PropTech: A Forever Home For Fintech

~9 min read

As the quintessential legacy system stretching back in some parts hundreds or even thousands of years, the property industry has its origins in very analog times. Though facing tremendous hurdles in digitization, fragmentation, legacy interests, and data opacity, PropTech — a broad category of technologies developed for the property industry to better manage, analyze and transact assets — has seen a proliferation of solutions targeting investors, brokers, property managers, and renters alike. And while a comprehensive digital-first rebuild of real estate remains elusive, innovators are picking off and rethinking pieces of the property value chain – with modernized financial services and FinTech powering much of the disruption.

FinTech Comes Home

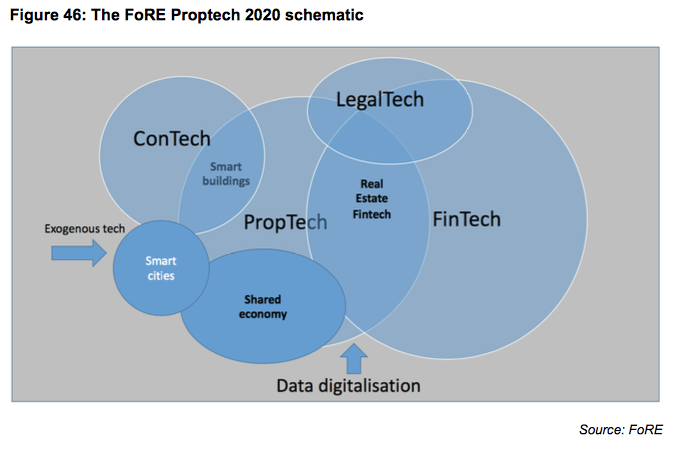

PropTech encompasses multiple areas and can be an amorphous term — does it include Construction Tech (ConTech) or not? — but it is seen as an umbrella term for three technological movements that are increasingly intertwined: smart buildings, which are technology-based platforms facilitating the operation and management of real estate assets; the shared economy, which entails technology-based platforms facilitating the use of real estate assets; and real estate FinTech, which facilitates the transactions of real estate assets. An incredibly young industry — in one MetaProp survey, only 13% of PropTech companies were more than five years old — PropTech began in earnest in the 1980s with simple advances like the personal computer and digital spreadsheets. But a tech industry focused on real estate solutions really only commenced this millennium with the advent of online residential marketplaces, like Rightmove in the UK, and Trulia and Zillow in the U.S., around fifteen years ago.

At that juncture — and to a certain degree today — real estate documents were still being digitized. The entire real estate transaction chain was horribly fragmented among its various traditional niches — agents, brokers, insurance companies, service sellers, etc.— with the underlying financial data largely kept out of public view. Such inefficient, opaque systems render real estate a frustratingly illiquid asset in terms of speed of sale, probability of sale, and costs associated with that sale. Fraud and agent bias can pose issues during the drawn out buying/selling process which incurs paperwork and numerous fees from the fragmented chain of service providers.

Partnering with agents and owners, online residential brokers transformed the consumer research experience by creating standardized marketplaces for homes. Most critically, these online marketplaces provided a foundation for data-derived innovations powering real estate FinTech innovations today. In recent years, advancements in machine learning and artificial intelligence have allowed for predictive models of unlisted home prices by scraping publicly listed information online, fostering deeper transparency to the opaque industry through automated valuation models (AVMs).

Such innovations have firmly placed big data and data analytics at the forefront of PropTech’s acceleration. And within real estate more broadly, commercial real estate is particularly fragmented and opaque, with automated valuation models still catching up. However, big data firms like Reonomy are partnering with institutions across the commercial real estate spectrum to better inform transactions and management of assets and property. Aggregating alternative data from numerous sources, Reonomy provides a standardized data structure which the commercial real estate industry has glaringly lacked, and it utilizes a vast partner network to unearth and string together critical property data. During the pandemic, such data and analytical models have remained essential for companies managing assets through uncertainty. So while funding overall has fallen in the short term, big data has accelerated in adoption — with accompanying tech solutions as well.

“For a while, there were a lot of people evangelizing technology as imbuing our systems or companies with the right tools to get ahead, but it was just a lot of chatter, not implementation. Now, we are at the phase where there is that kind of mass market adoption in play.”

Aviva Fink, VP of Business Development, Reonomy

Through partnerships and alternative collection methods similar to FinTech’s tactics in other data-obscure markets, waves of data have enabled increasingly sophisticated solutions to tackle liquidity and transparency in real estate. Online listing sites like Zillow, a late so-called “PropTech 1.0” firm that came to dominate the U.S. market, act as an accessory to the work of legacy agents and brokers. But the industry faced outright disruption when iBuyers entered the market in the past few years, compelling leading broker Zillow to enter the iBuyer space as well.

iBuyers leverage big data and AI to fuel AVMs, which enable them to both list and buy properties. iBuyers like Opendoor and Offerpad buy homes and resell them after a minor refurbishment, also charging a service fee of around 7% of property value. These outlets have embraced AI and VR to enable unaccompanied or virtual house tours — elements which unsurprisingly have accelerated during the pandemic. Incorporating LegalTech such as smart contracts, these iBuyers cut out many analog middlemen from the arduous transaction chain, with AVMs democratizing information and eliminating fees for buyers and sellers alike. FinTech solutions are being applied to renting as well, with perhaps the most prominent example being Rentberry, which connects tenants with landlords and facilitates price negotiation.

