Quantum Computing: Believe The Hype

~9 min read

It’s still an open question when quantum computing becomes commercially viable. But among those researching and working on quantum computing, there is little doubt that it will happen, becoming the next transformative technology after generative AI. The financial services sector, with many of its industry leaders investing billions of dollars in the research and development of quantum computing, stands to lead the way in this transformation. But as a technology that sounds like science fiction to the average finance professional, a chasm remains between the complex mathematics underpinning such theoretical advances and the superficial understanding among most that it will magically transform financial services and society as we know it. This week’s Insight seeks to bridge that gap and make sense of the seemingly indecipherable — and just how exactly that transformation of financial services will really look when commercial viability is reached.

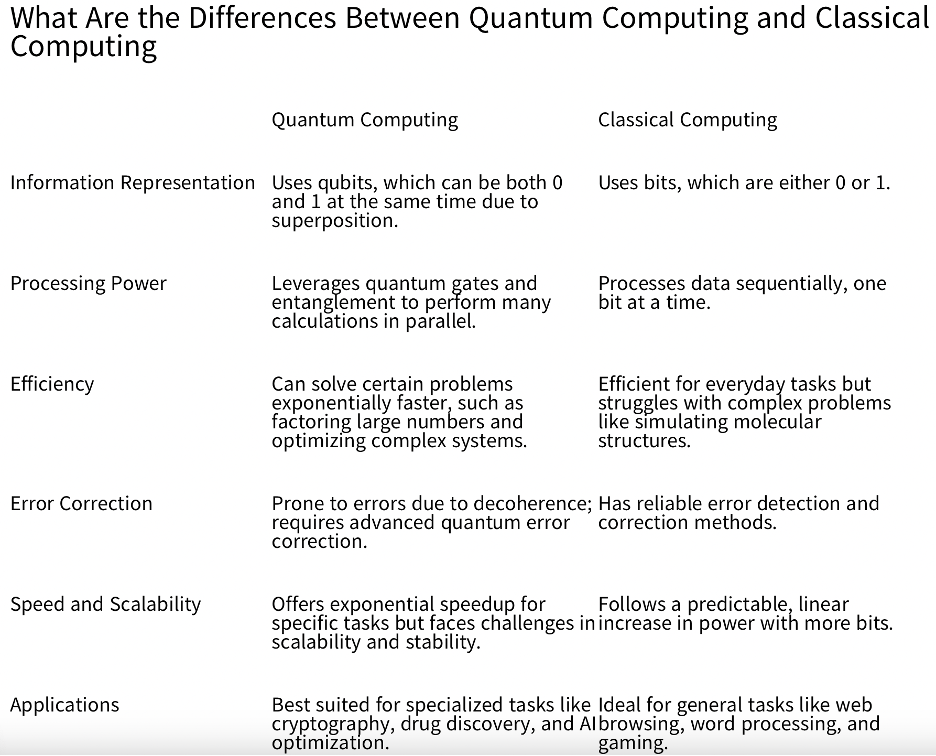

On the Precipice of Transformation

At this juncture, quantum computing is at roughly the same stage that nuclear technology was at in the 1930s: theoretically well-proven, but with work remaining for engineering to put that theory into viable practice. In classical computers, information is represented in binary “bits” — either a 0 or 1. Quantum computing goes well beyond the capabilities of a classical computer by enabling information in the quantum state — “qubits” — to be in a state of superposition, occupying multiple positions at the same time. By doing so, the processing speed of such a computer is increased in quadratic terms; if a classical algorithm takes X time to make calculations, a quantum algorithm takes the square root of X time to make the same calculations.

What in practice this does is to make intractably long calculations and simulations possible. Monte Carlo simulations are computational algorithms that rely on repeated random sampling to obtain the likelihood of a range of results occurring. Although used in areas such as financial trading and financial derivatives, their breadth is limited by the sheer time required to compile voluminous sampling. Quantum computing changes that.

“Instead of hundreds of simulations, you only need 10 to get the same precision, because 10 squared is equal to 100. But those simulations [for financial applications] are usually [done] 10,000 [times] or something, so that this quadratic speedup actually is quite significant.”

Eric Ghysels - Professor of Finance, UNC Kenan-Flagler Business School

Ghysels has already done research describing just how quantum computing would transform areas such as portfolio optimization. While quantum computing would make little difference to long term investors, it completely transforms something like high-frequency trading. “If you really are monitoring throughout the day your portfolio positions and want to trade, then being able to solve this problem in a matter of a few seconds versus a few minutes or half an hour, that's a huge difference,” said Ghysels.

