Germany’s Cash Culture: Entrenched, But Evolving

~10 min read

In Germany, the winds of digitization are blowing, though they may be more swirling than a concentrated gust. You can find it in the buses of Berlin, which announce to riders that “starting September 1st, payment will be cashless only” — never mind that there’s no electronic payment gateway present nor bus employees to validate e-tickets. You can see it even while entering the small shops and restaurants tucked within the cobblestone streets of Göttingen, a bustling small university city. In these shops, Germany’s longstanding cash culture is both confronted and confirmed, evolving yet entrenched. As German culture and bureaucracy slow the tide that inevitably turns on cash, a deeper look into the hearts, minds and shape-shifting wallets of Germans reveals both the inescapable gravity that is digitization — and a resilient attachment to cash shapeshifting according to these changing times.

Cards For Candies?

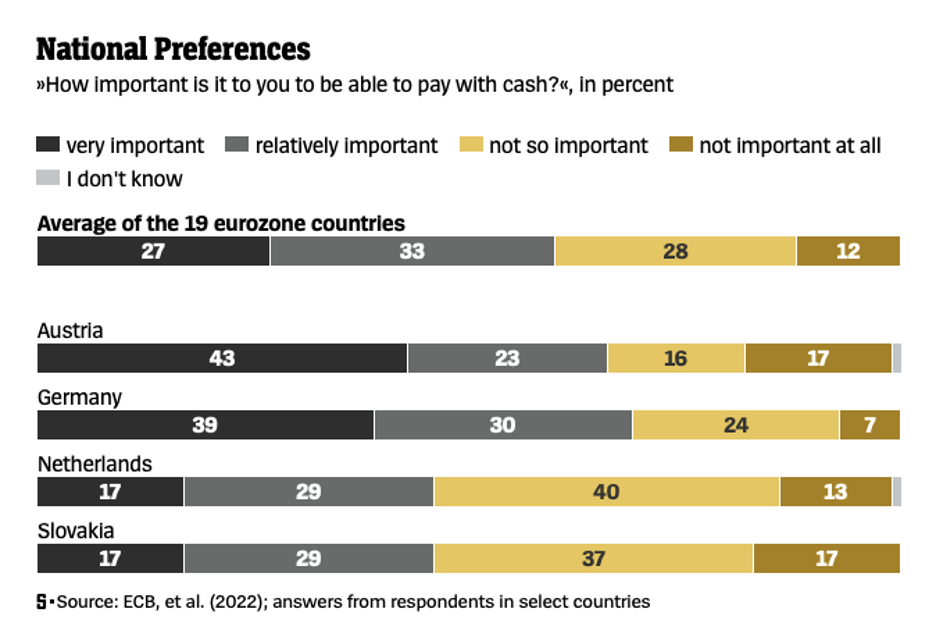

As Mondato Insight has discussed before, Germany consistently rates among the highest in European metrics for cash usage, with digital adoption waning compared to its peers.

