Travel And Fintech: Where Challenge Meets Flush Opportunity

~8 min read

As travel deals with a myriad of cancellations this year and, until very recently, sky-high prices, the industry is now embracing fintech and other tech capabilities as key components to catching the rebound, primarily by easing the convenience and flexibility of travel plans as well as reducing fees and unpredictable price spikes — the bane of any traveler’s existence. Yet it isn’t merely the digitization of travel payments that are revolutionizing travel as we know it. Fintechs and travel companies are beginning to offer a suite of products and services providing a facsimile of life as a global citizen with affordable access to similar financial products and ecosystems abroad, though still with its limits. The revolution underway isn’t simply about making the travel experience cheaper and more convenient — it’s enabling travelers to take their finances wherever they go.

Competition Driving Innovation

Even before the pandemic hit, the travel booking process was already arguably one of the most digitized retail sectors when it came to purchases. Yet the various stages of the pandemic also laid bare the inefficiencies, inconveniences and hidden fees riddling the travel industry. Subsequently, the instability of travel rules and prices created opportunities for innovative fintechs to meet customer needs while pushing the sector forward. Ben Walters, Head of Strategy and Business Development at Hopper Cloud, recalls how in 2020, while travel companies everywhere were getting slammed by cancellations, the travel fintech Hopper saw its fortunes blossom.

“The ability to freeze the price of flights, make tickets fully refundable, protect yourself against disruptions that are outside of your control — those products gave our customers a lot more confidence to go ahead and book. We were hit, yet revenue was actually growing.”

Ben Walters, Head of Strategy and Business Development, Hopper Cloud

As a travel fintech offering a variety of data- and AI-driven products, Hopper has now raised over $600 million in funding, with its valuation reaching $5 billion. According to Walters, Hopper is on pace to sell $4.5 billion in travel this year, which would be 4-5 times higher than last year and 30 times what Hopper’s revenue looked like in 2019. As a company offering both booking options for customers directly as well as — since last year — offering software services through Hopper Cloud to other travel brands, Hopper is simultaneously capitalizing on a wave of travel activity among customers and a pressing need for travel companies to upgrade their fintech-driven capabilities.

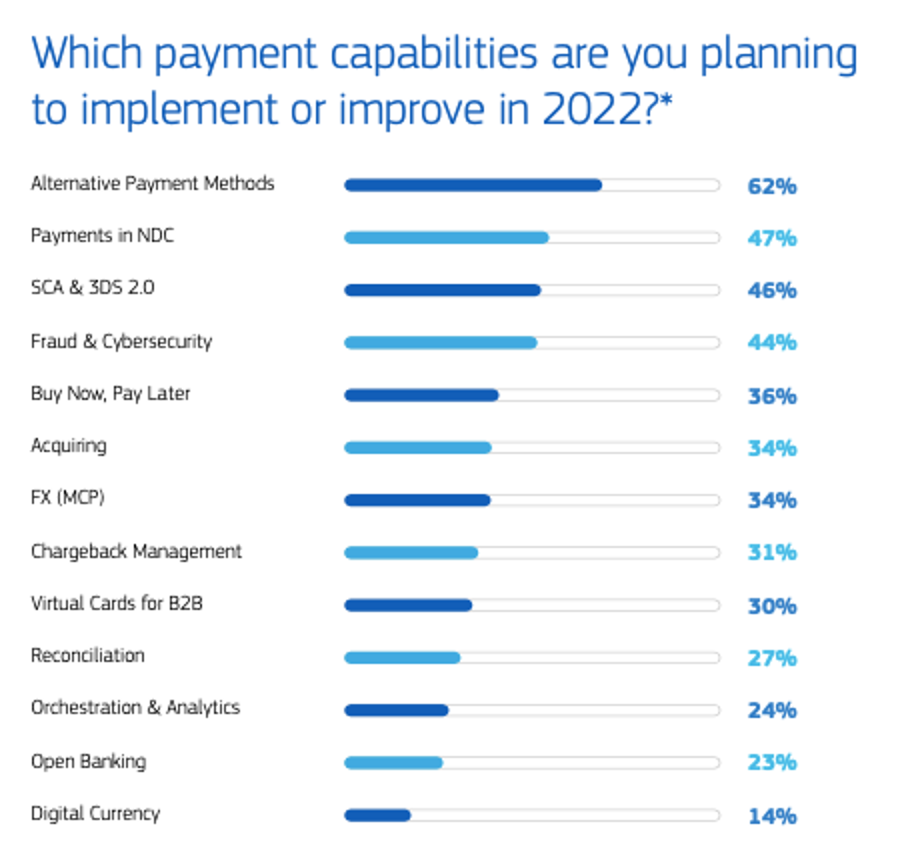

In a recent survey by Amadeus, a travel fintech software provider, of 70 senior leaders from airlines and travel sellers, 90% of company leaders said fintech and payments were a high priority in investment, with 70% taking an aggressive investment strategy to capture the travel rebound.

