Africa’s VC Boom: An Enabling Present or a Bet On The Future?

~9 min read

With African tech startups expected to receive a record-breaking amount of venture capital (VC) this year — projected to reach between US$2.25 billion and US$2.8 billion by the end of 2021 — headlines have been dominated with announcements of new deals and investments. Though the pandemic caused a 29 percent funding decline last year, 2019 was the continent’s most active year of VC activity, with 234 companies raising over US$2 billion. The trend is projected to continue through 2025, when Africa’s VC investment is expected to reach US$10 billion.

Africa’s growing youth demographics and Internet penetration make it an attractive continent for tech investment, but structural barriers have made it a historically difficult business environment, which has previously prevented the influx of capital that we are seeing today. Challenges like low consumer purchasing power and inconsistent regulations to inadequate data and a fragmented marketplace kept investors away from a seemingly high risk environment.

As a result, African tech firms struggled to secure financing in the past. The sudden funding spike therefore begs the question: what has changed? While this growth is certainly good news for African tech entrepreneurs and startups, this week’s Mondato Insight takes a closer look at where the investment is going — and what this means for the broader digital finance and fintech ecosystem in Africa.

More Money, More Players

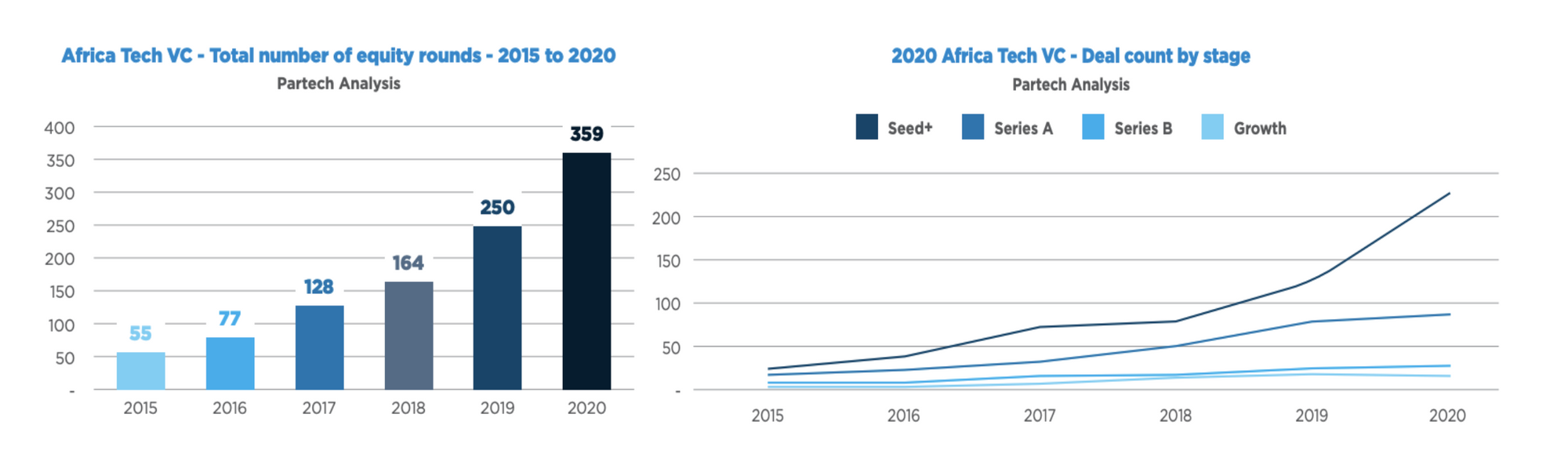

While various facts and figures appear across a number of reports, the key takeaways are that more investors— especially from developed markets — are getting involved in the continent, and the average deal size at growth stage, as well as the number of deals, are on the rise. Though 2020 saw a decrease in Seed and Series A and B deal size, likely as a result of lower valuations due to challenging market conditions during the pandemic, the number of equity deals jumped and promises to continue on an upward trajectory through this year.

