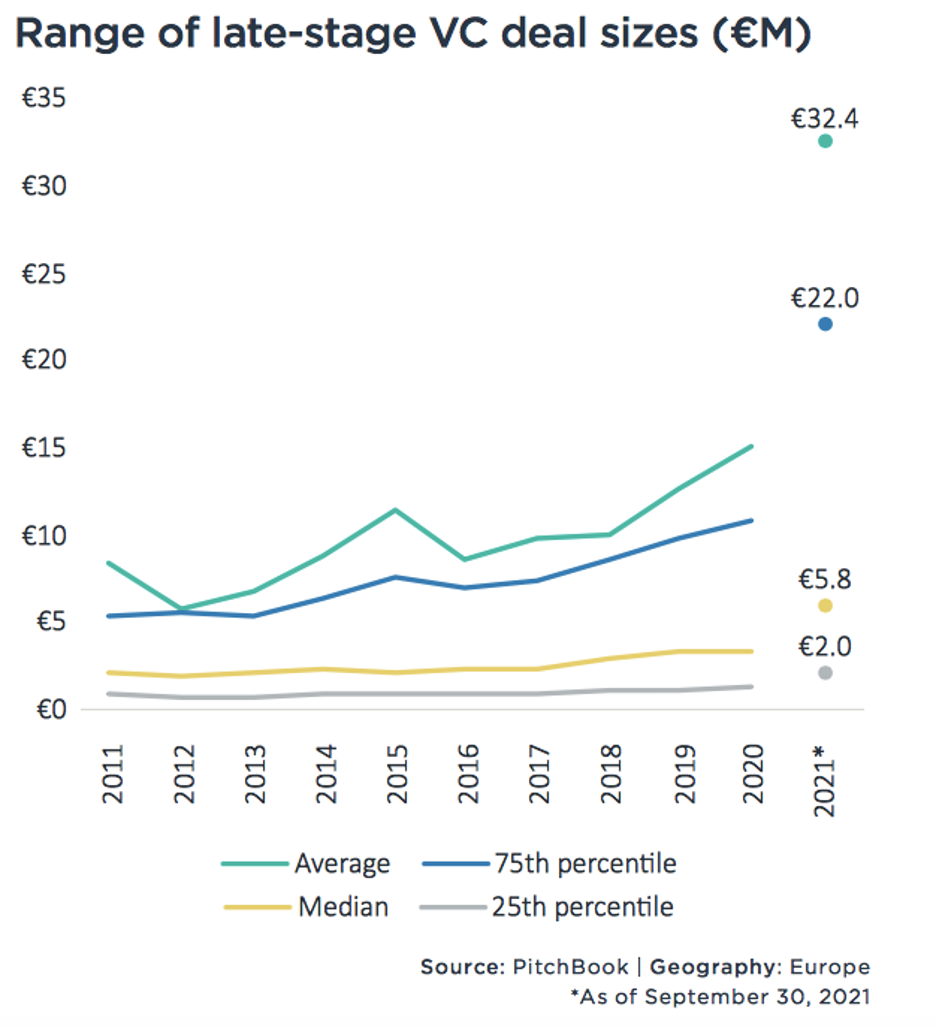

So which one is it? All respective markets possess unique factors that would suggest the conditions are ripe for such a step change. In the U.S., the aforementioned stimulus funding and low interest rates encouraged investment this year, yet as Illuminate Financial’s Beeston puts it, developed markets are still digitizing financial services to replace decades of legacy infrastructure. Combined with the rapid acceleration during COVID, this has led to the U.S. seeing half of the newly minted unicorns in the past year, according to CB Insights. In Europe, which is experiencing particularly elevated investment levels, investors believe not only that the digitization of deal-making has levelled the playing field, facilitating more U.S. investors into foreign markets, but that the European market has reached a level of maturation for the sector to truly take off. Though more scattered talent might have slowed the European market’s development compared to the U.S., Speedinvest’s Boles believes that process has finally come to fruition.

“It’s classic ecosystem maturation – one great startup becomes a larger tech company, and all of the heads of products and VPs leave that big tech company like a Google or Facebook to start their own company now. That cycle of startup ecosystems has happened a couple of times now across the major European cities. There’s just more talent that has been through the process before in Europe than there ever has been.”

Charlie Boles, Senior Associate, Speedinvest

With that maturation has come grander European ambitions, as flagship companies like Klarna expand to a global stage.

