Fintech 2022: A Retrospective And A Preview

~8 min read

In 2021, as the world experienced its second year of the COVID pandemic — and the rapid acceleration of digital financial services is turbocharged — two seemingly contradicting features of the new normal emerged. On the one hand, we saw marked democratization of financial services, whether it be among challenger institutions punching above their weight and carving their specialized niches in competitive markets — and even supplanting incumbent institutions — or retail investors impacting markets to an unprecedented degree. On the other hand, we also saw the increasing power and consolidation of industry heavyweights.

2022 will certainly be different, however (doomsdayers’ “2020-two” notwithstanding). These competing trends of 2021 — democratization of finances and consolidation in the tech-native world to come — will come to a head, as stakeholders in the private and public sector further systemize the rapid disruption witnessed in the last two years. To ring in the new year, Mondato Insight takes a look at the significance of some of last year’s prevailing trends — and how such developments will evolve in the coming year.

The Investment Boom

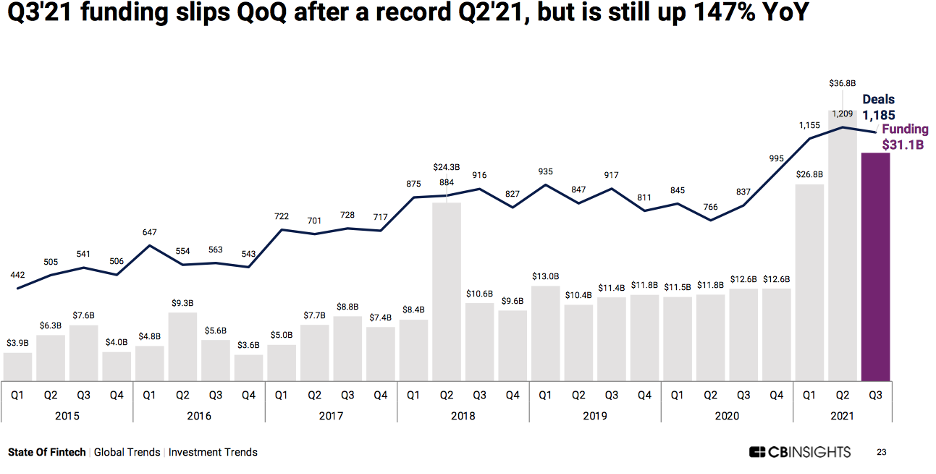

As Mondato discussed in greater detail in November, this past year witnessed unprecedented investment levels in the digital financial services industry. Illustrated by the most recent CB Insights Report, global fintech funding already nearly doubled the levels of funding seen in 2020 through Q3, with many investors, fueled by government stimulus money and armed with excess capital to burn, banking on extended growth into the future as fintech undergoes mainstream adoption and disruption.

The uptick in investment also coincided with a “democratization” of investing itself, which saw retail investors comprise 25%

of daily stock market trading volume, up from 10% before the pandemic. The expansion to everyday investors, fostered by unicorns like Robinhood and its over 31 million users, often times made its impact clear, whether it be the influx of crypto investment seen or the infamous short squeeze on GameStop shares in the beginning of the year.

What 2022 May Bring:

A course correction of some sort is likely in order. Many of the optimal conditions for investment present in 2021 — in particular low interest rates and public stimulus programs — are likely to reverse themselves as governments tighten their purses and attempt to tamp down inflation. Troubles may be on the horizon especially if COVID in 2022 stubbornly continues to impact economies and global supply chains, yet such impediments are not assuaged with government assistance, like earlier in the pandemic.

But while certain asset bubbles amid 2021’s broader funding boom may burst and penetrate fintech markets, the growth and adoption encouraging investments are not going away; if anything, the maturation of digital markets will enable clearer winners to spring forth and ecosystems to stabilize. Though this may reverse the uptick in early-stage investments seen in 2021 compared to 2020, such shifts in investment may enable more solid portfolios as sustained market leaders emerge from the pretenders lavished recently with unicorn status.

