Argentina: Can Bank-Driven Wallets Compete With Big Tech Platforms?

~7 min read

Following the pandemic, a certain playbook for revamping digital payment ecosystems has emerged across geographies. This often involves deepening cooperation between fintechs and banks relying on each other’s strengths, as well as the push — either through private or public initiatives — for an open banking- and instant payment-enabled system. The overarching vision: a payments system that is streamlined and integrated. How the vision translates to messy reality is where market-specific tailoring does its work. But jockeying to capture that market are competitors big and small, local and global, with contrasting visions of what “integration” entails: interoperability, or consolidation. In this payments terrain, what was once the digital upstart not long ago may have grown to become its own sector giant — even to anti-competitive extremes. A place like Argentina — an advanced economy nonetheless suffering from longstanding inflation — offers a valuable case study in understanding how this battle for the soul of domestic payments systems is taking place even when customers have grown to expect the economically unexpected.

High Promise, High Inflation

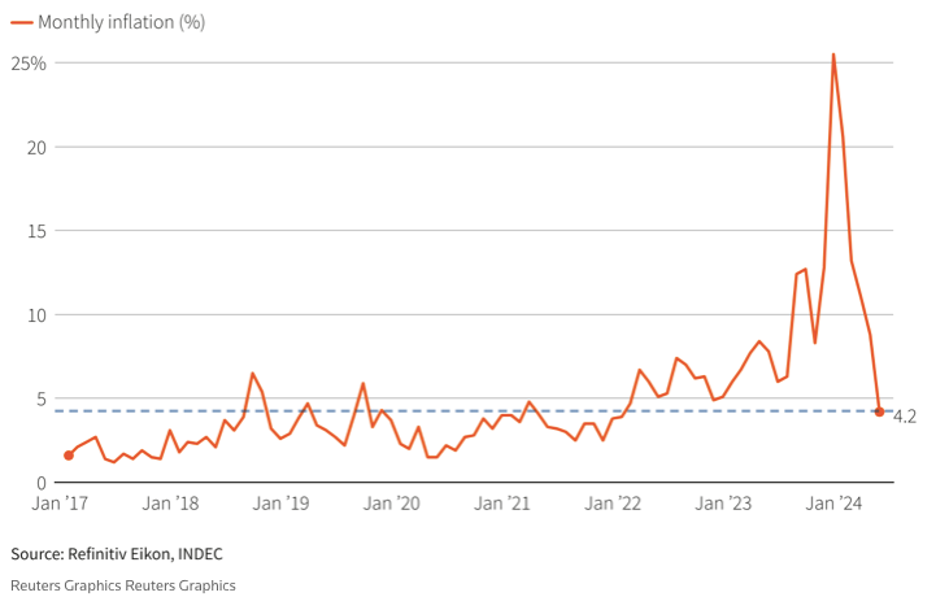

Mondato discussed as far back as five and a half years ago the implications of what continues to plague Argentina’s economy the greatest: inflation. Back then, Mondato described how Argentina saw in 2018 its peso lose 75% of its value to the U.S. dollar, with the consumer price index rising by over 45.9% in one year alone. Amidst the freefall, the presiding government at the time sought to make the struggling economy more attractive for foreign businesses by cutting taxes and adding incentives, while implementing steep interest rates to 60% overnight.

Over the next five years, however, Argentina’s inflation continued, as the annual inflation rate hit 185% in 2023. Spending cuts since the Milei regime took over late last year has recently helped slow inflation, though it has also brought economic contraction.

Source: Reuters

Source: Reuters

Analyzing the woeful situation back in 2019, Mondato wondered if rapid inflation might catalyze significant adoption of cryptocurrencies. That didn’t happen — but digital transformation did. Argentina was one of the 25 countries with the greatest growth in financial inclusion from 2011 to 2021, according to the World Bank, with the percentage of unbanked Argentinians dropping from 67% to 28% during that time period. The pandemic alone saw 40% of Argentinians open a bank account for the first time. The country possesses some of the strong fundamentals necessary for such inclusion, including high connectivity rates and the Transferencias 3.0 instant payment system, established in 2020 by the Central Bank of Argentina.

But unwavering economic instability creates for an unbalanced sector. The same World Bank reports have shown Argentinians to have little economic cushion, with a third of adults saying in 2023 it would be difficult for them to raise funds in an emergency situation. Stubborn inflation, likewise, has driven the credit ecosystem haywire, forcing high interest rates and subsequently meager participation, with only 13% surveyed by the World Bank utilizing lending services.

