Can Utilities Digitize in Africa?

~10 min read

Utilities are odd organizations. They provide vital critical services like clean water, electricity, waste and sanitation, whose importance to modern economies is too important to be left entirely to either the public sector or the private sector. Yet in Africa, they are perpetually stretched thin, underperform, and set to struggle even further with climate change. What role can digitizing operations play in improving utilities’ financial and operational health, and what role should nimbler “utility-tech” startups play in filling the gaps? In a parallel to the classic banking/fintech story of incumbent versus challenger, this week’s Insight examines what it might take to foster a collaborative ecosystem for expanding access to the curious commodities of the utility business.

Curious Commodities

The provision of utility services has long held a unique place in the imaginations of economists as well as the day-to-day fray of popular politics. In classical economic theory, “utility theory” forms the basis of microeconomics, with ‘utils’ as hypothetical units measuring satisfaction that can be graphed along preference curves and explain price movements at the intersection of supply and demand. Influential philosophers like John Stuart Mill and Jeremy Bentham developed a whole field of ethics in the 18th and 19th centuries based on the concept of maximizing aggregate social utility — utilitarianism — that to this day lends enormous moral weight to the authoritative conclusions offered by the dismal science.

Contrast these heady origins to the somewhat duller reality of paying your utility bill each month to companies that, frankly, seldom inspire enthusiasm or confidence: solicit a Lagosian’s opinion on NEPA or a Californian’s on PG&E, and your response is likely to span the spectrum from neutral to vitriolic. That’s because despite the fact that utilities are supposed to provide utility, the curious commodities they provide — principally electricity, water, but also gas for cooking and waste management services — straddle a strange middle ground between products and rights.

The story of utility delivery service, consequently, has historically been one of technological innovation, market design and regulation, deregulation and re-regulation. From Edison’s lightbulb moment to the first power companies in New York and Chicago, the provision of goods where massive capital expenditures are needed to achieve affordable basic features of modernity (like street lighting or piped water) through economies of scale is unambiguously considered a critical strategic input into economic development and social wellbeing for the households, towns, cities and nations of the 21st century. The result: a ‘utility consensus’ model justifying the special rules that govern ‘natural monopolies,’ or industries that are just too important and expensive for the ‘invisible hand’ of the free market to deliver.

This, of course, was not exactly the thinking that drove investment into plants, pipes, poles and wires on the African continent in the early 20th century. European colonial administrations primarily built infrastructure to more efficiently mine and move natural resources; certainly not to maximize welfare for all. But as African nations gained independence in the mid-20th, the delivery of the basic services afforded by the miracles of modern infrastructure became inseparable from the political projects of state-building that African administrations to this day negotiate among their varied constituencies of citizens and interest groups. In other words, who gets service is deeply political — and this partly explains why across the continent, utilities are generally chronically indebted, struggle to reach the poorest, and all-too frequently fail to provide reliable service to those it does reach.

