Digital Distancing: The Key To Payments Reimagined

~5 min read

Digital payments are receiving much special attention at the moment. Firstly, officials in China and elsewhere hypothesized early on in the crisis that the novel coronavirus could spread via physical cash. For this reason, governments have actively encouraged citizens to use digital means of payment like contactless card payments and x-pays. In addition, digital payments have seen a passive benefit from many of the measures enacted to combat the crisis. Social distancing, shelter-in-place, and the temporary closing of storefronts have moved many daily transactions from offline to online, and in-person payments, naturally, have moved online right alongside. This shift will no doubt prove bountiful for some platforms, but burdensome for others -- where will the fault line be drawn?

Channel-Chasers

The combined active and passive effects of anti-COVID-19 measures across the world may be kickstarting what many in the Fintech and Digital Finance industry have been waiting for: a mass push for adoption of digital payments. Optimists have pointed out that, although it likely won’t be a smooth process, the COVID-19 crisis is accelerating a “move to digital alternatives and away from the expensive, costly, and slow incumbent” -- which is exactly what many voices in fintech have been advocating for. It makes intuitive sense; if left with no other choice, consumers will adopt digital payments and, having experienced their convenience and speed firsthand, won’t go back to cash once the crisis is behind them.

But there is more diversity within the world of digital payments than meets the eye. If we define digital payments as those in which the payer initiates the payment electronically (i.e., not using cash or a check) then the category includes channels such as mobile payments, eWallets, debit/credit cards, and cryptocurrencies. The "optimistic" hypothesis states that such channels will flourish under a lockdown. If, all else being equal, commerce is “forced” online by anti-COVID measures, then payments will be forced online as well, to the relative detriment of “paper” methods.

But even within the digital payment ecosystem, fissures between supposedly synergistic channels are emerging. This is because, pre-COVID, even the most digitally native payments platforms were designed to work in an omnichannel fashion, and while some channels are thriving, others have not been as fortunate. For example: users can pay for merchandise with a Visa card at a physical point-of-sale (known as a ‘card-present’ transaction) at a shop or restaurant that accepts Visa. They can also use the same card to make ecommerce purchases online (‘card-not-present’ transactions) by entering their card number, expiration date, and security code. Formerly, this distinction separated two fairly similar aspects of Visa’s broad payment processing portfolio, but card-present and card-not-present transaction volumes are likely to diverge in terms of usage as the crisis persists (although Visa has noted that CNP transactions are also lagging as a result of diminished spending on travel globally).

Win Some, Lose Some

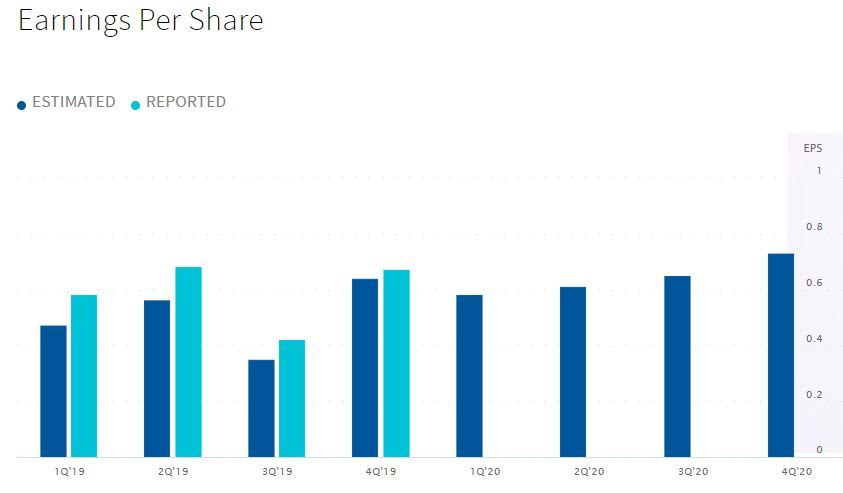

For an example of a platform with signficiant upside, take Paypal. One could expect that, as the original digital payments platform, the firm should emerge from this crisis in a stronger position relative to other financial services firms. The core assumption is that, with its significant exposure to ecommerce, Paypal may benefit from the slice of the payments pie that is growing thanks to the crisis, while remaining relatively insulated from the broader slowdown in consumer spending. At present, this hypothesis appears validated somewhat; projections say PYPL earnings-per-share will outperform 2019 in every quarter of this year -- which is not the case for firms with more diversified service portfolios, like Visa or Mastercard. (Official earnings will be released April 22nd for Paypal and Visa, and May 5th for Mastercard.)