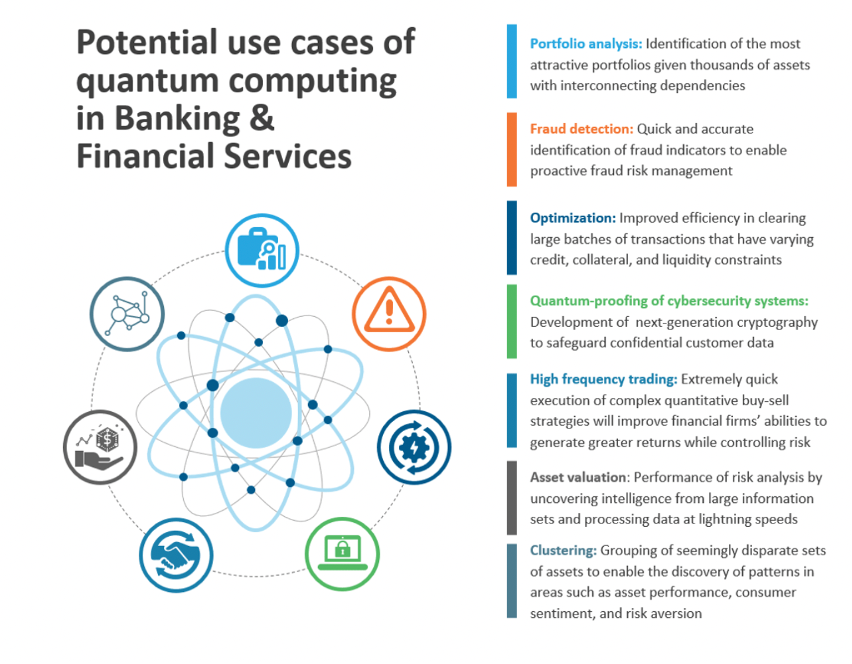

The quadratic speedup in computational power carries over to numerous financial applications: reducing fraud detection times, managing various forms of financial risk, calculating financial derivatives, and even speeding up regulatory compliance mechanisms. Some of Ghysels’ recent research has explored how quantum computing will improve areas such as credit modelling, proving that quantum computing can handle changes in default risks and credit ratings over time in formulating credit decisions.

Source: Everest Group

Source: Everest Group

Another transformative aspect of quantum computing will be its ability to crack traditional cryptographic protocols. In a world of quantum supremacy — when quantum computers can perform computations that even the most powerful classical computer can’t — essentially no traditional cryptographic protocol is protected from the capabilities of a quantum computer, opening all sorts of financial and other data to hacking vulnerabilities. Such a feared “Q2K” explains much of the research being carried out by leading financial institutions such as HSBC, J.P. Morgan, Morgan Stanley and Goldman Sachs. A 2023 survey of 200 financial sector leaders found that 86% of organizations feel unprepared for post-quantum cybersecurity, with 84% anticipating the need to adopt quantum-safe security solutions within the next two to five years.

While most major financial institutions are researching quantum-safe cryptographic methods — one IBM executive estimated to Ghysels that about 75% of international banks are now “quantum-safe” — this is an ongoing process. Considering many regional or shadow banks lack the means to undergo such an overhaul, it is still a significant question whether the financial system — and all sensitive data-possessing institutions, for that matter — will be prepared in time for quantum supremacy.

Slowing the financial industry’s preparation for quantum computing may be a gap in institutional knowledge and skills. Straddling the very different worlds of physics and finance, Ghysels is among the very few economists to heavily research and write about quantum computing. “A lot of [the existing quantum] literature is populated by people who are very strong in physics or computer science, but not in finance,” said Ghysels. Ghysels likens the current dynamics to the advent of financial derivatives in the 1980s and 1990s, when finance firms hired mathematicians who could solve partial differential equations — but lacked an understanding of finances. Ghysels co-organized the first academic conference on financial and economic applications of quantum computing in early April, attracting figures from companies like Amazon, Google, Microsoft, J.P. Morgan and Wells Fargo.

Turning Theory Into Reality

For quantum computers to even become commercially viable, however, improvements in hardware are needed to ensure quantum computers are reliable, scalable, accessible and cost-effective.

Most critically, quantum computers need to dramatically increase the number of physical qubits they contain, while reducing the number of errors they produce. While top-of-the-line quantum computers today contain hundreds of qubits at a time, a commercially viable quantum computer needs thousands, if not millions, of physical qubits.

These qubits are incredibly fragile and prone to decoherence — losing their quantum state — due to interactions with their environment. Consequently, current quantum computers possess too high of error rates — .1% to 1% — for commercial viability, though strides are being made.

In addition, the costs remain commercially prohibitive; a “useful” quantum computer currently would cost tens of billions of dollars considering the complex materials, maintenance, electrical output and skilled labor required. While millions of qubits are likely required in a commercially functioning quantum computer, a single qubit currently costs around $10,000 to produce.

