Fintech’s Pivotal Role In Sanction Regimes

~10 min read

Never before has a country so large and economically important as Russia faced such potentially dramatic exclusion from the global financial system as it does now. As countries move to remove Russia’s central bank and key Russian institutions from SWIFT and the ruble crashes, the effects not only among traditional financial systems but digital financial services will reverberate in unprecedented ways. Yet experts, literature and past examples offer a roadmap as to what comes next. Applied in different ways using different technology, fintech can be either an enabler or an impediment to sanctions regimes. And likewise, recent cases show how sanctions can fundamentally alter the shape of fintech ecosystems.

A Game Of Cat And Mouse

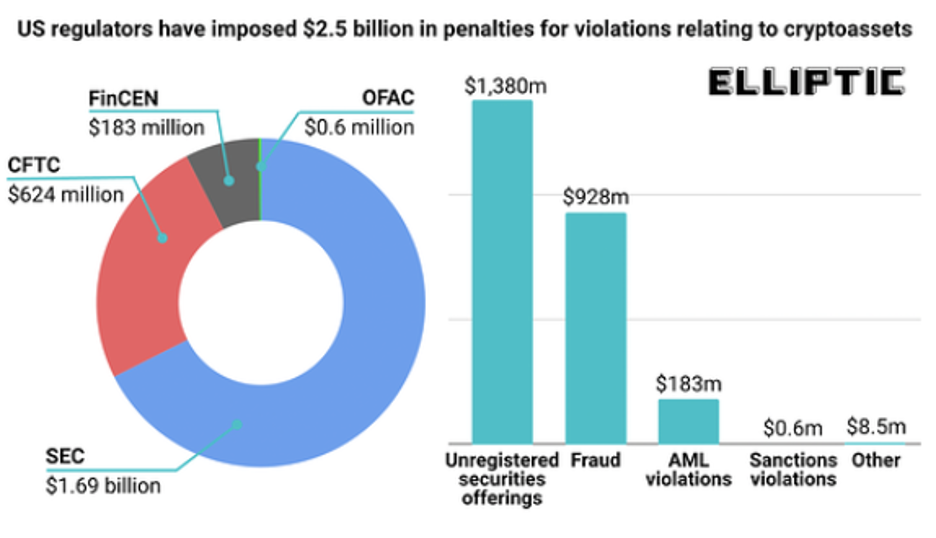

Though fintech is often cited through measures like cryptocurrency as a potent tool to evade sanctions, technology figures prominently among regulators’ attempts to surveil cross-border transactions for cases of sanctioned entities doing business.

“Regulators are using technology to enhance their own surveillance and financial systems. And we see this now with respect to having real-time surveillance of bank capital requirements, placing requirements on prudential supervision, and also real-time surveillance of capital market transactions to detect market abuse and insider dealing.”

Dr. Kern Alexander, Professor of International Financial Law and Banking Regulation, University of Zurich; Author of “Economic Sanctions: Law and Policy”