Crypto Enters The Mainstream Consciousness

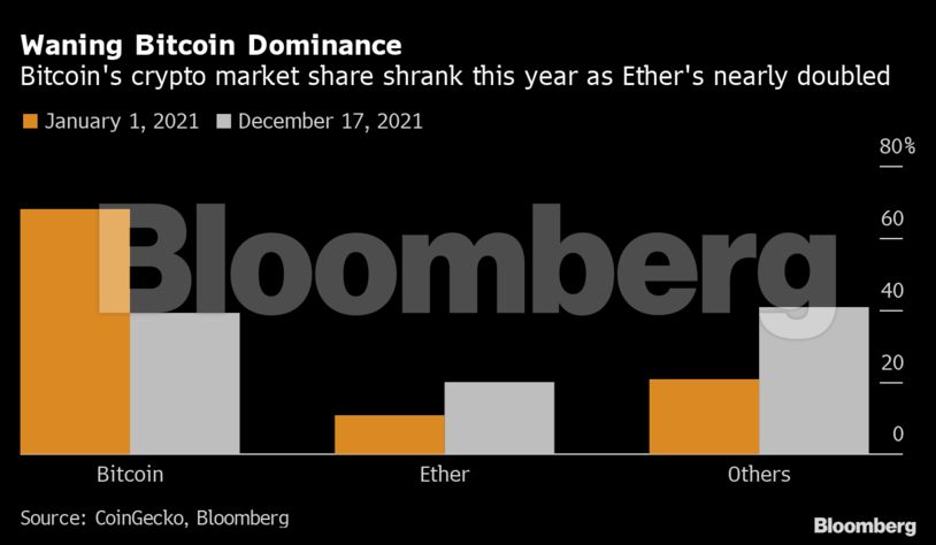

Utilization of cryptocurrencies still remains on the fringes, but one cannot ignore any longer the fervent movement for blockchain-based solutions. A year that began with NFTs saturating buzzy corners of the Twitterverse saw the overall market value of cryptocurrencies increasing by about $1.5 trillion to $2.3 trillion by the end of the year, with Coinbase seeing its IPO debuting at an $85 billion valuation. Investor attention shifted away somewhat from Bitcoin and towards other cryptos with greater potential use cases like Ether — but at times, also meme tokens like Dogecoin. In some sense, the meteoric rise of a token like Dogecoin embodies the contrasting nature of 2021 — an unmistakable trend initiated as a joke by the elitist of the tech elite, Elon Musk, yet fueled by a dedicated group of online investors (and trolls).

However, it wasn’t merely retail investors fueling crypto’s unavoidable presence. Investments from leading tech companies were coupled with the cautious buy-in from some legacy institutions. JP Morgan became the first bank to offer crypto access to retail customers beyond the very wealthy, while several of the leading U.S. banks began engaging crypto markets as well. At the same time, 2021 also saw China’s outright banning of all crypto-related activities.

What 2022 May Bring:

If 2021 was the year blockchain-based payments and technologies crashed the mainstream consciousness, 2022 may serve as a(nother) reality check on real-world uptake and use cases. As Mondato Insight chronicled in June, crypto-related industries are reaching a regulatory crossroads, in which applications beyond mere speculation demand firmer regulatory environments. The EU and the U.S. are primed to look deeper into implementing firmer regulatory regimes over crypto, as fraudulent schemes still flourish in largely unregulated crypto markets. Crypto, undoubtedly, is in large part driven by ever-growing hype, with its feverish fan base seemingly transcending the archetypical Gartner Hype Cycle — how many downturns has Bitcoin already faced? — yet stricter regulation will demand greater responsibility and clearer solutions, with the hope of necessary consumer education to follow.

To rein in the reach and potential havoc of decentralized cryptocurrencies, 2022 might finally be the year for central bank-backed digital currencies (CBDCs) to arrive, starting with China’s digital yuan. Though plans to implement CBDCs have been delayed by the turbulence of the pandemic, greater stability in the fiscal and pandemic situation may allow governments to finally take the plunge with a newly tech-immersed public.