Paypal EPS. Source: Nasdaq

Paypal has also made headlines for participating in COVID-19 relief efforts in the U.S., both on the lending and payments fronts. Along with Intuit and Square, Paypal won approval to participate in the federal government’s Paycheck Protection Program, which will issue loans to small businesses struggling to stay afloat. The firm has also been tapped by the Internal Revenue Service (who is handling the government-issued $1200 one-time direct stimulus payments) as a tech-forward way to disburse funds. While the motivation behind these efforts may be altruistic and not necessarily bottom-line-oriented, Paypal is certainly flexing the strength of its integrated suite of services and stepping up at a time when digital solutions are sorely needed - indicators that the company may be seizing an opportunity to lead their sector.

“When the virus dust settles, long-term growth potential will be back in fashion… the second quarter is going to be awful for everyone. But for PayPal I think it’s going to be less ugly than anyone else.”

Dan Dolev, Senior Analyst, Macquarie Group

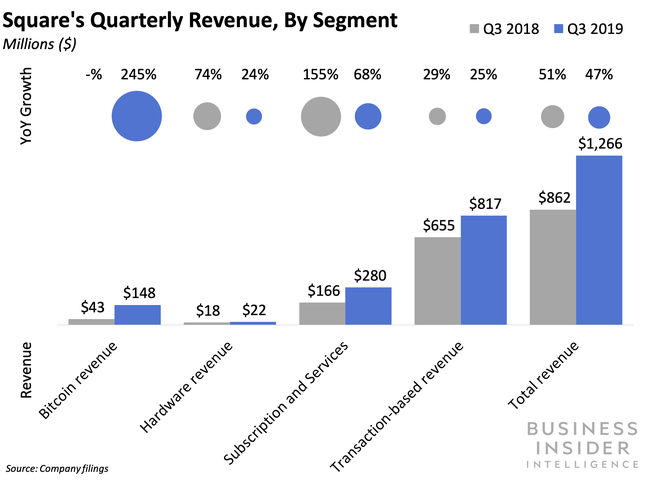

Paypal is not the only company in the payments space pitching in during these uncertain times. Square (and Twitter) CEO Jack Dorsey recently announced he would donate $1B worth of Square equity toward COVID-19 relief across the world. Meanwhile, as a point-of-sale hardware provider and transaction processor popular with small businesses, Square may be disproportionately exposed to the negative effects of the COVID-19 crisis, with little upside.

While the firm has diversified into P2P payments in the form of subsidiary CashApp, as of 2018, 74% of Square’s revenue was still transaction-based. Given that Square is known as a hardware provider, it’s safe to assume that a significant chunk of this revenue consists of card-present transactions - which have all but evaporated. Moreover, the crisis struck at a time when Square’s unprofitability was just turning the corner. For a company depending on a steady flow of card-present transaction fees to lift them out of the red and into the black, few things could be worse than a pandemic which keeps consumers at home and away from shops and restaurants.

Distance, But Make It Digital

Even if governments hadn’t issued warnings about cash potentially carrying the novel coronavirus, banknotes were never going to be popular means of payment during this pandemic. Digital distancing, or using digital tools to perform necessary processes (like paying for goods) without coming into contact with others, appears widely popular where available. However, it’s worth noting that digital payment channels which mimic cash -- like card-present points-of-sale and in-person mobile payments -- are likely to suffer the same fate as their paper analog: simply that no one wants to be near one another.

For this reason, payment channels which instead mimic card-not-present transactions, requiring no face-to-face contact (or geographic proximity at all, for that matter) are better-positioned to ride out the current storm. Consequently, platforms who play in this subarea are similarly advantaged. Although it is broadly true that the new, more-online world opens doors for digital payments and other fintech solutions, those same doors are shut in many cases by the very measures which supposedly created demand for them. If exchanging banknotes can spread COVID-19, then using the same point-of-sale terminal as other customers can too, not to mention visiting crowded markets or pharmacies. Distancing is distancing, and digital payments are only useful insofar as they honor the guidelines put forth in the interest of public health. As long as these measures persist, the success of payments channels will likely follow at least one rule: “the more distance, the better.”

Image courtesy of HelloimNik

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

The Fourth Industrial Revolution: An Opportunity For Africa

Startups Won't Survive Unless They Play Both Sides