Source: Partech Africa Tech VC Report, 2020

Certain regulatory initiatives, like the launch of the African Continental Free Trade Area (AfCFTA), which began at the beginning of 2021, promises to integrate the continent’s markets through reduced trade tariffs and policy reforms. AfCFTA, in theory, would simplify the process of expanding to and operating in new African markets, an essential component to growing a tech business, particularly in the digital finance sphere. Informal payments currently make up a majority of cross-border trade, and fintech offers the opportunity to formalize these payments. To support this opportunity, AfCFTA is piloting a payment and settlement infrastructure for intra-African trade and commerce called the Pan-African Payments and Settlement System in collaboration with the African Export-Import Bank.

Similarly, the recent regional integration of Central Africa’s CEMAC countries hopes to achieve the same results by easing barriers within the region, as discussed in a previous Insight. Regional harmonization efforts like these reduce barriers to entry, charting clearer growth potential for mobile and digital payment businesses.

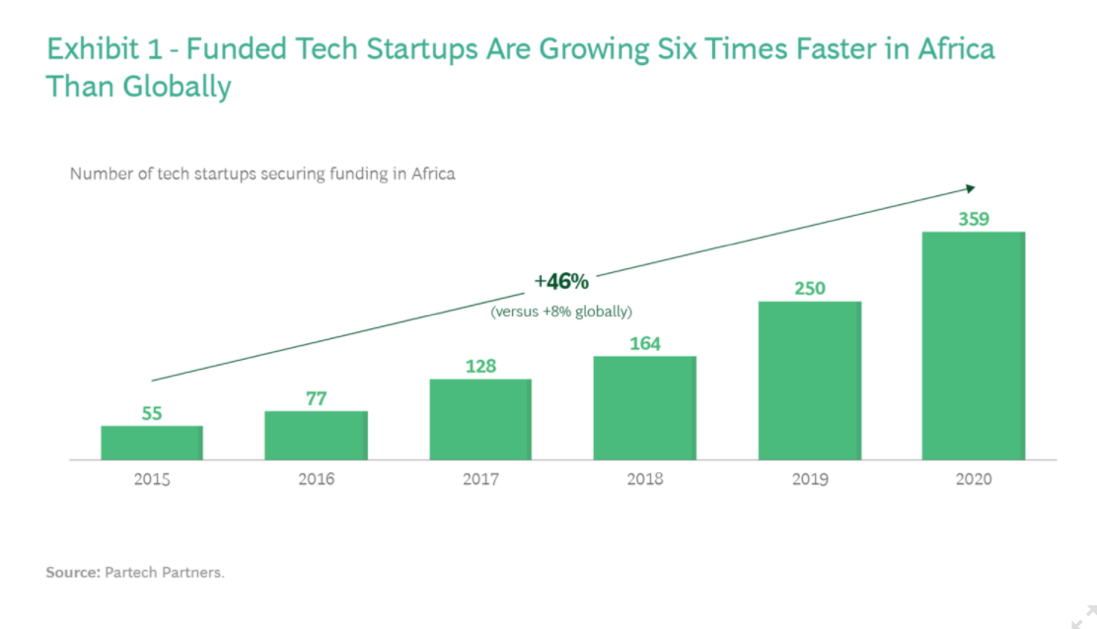

Another key data point for investors, particularly when entering new territory, is a proven history of success. A recent report found that since 2015, there has been a significant increase in the number of African tech startups that are able to move to the next phase of growth, and that these companies were growing at a faster rate than the global average.