Preaching the Interoperable Gospel

It is in these turbulent conditions that the Argentinian digital economy has taken shape nonetheless. Rafael Soto is the CEO of MODO, a private corporation owned by Argentina’s public and private banks, serving primarily as a digital wallet. Founded in 2020, MODO’s approach has taken much of the modern-day payments gospel to heart. MODO looked at examples elsewhere of bank-owned digital wallets for inspiration, including Bizum in Spain and Zelle in the United States. Like those examples, MODO facilitates P2P transactions using telephone number identification, and it offers P2M capabilities utilizing QR, NFC and online payments with both cards and bank accounts.

“Right now, there is a new trend of banks joining forces to build wallets. So we look a lot at what they do elsewhere. But there is no one-(size)-fits-all.”

Rafael Soto - CEO, MODO

Even with such influences, several of MODO’s characteristics are distinctly Argentinian. Due to the propensity for Argentinians to have multiple bank accounts at once, MODO’s app — a standalone service aside from the backend and even frontend services it offers to Argentinian banks — allows its users to incorporate their various bank accounts into one app.

MODO and others in the Argentinian market adapt to a context in which constant inflation has pushed cashbacks and discount offers as a mainstay of Argentinians’ consumption patterns, with Argentinian businesses and banks working closely together to offer deals for customers. “What we did with MODO is to digitize all that promotion that used to take place in an analog [way],” said Soto.

This includes third-party loyalty programs, which MODO embeds within its own app. “We integrate so many parts,” said Soto, “so we can start connecting dots and making that value for the consumer.”

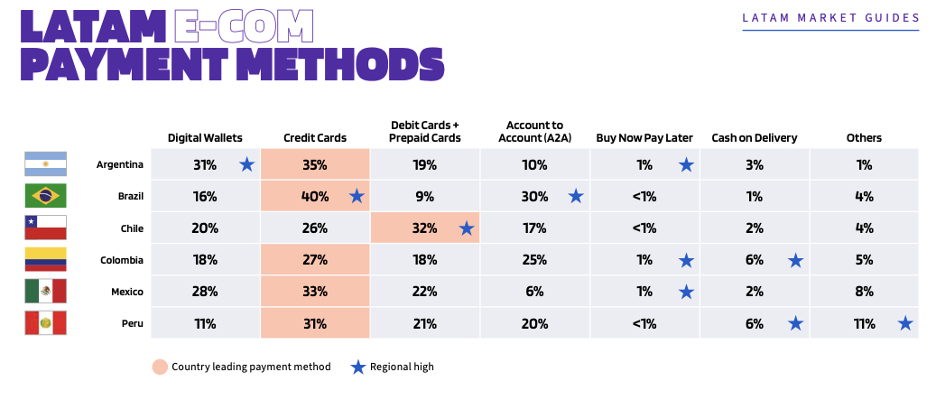

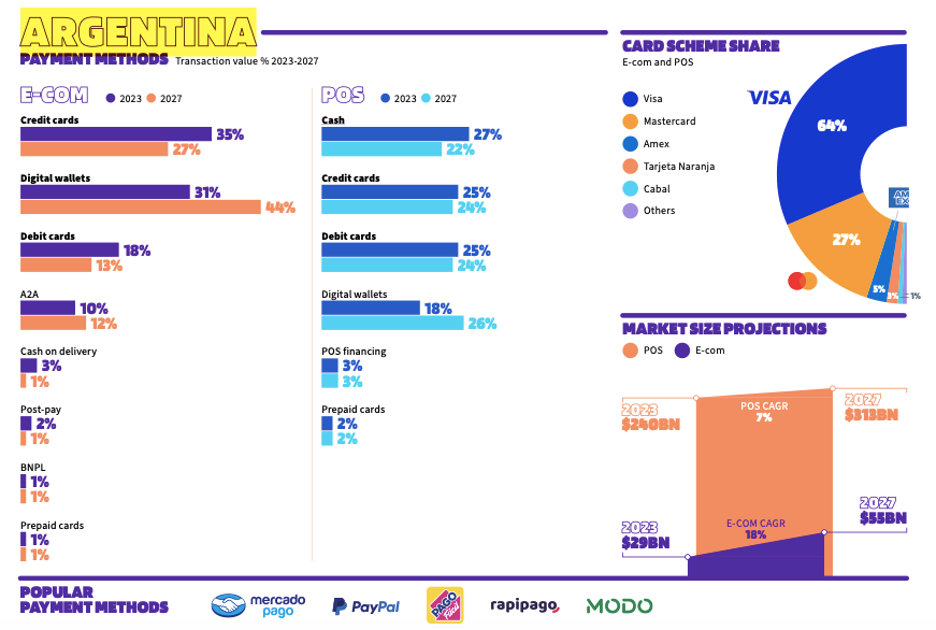

Other quirks of a system built on inflation expectations is the surprising strength of credit cards in daily consumption use. According to WorldPay’s 2024 Global Payments report, 35% of Argentinians use credit cards for e-commerce, leading all other payment options. Unlike elsewhere, where debit cards may be used for daily purchases and credit cards are reserved for bigger ticket items, Soto says many Argentinians use their credit cards even for small daily purchases, with the payment method comprising a quarter of POS payments in Argentina.