Buy The Dip

When the COVID-19 pandemic hit, iBuyers struggled as inventory plummeted. Many temporarily closed up shop. But in the months since, the iBuyer market has come roaring back, with demand “higher than ever,” as the pandemic — and its underlying uncertainty — has granted an opening to tech schemes able to capitalize on distressed customers’ financial positions and streamline the process through digital means.

Flyhomes, for example, is a real estate brokerage and tech company that helps prospective homebuyers. When a customer finds a suitable home, Flyhomes fronts cash for the transaction — due to speed and certainty of transaction, cash buyers tend to receive steep discounts — and sells it back to them at the same price (plus an industry standard real estate broker fee). Possessing a mortgage branch as well, Flyhomes assists homeowners looking to upsize or downsize. As Flyhomes CEO Tushar Garg explained, by simplifying the real estate transaction process (and digitizing it where possible), the company has enjoyed an increase in demand during the pandemic as work, school, entertainment, shopping, and even exercise have relocated to the confines of home.

“A big part of the issues underlying the homebuying experience was the tremendous uncertainty throughout the process. Sellers, when they take an offer, they should be able to move on from their lives, and the buyers should be able to get long-term financing and be able to close at exactly the same day. The process was fundamentally broken, and we saw that every day. The premium in trust was placed higher. So in my mind, we were built for times like this.”

Tushar Garg, CEO and Co-Founder of Flyhomes

Garg noted a correlation between the pandemic and stay-at-home orders on one hand, and growing public willingness to accomplish more of the homebuying experience online on the other. While in the past Flyhomes did on-boarding meetings in person, the company found that in 2020 customers typically preferred on-board meetings through Zoom. The remaining in-person sticking point seems to be in-house tours, and even then, there are cases of homes sold 100% virtually. The pandemic has led companies to expand options and allow prospective buyers to enjoy unaccompanied viewings utilizing geolocation technology to grant them remote access — an application from the Smart Buildings sector of PropTech.

While real estate has traditionally been debt-driven — sometimes to devastating macro effect — some real estate FinTech solutions are inverting the traditional model towards a growth-driven equity or investment model. For homebuyers, equity loan providers offer cash to bridge deposit shortfalls in return for a minority equity position in a property. “Part own, part rental” startups like StrideUP, Unmortgate, and Heylo Housing offer private market-shared ownership products through which no debt is used and an aspiring homeowner can initially buy a small fraction of the property and rent the rest, with the prospect of buying the property in full in due time.

Such tech solutions have the ability to transform how people extract value from what is often their most valuable asset — their homes. Noah, for instance, is a consumer finance platform helping homeowners get liquidity for their home. As the California-based company views it, the U.S. has seen a generation of people who are asset-rich yet cash-poor. While the U.S. housing market sits on about $20 trillion in home equity, with home appreciation of 4-5% annually in the past ten years, wages have remained flat in that same time for most Americans. With this in mind, Noah enables people to access up to $350,000 in home equity — money which they can use to cover emergency expenses, pay off debts, or start a business. In return, Noah gets a fractional stake in the borrower's home. This can save customers hundreds of dollars every month in interest that would otherwise go to lenders. This expands options for financially distressed homeowners without burdening them with further debt, potentially leading to a healthier personal balance sheet, a lower debt to income ratio, and improved credit scores, according to Noah co-founder Sahil Gupta. While traditional lenders focus on individuals’ FICO scores and debt-to-income ratio, Noah cares solely about the asset itself and its potential to appreciate over time. This model of fractional ownership is still in early stages of adoption, but it’s picking up steam amidst current economic uncertainty.

“We wish to introduce the idea that you can leverage equity in a meaningful manner to improve housing affordability, access. We believe that can have a meaningful impact not just on homeowners but on the ability of people to buy homes and much more importantly make the housing market that much more liquid.”

Sahil Gupta, Co-Founder of Noah

Waiting For The Grail

Public awareness and understanding will come with time, but the industry still needs to mature both competitively and technologically speaking. The market is beginning to see consolidation, with VCs shifting their attention away from seed investments towards Series A, B, and C rounds, and ever-richer data is being unified among networks. But real estate tech must still build on a very analog, fragmented system. As Softbank Investment Director Justin Wilson said commented, the holy grail of the industry would be “an end-to-end software solution covering the full spectrum of everything that an investor or operator would need,” touching upon areas of geospatial intelligence, ConTech, leasing and asset management, investment and lending. While many tech providers are expanding their offerings to cover multiple facets of the real estate process, a fully streamlined process remains far off.

