Inclusion Through Gig Work: A Tricky Venture

~8 min read

The idea to utilize gig work for financial inclusion purposes is obvious, yet its manifestation is elusive. The formula was supposed to be simple: take smartphone-owning gig workers often coming from the informal economy — and “bundle” their digitally-enabled work with relevant financial products. Data from their gig work could even serve to build on previously thin files. Yet as a series of recent CGAP reports reveals, providing financial service products to gig workers is often the culmination, rather than the kick start, of a successful digital payments revolution. Design, touch, guidance, and strategy decide whether adoption actually happens, with different pathways across heterogeneous market and worker profiles — but at the end of the day, the broader fundamentals make it possible.

It Starts With Fundamentals

A CGAP team led by Gayatri Murthy, with Malika Anand as the lead author of recent publications, worked across geographic, market and platform contexts to research and help deliver relevant and affordable financial products to gig workers in five pilot projects with platforms. Throughout the process, they also spoke with about 50 platforms in regards to financial services for gig workers. Over the course of its research, CGAP identified the many strengths of gig work as a conduit for financial inclusion, though with its current shortcomings as well.

The researchers found that while aspects like design, acquisition and platform-worker relationships do matter, success depends first and foremost on the fundamentals of the given environment. For starters, they found it easier spurring adoption in pilot projects operating in places with an advanced digital payments apparatus from a regulatory and normative perspective, like Kenya and India.

“There are certain kinds of environments in which financial services feel natural and other instances where it's new, and maybe feels uncomfortable, and there has to be some kind of trust building, engagement and introduction of the services.”

Malika Anand, Consultant, CGAP

A simple characteristic to meet, yet easier said than done; Kenya and India, after all, remain the exceptions with such well-integrated digital payments infrastructure down to the bottom of the pyramid.

Besides having an advanced digital payments infrastructure, the other most telling fundamental attribute for savings and insurance products — laggards in the space compared to credit — that Anand and Murthy discovered was having deductions done automatically. In India’s UPI inclusion wonderland, the tech stack allows for seamless automated deduction — a function still unavailable in Kenya’s mobile money-driven, M-Pesa-led infrastructure. The gig workers CGAP spoke with were most responsive to apps with consistent, automated deductions that were small enough to feel painless.

One pilot that stood out in this respect was with ABALOBI, a market facilitator for small-scale fishers in South Africa. The ABALOBI savings product, which automatically deducted a percentage of the fishers’ earnings smaller than even the fishers had suggested, was launched following months of studying the workers’ habits and preferences — and with the help of several iterations. They settled on an “intermediate approach” balancing simplicity with a sensitivity to earnings fluctuations. With extensive personal attention offered and coaching available, the program managed to see two-thirds of the fishers offered the product using the product consistently, saving an average of $750 over 250 payments in four months.

Without access to a mature digital payments infrastructure or automated deductions, Anand and Murthy say platforms are forced to come up with workarounds that often render digital financial products less seamless or trusted in the eyes of gig workers, depressing adoption.

Finding The Right Fit

But even with the baseline characteristics of a mature digital payments infrastructure allowing for automated deductions, CGAP's research found that off-the-shelf products don’t really cut it with the needs or irregular characteristics of gig workers. A whole host of factors and stakeholders need to be working in the product’s favor for gig worker adoption.

“There's no kind of silver bullet for you to get the marketing campaign right, where falls into place. It really is about the entire sector community working together correctly: the regulatory side, the tech side, the digital payment side, and the platform side.”

Malika Anand, Consultant, CGAP

Anand and Murthy kept coming across instances where uptake of financial products was lacking because of incomplete integration into the platform's app or a mismatch between the platform and financial services offered. One project that initially failed to see adoption was Nigerian e-commerce company Jumia’s offer of telemedicine and hospicash insurance services to MSE sellers on the platform. Also facing tedious registration, workers reported to CGAP feeling uncomfortable accessing health products through an e-commerce site. By contrast, Indian ride-hailing platform Ola enjoyed success in offering car insurance to their drivers, doing so in a far more seamless, easy-to-use setting than Jumia had managed. This was bundled further with health insurance that remained relevant to their individual context.