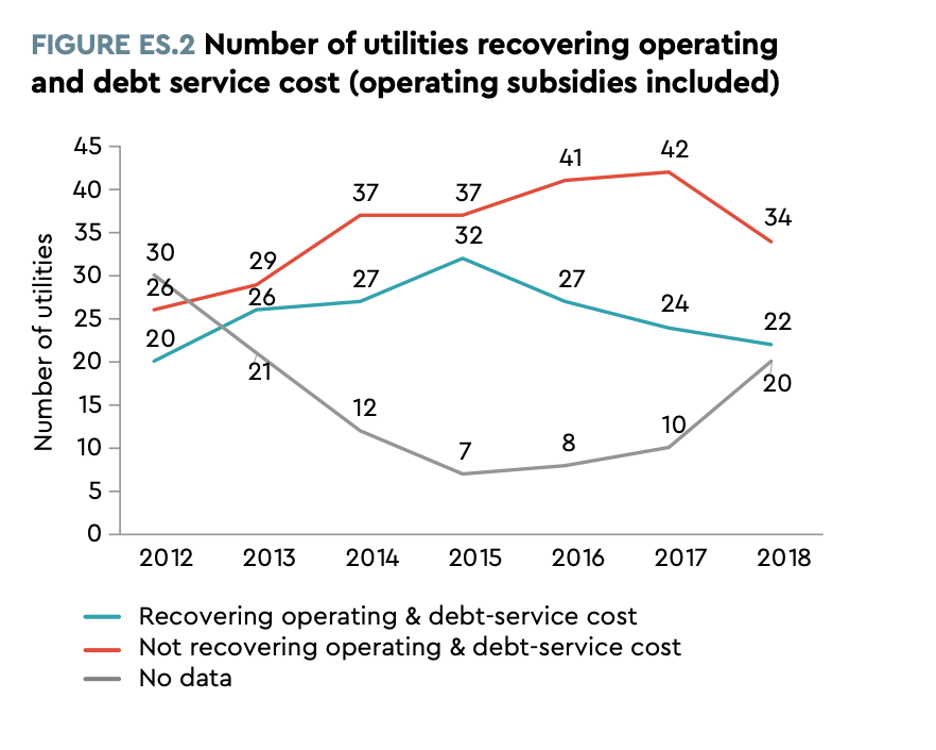

Indeed, the challenges facing African utilities are enormous. Despite the critical role they serve, few utilities in Africa recoup even their operational costs through customer revenues, requiring massive subsidies from the national treasury and from development partners year after year.

Source: ESMAP (June 2021) Utility Performance and Behavior in Africa Today

“Zombie utilities,” as these are sometimes known, are difficult to revive, but too important to be killed. But why should anybody expect a sprawling complex of machines and organizational systems inherited from an extractive colonial enterprise to perfectly serve the needs of millions of customers — or easily expand to serve millions more, when as much as 80% of the population in the poorest low-income countries can’t afford a “subsistence consumption” monthly utility bill of $8?

Digitizing Slow-Moving Behemoths

The digitization of utilities has occupied a particularly attractive and techno-utopic discourse since the advent of buzzwords like “Smart Cities,” “Fourth Industrial Revolution,” and “Internet of Things.” The reality, however, is that most utilities, no matter the continent, are slow-moving behemoths whose primary concern is not delighted customers, but customers who just pay their bills without thinking about it too much; such organizations do not dream of striding for a decarbonized future through structural change but are more concerned with simply keeping the machines working.

Infrastructure in Africa in particular can be quite old and stressed; electricity, in particular, is such a tricky commodity to generate and distribute that grids are frequently described by engineers as systems that “work in practice but not in theory.” That consumers pay for a kilowatt-hour of electricity abstracts from the fact that the service they are paying for is not even a “thing” — technically speaking, electricity is a flow, the oscillating movement of electrons across wires excited thousands of miles away, usually through a combination of burning fuels, steam turbines, and spinning magnets. And in Africa, much of those flows are hydro-electric, with climate change threatening to batter utilities worse with each drought.

But what does it mean to digitize an organization that itself produces and distributes electricity? For Africa’s myriad utilities, digitization essentially refers to operations; in other words, the use of digital technologies to streamline operations.

Digital payments, for example, have reduced collection costs for water utilities by 57-95 per cent and increased revenues between 15 and 37 per cent, according to a CGAP/GSMA joint study. Digital utility payments are available in more than three quarters of all countries worldwide — which, like mobile airtime top-ups in emerging markets, tend to be small and frequent.

