Can Insurtech Learn Best Practices For Selling To The BOP?

~8 min read

One year ago, Mondato Insight examined the factors behind low-take up of insurance products for low income customers, and the challenge to the market to prove they can develop product offerings that customers truly value. Building upon a significant body of empirical literature on what works and what doesn’t in microinsurance, and against the backdrop of compelling innovations enabled by mobile money and the DFC ecosystem, fundamental questions still remain around whether, how much and under which conditions insurance is valued by those at the base of the economic pyramid (BOP).

Furthermore, from an initial focus on ‘microinsurance’ primarily targeting health outcomes to ‘inclusive insurance’ offering farmers a response to climate change, the industry has shifted markedly in recent years. What best practices have emerged in successfully insuring the BOP, and what insights from the emerging field of behavioral economics have been adopted by established players and new entrants in responding to what end-users actually want?

KYD: Know Your Demand

What is clear from the history of insurance as ‘sold, not bought’ is that selling insurance to the poor is a hard sell. Marketing products without a solid understanding of consumer behavior is a recipe for disaster, no matter how buzz-worthy the latest tech innovation, from remote sensing to blockchain, applied to the problem is.

The empirical literature indicates that there may be serious ‘product cannibalization’ impacts of offering multiple DFC products to consumers, resulting in lower adoption overall. In an empirical evaluation in Malawi, the Poverty Innovation Lab (a behavioral economics research organization based out of MIT and other global research institutions) observed that farmers' take-up of credit products was actually lower when products included both loans and insurance. In a separate evaluation, the Poverty Innovation Lab endeavored to measure the benefits of health insurance, and discovered that mandatory health insurance for loan recipients resulted in massive client drop-out in India.

A major insight emerging from these and other interventions aimed at insuring the BOP is that the value proposition needs to be extremely simple and appropriately communicated - paralleling best practice among insurtech in developed markets. Lemonade, for example, has succeeded in attracting droves of app-savvy American millennials to its insurance products by marketing extremely simple processes for quotes and settlements, mediated by technologies such as artificial learning and machine learning.

A related reason why insurance is such a tricky sell at the BOP is that consumers are extremely price sensitive. Empirical literature from Ghana indicates that small price differences in premium costs translated into significant adoption swings: a difference of less than $1USD per acre insured begot a drop from 40 to 50 percent uptake to less than 20 percent in Ghana. Meanwhile, analysis in India determined that “given current take-up rates, price reductions alone would likely not be sufficient to generate widespread use of insurance…[as] non-price barriers, such as poor understanding of the product, distrust of insurance agents, and liquidity constraints also limited demand.”

This dynamic encapsulates the basic challenge of creating products the poor are willing to pay for: the traditional model of charging premiums for a service whose benefit to users is primarily felt if, and only if, things go wrong makes it extremely challenging for insurers to cover marketing and administrative costs, never mind make an actual profit.

What is encouraging is that having insurance can and does indeed change user behavior once they try it. While research attempting to quantify positive socioeconomic impacts of affordable insurance products remains mixed, a clear insight is that once insured, users do indeed feel empowered to engage in riskier investments of their time and money which can in turn improve their economic well-being.

In one study, farmers with agricultural insurance invested approximately 13 percent more on inputs like chemicals, land preparation and hired labor relative to comparison groups. From insurers’ perspective, this signals that users do intuitively understand the value of insurance products and can exploit them productively in ways that make them more attractive customers over the long-term.

Make The Sign-Up Stick

A lot of traction in achieving customer expansion, particularly from telcos dabbling in the space, initially involved the introduction of ‘freemium’ models, wherein customers pay no or nominal sign-up fees for an initial amount of insurance coverage they can experiment with at low cost (and eventually pay to upgrade).This approach, while itself cost-intensive from the supply perspective, touches on the basic but critical question of understanding customer cash-flow cycles and tailoring products to their harsh realities. While best practice in targeting uptake has evolved to focus sales efforts when potential customers actually have money (for example, immediately post-harvest), the challenge of marketing a solution to a potential problem in the future remains a sticking point - known in behavioral psychology as the ‘present problem.’

An innovative approach to this challenge has focused on pegging customer’s payments to outcomes: in a program targeting 80,000 Kenyan contract sugarcane farmers, 72 percent of those offered insurance with premium payments deducted from harvest revenue signed on to the program, compared to only 5 percent of farmers who were offered the standard upfront premium insurance payment scheme. This drastic difference illustrates that for those aiming to bring insurance to those traditionally excluded from such markets, the product may have to be completely reimagined from what has worked since insurance contracts were first formalized at least as far back as the 14th century.

In addition to thinking outside the box when it comes to collecting insurance premiums, education and training is quite effective in addressing endemic issues that inhibit take-up like lack of awareness and trust. This is of particular interest to policy-makers and governments invested in improving economic resilience of low-income populations.

A Harvard Business Review of such programs highlights how innovative education programs subsidized by the state contributed to adoption rates. In one Chinese example, financial literacy education training focused specifically on correcting the systematic underestimation of compound growth processes, which was delivered a few days prior to the roll-out of a pension offering, increased contribution rates by 40 percent against a baseline group. This finding reveals that targeting specific and known psychological biases culled from the nascent field of behavioral economics holds much promise for improving the effectiveness of financial literacy training and marketing.

Unfortunately, these kinds of marketing activities remain quite expensive. Where local partnerships exist that already have high-touch relationships with aggregated groups of potential consumers, the unit economics of small-premium insurance policies can and do, however, result in both profitability for insurers and wide coverage.

Having a partner well-placed to deliver awareness and education around insurance benefits - and well-placed to foot the bill - can radically reshape the profitability of low-margin policies in the calculus of investing in marketing and collecting premium revenues. Global companies working directly with the BOP are increasingly seeing the value to their own business of investing in insurance literacy and financial education, particularly in the agricultural commodity space - clearing the way for insurance specialists to focus on their core product.

