Where Financial Inclusion and Climate Resilience Intersect

~9 min read

Despite contributing the least to greenhouse gas emissions, smallholder farmers and small-scale fishers are some of the most vulnerable to the effects of the climate crisis. Subsequently, many non-profits, governments and other organizations have made an effort to bolster climate resilience in these communities.

Climate fintechs that focus on financial inclusion through tools like embedded finance and digital payments could be instrumental in making climate resilience solutions more accessible to those most affected by the climate crisis. But can these fintechs sustain themselves long-term and create lasting change?

More public funding can bridge the gap and support climate fintechs before they reach sustainability, though with smarter, better-targeted investment strategies than what the sector has seen so far.

Challenges of the Niche

While a growing amount of fintechs are integrating financial inclusion with climate resilience efforts, the public funding apparatus has not always propped the best solutions emerging in the sector.

“A lot of these companies are being propped up by development funds or impact investments that are searching for proof of value and are struggling to do so. Low-income and vulnerable people will never be able to pay $1,000 even if it’s split into many monthly installments.”

Howard Miller - Research Director and Lead of Green Inclusive Finance, Center for Financial Inclusion at Accion

Pay-As-You-Go, or PayGo, solar technologies were introduced as a green solution to the challenge of bringing electricity to the millions of people globally who currently live off-grid. Yet many paygo solar companies in sub-Saharan Africa have failed to succeed as their clients struggle to afford the monthly payments, leaving many of them in debt and without electricity. According to Lighting Global, the average monthly repayment cost for solar-powered appliances in sub-Saharan Africa is $20-$75 — rendering them financially out of reach for many rural smallholders. When factoring in an affordability constraint, Lighting Global reported that the “serviceable” market in sub-Saharan Africa for solar-powered appliances (e.g., irrigation pumps, refrigeration) is $700 million — a sizeable number, but a far cry from the $11 billion estimate that ignores affordability constraints. Edoardo Totolo, the Vice President of Research and Programs at Accion’s CFI, does see an increasing number of fintechs incorporating embedded finance solutions like PayGo, and despite its drawbacks, it can still be successful in places that have the infrastructure to support it, like in East Africa, where the technology has seen some positive uptake.

According to Miller, another challenge many of these fintechs face is a failure to show good evidence of customer-level impact in areas the development sector is striving for, such as income, agricultural productivity, and nutrition. Along with shortcomings on the customer end, these fintechs are grappling with the lack of scale while occupying small niches by their nature; even with a good proof of concept, the difference they make in the grand scheme is negligible compared to the role of larger financial institutions. Partnerships with banks, insurance companies and international organizations, however, can give these smaller fintechs the platform they need to scale their innovations.

All these challenges — affordability, unpredictable risks, difficulty calculating impact and scalability — make fintechs that focus on financial inclusion and climate resilience seem like a dicey proposition. However, with the right support systems, partnerships and the direct acknowledgment of all aforementioned risks, succeeding in this niche is possible.