Source: Der Spiegel

Source: Der Spiegel

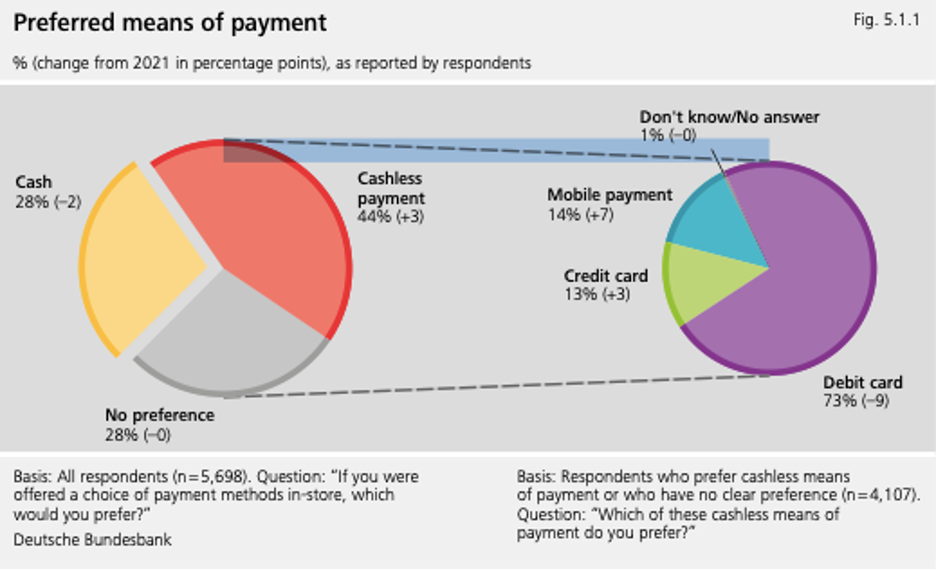

Now more than four years after the start of COVID, however, (some) change has come. According to a survey released in July this year by the Bundesbank, Germany’s former central bank and its member of the monetary Eurosystem, the digital gains made during COVID have continued even after the pandemic subsided. In late 2023, when the surveys were carried out, cash comprised 51% of all transactions made by Germans — a decrease of 7% in only two years’ time. This drop in cash usage was replaced by growth largely with debit card usage but also through mobile payments, which increased from 2% to 6% of total transactions from 2021 to 2023.

Such figures align with what over a dozen shopkeepers and small business owners reported on the streets of Göttingen. Whether it be at sweets shops, clothing stores, hardware stores, bakeries, kiosks or computer stores, nearly all described to Mondato Insight a perceptible increase in adoption of cashless payments. “Up and down the street here, all the stores began accepting contactless,” said Alfred Ewert of the Ewert Tea House. “And the trend against cash has continued ever since.”

Not only how people spend, but what financial tools are used continue to change. After the percentage of respondents in 2017 who said they don’t use online banking (42%) halved to 21% by 2020’s disruption, that figure only crept up slightly to 23% by November 2023, according to the Bundesbank survey.

Further along Weender Street, even places like the Susswaren Factory, a specialty shop offering mostly Japanese candies and niche foreign snacks, have taken to cashless payments. About half of the mostly young customers at Susswaren Factory pay with cash, while others pay with card, according to the store owners. Susswaren Factory had recently installed a Sumup POS device due to growing demand for cashless payment options even for the low-ticket snack items on sale. According to the store owner, it’s actually the teenagers who still pay with cash at the store because their parents hand out weekly allowances still in cash.

Source: Bundesbank

Source: Bundesbank

But such trends aren’t uniform. At Cocoon woman’s clothing store also on Weender Street, the installed NFC-enabled POS device is used much less, with customers almost never utilizing a mobile device, according to Louisa Ode, a young cashier there. That’s because most of the store’s clients are older women. “It’s too complicated for them,” she says.

That’s not the case for Ode, who says she’s been paying with her phone for three years now after her father, a banker, introduced the technology to her. “It’s not so complicated,” she said, “and it’s really easy. So why not?”

Kids At A Cash Crossroads

The age divides across the German DFS landscape appear at first blush to be typical. The Bundesbank survey found Germans 18 to 24 years old used cash the least at 35%, while those over 65 years old had the most percentage of their transactions done in cash, at 64%, with only a fraction utilizing mobile devices.

But inherited social attitudes towards cash can be difficult to shake off even among the younger cohorts.

Paulina Döbbe would seem to fit the demographic of a German convert to cashless payments. She’s 25, a medical student from a family of high-earning doctors, with experience abroad in countries much more digitally friendly than Germany. Nonetheless, she retains an aversion to paying with her mobile device. Döbbe mostly uses her physical debit card for payments, she says, and with many shops still only accepting cash, she looks to always keep cash on hand.

