Does Crypto Hype In Latin America Exceed, Meet — Or Make — Reality?

~8 min read

How one views the advent of cryptocurrencies in Latin America can be a Rorschach test for how one views the advent of cryptocurrencies in general. On the one hand, multiple characteristics of individual markets in the region are to crypto advocates the telltale preconditions for vast consumer uptake just around the corner — including high levels of remittances, low levels of financial inclusion, and instances of unstable currencies or hyperinflation driving skittish businesses and individuals towards the alternative financial system, as Mondato Insight previously described in failing economies like Argentina and Venezuela. Momentum has seemingly accelerated — at least online — recently with El Salvador’s recent groundbreaking decision in June to recognize bitcoin as legal tender, becoming the first country to do so. Investment activity is increasing as well, with crypto exchange firms raising millions of dollars in funding, including Mexican crypto exchange firm Bitso, which became the first crypto unicorn in the region. To advocates, such regulatory and investment milestones signal vindication, commencing what the army of laser eye Twitter profiles have long prophesied.

Yet skeptics answer the siren calls for crypto’s coronation in Latin America with one word: proportionality. This week’s Insight gets to the bottom of the crypto space’s position in the Latin American region, whether the hype is real or not — and if not, whether what comes next provides new meaning to the phrase “fake it ‘til you make it.”

Cuando Lambo?

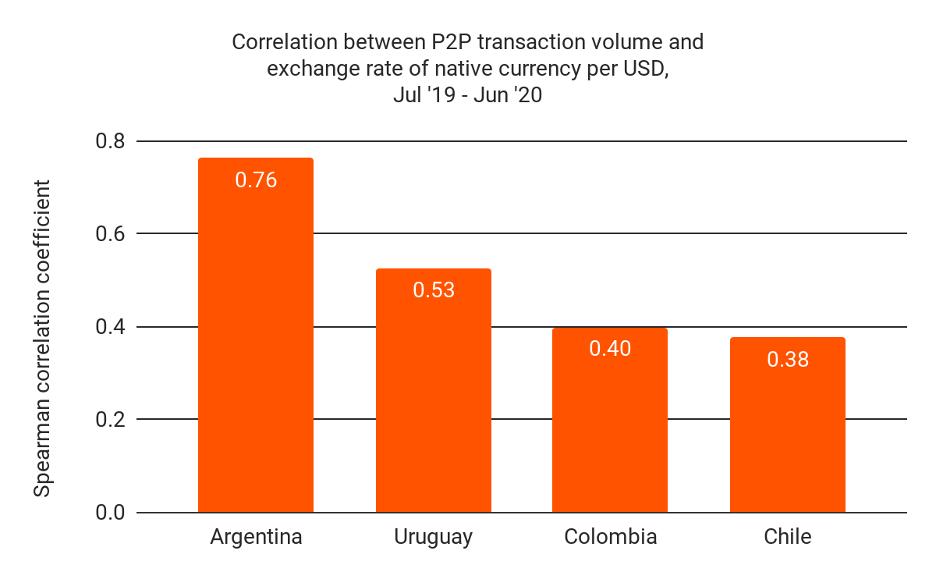

Even before El Salvador’s groundbreaking announcement, several factors in Latin America provided the region with unique potential for crypto adoption. Argentina and Venezuela especially have been two prime examples of hyperinflation driving individuals and businesses towards cryptocurrencies, with crypto markets experiencing a surge upon the collapse of the respective countries’ currencies. While Venezuela’s state-backed digital currency, the petro, has been deemed all but a failure in reining in hyperinflation, Venezuela and Argentina far outperform their market size on P2P crypto trading platforms. A Chainalysis post dove deep into this phenomenon tying currency strength in Latin America with regional trading activities, finding a statistically significant relationship between the weakening of local currencies and an increase in P2P crypto transaction volumes in countries like Argentina, Uruguay, Colombia and Chile.

