Sanctions And CFT: Recent Palestinian And Russian Case Studies

~8 min read

In a world of widening economic sanctions, de-risking efforts by banks too often leave expats and immigrants from sanctioned regions in the crosshairs. For those who migrate across widening political — and, to subsequent effect, banking — divides, steep learning curves regarding financial norms and regulations are compounded by financial exclusion and limitations. Making such a jump often requires adopting a brand-new financial identity and way of life. The emerging stories of Russians and Palestinians at home and abroad offer lessons for this fraught geopolitical moment the digital finance experiment now must confront.

Adaptation At Home, Exclusion Abroad

From a digital financial perspective, the West’s sanctions on Russia’s financial system since the war in Ukraine began have had uneven effects on the Russian population. As Mondato discussed at the onset of the war, Russia previously enjoyed an advanced digital economy, especially in its major cities. Katya, a woman in her mid-20s, had spent her years in Moscow using all the amenities of the fintech revolution like most urban Gen Zs there. “All the financial services were on your phone,” she said. “It was so easy. Ordering taxis, paying for food, for Spotify, for Netflix. Now, most of it is impossible to pay.”

Katya was spending a winter in Istanbul when the war began almost two years ago. The panic in her neighborhood in Istanbul — where many Russians reside — was palpable. By her estimation, more than half of all ATMs in the Istanbul neighborhood was emptied of cash from Russians seeking to withdraw Turkish lira before their accounts were frozen.

After a week, she returned to Russia to retrieve her money. “I needed to open a bank account somewhere else to transfer money because all my Russian money now was just locked inside of the country,” she recalled. She ended up with “seven or eight bank cards,” opening any account she can in a desperate bid to find something that would work in Turkey.

Very soon, none of them did. When the Russian government began to block the withdrawal of foreign currency, Katya and other Russians began to frantically put their money into cryptocurrencies and then stable coins. But soon enough, Binance announced that Russians couldn’t hold more than $10,000 in crypto — causing Katya further issues after she had already spent two years saving up to pay for a Master’s program abroad. “It was two months of complete mess,” she said.

Following an early panic, the financial system in Russia stabilized even as it was entirely cut off from SWIFT. Despite the sanctions, Mastercard and Visa still work inside Russia — though Western pleasures like Apple, Spotify, Netflix, and even McDonald’s are no longer available.

Source: The Paypers

Domestically, sanctions have done little to dismantle Russia’s advanced digital financial ecosystem, if constraining it to within its own orbit. To this day, Liza, a former product manager at a leading Russian fintech in Moscow, still utilizes the super app of the leading fintech she worked with, which utilizes an interface that starkly resembles the look and functionality of a Revolut.

“It still works perfectly inside Russia,” she explained. “I can still pay for things on my phone.” While Russians can no longer use services like Spotify or Apple — Katya says she “can never lose” her iPhone at the risk of losing all the apps she had downloaded before the App Store was closed off to Russians — workarounds such as VPNs employed at home manage to circumvent some of the restrictions, according to Liza.

This summer, Liza began a monthslong trip spanning Turkey, the Middle East and Southeast Asia, having quit her job and seeking a fresh start elsewhere. But in her travels, the digital native found herself “back in the 20th century.” Unable to use her Russian bank accounts, this fintech product manager relied on expensive money transfers from brick and mortars upon arrival at a new country, operating solely in cash for months after spending years barely using it at all.

“I was thinking that after the trip I would move to somewhere new outside of Russia. I still want to, but now, I’m not sure where I can transfer all my money over.”

Liza, former product manager at leading Russian fintech

Travelling place to place, Liza learned from Russian expats like Katya she encountered along the way some of the tricks necessary to survive financially abroad as a Russian. One of the very few payment facilitators that still work for Russians abroad is KoronaPay, a money transfer app that charges a hefty fee but has set up a series of a brick-and-mortar money exchanges across countries allied with Russia.

Katya says that since the war started nearly two years ago, the network of Russian expats has strengthened considerably through the sharing of information and even assistance making transfers and currency conversions. “It would be impossible to figure it all out alone,” she said.

But each jurisdiction presents its own opportunities and challenges. In Armenia, nearly all the Russian bank cards still work for Russian emigres. On the other hand, In Georgia, where many Russians ended up after the war, even the KoronaPay option is off the table.

In Katya’s networks, while some Russians in Georgia make their money transfers through cryptocurrencies, most often, Russians ended up finding groups on Telegram, matching people who needed Russian rubles with those who needed Georgian laris, for example — creating a de facto decentralized P2P system of money transfers and conversions.

This fall, Katya moved to Barcelona after nearly two years in Istanbul. By now, her Russian financial background feels like “a past life,” relying instead on the Turkish bank account she managed to open with Ziraat Bank in Istanbul.

“I’ve already started fresh, so I’m less scared now. I have my Turkish [bank] account to fall back on now.”

Katya, Russian abroad

Stranger In A Strange (Cashless) Land

While the Russian digital financial landscape domestically has continued to run apace — if with much fewer international vendors operating — the financial exclusion of sanctions is really felt by those who have left Russia’s own financial system, like Katya.

But when it comes to Palestinians who live abroad or transact with the outside world, their positions is of a much different nature owing to the insufficient and dependent financial and digital system they come from — and longstanding worries by banks of being implicated for terrorism financing in the Palestinian market.