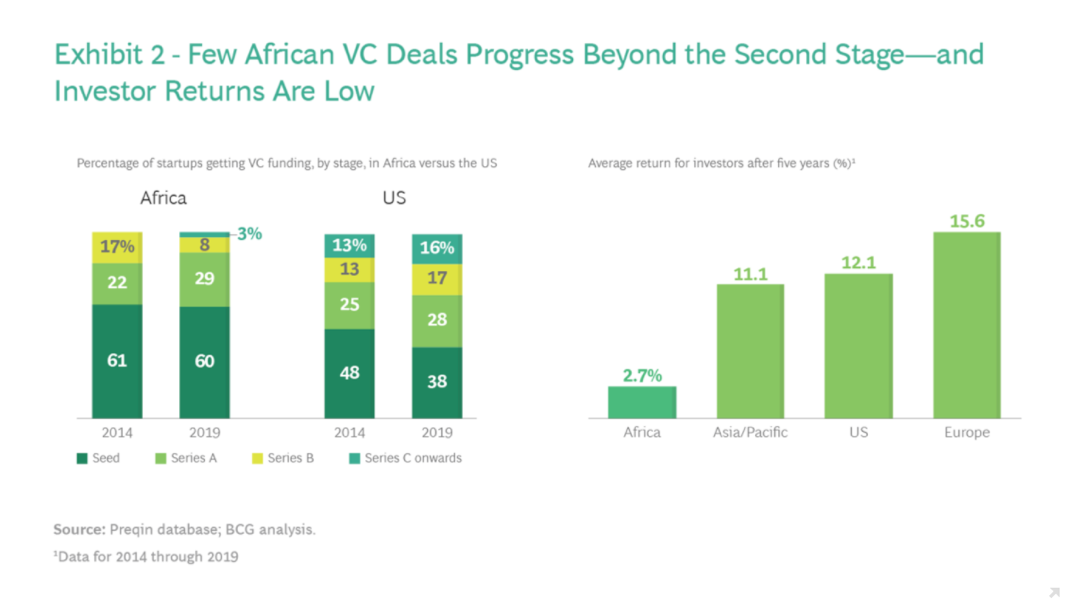

That being said, fintech funding is on the rise not only in Africa, but across the globe, with one in every five dollars of venture capital going to fintech companies. However, the momentum of fintech financing does not necessarily translate into revenue performance. African tech startups still suffer from long-term instability, and only a handful survive beyond Series B funding rounds. In general, VC investments in Africa still deliver lower returns than other regions. More than 20 percent of fintechs that received funding in 2019 have since shut down.