Emerging Markets Have Their Moment

As Mondato discussed multiple times in 2021, digital financial services in emerging markets began to see real market share gains and a flood of investment. An analysis by McKinsey revealed geography — and in particular markets with lots of room for growth — to comprise the largest factor in accounting for a financial institution’s positive price-to-book ratio, a reversal of trends that previously favored more developed markets.

While fast-growing markets with untapped potential like Indonesia have seen rapid adoption of digital financial technologies, the positive trends were arguably most pronounced among markets that combine unrealized market share with enabling regulatory regimes, the greatest example of this being India. With its Unified Payments Interface (UPI) and Aadhaar systems fully operational, India saw its digital adoption take off — likely buoyed somewhat by China’s fintech crackdown. The fintech growth seen in India in 2020 accelerated further in 2021, with UPI transactions growing in volume by 103% in September from the previous year, compared to UPI’s 88% growth the year before; UPI transactions accounted for 49.1% of all digital transactions, compared to 27.4% just two years before.

It wasn’t merely top-down regimes that promoted greater digital financial activities in emerging markets, but the preponderance of alternative financing options servicing lower-income groups — another lever in the democratization underway in some circles.

“I’ve seen a lot of financial access and inclusion being made available in emerging countries through avenues like P2P financing or lending, digital banking, basic personal apps, consumer apps, consumer finance apps, etc. In Indonesia, in Cambodia, even in countries like Laos and Myanmar, this is all moving very quickly. This is the trend that is probably having the biggest impact, allowing the lower-middle mass segment to have access to financing through these different avenues."

Umar Munshi, Co-Founder, Ethis Global

What 2022 May Bring:

As the segment with the most obvious room for growth, emerging markets might be the safest bet for fintech’s positive trends to continue, if not accelerate, especially as funding flows like it never had before and regulations take shape. Long-term barriers like a lack of digital literacy and struggles creating sustainable business models will still hamper efforts to service the lowest economic strata of emerging economies. But the maturation of digital economies in emerging markets and specialization of fintechs will enable increasingly sophisticated products that meet the tailored needs for customers in emerging markets, something that stakeholders like Kevin Mutiso, Chairman of Kenya’s Digital Lenders Association, are anticipating, highlighting regulatory advances like Kenya’s updated CBK Amendment Act of 2021.

“A lot of fintech has been B2B, and a lot of the big players are B2C. But I think you are going to see an evolution of that B2C solution. You are going to see a lot of more niche products, particularly in Kenya, Africa, South Korea, China, the US, the EU, and parts of Latin America that have also opened up in terms of getting to the scale of Fintech 3.0."

Kevin Mutiso, Chairman, Digital Lenders Association of Kenya

Embedded Finance Is Everywhere

With a year of pandemic conditions under its belt, embedded finance became increasingly ubiquitous online. Big techs — and their selective prioritization of payments and other profit- or data-rich financial services offerings — are the most seamless gateways for any new consumer wading into the waters of digital finance, as Mondato Insight discussed in October. If 2020 sought to rapidly expand digital service offerings during the pandemic, 2021 enabled an unprecedented convenience of such financing. But as the recent McKinsey banking report described, leading fintechs, specialists and banks are replicating big techs’ embedded financing model to great effect. First, companies like Klarna and Alipay solve specific yet relevant needs, like facilitating easier cash management for businesses and allowing for simple onboarding, transparent pricing, and BNPL solutions (itself one of 2021’s greatest trends). Working within an ecosystem, top performers like Square can branch out from their initial offerings to develop comprehensive value-added services for specific sectors, with the last step providing customers with personalized analytical insights that increase consumer engagement while multiplying potential data insights.