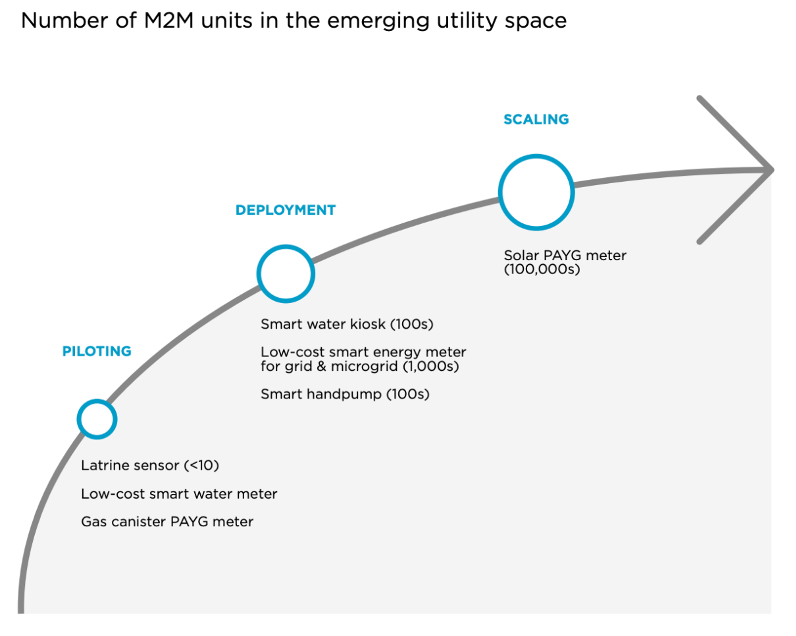

Pay-As-You-Go (PAYG) metering systems, developed in tandem for both off-grid solar companies and urban utilities, are sweeping the continent’s utility sectors as the de facto way to link service for payment, while all manners of remote sensors and control systems are emerging to reduce financial losses from technical inefficiencies or behaviors. Such human-to-machine interfaces increasingly mesh hardware with software, and business models dynamically zero in on the product-market-fit niche that is a prerequisite for monetization in a pay-to-play world dominated by access to capital.

Source: GSMA (2016) Mobile for Development Utilities: Unlocking access to utility services

SteamaCo, for example, manufactures smart-meters that enable both ‘traditional’ utilities and (off-grid) mini-grid providers to easily scale the monetization of electricity flows to customers through a physical meter unit networked through 3G, 2G and even SMS channels for real-time Pay-As-You-Go consumption of electricity — enabling utilities to operate and bill at the literal speed of lightning. Yet they started as a wind turbine company that realized generating electricity in East Africa was actually much easier than getting paid for it — particularly at scale, as any utility model (whether traditional or disruptive) requires to sustain itself.

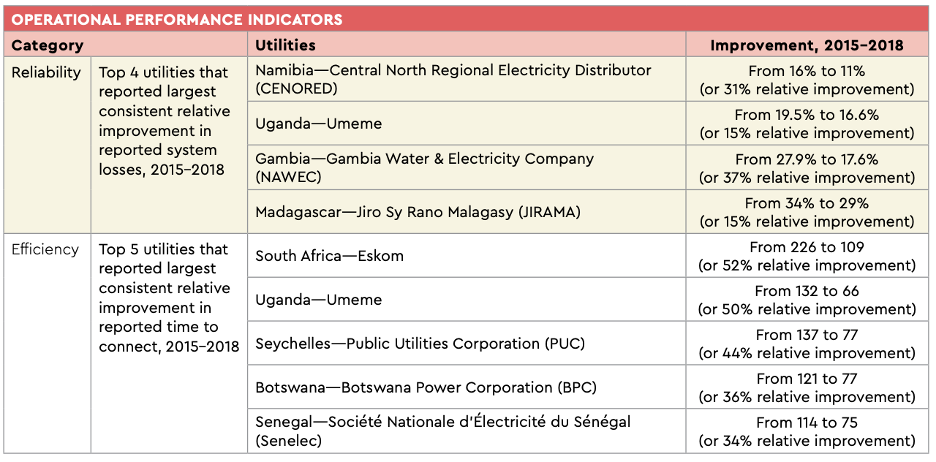

Thanks to adoption of such technologies, traditional utilities, for their part, have appeared to improve across a number of financial and operational metrics; since a seminal 2016 World Bank report finding only two utilities on the entire continent covered their operational costs through customer billing (Uganda and the Seychelles), more recent literature finds a few more utilities to celebrate.

Source: ESMAP (June 2021) Utility Performance and Behavior in Africa Today (UPBEAT)

Chief among utility high achievers is Umeme, Uganda’s innovative power utility. As the energy transition sweeps global markets, Umeme is keeping pace at the global cutting edge with recent announcements of rare grid-mini-grid partnerships.

“Regulation to date has treated these industries in a mutually exclusive manner, limiting the ability for these sectors to collaborate and innovate. That is why you do not see many cases of utilities’ partnership with a renewable energy company.”