Döbbe’s more tech savvy brother had gotten her to sign up previously with N26, a leading German neobank, but she cancelled her account due to the monthly fees. He encouraged her to utilize her mobile device for payments, though she’s still not comfortable with it.

“It still feels kind of weird that my whole bank data is so easy accessible. By just clicking twice on my phone and then putting it on whatever machine, I have made a payment. That feels like giving a bit of control over my money to a machine that could be accessed by I don't know.”

Paulina Döbbe, Medical Student

Döbbe expressed further wariness over the traceability of her digital transactions, unsure of what kind of surveillance this may elicit. Döbbe had never heard of the EU’s PSD2 directive, let alone the proposed PSD3 directive intending to empower individuals with their own payment data.

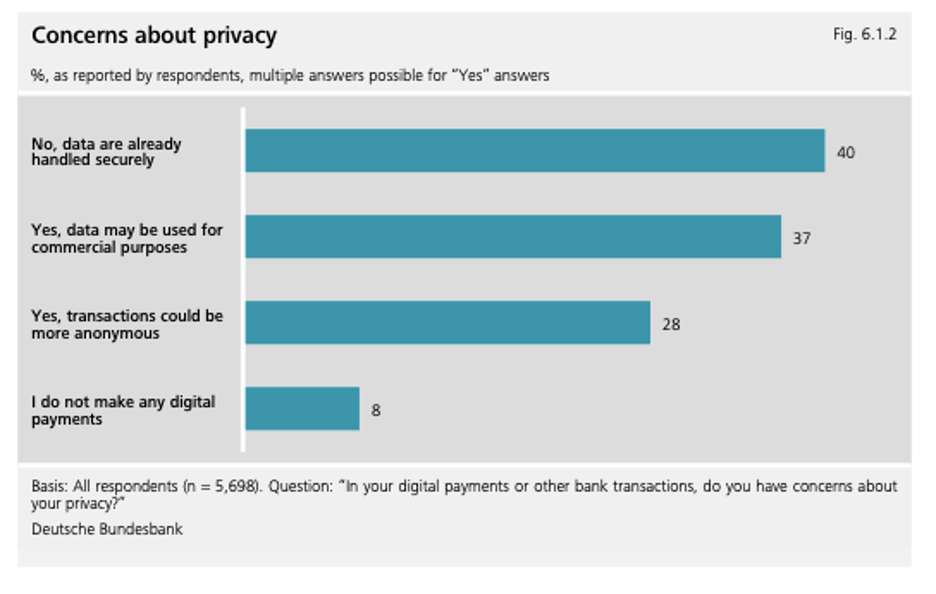

Döbbe’s worries about data security and privacy reflect lingering concerns slowing the pace of digitization across German society. While 90% of Germans surveyed by Bundesbank said that their bank responsibly handles payment data, that figure drops to only 20% who say that’s the case with Big Tech firms, with only 17% saying startups or fintech firms responsibly handle payment data. Likewise, of those surveyed, only 40% of those surveyed believed their payment data was being handled securely, with pluralities believing their data may be used for commercial purposes or could be more anonymous.

Source: Bundesbank

Source: Bundesbank

Such fears leave many Germans perceiving cash as the only tangible and reliable form of currency that can’t be easily manipulated or tracked. “We Germans say cash is the only true money,” said Alex Hermann, a young employee at Snipes, a sneaker store in Göttingen. “And especially old people – they think plastic is just not good.”

At the sneaker store, however, Hermann observed few making transactions using cash, in large part due to the higher-ticket price for the high-end basketball sneakers sold to a largely younger crowd. “Every payment is like 100 something euros, so people don’t want to take 100 or 200 euros with them,” said Hermann.

Indeed, while half of the transactions at German brick and mortars were done in cash according to the Bundesbank, that figure drops to only 27% when measured by total amount, with credit and debit disproportionately used for higher-ticket items.