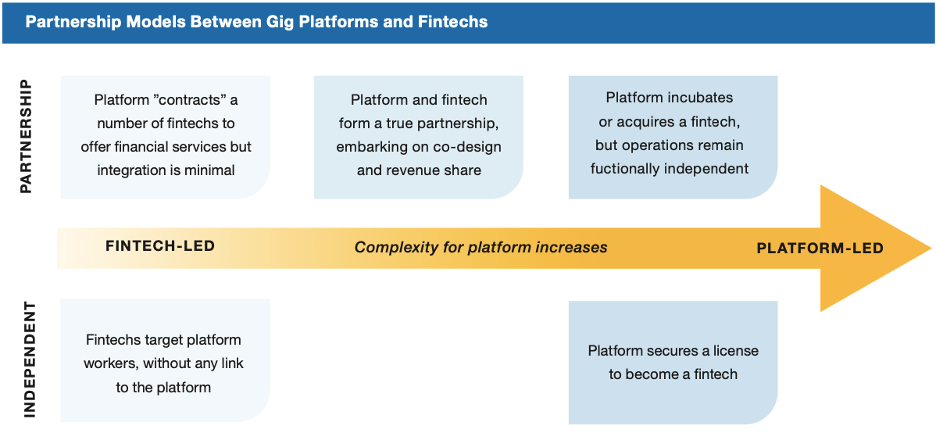

In surveying the spectrum of partnership models and arrangements, Anand and Murthy identified pros and cons for each of them, with their ultimate value coming down to contextual fit. As they lay it out, at one end of the spectrum are the platforms that decide to create fintech products in-house. In this instance, a more seamless process combines with the (potential) integration of data, though with the higher costs and challenge of creating compelling products outside a company’s bread and butter. At the other end are fintech-led products with minimal integration. Straddling these extremes are where most of these nascent products are: a partnership often between specialized fintechs and platform behemoths.

Source: CGAP

The CGAP pilot projects facilitated several types of arrangements, with the common denominator for success being a willingness to listen and adapt. SafeBoda stands out for its in-person engagement with its drivers, including ongoing “service weeks” and a SafeBoda Academy, where drivers receive guidance, purchase equipment, and learn about new products and services, among other perks. SafeBoda created a savings product in-house, starting with a flexible voluntary savings product. After fixing early issues with onboarding and registration challenges, SafeBoda saw early success in its program, but this soon plateaued, even with additional marketing and ambassador efforts. Listening to further feedback from drivers, SafeBoda removed minimum account balances and created a new “daily saver” product that automatically deposits certain amounts on days when earnings exceed a threshold — a gift for later, rather than a momentary deprivation. Especially with the advent of an automation feature, adoption picked up steam.

“When [gig platforms] do [financial services] right, it's because they get in-house expertise, figure out the way it's been done until now, and reconfigure it for this space.”

Gayatri Murthy, Financial Sector Specialist, CGAP

The ambitious model SafeBoda went for — spending labor and capital for an in-house product — won’t work for many platforms already operating on thin margins. Though grappling with more potential integration challenges, partnerships may allow for a range of options that can suit the individual needs of a gig worker. Anand and Murthy praised Little App, a Kenyan ride-hailing service, for offering a large variety of financial services to its drivers. While it took Little App drivers some getting used to, the workers told Anand and Murthy they were finding options that actually suit their needs.

“You don't want to bet on just one horse, but rather, you want a bunch of different horses that you can use for a bunch of different use cases.”

Malika Anand, Consultant, CGAP

Crunching The Numbers — Or Finding Numbers To Crunch

As savings and insurance products for gig workers inch along, credit products have proliferated. But even there, critical steps lie ahead. What’s often on the market for gig workers are lower-ticket products erring on the side of caution rather than advancing riskier but potentially more transformative products like car loans.

“To do [credit] scoring well, you need to be ready to see and absorb some loan default to improve predictability, and you have to do it over many cycles. Then you're really unlocking the value of the data.”

