Gen AI In Emerging Markets: Is The Hype Warranted?

~8 min read

In an otherwise difficult funding environment, slapping “AI’ onto any product or service has become shorthand for “we’re innovative; give us money.” Whether that’s true, however, remains an open question for investors and consumers alike. In a tech cycle that takes maybe a year or two from idea conception to market implementation, funding remains well ahead of the actual transformation we’ve seen so far. Looking at this from an emerging market perspective invites tantalizing possibilities — still — but also certain warning signs resembling hype cycles past to take note of.

Money Talks

It was one year ago that Mondato Insight boldly declared that synthetic data — the data undergirding generative AI — would transform fintech as we know it. The reasons were manifold, starting with creating GDPR-compliant, privacy-protective data that likewise could power increasingly potent data analytics models that enable personalized risk scoring models and fundamentally overhaul the data economy.

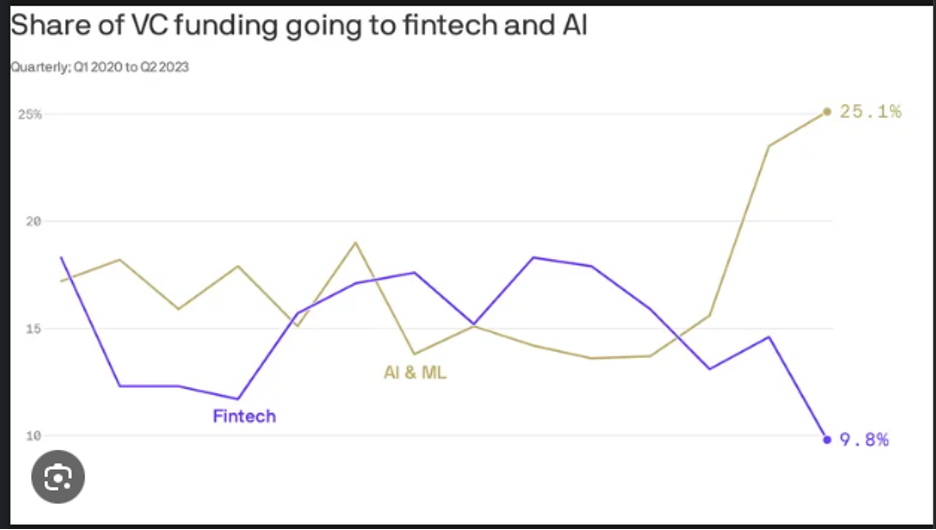

The eye-popping valuations of AI leaders like OpenAI and Nvidia reflect a global trend. In a brutal down year for most tech verticals, 2023 saw a 48% drop in funding towards fintechs compared to the year before. AI, by contrast, saw its funding totals increase 9% to almost $50 billion, according to Crunchbase.

Source: Axios

Both investors and emerging reports suggest digital financial services may be among the sectors most impacted by generative AI when transformation takes place. A recently released report by The Burning Glass Institute claimed financial services will see the greatest impact on its workforce, with “financial examiners, personal financial advisors, loan officers, financial analysts, actuaries and accounts” facing transformation due to generative AI. This expectation of forthcoming transformation, which, according to the report, may impact 60-80% of the workforce of banks and tech companies, has pushed even the biggest of the Big Techs to continue with layoffs to create more budget for billions of dollars in investment towards AI research.

All of this gives the impression that ChatGPT is the harbinger of something much bigger — and we are on the precipice of it. But the step-change leap that ChatGPT made — specifically, the large language model (LLM) algorithm powering it, which utilizes incredibly large data sets to develop deep learning techniques of understanding and data synthesis — should be best understood as only the next significant step in the loosely-defined technology of artificial technology. We haven’t reached the singularity yet, folks.

The early LLMs brought to market are notable for their speed and relative competency in taking complex prompts and synthesizing a good facsimile of what a human can do. The transformation this has had on creative aspects of fintech businesses is already felt in all corners of the globe. In Kenya, Allan Mukui, a career DFS professional from Kenya who is on the board of the Digital Financial Services Association of Kenya (DFSAK), sees the impact in the Kenyan space as mostly dealing with LLM’s obvious strong suit: improving the work flow. This has spurred an immediate impact in how fintechs in Kenya brainstorm ideas and produce digital ads.