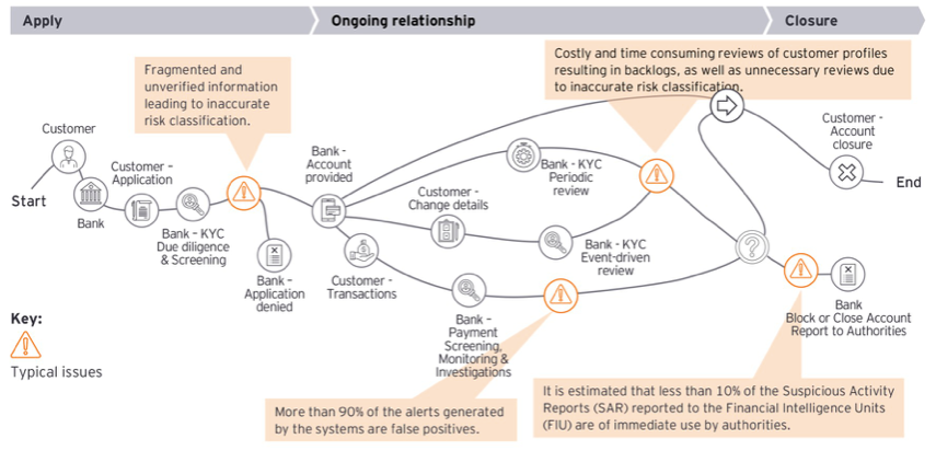

The shift away from comprehensive sanctions of countries to targeted, or “smart” sanctions in the past 20 years has been intended for sanctions to hurt only those who sanctions wish to punish. Yet in practice, the targeted sanctioning of individuals or entities creates a compliance nightmare for payment firms operating cross-borders. Today, leading multinational banks and payment firms routinely employ sanctions compliance experts to sort through transactions and determine suitable clients. Yet the compliance costs and risks of sanctions exposure have led to a culture of “overcompliance” among traditional banks and leading fintechs backed by incumbent institutions, similar to what’s developed in the case of anti-money laundering (AML) regimes. The pervading sanction regimes led by the U.S. have fostered more of a coercive than truly collaborative relationship between financial institutions and regulators in this regard.

“Regulators and banks have been stuck in this kind of cat and mouse game where the regulator really suspects banks are not complying, and sometimes for very good reasons. So the tendency is to try to hit the banks whenever they see [anything] but not work with the bank to change their culture. And the effect of that is that the banks are very reluctant to show the regulator how they really operate because they're afraid to admit failure.”

Gregoire Mallard, Director of Research at the Graduate Institute of International and Development Studies (Geneva)

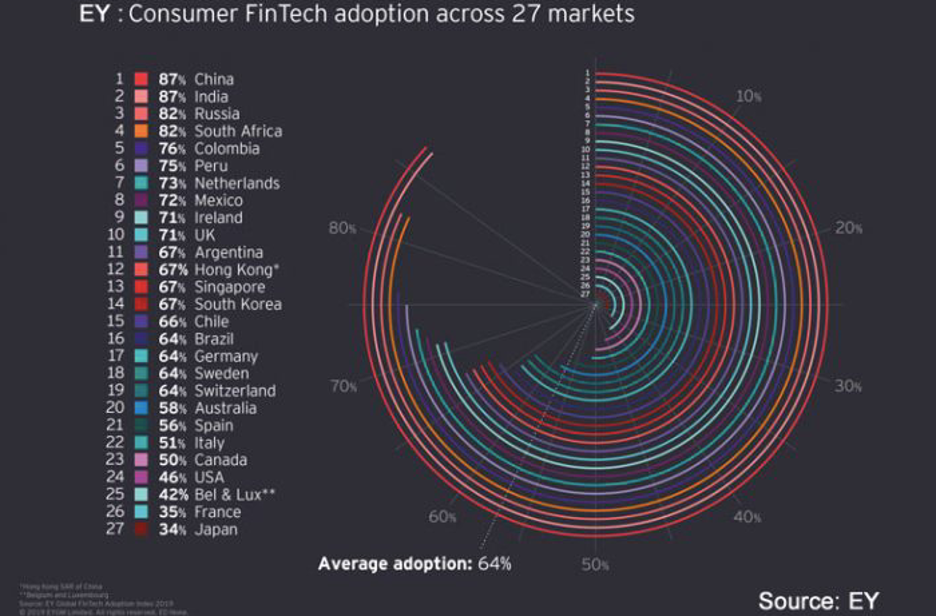

Source: EY

The case is a bit different when it comes to fintechs. Fintechs, especially paytech firms backed by traditional banks, will typically be following the same kinds of oversight from their correspondent bank. However, the lack of regulatory regimes in some jurisdictions directly overseeing fintechs may allow them to slip between the cracks. Although leading fintechs and crypto firms employ sanctions compliance specialists, others — especially those not reliant on the balance sheets of banks — can operate under the radar to facilitate some transactions that would violate sanctions, wittingly or not.