Source: Amadeus Travel Fintech Investment Trends 2022 Report

Travel is uniquely well-suited to the capabilities that fintech offers and the needs it provides solutions for. As a big-ticket item subject to cancellations and disruptions and that literally traverses borders and varieties of laws, currencies and exchange fees that come with it, customers require clarity, security, cheap rates, and personalized solutions from their travel providers. The nature of these transactions give way to the rapid adoption of products like Buy Now Pay Later (BNPL); an Amadeus survey found 49% of 5,000 people surveyed said they would be more likely to book travel ancillary services and 68% said they would spend more on their trip if BNPL was available. With travel companies mostly plugging these BNPL offerings through third-party specialist providers, Amadeus found more than a third of travel companies were implementing BNPL in 2022.

Beyond BNPL, travel-specific fintech products to accompany the typically $1.4 trillion travel industry offer immense opportunities; consider that Hopper customers spend 10% more when they book while utilizing a travel product, and half of Hopper’s customers purchase at least one fintech product along with their booking.

Hopper took on a considerable amount of risk relying on its rigorous AI-driven pricing models to offer appropriate protections and flexibility to its customers. Two years into pandemic-induced instabilities and cancellations, this gambit has paid off as revenue skyrockets for this investor darling, though the company has yet to break even in spite of billions of dollars now flowing in. Among its offerings include Price Freeze, in which Hopper allows customers to freeze the price of a travel purchase at any time, with Hopper covering the difference up to a set amount if prices increase afterward. The Price Freeze fee is dynamically priced between 3% and 15% of the original ticket cost, depending on the expected price increase, according to the AI’s calculation.

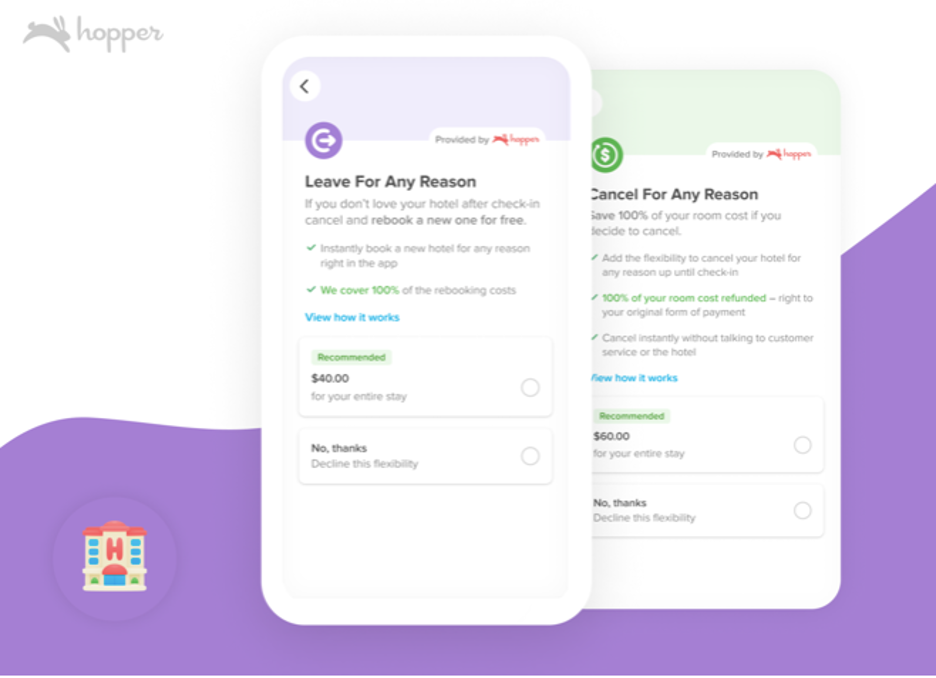

Such products fundamentally impact customer behavior, with Hopper customers utilizing Price Freeze ultimately booking 80% earlier than without such options. According to Walters, conversion rates increase by approximately 6% with the tool. Expanding its products to all sorts of travel, most recently short-term home rentals, Hopper’s product line seems tailor fit to the typical complaints from travelers, exemplified in their recently launched Leave For Any Reason product: for a fee, if a hotel does not meet the expectations or needs of any customer for any reason, they can rebook another same star hotel at no additional cost.

Yet Hopper’s most popular product lately when it comes to air travel is actually a Flight Disruption Guarantee: if a flight delay causes a customer to miss a connection or a flight is outright cancelled, customers can rebook any other flight to that destination immediately and at no further cost. Such an option has proven popular as customers realized in the past couple years that traditional travel insurance often fails to cover very much. The pandemic exposed serious shortcomings among traditional travel sellers, and customers are now eager for alternative solutions.

Source: Hopper

In its B2B business, Hopper’s products have subsequently proven popular among even legacy institutions. Though a competitor as a fellow travel booking site, Hopper has licensed its Price Freeze technology to companies like trip.com and makemytrip.com, with Hopper guaranteeing the price difference among their competitors. As a booking industry with relatively little customer loyalty — customers will utilize whatever service offers the best prices and accommodations — fintechs like Hopper are pushing even traditional institutions to keep pace.

“The travel industry is very competitive. Everyone is trying to grab the customers and get the relationship. The new innovative startups are creating essentially new experiences in the whole travel area. And that is what drives a lot of the fintech investment as a whole: you can't afford to be behind.”