Especially younger Germans are increasingly opportunistic in using digital forms when it is convenient. “I wouldn’t say people like to use card more, but if it’s easier to do it with card, they do it,” said Hermann.

Old School Vs. New School

Even as card acceptance inches towards ubiquity, it still falls short of how widely accepted cash is. At Lutze’s bakery in Göttingen, the older store owner keeps a strictly cash-based business. “I am old school,” she said. “It is nice at the end of the day to have my cash and that is it. And it is nice to see all the money I have made at the end of the day.”

And what if people come and they only have card?

“They come back again with cash,” she replies with a smile. “You know my food is good!”

Indeed, while 97% of Germans surveyed by Bundesbank said their cash was always accepted by merchants in the past month, only 82% could say the same with card.

Sometimes, cards aren’t accepted because owners like Lutze’s remain “old school.” Other times, it may be because of simple economics. At Zanko Göttingen Kiosk, they apply a 10 euro minimum to allow for card use. “I have to pay taxes for the card payments, so it has to make economic sense,” said the store owner. Other kiosks may add a surcharge for such small card purchases.

At two kiosks located in the hip neighborhood of Fredrichshain in Berlin, the reasoning for going cash-only was also simple: “taxes, man,” as one of them put it.

Or, as it’s also referred to: tax evasion.

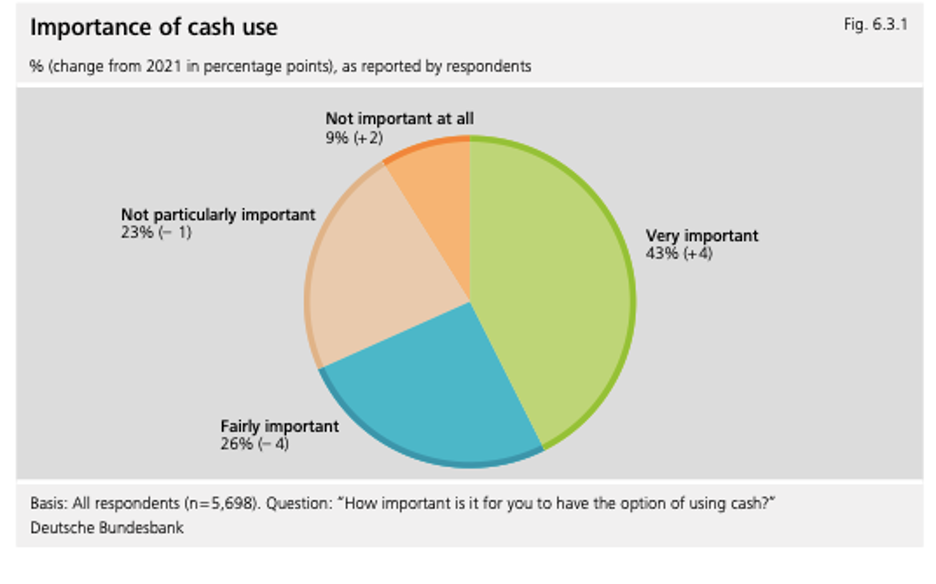

The Bundesbank survey found about three quarters of Germans wish for cash to be used in the future at least as much as now. And Germans surveyed continue to say that it is important to have the option of using cash. Though the payment mix may shift, cash will certainly remain a key part of life in Germany.

Source: Bundesbank

Source: Bundesbank

But as Germans become more comfortable and familiar with digital forms of payments, digital uptake will continue to increase. Even Döbbe, the young digital payments skeptic, says that once more people in her circles use digital payments more frequently, it may allay her data privacy and security worries.

“I have to admit to myself that [digital payments are] so much easier and so much more convenient, and that my skepticism is maybe misplaced,” said Döbbe. “Especially if my friends in Germany would also start using cashless payments, that would show me that it's totally fine to pay by phone. I guess it’s still just so new here.”