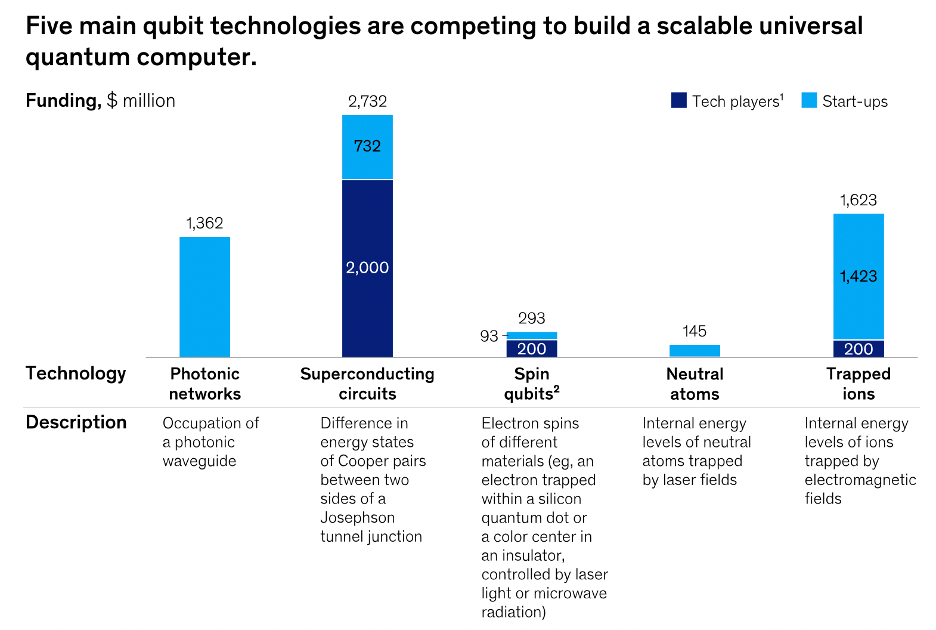

A host of companies are vying to solve these issues of scale, reliability and cost-effectiveness via competing engineering models. Ghysels likens this race — taking place not only among private companies, but through funding from geopolitical rivals like China and the U.S. — to the atomic bomb development in the 1930s and 1940s, when scientists weren’t sure whether a nuclear bomb would be first created utilizing plutonium or uranium. Of the several types of quantum computers being developed at this nascent stage, each possesses its own advantages and disadvantages so far.

Source: McKinsey

Source: McKinsey

A superconducting qubit operates on the principles of superconductivity, in which certain materials exhibit zero electrical resistance when cooled to extremely low temperatures, creating quantum states that are coherent and stable for performing calculations. IBM, Google, Rigetti Computing, SpinQ and D-Wave lead a group of companies developing this form of quantum computing. Currently, superconducting qubits can be manufactured with existing semiconductor technologies, providing it superior advantages in achieving higher scales compared to competing models. It possesses relatively longer coherence times than other qubit forms, and with a longer history of research and commercialization, there is a more robust infrastructure for fabrication, control and measurement. But superconducting qubits are still vulnerable to quantum decoherence caused by environmental factors, requiring sophisticated cryogenic systems to operate and still lacking in the low error rate — and speed to correct such errors — that is necessary to reach commercial viability.

In a trapped ion qubit, ions are trapped in a vacuum chamber using electromagnetic fields and manipulated with lasers. Championed by companies such as IonQ and Quantinuum, trapped ion qubits offer higher precision and longer coherence times than other methods, but considering the difficulty of precisely controlling many individual ions, it faces scalability issues.

Neutral atom qubits use neutral atoms instead of charged ions, holding them in place and manipulating them using lasers as well. Led by companies such as QuEra Computing and the French startup Pasqal, the neutral atom approach possesses advantages in regards to scalability, coherence times and qubit interactions, but precise control of large arrays of individual neutral atoms remains an outstanding challenge.

Other methods being tested include manipulating photons, anions, and individual electrons — each of which struggle so far to check all the boxes necessary for commercial viability.

Despite these significant engineering challenges, Ghysels is all but certain that the engineering will catch up to the quantum theory. “It's a matter of time,” he confidently declared. “That's why there is currently so much money going into this arms race right now.”

Place Your Bets

Dan Caruso, a three-time decacorn entrepreneur, helped lead the fiber optic revolution, but now, he and other big-name investors have their sights set on quantum computing technologies. In Q1 of 2025 alone, investments in quantum computing more than doubled from the year before to $1.25 billion raised. IonQ, with a current market cap of approximately $10 billion, raised $360 million. In Q1 as well, QuEra Computing raised $230 million, Quantum Machines raised $170 million, and D-Wave Systems raised $150 million. “You're seeing more and more data points of quantum companies, both private and public, who are being valued in the many billions of dollars,” said Caruso. “Two years ago, you weren't seeing any of that.”