“Because of inflation, people in Argentina rely a lot on credit cards because they get a financial gain from acquiring the good today and then paying for it 30 days later. And therefore, we had to incorporate credit cards in our model from the very start.”

Rafael Soto - CEO, MODO

This economic reality has also led to BNPL taking a strong relative position in the Argentinian digital economy, being utilized for 1% of e-commerce transactions.

But the most significant takeaway might be Argentina’s disproportionately high share of digital wallet use compared to other payment methods. Besides Mexico, where 28% of people surveyed by WorldPay used digital wallets for e-commerce, Argentina’s 31% rate nearly doubles the rest of the surveyed field in Latin America. This stands out in a particular context where customers are needing to scramble for every efficiency they can find in a market defined by price instability. That includes the heavy adoption of digital wallet providers like MODO that facilitate instant payments for merchants seeking to complete transactions before inflation rears its ugly head by the minute.

Source: WorldPay

Source: WorldPay

MODO has made significant inroads to the Argentinian market through its local integrations and partnerships across the ecosystem. Running ahead of Argentina’s regulatory apparatus that is yet to implement open banking, MODO also facilitates bilateral APIs across Argentina’s digital ecosystem, viewing itself as a “connections hub” for third-party apps and companies. But in market terms, they still run well behind Latin America’s payments giant: Mercado Pago, the payments arm of Mercado Libre.

Underdog Banks vs. Tech Giants

Argentina is following the same pattern increasingly exhibited elsewhere: banks join together to compete against Big Tech disruptors with outsized clout. MODO was the Argentinian banks’ answer to Mercado Pago, which is now the primary digital wallet for 63% of Argentinians surveyed, according to the WorldPay report.

Though once an innovative startup disruptor, 20 years have seen Mercado Libre become a mature company with strong profit margins and advanced tech capabilities. That leaves a company like MODO fighting for where its relative strengths lie: local relationships.

“We wouldn't have the same technological capabilities that Mercado Pago or Google Pay or Apple Pay may have. Instead, we rely on the relationships that we have with banks and merchants to provide integrations and offers that these other players would not be able to generate.”

Rafael Soto - CEO, MODO

In a landscape that emphasizes interoperability, simplicity and the power of integrated local relationships can prove its worth. This explains MODO’s dogged refusal to align itself with one acquirer or another, leaving itself open to partner with anyone in the Argentinian market that wishes to do so. Such an approach extends to MODO’s close-knit relationship with the card companies like Visa and Mastercard — a common trend in Argentina — which Soto says allows MODO to facilitate cross-border transactions on par with a regional giant like Mercado Pago.

Source: WorldPay

Source: WorldPay

Such examples make digital payment discussions regarding “incumbents” and “disruptors” feel out of date. In the open banking era, the delineation becomes more a matter of “platform giant” versus “connections hub”.

The idea of any payments-driven company becoming an entire ecosystem unto itself — with third-party vendors a mere node to their inescapable center of gravity — isn’t simply haughty at a moment where interoperability is the overarching goal; in the eyes of the European Union, it is illegal.

That same dynamic is playing out in Argentina, where MODO filed a complaint earlier this year against Mercado Pago for anti-trust practices in the same vein as Apple in the E.U. In particular, the complaint states that Mercado Libre — with its dominant e-commerce market share — prevents competing wallets like MODO to be available as a payment option with their QR codes or in their payment gateway.

The jury is still out regarding what the Argentinian authorities may do — if anything — in response to such complaints. The Milei regime’s ideologically libertarian bent would likely portend a friendlier stance towards Big Tech payment providers than the EU’s, which is now armed with its landmark Digital Markets Act. But what does transpire in the Argentinian context may prove to become a vital battleground in that brewing war of ecosystem models. What will be at stake is whether domestic payment ecosystems maintain their unique characteristics and payment providers — or if they simply become carved out fiefdoms among Big Tech entrants that implement their technologically superior platforms to the benefit of consumer efficiency, if to the likely detriment of competition and choice.

At this stage of the digital payments revolution, it’s in the regulators’ hands.

Image courtesy of Engin Akyurt

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Germany’s Cash Culture: Entrenched, But Evolving

Can Digital Monitoring Unlock Climate Finance?