While developed markets are replacing legacy infrastructures, emerging markets are tapping into the unrealized market potential among the millions of unbanked customers, creating digitized financial infrastructures where there was no infrastructure before. This, combined with the maturation of ecosystems, has enabled unprecedented funding to pour into regions like Africa, as Mondato Insight discussed earlier this year. From the perspective of Goyal, whose Apis Partners has long focused on emerging markets, the multi-billion-dollar valuation of companies like Egypt’s Fawry and Nigeria’s Interswitch are justified considering the growth they are experiencing combined with their long, established track record and swaths of market share yet to be realized. With its untapped potential, investors across the globe are seeing emerging markets as the next great frontier, with capital flowing from Silicon Valley into emerging markets like never before.

Bigger Players, Bigger Pies

The pandemic’s push towards digitalization and remote due diligence and deal-making has, in essence, levelled the funding playing field. Remote due diligence, combined with the fast-paced investment environment, has transformed, and compressed the investment process. While investors lament the lack of in-person vetting of company leadership and company operations, the shift to digitalizing all operations has enabled more comprehensive insights into an operation for investors while making the process more efficient, according to Speedinvest’s Boles. Combined with the competitive investment environment, this has led to investment pushes before formal funding rounds manifest.

“Our overall investment strategy has not changed at all during the pandemic. Instead, what has changed is our investment process. We’ve been engaging with companies at earlier stages, well ahead of their formal fundraising rounds. This helps to pre-qualify investment opportunities before the official start of fundraising, thus enabling us to make investment decisions faster.”

Patrick Meisberger, Co-Founder and Managing Partner, CommerzVentures

However, the dominance of mega-VCs like Sequoia and Tiger Capital have in many instances spurred elevated funding rounds, leading smaller VCs to sit on the sidelines or be followers in funding rounds when they previously would have led. At Illuminate Financial, which specializes in B2B fintech and takes a generally more considered approach, its main competition has fundamentally changed during this time.

“If four years ago you asked where the competition is coming from, I would have said our largest competition is actually the tax-incentivized high net worth sector that overvalues [B2B] deals. On some of those we just walk away because we say, ‘okay, that just doesn’t make sense for the business stage or what we think the time commitment is’ from a more institutional investor. So I don’t think the end result has changed that much but I think sometimes who we see driving the deal has changed.”

Mark Beeston, Founder and Managing Partner, Illuminate Financial

The geographic dispersion of deal-making from major U.S. VCs have caused a domino effect, with Apis’ Goyal noting how his emerging markets-focused firm, which has three potential deals in the pipeline, is more of a seller right now, as several of its companies have exited the market during the pandemic.

More than ever, investment firms are spreading their investments around more liberally, banking on the idea that all it takes is one or two in their portfolio to become a category leader. This isn’t new; Goyal cited a study that showed how 65% of VC deals from 2004 to 2013 failed to return its investment, with only 4% yielding substantial returns — a disproportion that Goyal sees as sustainable nonetheless considering the success of category leaders. Yet in the current climate, this aggressive behavior by large VCs creates inflated values out of institutional necessity, crowding out more specialized VCs like Apis. These larger VCs are less sensitive to the size of the check they’re deploying.

“If you’re a company that was going to raise 10 million at a 90-million-dollar pre and somebody comes in and says, ‘I can’t deploy 10 million dollars, that is too small, I can deploy 20 million dollars at a 180 [million] valuation,’ the dilution is the same. That’s a very extreme example, but that is the kind of thing that is happening. They are playing more on if this thing is a 10xer, then my 20 [million] becomes 200 [million]. But I am happy to put it in the 65% of the portfolio that doesn’t return me anything because I am playing the numbers game.”

Udayan Goyal, Co-Founder and Managing Partner, Apis Partners

These inflated values may render more spectacular crash and burns in the long run, but considering the strong fundamentals in the fintech market, it may be better to view such changes as less of a bubble being formed than a wild crapshoot of a burgeoning sector bursting into the mainstream — with some winners and many losers to follow on a company level.

Boom Or Bust

The feverish market activity has indicated a broad shift towards private over public markets, with many wondering what becomes of this glut of highly valued companies in the private market – will exits keep up with these high valuations under way? Once upon a time, a $46 billion company like Klarna would have already exited into the public market, but it has reached its preeminent market status without having to do so — along with the regulatory and disclosure requirements going public would impose. In the public markets, there is subsequently a demand overhang and a supply shortfall.