“A lot of fintech is conducted in a way so it doesn't come under regulatory oversight. They're not banks, they don't have deposit accounts for their customers. They're basically providing a platform for them to find and to identify investments and to move capital across that platform; fintech companies take a cut and then it goes into investments somewhere. Crowdfunding, all this stuff, is not within the scope of surveillance of regulators now.”

Dr. Kern Alexander, Professor of International Financial Law and Banking Regulation, University of Zurich; Author of “Economic Sanctions: Law and Policy”

That is not to say non-crypto fintechs are open season for sanctions evasions — but ambiguities and gaps certainly persist. A 2020 survey found that 60% of fintechs surveyed felt there was sufficient government guidance regarding sanctions compliance. Fintechs are increasingly getting approval for sanctions-specific policies rather than simple AML policies, but this process is ongoing. While 60% of those fintechs surveyed screen against lists of close associates of sanctioned people, only 29% conducted a standalone sanctions risk assessment. Applying a risk-based approach to such cases can be difficult, as sanctioned entities hide behind layers of convoluted ownership structures.

Finding ways to navigate around unilateral U.S. sanctions, like the E.U.’s INSTEX, a special purpose vehicle intended to facilitate trade with Iran without using U.S. dollars, have failed, and obtaining the correct licensing and approvals for humanitarian-driven transactions and shipments to sanctioned entities is tricky. Alongside fellow researchers, Gregoire Mallard’s 2020 paper explored these conceptual shortcomings of unilaterally driven, targeted regimes as it pertains to humanitarian-purpose programs. The hegemonic regime overseen globally by the U.S.’ OFAC leads to both ambiguity and high compliance costs for financial institutions to do business with sanctioned countries even for humanitarian purposes, with poor coordination and a lack of multilateral licensing boards rendering the path to sanctions-compliant business arduous.

The paper’s team of researchers proposed a single-purpose digital currency, a Safecor coin, that would facilitate establishing a clean economic circuit where money flows in and out of a sanctioned country. A neutral third party would authorize new entities at the point of entry into the circuit, tracking all humanitarian-related transactions to ensure the flow of money is towards permitted ends.

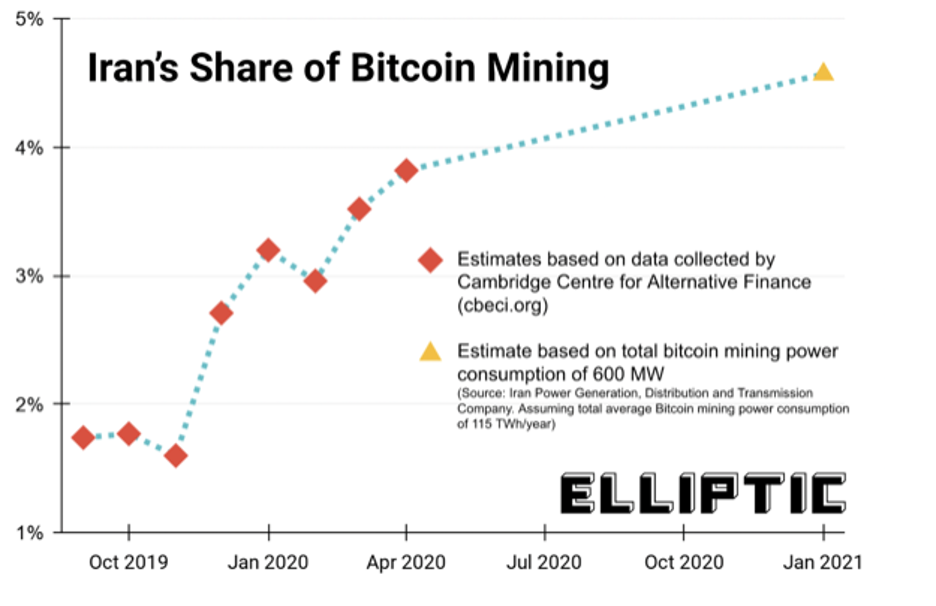

Of course, this theoretical use of digital currency is outweighed by the very real use of cryptocurrencies by sanctioned entities. Russia, North Korea, Venezuela, Iran and Syria are among sanctioned countries notorious for raising funds through ransomware and crypto mining; North Korea alone raised $2 billion in 2019 through cryptocurrencies, which helped fuel its nuclear weapons program.