Bridging The Gap

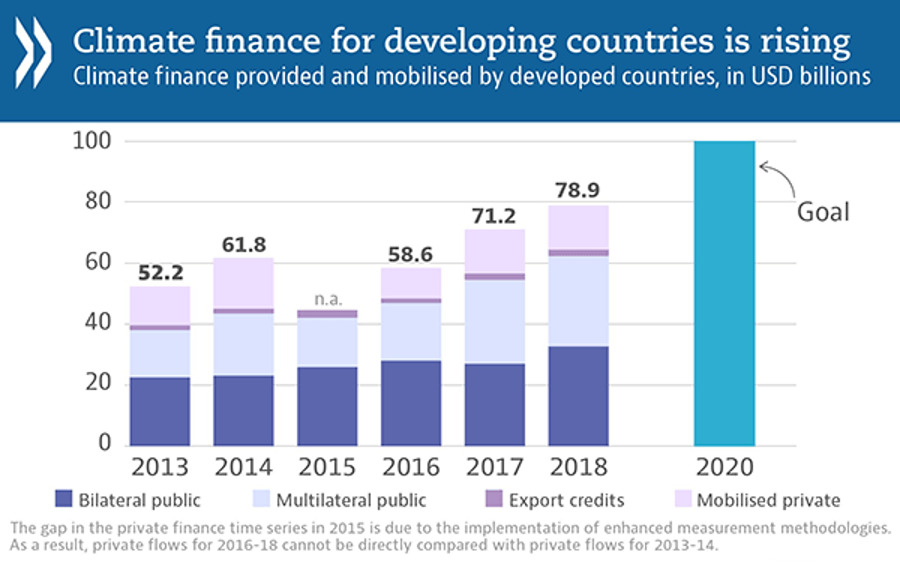

Funding from developed countries aimed at climate resilience could be key in fostering success of climate fintechs that focus on bolstering the resilience of smallholder farmers and small-scale fishers. This could start with developed countries honoring the promise they made in the Paris Agreement to provide $100 billion annually by 2020 to least developed countries (LDCs) for the purpose of mitigation and adaptation in response to the climate crisis. This has yet to happen, however; developed countries’ contribution came up almost $20 billion short in 2020. Whether such funding can be met may determine if these emerging industries can be subsidized for the public good — or fail to stand on their own legs in the private market.

“There was a commitment at Paris to provide $100 billion a year to low-income countries for mitigation adaptation that has not one year been upheld. That’s exactly the kind of funding that could be channeled through subsidy into these models, so I’m not sure if they have to be commercially viable because there’s a strong moral case for subsidy.”

Howard Miller - Research Director, Lead of the Green Inclusive Finance team at the CFI, Accion

While climate finance for developing countries is rising, it’s not rising fast enough. If developed countries don’t take bolder actions to support LDCs in becoming more climate resilient, not only will they not meet their goal of ending extreme poverty by 2030, but it will also be too late for them to appropriately mitigate and adapt to the climate crisis.

Source: World Economic Forum

Source: World Economic Forum

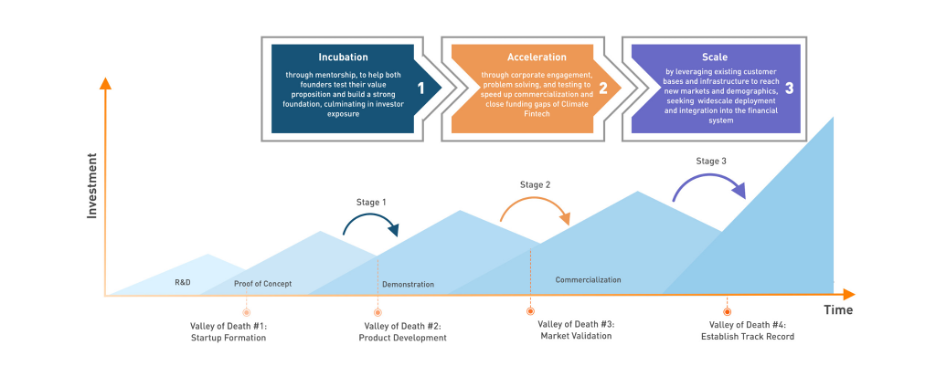

Funding from developed countries can support climate fintechs as they grow, especially through potential valleys of death, as pictured below. Considering developed countries are the primary drivers of the climate crisis, the question becomes whether they truly take financial responsibility to help those most affected become more resilient to climate shocks.

Source: New Energy Nexus

This is not to suggest that throwing money blindly at budding climate fintechs is the answer. Climate fintechs in the past have often failed because they fail to account for a consumer’s ability to pay while struggling to scale up — with PayGo’s shortcomings a prime example.

PayGo’s Pitfalls And Solutions

Solar PayGo has a history as a very risky venture. It’s a low-margin, high-default business in a niche where investors and lenders are known for demanding quick returns and results. Such companies are often in constant need of funding, but funding can only go so far. Following former U.S. President Barack Obama’s call to bring power to Africa in 2013, a host of PayGo solar companies arrived on the scene, such as D.light, Mobisol, and Zola, promising to do just that. These businesses received global support from major corporations and humanitarian agencies alike, racking up around $300 million in support. Yet former employees of these companies reported an immense pressure to grow at rates that resulted in unattainable prices for customers, faulty products, misleading sales pitches and little to no follow up post-installment. In many areas where these PayGo solar solutions were installed, communities couldn’t pay the monthly cost, plunging them into debt and without electricity. These companies, mostly sourced from developed countries, went into LDCs and left many that they promised to help worse off than they were before.

However, a new generation of PayGo companies are seeking to learn from past mistakes. SunCulture is a PayGo solar company that offers rural smallholder farmers, primarily in Kenya, access to highly effective solar-powered drip irrigation and water pumping systems. SunCulture provides an end-to-end model that covers consultation, delivery and installation, training and ongoing customer support post-installation. The PayGo for SunCulture's base product is $27 (Kshs 3,299)/Month for 24 months after a small down payment. SunCulture does aim to ensure that the monthly payment option for solar power irrigation pumps is less than what farmers pay for diesel pumps ($40 - $80/acre) and also less than the additional income farmers will make from using SunCulture pumps. In a recent impact report conducted by 60 Decibels, 94% of SunCulture farmers reported improvements in their quality of life, 96% reported improvements in their way of farming, 87% reported increases in production and 81% reported increases in revenue. Average revenue increased 40% per season.