A Crowding Field?

With all the buzz around insurtech, one can’t help but wonder if those seeing the inroads into the base of the pyramid through tech-tinted eyes have learned from those that came before them in trying to insure the poor, whether for profit or not. Indeed, sustainably insuring the poor seems to require not just identifying a niche product for the lowest hanging fruit but achieving profitability through massive scale: this is where it pays to develop a model that keeps costs under control.

In a review of the profitability of microinsurance, “administrative costs were more often determinative of program success than claims costs. Without scale, firms cannot get their unit costs down to support profitability.” Thus, differentiated approaches and technologies have emerged in the field to develop a repeatable, multi-geography expansion plan.

This ‘move fast and break things’ mentality is a language well-understood by venture capitalists, and among the players targeting insurance for the base of the pyramid includes would-be unicorns aiming billion-dollar exits solely based on insuring remote populations, like WorldCover. With the race to scale comes competition for the training and distribution partnerships that keep costs low; reaching millions of remote customers by going it alone is a strategy few insurtech players can afford, no matter how many millions they can raise in Silicon Valley.

Not to be sidelined by the daunting but enticing growth opportunities of the “unprecedented expansion of the global middle class,” traditional insurers and reinsurers have joined the fray. Blue Marble Insurance, a consortium of 9 established players in the field like TransRe and AIG, have joined forces to ideate, incubate and pilot successful insurance models, often in ‘emerging consumers’ units.

James Whitelaw, one of the directors of the consortium, detailed the ethos of collaboration to ‘create a bigger pie’ by developing and disseminating successful models for insuring low-income consumers in non-traditional insurance markets. Innovative approaches hinge on not only the mobile, but also satellite innovations, which are ironing out best practices in using parametrics for claims processing (i.e. where claims are automatically triggered and adjudicated by remote sensing and machine algorithms, indexed for example against crop health or rainfall).

Tipping the Scales

The momentum for insurance for the poor has come a long way since the early excitements, and disappointments, of microinsurance. The industry’s ability to leverage mobile proliferation and advanced remote sensing has driven together the dual objectives of financial inclusion and climate change resilience; witness the African Union’s African Risk Capacity agency, utilizing the insurance approaches largely pioneered in the private sector to help governments plan, prepare and respond to extreme weather events and natural disasters.

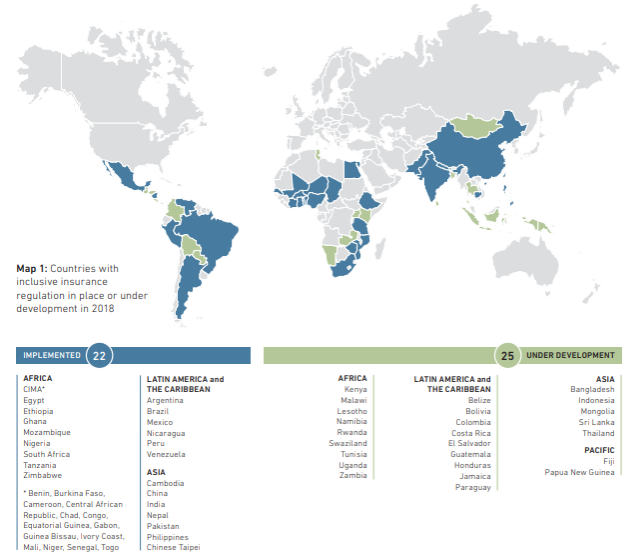

Indeed, the coalition of committed parties for addressing all manner of shocks and stresses through insurance is gaining steam from venture capitalists to governments, as evidenced by the growing number of countries with inclusive insurance regulation in place or under development.

Source: The State of Microinsurance 2018

Source: The State of Microinsurance 2018

Now that the approaches for achieving profitable unit economics through technological and business innovations have emerged, the real winners will be those who manage to execute expansion at scale and sustain it through long-term customer relationships. With no dearth of models - from sector-specific insurers betting on their ability to trigger payouts from space to traditional, deeply experienced insurers committed to reinventing the wheel for unpaved roads, there is ample room for new approaches and even new entrants.

For anyone to reach scale, though, it is clear that everything begins with leveraging the collective knowledge generated around understanding how end-users value risk and protection. To be worthy of the ambitions of truly inclusive insurance, offerings need to be demand-driven, appropriately priced and scheduled, and most of all, simple enough to be a no-brainer for those at the bottom of the economic pyramid.

Image courtesy of [hodag](https://www.flickr.com/photos/hodag/4572539890/in/photolist-7Y4sNE-q47m3e-7Y57Ww-phnNJi-7XYkxX-7XYVDt-7Y1pGq-7XXAkK-7XWtbi-7XURuv-ekQPvH-ekQNyM-pyBDa6-phnQSg-dCFaAe-aCqYCn-dCLui3-dCLDRf-dCLyi9-dCLDfG-dCLv7d-dCFe3V-dCF9JT-dCFbJV-dCLCn9-dCF6GZ-dCF5BH-dCF64V-dCLFcA-dCLA1W-dCLDdw-dCFbe2-dCLz2G-dCFdmp-dCLASq-dCFdzV-dCLFTY-dCFggr-dCF91M-dCFeKF-dCFh56-dCFaGi-dCLAhY-dCF7MZ-dCFhep-dCF6tV-dCFgLB-dCLD65-dCF9X8-dCF6La)

Click here to subscribe and receive a weekly Mondato Insight direct to your inbox.

Credit Bureaus: Resting On Their Laurels?

Gamification: Jackpot Or Fool’s Gold?