In the eyes of Jonas Eichhorst, CEO of Vietnamese digital bank Timo, these select use cases represent more of an “augmented intelligence” than artificial intelligence. The main impact of generative AI at Timo Bank so far has likewise been in regards to workflow. In Eichhorst’s estimation, 30-40% of Timo’s “visual work” is now based on generative AI, which often produces a first version that is further edited and proofread. In a market like Vietnam where English can be lacking, producing adequate English content via generative AI can shift valuable manpower to elsewhere.

Reality Bites

But the reality is that beyond the obvious use cases of LLMs, the more major potential transformations have not yet come to fruition in the emerging market context.

Mukui sees Kenya as primarily being a “consumer” of this nascent technology, following the lead where other markets have an edge in the requisite engineering skill level, money and swathes of data needed to build these generative AI engines themselves.

While digital lenders and other kinds of fintechs across Kenya’s ecosystem advertise themselves as being “powered by generative AI,” Mukui doubts almost any of them are actually doing it. Only true industry leaders like Branch, Tala and Safaricom even have the capacity to possibly do so.

“Everyone is saying, ‘oh, we're using AI to grow cabbage.’ But are they really? It’s just become the buzzword to use with investors.”

Allan Mukui, Board Member, Digital Financial Services Association of Kenya

Smart investors have likewise sniffed out the proliferation of false promotion and fraudsters that always proliferate in the early days of an exciting new technology that few really understand the nuts and bolts of.

“Sometimes companies say, ‘Oh, this is AI-driven, but then you look under the cover, and… there's no new innovation, and they're not really using any AI… A lot of lending companies say, ‘Oh, we have AI-driven models.’ But the reality is they don't — it's just a traditional risk engine.”

Udayan Goyal, Managing Partner and Co-Founder, Apis Partners LLC

As an investor, Goyal approaches generative AI as simply one critical ingredient to several technologies, like the cloud and blockchain, that together can disrupt workflow and engender positive efficiencies by impacting unit economics.

“Disruption happens when the total cost of service or product — the manufacturing cost plus the distribution cost — takes a quantum leap. So we are going to target these areas where we anticipate generative AI to have the highest impact on unit economics, and, therefore, actually disrupts pretty much all the business models.”

Udayan Goyal, Managing Partner and Co-Founder, Apis Partners LLC

In the interim, Goyal notes investment flows in AI proceeding towards sectors that were already a given market’s strong suit. Singapore is seeing particular investment on AI applications in fintech, while India’s B2B sector — think outsourcing — has seen its AI focus reoriented in that direction. China, at the same time, has taken a B2C orientation to its investment in AI innovation.

Source: CB Insights

The early tea leaves — and indeed, it is still awfully early — portend to AI as serving in the nearer term to strengthen a sub vertical’s front-runner status, not shake up the basic characteristics of a digital financial services landscape within itself.

Whether generative AI serves to level the playing field between incumbents and challenger institutions will highly depend on whether regulators — certain to lag behind development and innovation — enable a level playing field in access to the data at the foundation of deep learning networks, or if Big Techs manage to horde the massive data sets needed to produce the “new oil” of the generative AI-powered revolution to come. Such dynamics, Goyal speculates, may even tip the scales in favor of a country like India, which generates the second-largest amount of digital data in the world.

Hallucinating With Money

The real transformation the recent reports allude to — such as managing to automate decisions centered around risk like insurance and lending — are in theory quite game-changing, but in practice far away from sensibly hitting the market. Eichhorst notes that in Vietnam, the banking segment target set by State Bank of Vietnam for loan performance is 97% — or inversely there is only a mere 3% end of year maximum acceptable failure rate to clear for any prospective “LoanGPT” program. “Whenever you use ChatGPT,” he notes, “five out of 10 times, it's going to be ‘Wow.’ Four out of 10 times, it's going to be interesting. And one out of 10 times, it's going to be crazy nonsense.”

Such a success rate may work in businesses like content writing, copywriting or visual design, says Eichhorst — but not when it comes to handling people’s money.

“Anybody who is half honest or knowledgeable is going to say 97% accuracy is pretty much impossible with any of these kinds of technologies right now.”