“Buying a home is not just through a brokerage. Mortgage, title and escrow, home insurance, home sellers’ services, you could add a whole bunch of verticals to it – you certainly have specialized services doing a really great job, but for the most part, having to go to like 60 different services is really hard for the customers. For customers, a big part is customer service and relations, the products themselves, and technology experience. We find that every [company] offers a different technology experience, different customer service levels. And customers really struggle with that.”

Tushar Garg, CEO of Flyhomes

Operational barriers to unification and mass adoption remain considerable. New systems must continue to integrate with existing legacy systems; one survey found about half of commercial real estate executives still use spreadsheets as their primary financial tool. Such bottlenecks, along with a lack of collaboration among real estate companies, hinders the progress made by big data aggregators fueling AI and machine learning. As the industry grows and develops, legal questions must also be clarified; smart contracts, which automate the movement of funds, data and agreements utilizing blockchain technology, do not yet actually have legal status in PropTech’s Western epicenter, the U.S.

Blockchain in real estate FinTech is representative of just how immature the space remains — yet how tantalizing the possibilities can be. So far, blockchain solutions have been limited primarily to the use of smart contracts. True blockchain provides five critical elements: distribution, encryption, immutability, tokenization and decentralization. Such elements would pave the way for a hypothetical “real estate singularity,” but even before the technological progress or regulatory regimes requisite to that vision are attained, data sets need to be unified and standardized across the board. Today, even digitization of documents remains a challenge. But initial steps are underway. Though in their infancy, tokenization schemes are being hatched, allowing properties to be split into smaller pieces as blockchain-based tokens. Contracts, assets, service agreements — all of these can be rapidly verified, transferred and completed in a blockchain-based solution. In March 2019, participants from a consortium of organizations took just 36 minutes from start to finish to complete the first blockchain-based real estate transaction - lightning-quick compared to the weeks or months of a traditional transaction. Mass adoption of such applications is, optimistically speaking, several years away — but a strong case can be made that Fintech-enabled real estate solutions will, if adopted, enable unprecedented liquidity, eliminate service and agent fees, and streamline contracts.

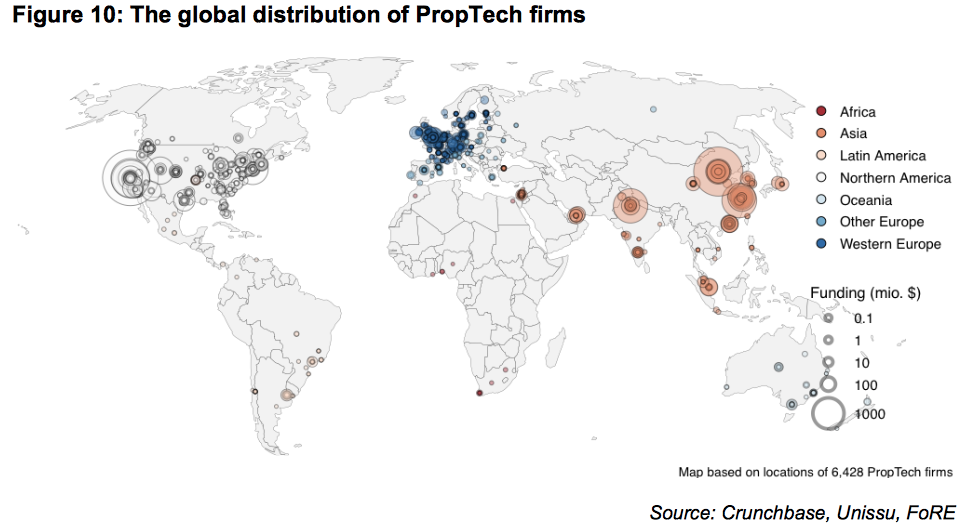

Although issues stemming from fragmentation and legacy institutions must be sorted out, the PropTech industry and its FinTech components will continue to mature and evolve as public awareness grows and the propagation of IoT, Smart Homes and 5G enable unprecedented data-derived insights. The technological solutions penetrating the market often originate in very specific and separate use cases. But with data as the foundation tying together these disparate branches of the PropTech world, the tech ecosystems are weaving themselves together in patchwork form. As an industry evolving alongside technology progressing at an exponential rate, how we think of real estate transactions and property in general will look radically different in the not-too-distant future. Transforming an industry that encompasses more than half of the world’s mainstream assets to yield economic efficiencies and dramatically improved transaction speeds will mean big money. In fact, it already does at the investment level; since 2017, real estate technology has spawned more unicorns than any other single industry sector in venture capital. And that's before most PropTech solutions have even approached mass adoption. Despite the hurdles in the way, PropTech solutions may ultimately prove the most lucrative of all fields borne of FinTech principles - and one with the potential to transform an essential aspect of life for billions across the globe.

Image courtesy of Namra Desai

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Travel Rewards: A Currency Out Of Context

Data Is The New Dogma: Monetize And Thrive