Death, Taxes, And Bureaucracy

These cultural characteristics serve to merely delay, not stop altogether, the march of digital payments, but another factor threatens to do the same: bureaucracy.

Take the example of the Spore Initiative in the hipster Berlin neighborhood of Neukölln. A cultural center housed in a sleek new building focusing on promoting the arts and biocultural diversity, it’s the exact kind of forward-thinking institution one would expect to be at the forefront of going cashless. But more than a year after opening its doors, the institute continues to be cash only, forcing visitors to withdraw cash at an expensive ATM across the street.

According to Patricia de Almeida Santos, a host at the Spore Initiative, this is because the Spore Initiative still hasn’t been granted the proper business licensing that would enable them to accept digital payments. “We’d love to go cashless, but we don’t know when they will ever grant us the business license,” she said to a nervous chuckle.

In the specific case of the Spore Initiative, Germany's national financial regulator, the Federal Financial Supervisory Authority, also known as BaFin, told Mondato Insight that such licensing responsibilities would be with local or regional authorities. Up and down the regulatory system, it's no surprise that bureaucracy in Germany, a place known for its strict adherence to rules, is often long and arduous to navigate. But experts like Florian Möslein, professor of law at the Philipps University of Marburg, believe the administrative approach to digital finance licensing — which is under the responsibility of BaFin — has slowed that rate of technological implementation and ultimately adoption by businesses.

“How [BaFin] interprets rules, how [they] interpret conditions for getting licenses — like how many documents you need, how long the process takes, etc. — it’s very practical, administrative minor points that add up to being a real inhibitor to growth in the digital sector.”

Florian Möslein, Professor of Law, Philipps University of Marburg

In response to some of these criticisms, BaFin told Mondato Insight through a representative that the authority “has put the issues of reducing complexity and improving proportionality on the authority’s agenda of its own accord”, offering as an example the introduction of robotic process automation to evaluate applications more quickly.

In regard to the complaints of businesses and those in the fintech industry who say the regulatory process is too slow and restrictive, BaFin calls itself “technology-neutral”, stating that its “same business, same risk, same rules” principle applies regardless of the technological considerations. For the sake of “maintaining the integrity of the financial market”, BaFin declared, “young and innovative companies will not be treated differently from other market participants.”

In the eyes of BaFin, “reducing bureaucracy, complexity, and proportionality” also means” no reduction in the ‘stringency’ of regulation”.

“We want to enable and support innovation. Innovations and new business models are a decisive factor for the competitiveness of the financial [sector]. However, a BaFin permit must be a seal of quality that stands for integrity. The duration of an authorization procedure also depends to a large extent on the quality and completeness of an application.”

Federal Financial Supervisory Authority, Germany

From Möslein’s perspective, this administrative philosophy is connected to Germany’s general aversion to digital payments; both are a byproduct of German culture, after all. But having testified to the Bundestag in regard to the crypto industry — which is facing pushback from BaFin as well — Möslein believes that like the purely cultural factors, such a stringent, uniform regulatory approach may ultimately be holding Germany back from innovation.

“What I think is missing [from the regulator] is a market-based approach, an entrepreneurial, forward-thinking approach… in order to change the attitude you need a different thinking, a different mindset within the regulatory body, and that is, of course, difficult to transpose.”

Florian Möslein, Professor of Law, Philipps University of Marburg

Among its European peers, Germany may stand out, but it certainly is not alone in both its cautious approach to innovation and a not entirely unrelated economic malaise; just this month, Mario Draghi, former president of the European Central Bank, declared in a report that the EU must additionally invest up to 800 billion euros a year to remain competitive with the US and China. As both digitization continues apace and long-term pressures on the German economy intensify, the real question becomes whether such developments engender a real change among regulatory bodies and the population itself — or if cultural inertia wins out.

Image courtesy of Christian Wiediger

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Are Accelerators On Borrowed Time?

Argentina: Can Bank-Driven Wallets Compete With Big Tech Platforms?