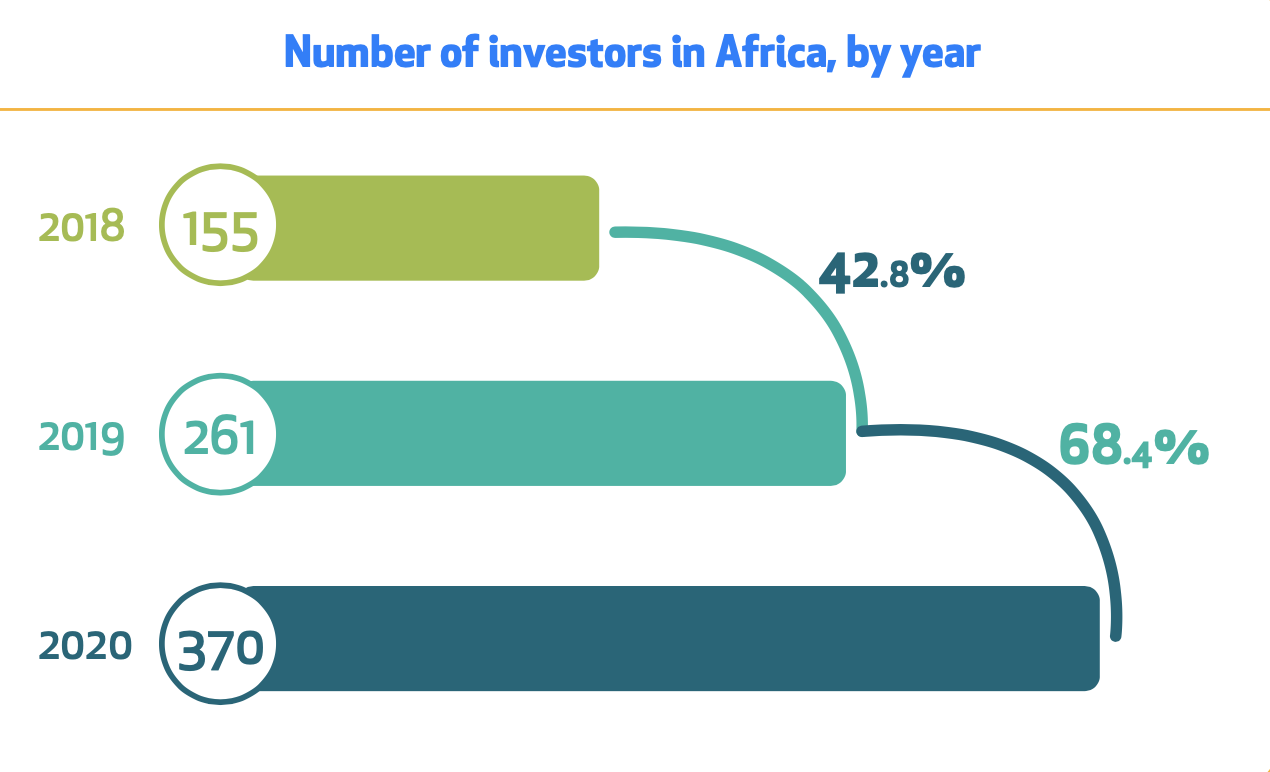

And yet despite the unimpressive returns, investors so far have refused to pump the brakes. A more diverse array of investors are exploring opportunities on the continent, signaling a markedly patient investor outlook for Africa’s tech sector. The total number of active investors in Africa was up 68 percent in 2020 from the prior year, many of which represent Silicon Valley and other foreign funds. Not only is the continent attracting more investors, but investors are putting more skin in the game, with over 25 percent involved in two or more deals.

Source: Disrupt Africa, 2020

With more accessible and available capital comes innovation. Because the continent has struggled with access to funding, entrepreneurship was previously an uphill battle; those with the requisite technical know-how preferred the safe haven of corporate environments. But as entrepreneurs and startups receive funds, interest in building tech companies has skyrocketed, and this has caused an influx in the number of startups popping up in all corners of fintech; since 2017, there has been a 90 percent increase in the number of fintech startups in Africa.

The presence of incubators and accelerators has given young entrepreneurs the resources to respond to the opportunities presented by the continent’s massively unbanked population. And now that a handful of these companies have achieved “unicorn status,” a snowball effect is taking place as hundreds of companies build on the confidence created by the recent trailblazing success of Egypt’s Fawry and Nigeria’s InterSwitch, Flutterwave and Jumia.

“Because there hadn’t really been as many success stories as there are now, entrepreneurship was not a thing that people aspired to do. I spent a lot of time in the early days trying to convince people to leave their jobs at KPMG or some other big accounting firm and join one of the startups we invested in. And, I think that has obviously changed now that people have actually made real money and seen exits.”

Lauren Cochran, Managing Director, Blue Haven Initiative

A COVID Dip

Though amplified investor and startup activity has been on the upward trend since 2015, the pressures of the COVID-19 pandemic slowed funding for Africa’s startups for the first time in 10 years. But even with the decline in total investment through 2020, the average deal size rose more than 10 percent from 2019, and investor appetite remained high, according to multiple reports.

2020 also brought the continent some landmark tech deals, such as Paystack and DPO Group’s more than US$200 million acquisitions (respectively), Jumo’s US$55 million Series C and Flutterwave’s US$35 million Series B. These events signal a new, exciting chapter of homegrown African fintechs reaching maturity. A track record of deals like these proves to investors that African tech firms can flourish if equipped with adequate capital, partnerships, technology and strategy.