Sumaya Mahomed, Uganda Director of Power for All

Playing Nice with Others

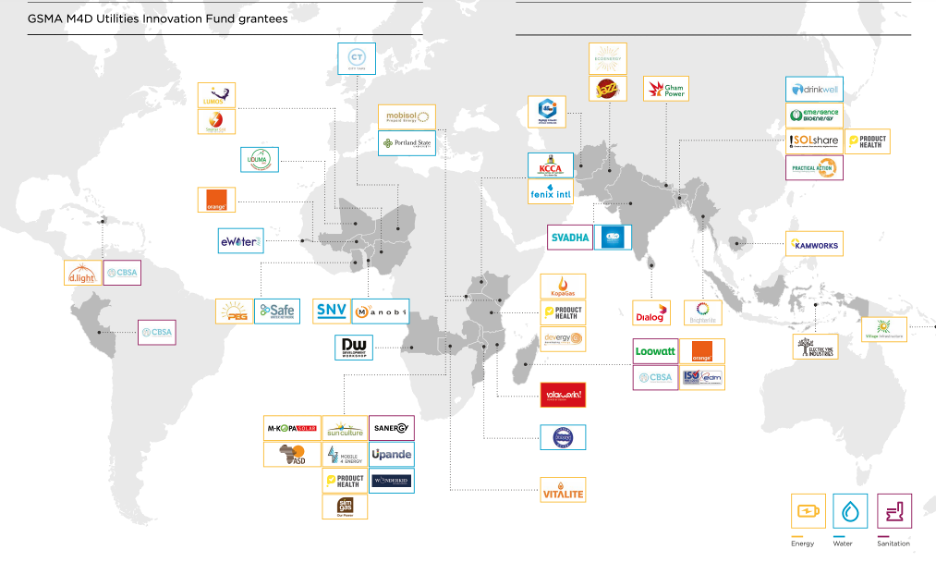

GSMA’s Digital Utilities program started in 2012 to foster the nexus between the technologies and solutions enabled by mobile networks and the provision of critical infrastructure services. Today, the program tracks dozens of such “UtilityTech” companies around the developing world through financial and technical support. CleanTech dominates the field with 32 grantees in its 2019 report, with WaterTech in second at 12 and WasteTech still in its infancy at 6 (notwithstanding several established players like Sanergy, founded in 2010, which designs, manufactures, sells and manages low-cost sanitation facilities in informal settlement communities in Nairobi.)

Source: GSMA (2019) Mobile for Development Utilities Annual Report Intelligent Utilities for All

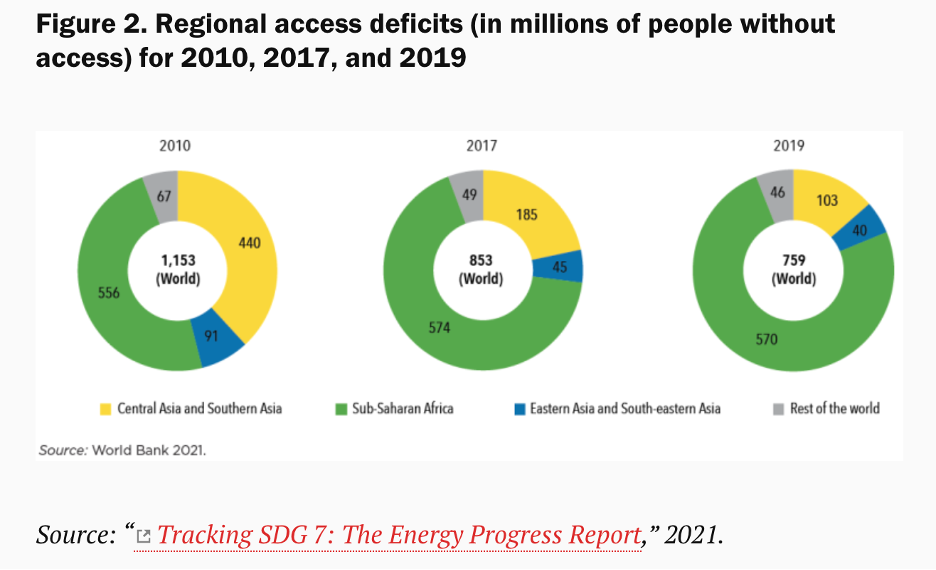

Implicit in the program’s mission is the reality that traditional utilities are simply not positioned to achieve universal reach on their own, even aside from their financial woes. “Work culture” studies in particular — anthropological accounts of how different utility actors behave — illustrate the extent to which the nature of infrastructure development correlates with conservative values qua engineering caution, whereas troubling trends in access to basic services seem to call for disruption and innovation. The pace of electrification in Africa, for example, is struggling to keep up with population growth, and water and sanitation access lags even further, particularly beyond urban agglomerations. And while utility deficits teeter precariously on the edge of bankruptcy (exacerbated by COVID), decentralized solutions will only continue lowering their costs of delivery — which are, in many cases, already the least-cost way to reach the majority of target communities.