Source: Chainalysis

Beyond the typical currency fanfare, however, is the potential in the region’s remittance corridors. While technical capabilities and comfort with cryptocurrencies are significant hurdle for migrant populations (more on that later), remittances — with the ability for crypto to significantly lower transaction fees compared to the standard fare — are an obvious potential use case. At the same time, it can both familiarize migrant workers with the technology and processes and bring cryptocurrencies into circulation within home markets, barring cash outs. According to the World Bank and as the Chainalysis post notes, only the Middle East and African regions have remittances comprise a larger portion of GDP than Latin America, and the importance of remittances in Latin American crypto activity is further evidenced by the fact that 90% of cryptocurrency received in Latin America comes from outside the region. When looking at surveys of crypto users around the world, the countries with the highest percentage of individuals who say they use cryptocurrency sounds like a who’s who of remittance-heavy markets, led by Nigeria, but also followed by countries like Vietnam, Philippines, Thailand, Turkey and in Latin America countries like Peru, Colombia, Argentina and Chile. Other confounding variables — like weakening national currencies — certainly play a role, but remittances cannot be discounted.

Another area suggesting Latin America’s growth potential in crypto is the levels of enthusiasm seen among a surprising number in the region; one January survey of 2,200 people from Argentina, Brazil, Colombia and Mexico found that about a third of those surveyed expressed an interest in either investing in cryptocurrencies or using it to maintain value in times of economic stability, with about a third expressing increased interest in crypto as a result of the pandemic.

Crypto’s Latin promise has been substantiated by growth during the pandemic among local crypto exchanges, and investors have taken notice. In Brazil, crypto exchange firm Mercado Bitcoin reported already trading $5 billion in crypto in the first quarter of 2021 alone, compared to $1.2 billion in all of 2020. It took Mexican crypto exchange firm Bitso six years to get its first million customers, a figure which it reportedly doubled ten months later during the pandemic. Subsequently, Bitso raised $250 million in its recent funding round, giving the company a $2.2 billion valuation and bragging rights as the first crypto unicorn in Latin America. When considering the underlying factors and impressive growth among exchange firms, many investors view Latin America as the region most primed to jump the proverbial crypto pecking order.

“From an investment and market activity standpoint, the growth in Latin America has been very strong due to geopolitical reasons, due to adoption reasons which we do not have elsewhere in the world. So I think it will grow to at least the top three regions in the next few years just because the growth is so important there.”

Hugo Renaudin, Co-founder, p00ls; Co-founder, Bender Labs; Co-founder, LGO Group

Hold On For Dear Life

When El Salvador became the first country in June to make cryptocurrency legal tender, it was praised by Renaudin and others in the crypto community as the first domino to fall in the march to regional and mainstream acceptance. El Salvador’s president, Nayib Bukele, heralded the move using all the crypto buzzwords and talking points: as the country in the region with the highest levels of remittance proportional to GDP (25%), Bukele argued the switch would enable El Salvador’s $6 billion in remittances to go totally crypto, cutting the average 3% in transaction fees to save recipients an estimated $180 million. The move was also declared an effort to give El Salvador, which has used USD as legal tender since 2001, more fiscal independence from the whims of the U.S. Federal Reserve, also offering the possibility for the government to convert bitcoin to USD when prices jumped to shore up the government’s significant deficit.

And yet, when digging deeper into the rationale and reaction to El Salvador’s move, the cracks in Latin American crypto become apparent. For one thing, of all countries in the region to be the first to make such a radical fiscal shift in such a short span of time — banks must make the necessary infrastructure and monetary adjustments by September — El Salvador is certainly not the primary candidate that comes to mind. The country suffers still from poor electricity and Internet coverage to enable an all-digital economy, let alone one where crypto is transacted at banks and local merchants alike. And although small bitcoin transactions in the country saw a four-fold increase in May compared to the year before, the reality is that such transfers still make up a tiny fraction of El Salvador’s remittance-heavy economy. Despite massive public support for Bukele, a July survey of Salvadorans revealed how misaligned public opinion is compared to the crypto Twitterati. In the survey, only 16.5% said they would be willing to receive their salary in crypto. 46% of Salvadorans said they knew nothing about bitcoin (and only 5% said they knew “a lot”). Among merchants, only 25% said they would accept bitcoin as cryptocurrency, and among those receiving remittances, 83% said they would prefer to do so in dollars over bitcoin. Although Bukele maintains wide public support, only 15% expressed confidence in him and Bitcoin, with a plurality believing the decision will make El Salvador worse off.

Source: Getty Images

Public fears are also accompanied by criticism from fiscal and regional experts, including one J.P. Morgan report which failed to see “any tangible benefits” to El Salvador adopting bitcoin as a second legal tender. The IMF, which is negotiations with the country to provide a $1 billion loan, has also expressed concerns with El Salvador’s decision, and Moody’s recently downgraded the government’s credit rating as a result.