Source: Elliptic

Yet cryptocurrencies are only one facet to sanctioned regimes’ efforts to utilize fintech to emulate normal financial activities and create a self-sustaining ecosystem. Below-the-radar fintech efforts long underway in Iran offers some clues as to how this may evolve in Russia’s case.

Iran Reinvents The Wheel

In spite of comprehensive regimes from the U.S. government largely shutting it out of the global financial system, Iran has managed to develop a burgeoning fintech sector in many ways mimicking what exists elsewhere — only on a smaller scale, and far less efficient.

Amir Fadavi, global sanctions lead at a fintech company, founder of sanctionsexpert.com and an Iranian-American sanctions lawyer residing in New York, describes an Iranian ecosystem that has learned to exploit technological loopholes to still interact with outside commercial channels while developing their own set of financial systems. Unshackled from global intellectual property laws, Iranian companies have taken to copying much of the financial and digital financial offerings in place elsewhere. Iran developed their own card structure schemes, with their own SWIFT-like system for interbank transactions, the Shetab Banking System. Way2Pay.ir is seen as the “Coin Desk of Iran,” offering the latest news and overview of the self-contained Iranian fintech ecosystem, with offerings including fintech, regtech, insurtech, and the like. Although these systems have greater inefficiencies and costs than global financial systems, this developed resilience has allowed high-tech Iranians to enjoy many of the same features one would find in any other country.

Source: Tehran Times

Cut off from external sources of investment, much of Iran’s domestic fintech sector is backed to some degree by the government or state-backed banks. Irani Card is one of the main conduits for Iranians to access global financial markets, allowing everyday Iranians to access PayPal, Visa, Apple gift cards and foreign exchanges through shadow banking channels. According to Fadavi, this Iranian fintech coordinates with those outside Iran to facilitate these transactions using non-Iranian cards. From there, an Iranian can use a VPN — commonplace in the Islamic Republic — to mask their location, go on Amazon, order something delivered to a location outside the country, and from there a “brave third party” will send the Amazon shipment to an address in Iran, with the third party reimbursed through Irani Card. This evasion of compliance measures allows everyday Iranians to shop on Amazon, use Spotify Premium and otherwise remain strikingly connected in a supposedly isolated locale.

While Iranian fintechs find alternative routes into the global commercial system, cryptocurrencies in Iran are already quite popular as a means to facilitate transactions not merely among the government elite, but everyday people.

“You have Coinbase, you have Gemini, a few crypto exchanges that when you want to open an account, they ask for ID, they ask for everything. But that's only a few exchanges or wallet providers doing that. There are still so many that they literally let you go online without any documentation or ID.”

Amir Fadavi, Founder, sanctionsexpert.com

Source: Elliptic

The young tech-savvy Iranian population has readily adopted this array of fintech tools, with even older generations using such tools for purposes like remittances. APIs are coming into shape in Iran, with everything Iranian-built and run. According to Fadavi, the Iranian case reveals the shortcomings of comprehensive sanctions in the digital age, with pain certainly felt, but not altogether to prevent resilient ecosystems from springing forth.

“[Sanctions] make [their ecosystem] more developed, though it slowed the whole thing very drastically because they have to reinvent the wheel every time they want to do something... But this is where sanctions become counter effective: they were designed to stop a country from engaging in certain behaviors by depriving a country from accessing some services, but because a local parallel has been developed, the sanctions imposers tend to have a lesser degree of leverage over the country.”