Wesam Alqaraja moved in 2019 from the West Bank to Barcelona. Rather than experiencing the “regression” of digitally savvy Russian expats, Wesam was forced to similarly start over with his financial services — in this instance, making a digital leap forward.

In the West Bank and Gaza, Palestinians chronically face issues accessing the global financial market. For years, Wesam enlisted foreign friends to help him send and receive money abroad via PayPal, which does not accept Palestinian banks. While Russia’s digital finance sector is far more robust — allowing for homegrown products to be administered completely within Russia’s banking sector and its regulations, and relatively free of outside interference — Palestinians don’t enjoy such privileges. Few solutions are created for the small yet operationally fragmented Palestinian market. In Wesam’s case, “I only really used cash in Palestine,” he said. “Most places wouldn’t accept cards.”

When he arrived in Barcelona, however, the tables had turned, with some places not even accepting cash. “People somehow judge you if you pay only with cash. They look at you like why don't you have a bank account,” said Wesam. “It's mandatory for everything.”

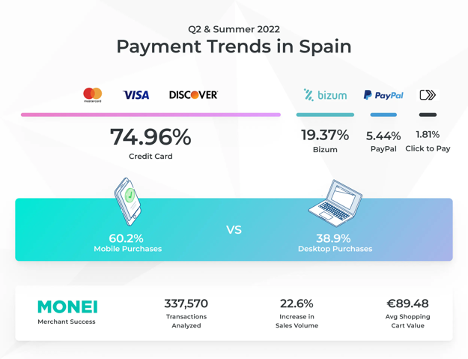

Source: Monei

Restarting his financial identity in Barcelona anew, Wesam quickly ran into issues. “The banks require that you have residency, but I didn't have residency at the beginning because to have residency, you need to have a bank account,” he said with a chuckle.

Then he heard from other immigrants about Abanca. Unlike the other banks in the Spanish market, Abanca permitted Wesam to open a free, basic account using only his passport rather than requiring the residency. With the account, he would soon gain residency.

“I consider myself lucky in Spain. Spain is quite easygoing with Palestinians in general. I have friends in Paris who have it far worse than me. They think all Arabs are thieves and troublemakers.”

Wesam Alqaraja

One Palestinian friend of Wesam’s in Paris, a PhD student, has struggled to open an account or make digital money transfers after being refused residency for three years now. He is forced instead to pay high rates via Western Union.

Though he laments the lack of cash in Spain, Wesam by now has been converted to utilizing Bizum, Spain’s instant payments scheme created in 2016.

“[Bizum is] way easier. I spend so much more money here than I used to just because it's easy to spend money. It's good, but I need [some] management.” — Wesam Alqaraja

Like Supports Like

Though coming from radically different digital financial ecosystems — each of which are now differently impacted by the mélange of economic sanctions and derisking measured employed by countries and banks, respectively — both Katya and Wesam’s financial journeys to Barcelona have been less of a bridge from their former financial identities than a life raft, with little to bring along.

Without having a robust homegrown digital finance ecosystem to fall back on, Wesam is careful avoiding any financial links from back home that can imperil his newfound “privileges”, such as sending money to Gaza. Those who have been trying to send money to Gaza since the war there started have done so with great caution and secrecy. Leaders from Hamas in Gaza and other jurisdictions have recently been slapped with international sanctions, and the already-difficult process of sending money to Gaza has become nearly impossible.

According to friends of Gazans and volunteer organizations who have sent money to Gaza, the already-difficult process of sending money to Gaza has become nearly impossible along a tightrope of questioning legality — if made possible only through digital channels.

One group of people abroad have recently worked to transfer money to a friend in Gaza who has been displaced five times since the war began. Like others trying to do the same, they find they can’t transfer money into Gaza directly. Instead, they have needed to find Gazans with Israeli bank accounts who also have a Palestinian bank account that can take the money from the Israeli bank account, transfer it to their Palestinian bank account, and transfer it over to Gaza via online banking.

Source: McKinsey

But even then, there are limitations. According to another European working for an NGO facilitating cash disbursements, West Bank bank accounts can’t be used to make the transfers without alerting Israeli authorities, who are practicing nearly zero tolerance for money flowing into Gaza right now outside official channels. Rather, the precarious arrangement requires a Palestinian with a bank account in Gaza to make the transfer to other Gazans. That person can’t be in Gaza, however, because under the current circumstances, they wouldn’t have the proper means to do so on the ground there.

Gazans who were formerly in Israeli prisons and, often, their family members, are unable to own bank accounts in Gaza. According to friends of Gazans on the ground, even if they manage to receive the money transfer from abroad — almost exclusively through digital channels — making that cash transfer liquid under the current situation is far from guaranteed.

Such examples of Russians and Palestinians at home and abroad paint a complex picture of digital financial ecosystems in today’s embattled world. As the technocrats advocating for risk-based approaches give way to the blunter instruments employed by political actors, balancing financial access with KYC and AML/CFT requirements becomes an even more difficult task for regulators and banks to accomplish.

Image courtesy of FLY:D

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Three Fintech Trends From 2023 — And How They May Look In 2024

Psychometrics: What Makes A Reliable Borrower?