Undoubtedly, the Salvadoran government’s decision will facilitate at least some degree of acceleration in the banking system’s digital infrastructure to go along with 1500 crypto ATMs that will be installed. Yet describing such a transition as “growing pains” may underscore the fraught perils in store for a government, society and banking system seemingly ill-equipped for such a dramatic shift, according to Manuel Orozco, director of the Center for Migration and Economic Stabilization.

“The first step will probably come from the banking sector, which is practically being forced to offer an exchange mechanism between dollar and crypto, and that will mean they will have to buy tokens in crypto in order to have that for interchange purposes. Maybe that will lead to a marketplace for the currency for commercial activities, but so far I think the industry isn’t clear, the banking industry isn’t so clear about it.”

Manuel Orozco, Director of the Center for Migration and Economic Stabilization

Making The Virtual Real?

In spite of worries from many fiscal experts as well as the Salvadoran public, the celebration from crypto corners has been effusive since El Salvador’s Bitcoin Law was passed. Proportionality rues the day when inflating cryptocurrency milestones and adoption, which for all intents and purposes remains a niche case at best. Commentary and reporting on the aftershocks of El Salvador online have not always done well in framing these moves accordingly. Coverage from outlets like Forbes, RestOfWorld, TheStreet, and elsewhere at times framed tweets from small-time politicians in countries around the region as serious interest from the governments themselves to follow El Salvador’s path. Perhaps most telling, one Internet researcher described to Foreign Policy how El Salvador’s President Bukele’s fervent online supporters employed astroturfing techniques to both hound critics online and flood social media spaces with fake accounts to create an illusion of consensus.

To a degree, this misalignment in perception and reality goes beyond El Salvador to the region’s crypto ecosystem as a whole. In spite of remittances being seen as an engine spurring crypto growth beyond merely speculative purposes, Orozco, an expert on migration and remittances in the region who has run multiple surveys and reports on remittances, including the growth of digital remittances during the pandemic, wholly dismisses the role cryptocurrencies currently play in remittances among migrant workers from Latin America. Migrant workers don’t know how cryptocurrencies work, and the differences in transaction costs are negligible to nonexistent when sending small-figure amounts, according to the remittance expert. According to Orozco, online buzz about crypto remittances to places like Mexico and Cuba are merely conflating anecdotes with nonexistent trends.

“The problem with the remittance market is not the market, it’s financial inclusion. There is no bitcoin cryptocurrency market [regarding] remittances. I hear people talk about using crypto in Cuba, for example. They’re anecdotes from one person who doesn’t even know how crypto works. But they like to say it because it sounds sexy.”

Manuel Orozco, Director of the Center for Migration and Economic Stabilization

How, then, does one explain the likes of Bitso reaching a $2.2 billion valuation, in part derived from the company’s claim

to account for 2.5% of all remittances going into Mexico from the U.S. (or more than $1 billion)? “They are making it up,” insisted Orozco.

Source: contexto.com

Crypto’s critics can be as vociferous as its proponents, and Bitso did not respond to a request for comment, but it can be difficult to separate fact from fiction when analyzing a market still in large part lacking the same reporting and transparency requirements of mainstream financial institutions. As a recent Insight discussed, a mature regulatory apparatus is a critical next step for cryptocurrency to move beyond its primarily speculative niche, as it will shed greater light on cryptocurrency’s true market share and growth.

Yet for all the doubts and uncertainties regarding El Salvador’s imminent Bitcoin experiment — and how far regional regimes and markets have come and will go in fostering cryptocurrencies — the possibility remains that hype, unfounded or not, brings with it both local digitization efforts and foreign investment to spur digital financial progress and growing use of cryptocurrencies, as a (mostly critical) Bank of America report recently suggested. Humility and proportionality are not concepts typically associated with crypto prognosticators. Latin America’s regional hype may be legit. It might be false hope, or the ironic foundations of a crypto paradise built on nebulous truths. If we’re being honest for once — who really knows.

Image courtesy of Bermix Studio

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

From Seed To Table: How Fintech Will Optimize Food Systems

Africa’s VC Boom: An Enabling Present or a Bet On The Future?