Alongside the improvements in the technology inching quantum computers closer to commercial viability is the impact that generative AI has on the minds of investors, who also see a technology in quantum computing that is primed to work synergistically with AI.

“Investors are saying, ‘What's the next AI, and how do I get in front of it so that I could enjoy the big gains that will take place when the technology and sector really takes off?’”

Dan Caruso - Managing Director, Caruso Ventures

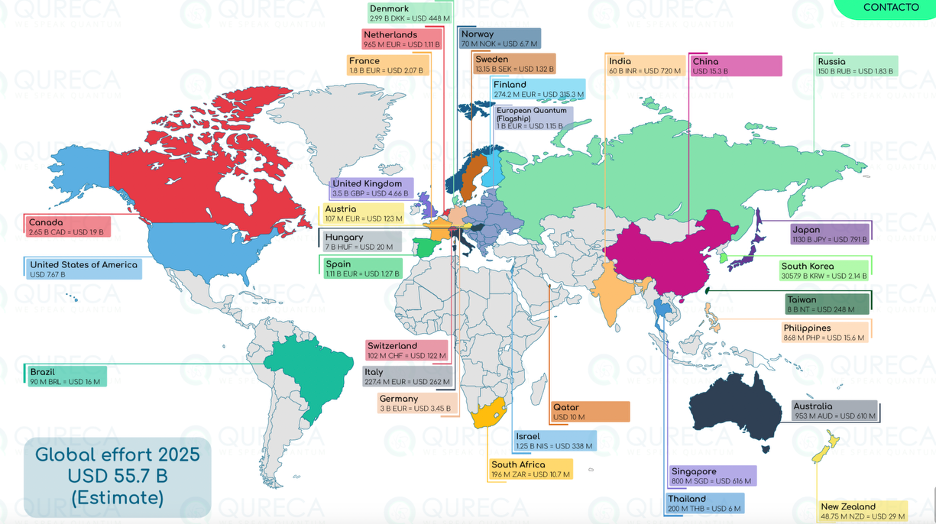

Source: Qureca

Source: Qureca

This private sector investment boom is paired with what amounts to an arms race among geopolitical rivals to attain quantum supremacy before rival countries do — at a scale and breadth not really seen since the nuclear race during and post-World War II. Among countries pouring vast funding into quantum computing technology are China, the UK, the EU and South Korea. The Trump Administration in the U.S. has unveiled a budget blueprint that would keep funding for quantum computing research intact, even as it would slash most other research funding.

Exceeding Expectations

When quantum computing achieves superiority over classical computing, it may have a similar “transformative moment” as ChatGPT’s launch in late 2022. But this transformation will be industry-led, not user-led.

“ChatGPT became a tool that we all are able to use seemingly at the same time. That's not how it's going to be with quantum computing. It's going to be very specialized users, but what they can do with those quantum computers might be gigantic, even in the early stages.”

Dan Caruso - Managing Director, Caruso Ventures

It is likely that for the foreseeable future, how this is commercialized will be through a hybrid approach that combines the relative strengths of classical computing with quantum computing.

Source: SpinQ

Source: SpinQ

“The future is one where you've got your data manipulations and all that happening classically, and then solving a particular problem is sent to a quantum hardware, and the results for the content are projected back up to the classical hardware for output.”

Eric Ghysels - Professor of Finance, UNC Kenan-Flagler Business School

Amid all the excitement, nobody really knows when commercialization will happen — is it just a few years, or at least a decade away? All of this comes down to advances in hardware engineering pushing quantum computing to that point of commercial viability. But in Ghysels’ close study of quantum’s development, he only sees progress outstripping earlier estimations. A 2019 research paper by Google forecasted that it would take about 20 million qubits to crack a standard 2048-bit RSA encryption key. But a new study Google released just last month suggests it would take less than one million qubits to crack such encryption protocols in less than a week.

“What has already been achieved was beyond what was predicted [a few years ago]. The predictions have understated the actual progress, which is not very often the case.”

Eric Ghysels - Professor of Finance, UNC Kenan-Flagler Business School

For all the complex mathematics and concepts undergirding such technological advancements, all of this is to stay that quantum computing, with little doubt, will transform the entire financial service terrain and beyond. Dramatically accelerating institutional knowledge and preparation will be crucial to ensure that the financial system as a whole seamlessly transitions into the quantum era.

Image courtesy of FlyDr

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

The Paradigm Shift of Sovereign AI

Tariff Tech And The Emerging Geopolitics of Innovation