Jonas Eichhorst, CEO, Timo Bank

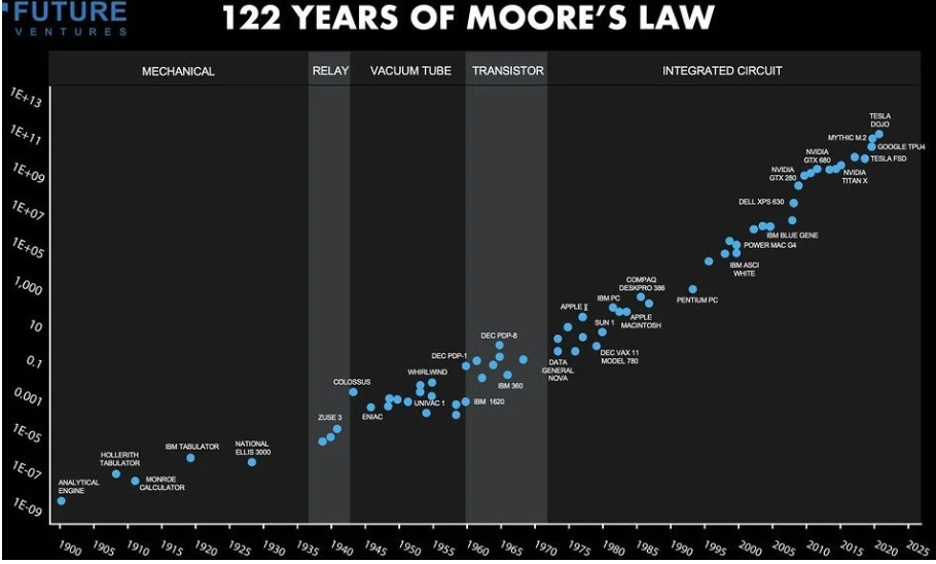

The Gen AI proponent would point out, however, that Gen AI in theory progresses in exponential terms. Moore’s Law — a hypothesis based on empirical data that has continued to be correct for over 50 years – states that computer processing power doubles about every two years. In Gen AI’s case, especially once returning data begins to augment and improve the models created only through synthetic data, the potential exists for rapid improvement.

Source: Unite.AI

At what rate it will take for that progress to reach the extremely low margins for error that financial services demand remains to be seen. Eichhorst even wonders if there are fundamental limits to how much this iteration of AI architecture can progress. Current LLMs fail to address questions crucial to any hypothetical artificial intelligence, like issues of causality that fall outside the original data set.

Some of generative AI’s other proposed use cases in fintech have yet to materialize — even when it comes to its bread-and-butter language processing capabilities. In Kenya, Mukui still sees rudimentary (albeit improving) chatbots powered more by machine learning. He also worries that the wide variety of language and dialects employed in Africa and its fragmented markets will make it even more difficult to get viable chatbots off the ground that manage to incorporate all the differences in dialect.

Such edge case issues are what LLMs in theory solve for — but LLMs are only as good and robust as their original data sets.

In Vietnam, Eichhorst is also somewhat skeptical of Gen AI chatbots. From the vantage point of a digital bank like Timo’s, customers that are facing issues are most likely edge cases that require personalized assistance — not cookie-cutter responses that may only leave customers feeling more dissatisfied.

“In reality, [LLMs are] actually more compression machines than really generating anything new. What that means is, if we're trying to solve something that's never been seen before, you can't actually get there, because your input data didn't include that — by definition.”

Jonas Eichhorst, CEO, Timo Bank

The Limit Does Not Exist… Yet?

Without improving the error rate from 5-10% to less than 3% (and really less than 1%), generative AI will be constrained to certain workflow improvements in financial services, little else. Having said that, we know the technology will improve — if not as fast as impatient investors may have come to expect last year when ChatGPT crashed the party.

However, as Eichhorst points out, artificial intelligence doesn’t have the technological shelf-life of a Walkman CD or the constrained purpose of blockchain as a decentralized ledger; LLMs will be only one step in a progression of advancements in AI architecture and techniques that will unfold for decades to come. But even when technological progress is exponential, progress still takes time.

“I am very optimistic that these kinds of error rates will improve and the domains where artificial intelligence can have a huge impact are going to continue to expand. And I'm not sure what that actual limit would ever be. But it's clear — I don't think we’re anywhere close to where we may have believed we would be a year or so ago.”

Jonas Eichhorst, CEO, Timo Bank

While developed markets — especially their ultra-wealthy Big Techs capable of throwing billions of dollars in R&D at the problem— may set the pace in building out these LLMs, digital financial services in the emerging market context are in a nonetheless exciting time of experimentation with these nascent technologies. It may require some patience and take on forms we did not anticipate until then — but finding the right use cases in correspondence with the technology’s present power is now the exciting (and potentially lucrative) part.

Image courtesy of Steve Johnson

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Open Banking in Nigeria: Are Grassroots Efforts Enough?

Three Fintech Trends From 2023 — And How They May Look In 2024