“Not only do solar water pumps help improve the lives of farmers directly, but from a macro perspective, they improve and protect the productivity of smallholder farmers, contributing to a food secure, climate resilient and economically empowered future for Africa and the rest of the world.”

Mikayla Czajkowski, Chief of Staff, SunCulture

SunCulture seems to have addressed many of the issues that have caused other PayGo solar companies to encounter major difficulties. They collect their own data and have had third parties conduct reports to prove the impact that they have had on rural smallholders. To help bring down the price of their products, Czajkowski explains that they are launching their carbon business to directly reduce prices for their end users. The carbon credits generated by replacing fuel and petrol pumps are audited, verified and sold in the voluntary carbon market.

SunCulture has also been the recipient of a wide array of public and private support, from organizations like Microsoft and USAID, that have helped them deploy projects faster through funding, expertise, market linkages and exposure. Funding from developed countries has been instrumental in their growth — illustrating the impact that targeted funding towards companies with proven impact, a sustainable growth plan and an affordable product tailored to local conditions can provide.

Source: SunCulture

Embedded Finance For The Financially Invisible

Beyond innovative pricing models, improving how climate-vulnerable populations and sectors transact will be critical in making both fintechs and small businesses sustainable and climate-resilient — and that starts with embedded finance and the financial inclusion opportunities it presents. For people who make their living through agriculture and fishing, the markets in which they sell their goods are largely informal, leaving them financially invisible, with no financial record and no way to prove an income. Abalobi, a South African-based fintech, uses embedded finance to help small-scale fishers become financially visible through a suite of digital tech products that provides them with transaction histories, access to fair markets and prices, weather info and a way to document their catch and communicate with other fishers.

“Most fishers are locked in a system of servitude where they have to catch as much as possible. The fish ends up being poor quality, and fishers sell for low prices to middlemen that channel profits downstream.”

Dr. Serge Raemaekers, Director and Co-Founder, Abalobi

Essentially, Abalobi cuts out the middleman with its Marketplace app and connects fishers to buyers directly while also offering fishers data on the latest weather models so that they can better manage climate risks. Buyers (e.g. restaurants, hotels, individuals) can also use the app to buy fish directly from fishers and trace the fish they buy directly to where it came from. Fishers get paid the maximum sustainable price based on market data and are also provided with a way that they can prove their source of income. This opens opportunities for them to get loans, mortgages and generally access financial services. Because Abalobi is so data-driven — collecting data from fishers every time they fish — impacts are easy to track. Fishers report experiencing more financial stability, fishing less overall and focusing more on quality, with Abalobi reporting a doubling in the price clients get for fish.

“Abalobi offers proof of income [and] gives fishers a digital profile that they have total control of. They can use data as a credit profile. They can use it to prove their status as fishers, apply for fishing permits and other government support because they have proof that their livelihood exists.”

Dr. Serge Raemaekers, Director and Co-Founder, Abalobi

Source: Abalobi

With plans to expand into other markets Abalobi has partnered with organizations like the World Wildlife Fund and the Irish Islands Marine Resource Organization. This linkage between large, global organizations and locally driven solutions will be critical in the sector when it comes to scaling and expanding, ensuring that climate fintechs’ solutions remain locally contextualized to wherever they expand to.

“The goal is to make Abalobi as do-it-yourself as possible and to fine-tune it enough that a fisher group in Peru could pick it up and use it with little supervision and training.”

Dr. Serge Raemaekers, Director and Co-Founder, Abalobi

Climate fintechs are risky, but they are quickly improving in their abilities to increase both the climate resilience of local communities and their financial inclusion potential. Learning from past mistakes, it’s critical to channel support to fintechs that can prove impact, have locally contextualized expansion plans, and offer affordable prices for their target clients. Public and private investors must strike a delicate balance in encouraging growth along a realistic, sustainable path that in the immediate term requires some subsidization, with the promise of structural overhaul and optimized efficiency. Going forward, it will be essential for public and private entities to take these factors into account while also investing more so that climate resilience can be achieved for the most vulnerable before it’s too late.

Image courtesy of SunCulture

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Impact Investment: Is Standardization Possible — Or Desirable?

Travel And Fintech: Where Challenge Meets Flush Opportunity