Amir Fadavi, Founder, sanctionsexpert.com

In Russia, A Seismic Shock?

So how will increasingly comprehensive sanctions impact the fate of Russia’s financial and digital financial systems? Certainly, lessons are to be learned from Iran’s resilience, but a few factors alter the calculus somewhat. Russia is larger than Iran’s economy — and far more integrated with the global financial system than Iran was when sanctions there began, and with higher fintech penetration. The ruble lost more than 30% of its value after Russia’s central bank, among other key Russian financial institutions, was cut off from SWIFT, with the country’s central bank subsequently ordering interest rates to increase to 20%. Russia has spent years accumulating foreign reserves and de-leveraging against the dollar, yet the coordinated, multilateral freezing of Russian central bank assets goes a step beyond Russia’s expectations as to potentially put the country’s financial system in tatters.

It took years for Iran’s financial ecosystem to gain a measure of independence and resilience, and in Russia’s case, the setback will be severe as it's cut off from Western rails and apps. Already, everyday Russians are finding they can't use foreign payment apps like Apple Pay for previously commonplace purposes, like paying for metro fares. Yet if onerous sanction regimes continue and expand, cryptocurrencies and VPNs will figure to play a large role in Russia’s financial operations in the future, similar to Iran. According to Kern Alexander, the nimbleness of fintechs will allow them to better maneuver increasing sanctions than traditional banks.

“If you do restrict transactions with other entities in Russia, fintech is pretty flexible. [It’s] innovative. They'll come up with ways of setting up businesses in offshore jurisdictions… where you can set up your business entity to conduct your fintech business.”

Dr. Kern Alexander, Professor of International Financial Law and Banking Regulation, University of Zurich; Author of “Economic Sanctions: Law and Policy”

Yet the Russian government’s prohibition of foreigners selling securities in Russian companies will lead to a drop in value of them, impacting the customers of Russian fintech firms, says Alexander. And if the situation persists, Alexander believes countries will increasingly focus their sanctions in a more targeted manner on Russia’s third party financial facilitators — their fintech companies.

From the Russian government’s perspective, a break from SWIFT will also likely hasten efforts to develop the cryptoruble, Russia’s central bank digital currency, as well as forging deeper ties with China. How comprehensively Russian banks will be denied access to SWIFT — which remains unclear at this juncture — will greatly determine how effectively Russian entities will be able to utilize “nesting” to access financial channels. In the immediate term, efforts to switch transaction volumes to its own SWIFT-like system, SPFS, will be difficult for Russia in the face of widespread condemnation, and Russian fintechs — especially patyechs involved in cross-border transactions — will need to shut down or dramatically shift operations in more isolated, shadowy manners. Yet if heavy sanctions continue and expand, the regulatory gaps remaining among certain fintech sectors — including paytechs that were designed to avoid SWIFT and its relatively high transaction costs — will be exploited as cryptocurrencies become ever more essential for Russian fintechs and everyday people.

In the new world to come, where a major global power may be shuttered from financial systems, we will see increasingly sophisticated regtech fighting increasingly sophisticated fintech in the struggle to trace the supposedly untraceable. Technology will play a vital role in all levels of sanction regimes: the implementation, the oversight, and yes, the evasion of them. Despite how potent cryptocurrencies are in evading sanctions — and the many ways small-time fintechs may work in facilitating transactions through furtive means, like in Iran — it would be foolish to think sanction regimes’ effectiveness are stymied altogether by fintech tools. Sanctions certainly don’t stop digital financial ecosystems in their tracks. But they will play a decisive role in forcing the Russian financial ecosystem to in a variety of ways undergo a painful transformation to become more self-sufficient — and subsequently less efficient with shallower pockets.

Image courtesy of Andy Feliciotti

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Digitizing SACCOs: Opportunities And Risks

Smartphones In Africa: Reaching An Inflection Point?