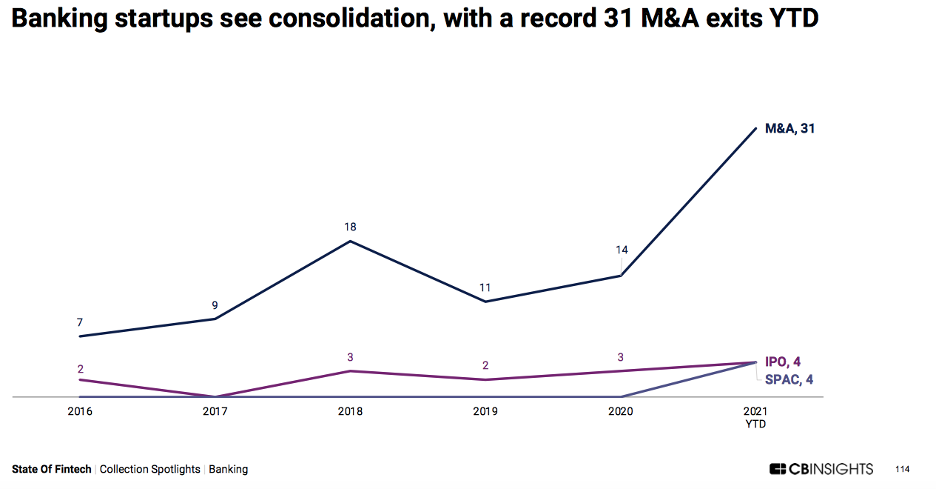

Such trends led to a rapid increase in consolidations — mergers and acquisitions in 2021 far outstripped 2020’s numbers — as legacy institutions sought to augment their digital offerings with banking as a service features. At the same time, the market also saw the ascendance of fintechs specializing in specific sectors primed for embedded partnerships, like Toast in the restaurant industry.

What 2022 May Bring:

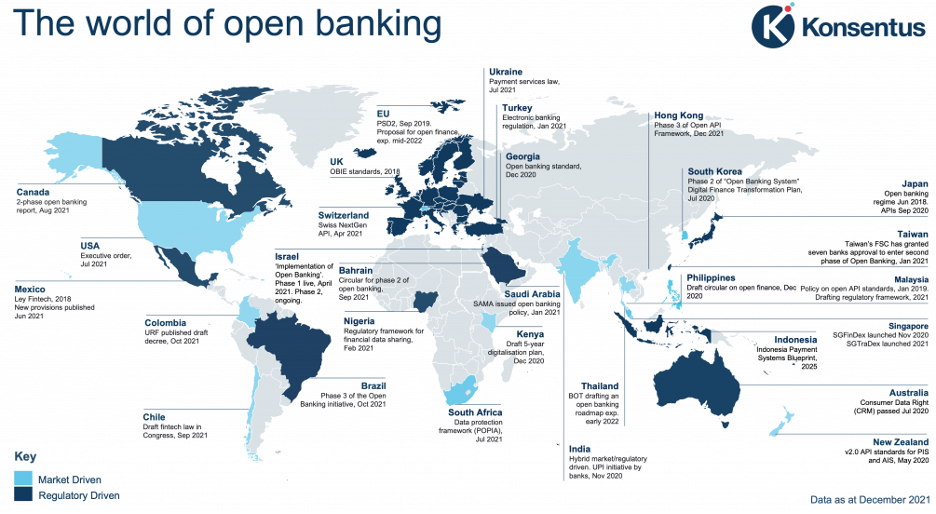

Following 2021’s explosion of partnerships, acquisitions and mergers, open banking is primed to finally take the next step in certain markets by fostering a more flexible and comprehensive version of embedded financing in 2022. It’s likely over-optimistic to expect open banking to truly impact emerging markets just yet, as regulations and the technology are still not quite there, let alone having gone through the years-long implementation process exhibited in places like the UK. But in markets where the kinks have been mostly worked out and companies have had time to adjust, like the EU and Australia, open banking can begin to leap embedded financing forward, facilitating a far more convenient mix-and-matching of specialty services. In places where open banking has yet to be to be formalized, screen scraping and private, consented data sharing will gain further traction.

Such trends will demand either a diffusion of specialized products or even greater consolidation, depending on the capital readiness for startups and competition rules and requirements applied by given regulatory bodies. But whatever the shape of the open banking-enabled ecosystems to come, financial services will only continue to embed themselves deeper in all corners of the digital economy, with greater specialization and more tailored solutions sure to come.

Image courtesy of Joshua Sortino

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Live Commerce: Is Culture A Deal-Breaker?

Australia’s Digital Economy: On The Precipice Of Transformation?