David Doctor, Executive Vice President of Payments, Amadeus

One of the leading B2B services Amadeus offers is in regards to providing that connectivity of traditional institutions to these innovative, digital-based products. The emerging ecosystem is one in which incumbents and challengers are both partners and competitors.

“I always say it's an industry of frenemies: sometimes, you're working with people because they bring something to you. And sometimes you're competing with those people… The whole idea is that we can improve the whole experience through not only the technology, but also the ecosystem of partners and capability that we can deliver.”

David Doctor, Executive Vice President of Payments, Amadeus

Traversing (Financial) Borders

As the travel industry transforms into more of a tech-driven ecosystem increasingly unified for the sake of coopetition, the fintech elements are increasingly diminishing the boundaries — and additional or hidden costs — that comes with travel. One of the tools seeing the most rapid adoption is when it comes to providing multi-currency pricing, with a third of those surveyed by Amadeus implementing such options this year. With 76% of travelers reporting unexpected foreign exchange charges when purchasing flights, travel companies are seeking to include a wider array of currencies as payment options. And further, the kinds of payments differ greatly across regions — think credit cards in North America, AliPay in China, mobile money in Africa — and travel companies are seeking to incorporate as many of them as possible. While the piping work needed to incorporate so many options may be tedious — and for legacy companies, often requiring the likes of third-party software providers like Amadeus — travelers exhibit a clear preference (89% of those surveyed) to avoid FX fees and pay in their more easily understood local currency.

But if the premise of travel fintech encourages a “global customer” to transact and utilize products as if they were home, the end-to-end process of travelling needs to be considered in all its complexities and nuances. Malaysia’s Air Asia has grown from a low-budget airline to become an entire super app ecosystem unto itself, rebranded as Capital A. Under Capital A’s fintech arm, BigPay is a Southeast Asian fintech company providing accessible and secure digital financial services. BigPay offers a prepaid debit card, which can be used to spend anywhere Visa or Mastercard is accepted, along with personal loans, local and international money transfers, micro-insurance, bill payments and a budgeting tool.

For many of its customers, the main draw to BigPay is its card’s utility overseas. Functioning as a prepaid card, the BigPay card gives users the real exchange rates from Mastercard or Visa, helping users to save money when they transact in foreign currencies abroad or online.

Source: BigPay

Chris Manguera, Chief Marketing Officer of BigPay, notes how BigPay is often used by customers for domestic spending as well, with automatic savings programs available so travelers can save up for their next trip. Its latest feature, Stashes, allows users to organize and save money that is separate from the main BigPay spending wallet.

“There's no silver bullet that really addresses that ultimate value [proposition]. I think the way we design our proposition is always about the whole journey of travel. We build and stack the interconnectedness of our services to maximize the value. The goal is always to minimize worry and maximize value.”

Chris Manguera, Chief Marketing Officer, BigPay

BigPay also sees their card and super app ecosystem as a financial inclusion play by offering alternative financial services that the underserved and unserved may not be able to obtain from traditional players. In particular, its prepaid debit card offering, coupled with its rewards system, is turning on its head the typical “purchases for miles” credit card premise.

“When people travel with their credit cards, they usually get miles. For us, we wanted to give that same experience and access to everyday users who might not have access to a credit card. So we're really focused on improving and enhancing the point system, because we want to make it so every time they do their everyday spend with BigPay, they feel like they're saving up for their next travel.”

Chris Manguera, Chief Marketing Officer, BigPay

As part of a larger super app ecosystem oriented around travel, BigPay takes a radically different approach than most in the travel fintech segment. Amadeus’ Doctor expresses doubt that the super app model will take off in the travel segment; with financial services so fragmented across borders, the possibilities of truly cross-border, interoperable financial services are limited to the partners available, with layers and layers of licensing and agreements necessary within each country.

Though it plans to expand beyond Malaysia and Singapore into Thailand and the Philippines next, efforts by BigPay to make its services an everyday, domestic affair for its customers to complement travel does give this credence. Yet while more penetrative tech-enabled financial products may be limited internationally, the ability for multi-currency options while purchasing travel and specialized cards to utilize abroad signify a significant step in reducing the financial barriers of travel and borders. This isn’t without mentioning the surging popularity and investment by companies in biometric authentication, which promises to both secure against fraud and make the payment experience relatively frictionless.

The coopetition among travel fintechs and incumbents is pushing travel and fintech closer together in a symbiotic, embedded relationship. The refrain that all techs will be fintechs hold only truer when it comes to such a sector with big-ticket items, a lattice of rules and complications, and a savvy customer population always on the hunt for the next deal. Whether travel becomes an entry point into a broader fintech-oriented world – akin to BigPay — or fintech becomes a navigational tool to booking and managing travel — like a Hopper — is beside the point. Fintech obviously can be separate from travel, but in today’s post-COVID environment, travel can’t really be separate from fintech.

Image courtesy of Z

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Where Financial Inclusion and Climate Resilience Intersect

Cloud And FinTech: Security Gaps Emerge