Gayatri Murthy, Financial Sector Specialist, CGAP

An underlying issue to consider in all this is where these gig jobs — and their newly accompanying financial products — should really lead to. The avenue for economic improvement providing a loan to an SME business owner is apparent; what about a car loan for a ride-hailing driver? “I think we, along with the rest of the financial inclusion community, are still trying to formulate that,” mused Murthy.

The lending potential in the gig economy is further diminished by the complete lack of platform data sharing at this point. Privacy-enforcing open data regimes remain the clearest to enable the kinds of insights allowing gig workers, with all their irregularities, to be properly serviced. This is both reinforced and stymied by the frequency gig workers are employed across multiple platforms — which, due to overlapping worker skillsets, are often competitors to one another.

But gig work as a person’s first or second digital footprint is still ripe with inclusive potential. The CGAP pilot programs worked with two of the leading fintechs collecting platform data, Africa’s Moove and India’s KarmaLife Financial. KarmaLife Financial works with drivers in trying to secure higher-ticket, installment-based loans for vehicle or fuel purchases — the exact kind of credit gig workers often need but can’t obtain. Early results from their work with KarmaLife found that greater earnings, longer working hours, and higher driver ratings were associated with lower repayment risk. Benefitting primarily thin-file workers, 90% of loans to such workers were repaid on time.

“We have seen a positive impact of using work data… And I think that works at two levels. On one hand, we can be far more inclusive, by a factor of four or five compared to… a bureau score driven eligibility model. The second is the ability to deduct our repayments at source when there is a payout from the platform with the user’s consent, making the repayment seamless and effective for our business model.”

Badal Malick, Co-Founder, KarmaLife

Moove goes a step further, collecting driving data via remote sensors to predict the risk of repayment. As Moove’s Chief Strategy Officer told CGAP, the different types of data enabled Moove to improve affordability and their revenue-based financing model. Moove tailored its offerings to include customized vehicle, health and life insurance along with service and maintenance.

But leveraging platform data is easier said than done — and it’s still barely done. Designed not for machine-learning or credit-scoring purposes, platforms collect minimum information required when onboarding workers, seeking a seamless work experience. A chicken-and-egg problem persists as platforms struggle to see the value of collecting more data — which also come with privacy concerns — and so they collect little Anand expressed concerns these data collection practices are often used punitively rather than as a vehicle to expand inclusion.

Until these issues are sorted out, the significant promise for gig work to provide the requisite data to jump start a thin file is often more aspirational than realistic at this juncture.

“Past repayment is still the best indicator of future repayment. We can keep collecting more and more data, but how useful it is, especially for credit providers, is still very much in the experimental stage.”

Malika Anand, Consultant, CGAP

Bridging Data — And Info — Siloes

Untapped potential for financial inclusion remains at the same time gig work makes tangible impacts on people’s financial lives. According to CGAP findings, approximately 60% of platform workers surveyed said it was easier to cover expenses and achieve financial goals since joining platform work. At the same time, 45% believed they did not have access to the capital needed to improve their skills leading to better pay.

Many of the underlying constraints — such as data silos, irregular habits and misaligned value propositions between platform and user — to utilizing gig work as a conduit to financial services adoption are simple to state, and stubborn to solve. The obvious solutions, like open data regimes, automated deductions for savings and insurance, and mature digital payments infrastructure, remain exceptions or altogether absent in today’s world. But this is an ecosystem yet to see the constellations come together.

Efforts to provide financial services to gig workers really only begin in earnest. At a recent CGAP convening that brought 50 executives from platforms and fintechs together, there was a strong sense that innovation is moving in the right direction, but Anand said “a lot of founders and innovators feel really alone on their journey and are sort of making decisions in a vacuum. There is very little sharing on success and lessons widely.” Once the various parts of the ecosystembegin communicating more and working in sync better, the pace will likely only pick up.

Image courtesy of Nik

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Psychometrics: What Makes A Reliable Borrower?

Bridging The Access-Usage Gap, Literacy Efforts Aren’t Key — Addressing Need Is