But the true impact of COVID is yet to be fully quantified, as the continent is still plagued with new rounds of lockdowns and travel restrictions. The longer these measures are in place, the greater the macro-economic uncertainty, which is likely followed by less capital from new funds, particularly for early-stage companies. On the other hand, COVID-19 has led to a push for digitization across the continent, as a previous Insight discussed in detail, and this has created opportunities to grow the addressable market across the tech sector, fintech in particular. Even as COVID caused companies to downsize and investors to refocus, the pandemic only heightened VC interest in the payments space as digital acceleration drove demand for alternative payment models, shifting consumer preferences to digital and unearthing a proliferation of B2B opportunities.

“The COVID-19 pandemic has shown us the powerful role digital financial services can play in enabling individuals and small businesses in African markets to continue operating in the face of crises and to build financial resilience. Since March 2020, we saw an uptick in digital transactions conducted, an increase in adoption of insurance and savings products and a shift toward digital commerce. During this uncertain and tumultuous year, we have also seen Africa’s fintech sector continuing to break records. From acquisition of Nigeria’s Paystack by Stripe, to the number of funding rounds topping tens of millions of dollars, to the rise in smaller rounds granted to a wider variety of fintech offerings than ever before, this year African fintech startups have made real waves around the world.”

Maelis Carraro, Director of Catalyst Fund

Fintech: Africa’s Tech Darling

While the actual figures and future forecasts differ from one report to another, the overarching theme is the same: fintech received, and will continue to receive, the greatest share of African VC funding, with a conservative estimate of 25 percent (and some reports stating a third) of total tech investment. Even while tech funding slowed in 2020, fintech’s portion swelled, with over US$160 million invested exclusively in fintech, according to a 2020 Disrupt Africa’s report.

A few overarching trends are fueling this fintech frenzy, making it the most attractive category of tech investment. Fintechs have slickly moved from focused niche areas within the digital finance ecosystem, like person-to-person (P2P) or utility payments, to wider product suites that include more lucrative offerings like loans, insurance and savings. Almost a quarter of fintech startups in Africa are now providing multiple products, up 15 percent from 2019. This diversification is driven by both increased demand and desire for expansion. As COVID pushes many to adopt digital and mobile technologies for everyday tasks, more Africans are familiar with and interested in using digital payment and related services; fintech startups subsequently are busy chasing these new market segments.

“This diversification is driven by the startups’ need to expand. Startups, especially those that are venture-backed where growth is a key performance indicator, are seeking growth and more customers.”

Tom Jackson, Co-founder of Disrupt Africa

In many cases, companies find it easier to add new verticals as a growth strategy over venturing into new geographies, mostly due to regulatory challenges;regional integration efforts like AfCFTA and CEMAC, however, promise to improve payment infrastructure and ease both regulatory and technical barriers to African market expansion. Investors are also seemingly aware of the imminent regional opportunity. Though expansion capital has been concentrated in more mature African markets, more funds than ever are being allocated exclusively for expansion activities.