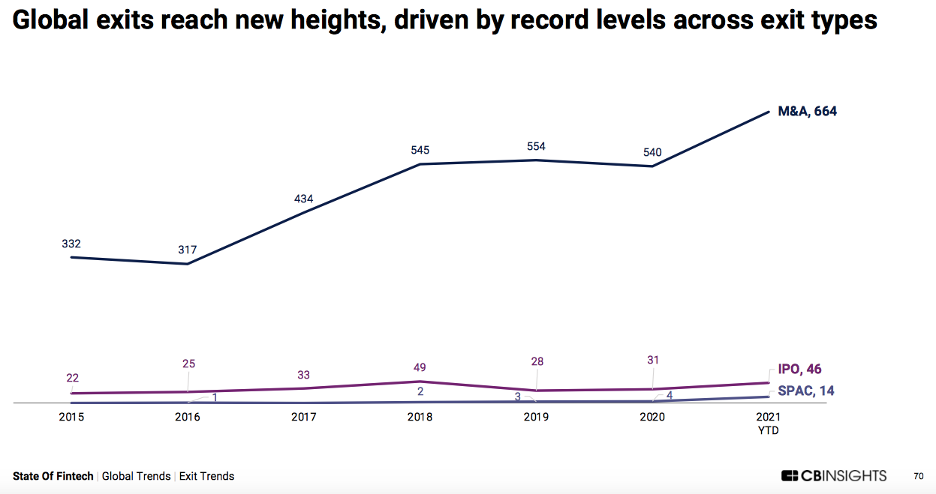

Even with these underlying factors, 2021 has been a record-setting year for exits — 724 through Q3, compared to 575 in all of last year — with median exit valuations tripling. But there are recent signs of this cooling, with nearly a dozen IPOs postponed or withdrawn in recent weeks as public investors hesitate to invest in highly valued yet low-profit companies. Most recently, Indian payments firm Paytm’s entrance into the public market resulted in a 27% plunge in market value in its first day of trading, wiping $5 billion off its value. Such activities are leading some to wonder whether fintech indeed really is in a bubble — and whether the bubble will soon burst.

Broader macroeconomic factors contributing to the funding boom, like the low interest rates and pandemic savings, already have or likely will abate at some point soon, especially with inflation wracking markets. Investors do expect a market correction to happen at some point, and the broader asset bubbles may very well be a contagion impacting fintech markets as well. Before founding the company, Illuminate Financial’s Beeston was a former fixed income derivatives trader, and he does see some parallels to 1999, considering the sheer market activity, competition and shorter horizon returns. But he also notes how fundamentally, fintech is better positioned for extended expansion in the coming years as digital transformation accelerates in expanding and developed markets alike.

“Do I think this is the new normal for valuations? No, I do not. Do I think there is a huge amount of value to be created in this space because institutional finance is a very long way from a public cloud-driven future state, which it needs to get to? 100%. So somewhere in the middle lies the truth.”

Mark Beeston, Founder and Managing Partner, Illuminate Financial

Nobody truly knows how well investors are adapting to this evolved landscape, and they likely won’t for a few years. Many of the valuations the market is seeing are undeniably optimistic and reliant on future growth that may never come. Many, if not most, investments will go bust. But does that render the market a bubble? A bubble implies valuations are unjustified and are more speculative in nature than grounded in reality. The reality is that fintech companies are experiencing impressive revenue growth, and the speculation is this will only continue further. Such speculation may prove foolhardy as favorable macroeconomic conditions regress and wider asset bubbles burst. As the world — through fits and starts — slowly exits an unprecedented, market-shuttering pandemic, there is no playbook to envision what comes out of this rapid digital financial transformation underway. Yet it might be wiser to view individual companies and valuations as more bubble-like than the entire fintech market itself. The future of financial services is technology-based, and prophesied unicorns gone bust won’t stop these inertial forces. A market correction may be in order at some point, but that doesn’t mean the gains in fintech revenue and consumer adoption are illusory. They’re real — and they’re spectacular.

Image courtesy of Marc Sendra Martorell

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Blockchain-Based Payments in Kenya: A Square Peg in a Round Hole?

Can Digitization Reduce Mass Migration From The Northern Triangle?