Yet organizational reform is challenging and political. Utilities are notoriously resistant to partnering with those who can help, reminiscent of the challenge in getting banks to partner with fintechs in achieving greater financial inclusion, as Mondato has previously covered. Of the 50 Digital Utilities grantees in the 2019 GSMA report, only two appeared to explicitly involve partnership with the local utility — of which one failed.

Even in Rwanda, where grid power reliability and access have improved to a stunning degree in the past few years, the still-burgeoning mini-grid industry faces the threat of extinction from a utility sector that more often than not sees off-grid players as competitors rather than partners in achieving access.

Indeed, after a much-lauded National Electrification Plan allocated 48% of Rwanda’s anticipated new connections to off-grid providers in 2019, recent revisions last August have downgraded the allocation significantly down to 10.3%. The justification offered is that the off-grid sector is moving too slowly — but conversations with off-grid executives reveal regulatory approvals for additional rollouts routinely sit on regulator’s desks for months.

“If we and [the national utility] both build grids, but we have to get permission from them - it’s like Shell having to ask BP to get permission to build a gas station!”

Rwandan CleanTech operator

“The trick to working with the water utility is to figure out how to work together without encroaching on each other’s space — and importantly, how not to make the utility look bad.”

Rwandan WaterTech operator

Indeed, operating in the utility space, despite the obvious public interest and the worrying financing shortfall most utilities on the continent face, can be a tip-toeing tightrope act if the protected monopoly doesn’t see a place for others’ innovation in the future of the turf it serves, however tenuously.

“Among 13,314 villages proposed to be connected through Grid Extension and Fill-in connections, some of them have got funding while for others, the funding is not yet secured.”

Energy Development Corporation Limited (2021) A concept note on the Rwanda National Electrification Plan (NEP) - 2021 Revision

Quo Vadis UtilityTech?

The future of utility services is not yet written on the wall but splashes of the techno-futurist painting offered by some visionaries may just yet begin to stick. While the future for off-grid is uncertain in Rwanda, for example, it appears bright in neighboring DRC, where alt-utilities like BBOXX have thrived in the absence of utility competition (SNEL, the state utility, connects a reported 500,000 households for a population of over 90 million.) Without better-aligned incentives to cooperate, then, it could perhaps be concluded that it is only in places where utilities are entirely absent that scalable alternative models may emerge.

But this can only be an intermediate step. If utility services are important enough to endow utilities with monopolistic powers and endless subsidies, they must also be made to marshall more collegial relationships with other purveyors of utility. Such hybrid-utility delivery models have much to offer to the old-guard, from deeper customer-centricity, faster innovation cycles, and a different set of socio-political constraints and opportunities within which to experiment — like appliance financing for productive uses of electricity, PAYG micropayments for water, or even village WiFi.

Yet it is unclear how quickly utilities can develop an appetite for innovation on their own, given how reliably they are subsidized despite the low standard they operate at on average — this despite the tremendous synergistic potential with their scrappier alt-cousins. What incentives, financial or otherwise, might impel such colossi to identify serious, scalable partners in reaching the dual targets of financial sustainability and universal access?

Perhaps such incentives do not exist. In this case, the only solutions may lie in regulation — the legislative process that confers and curbs special rights and privileges to those service providers whose curious commodities transcend the relative simplicity of goods and services and rise to the philosophical sphere of utils and utilitarianism. Indeed, if utility-tech is expected to meet the moment, regulation, too, must evolve to accelerate the integration between the old-guard at the frontline of basic service delivery, the innovators at the last-mile, and the institutions where they meet all along the way.

Image courtesy of Allen Meki

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

From Mobile Money Powerhouse to Super App: The Case of M-Pesa

The Digitization of a Society: How to Push Cashless and Pull Insights