Spreading the Love

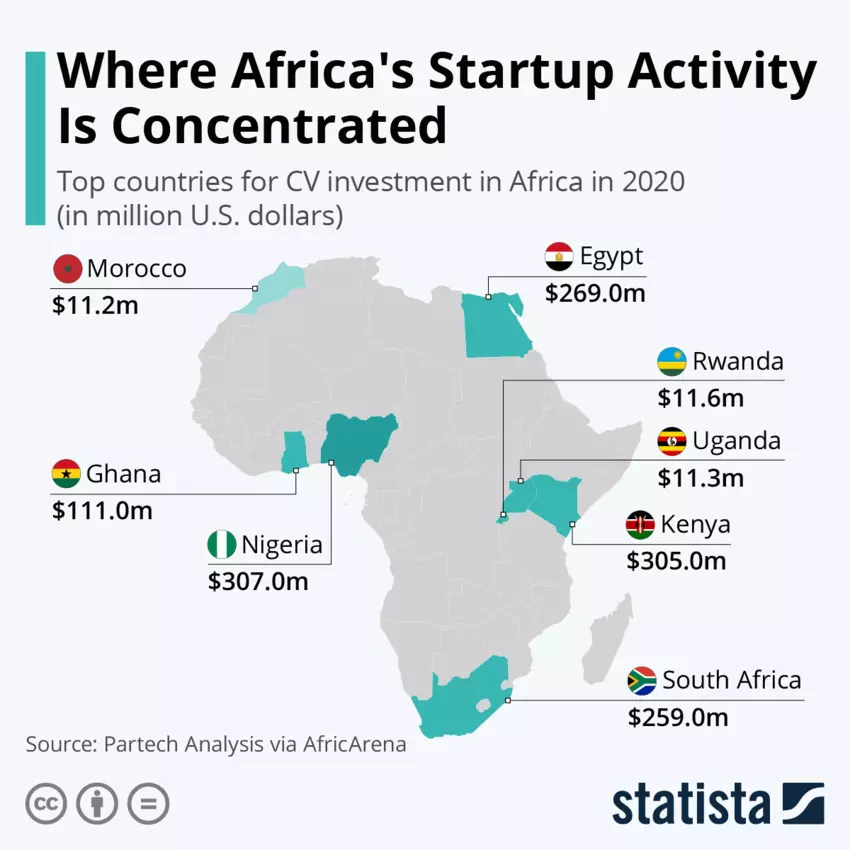

As these mature fintechs expand to new markets, capital is finding its way outside of the usual suspect markets of South Africa, Nigeria, Kenya and, more recently, Egypt. These countries, dubbed the “Big Four,” received the majority of investor attention, representing 80 percent of VC funding on the continent, but that is beginning to change, with other markets catching up quickly.

Experts foresee the number of deals to continue to increase through 2021, which should catapult a more even distribution across a greater number of second-tier markets like Ghana, Tunisia, Morocco, Senegal and Rwanda. Opportunities in new areas can be attributed to general economic development as well as market expansion by the region’s dominant fintech players. Legacy financial services providers and telcos have also played a major role in nurturing local fintech ecosystems through partnerships, incubators and strategic alliances.

One such example is the Middle East and Africa-focused venture fund formed by Orange, the most dominant telecom operator in West Africa, which is also present across the continent. The fund recently launched a Seed Challenge to distribute a total of EUR500,000 across seven startups in mainly second-tier markets. Ecobank Group, which is active in 33 African markets, was one of the first traditional banks to see the importance of fostering startup growth with its Ecobank Fintech Challenge, which identifies and partners with fintechs mature enough to scale and integrate into the Ecobank ecosystem.

Alongside private sector efforts, regulators in countries like Tunisia and Angola recently launched regulatory sandboxes and innovation hubs to support the local development of digital finance solutions. Public sector-led initiatives are extremely effective in strengthening industry competition and facilitating market entry, making a given market and its fintech players more attractive to potential investors.

What Comes Next?

While African fintech companies are broadening their scope and achieving increased maturity through diversification and geographic expansion, the African tech space still requires additional development and support to flourish. 2021 will continue to suffer from ongoing pandemic-induced economic challenges from the pandemic, and investors eyeing potential deals may delay until market conditions improve. Entrepreneurs and their startups will likely still face funding gaps if COVID’s effects continue to cause economic uncertainty and investors become more risk averse.

African tech companies should take full advantage of their home court advantage and the recent investor attention. As the continent becomes more conducive to tech innovation through improved infrastructure and digitization, international fintechs are stiffening competition for local players.Even if funding continues to grow, it is only the first step; Africa is only receiving a small portion of the capital currently going to US and European fintechs. To reach comparable levels, companies need to perform and deliver on returns, yet many are still falling short of expectations. In order to attract more advanced rounds of investment, fintechs will need to graduate to better understanding consumer behavior in order to build differentiated value propositions that lead to long-term profitability and scale.

Image courtesy of Lagos Techie

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Does Crypto Hype In Latin America Exceed, Meet — Or Make — Reality?

Digital Lending’s Self-Regulation: A Redemption Story?