Blockchain Reaches Adolescence

~8 min read

Long associated with cryptocurrencies, blockchain technology has come to earn a degree of skepticism among investors, regulators and large swathes of consumers as well. Underlying the hype, however, lies the reality that we are witnessing in real time blockchain technologies emerge from papers to pilots to projects, and there is perhaps no more authoritative validation of the maturity of the technology than those provided by blue chip companies. This week’s Insight reviews enterprise-grade blockchain solutions to determine, fanfare aside, what the state of practice in blockchain looks like at the top end of the business market, while examining some of the thornier challenges of tracing the origin of materials back to the “first mile.”

Big Businesses In Blockchain

The reasons for adoption of blockchain technology are, by now, mantra in blockchain conversations: trust through transparency, elimination of intermediaries, algorithmic automation. Yet it may be time to mark blockchain’s passage from overhyped to hyperdrive: a global market report on blockchain released by GrandView Research last month estimated the total 2021 market of the enabling technology at nearly 6 billion dollars, with a whopping 85.9% year-on-year projected growth by 2030.

Far from the Bitcoin world, where sometimes shadowy “whales” can wipe out millions in value in minutes, the blockchain universe is in fact dominated by some of the most staid technology companies like IBM, Microsoft, and the Linux Foundation. Such large enterprises accounted for more than 68% share of the global blockchain revenue last year.

A recent Harvard Business Review case study on Walmart helps put these figures in perspective from the enterprise point of view. As one of the largest retail stores on the planet, Walmart logistics challenges are immense, coordinating over half a million shipments per year across nearly 100 third-party freight carriers. 70% of invoices have historically required reconciliation efforts, a result of each vendor having their own system for tracking when and where goods and services are delivered. A radical change was clearly needed; Walmart used its massive buyer’s power to require its entire supplier network to migrate to a blockchain system designed by DLT Labs. The result: a drop to less than 1% rate of invoice discrepancies, and a project ROI of just three months.

Lessons learned from this project reveal both the challenges and the value resulting in creating a harmonized system for disparate actors, each with different accounting systems and ways of working. Of course, the success of this project comes from having a massive single point of influence — Walmart — who can unilaterally make decisions that all its partners are essentially forced to comply with. It’s not yet clear that smaller companies, particularly those in more fragmented value chains, would see such stellar results. At the same time, the SME (small & medium sized enterprises) segment is anticipated to experience the fastest growth rates in blockchain by 2030 according to GrandView Research, benefitting in large part from streamlined supply chain operations gained through smart-contracts.

Blockchain-As-A-Service

With early success stories such as Walmart’s, one would imagine every business would want a blockchain solution. The issue, however, is that it takes a lot of time, effort and expertise to set up and manage a blockchain; even a well-heeled corporation like Walmart would rather avoid standing up an entire division devoted to cryptography. After all, the technology is still new, and as successive waves are iterated in this early phase, patches and upgrades are needed, as with any software solution. It’s still 1s and 0s, after all — not magic. It stands to reason, then, that managed blockchain solutions would emerge to serve the need.

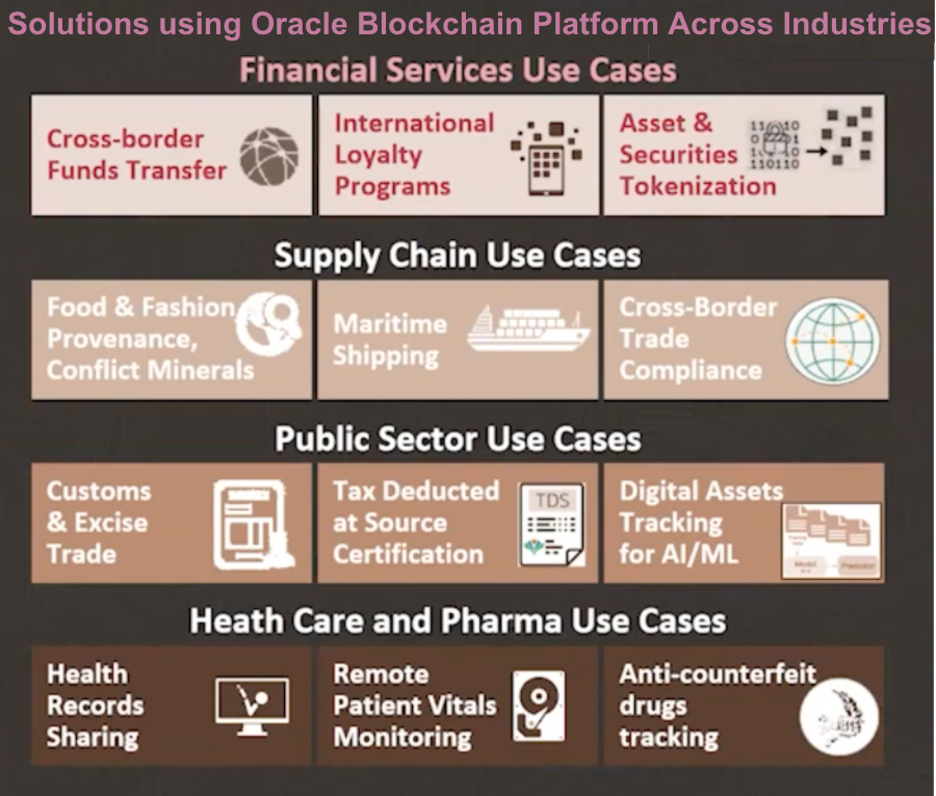

Oracle, another technological powerhouse from the old-guard, is perhaps not best known for being a blockchain company — but it has in fact been offering enterprise-grade blockchain solutions since 2018.

Todd Little, Blockchain Chief Architect at Oracle, describes the company’s foray into blockchain for transaction monitoring as initially tentative, given the immediate association most held at the time between blockchain and Bitcoin and the roller coaster booms and busts of the latter. “It’s very different,” he recalls, repeating over and over in distinguishing the anonymous, “permissionless” crypto to the more hierarchically-defined “permissioned” enterprise solution: “a key difference in such a system, of course, is that we have legal recourse, if necessary.”

From such humble beginnings, Oracle now counts over 250 customers and 200 trial users, offering blockchain-as-a-service management for industry use cases built on Hyperledger Fabric, one of the largest open-source blockchain platforms initially created by the Linux Foundation. The use cases for this enterprise-grade blockchain are varied — want a blockchain-verification before buying a $100,000 Beretta pistol? How about a system for tackling counterfeit drugs in contexts where fakes are becoming more common?

Source: Oracle Blockchain Solutions

Addressing such issues is not as easy as throwing a blockchain solution at a complex problem, however — the real challenge in a blockchain is building a consortium. “Blockchain is a team sport,” Todd quips; it only really works when all the different actors involved in a complex value chain agree to see how a decentralized mediating technology can improve outcomes for everyone, even if that everyone includes direct competitors. If one word captures the game-theoretic brain twister that is making blockchain work at the industry scale, it may very well be “competition.” In this version of corporations’ partnership strategy, competing organizations deviate from a winner-takes-all approach in favor of one that grows the overall marketplace in which all compete — or, in parallel, which addresses fundamental issues affecting every player in that market. The blockchain consortium market is where a lot of industry dynamism can be observed, as the specificities and unique needs of each become manifest in the products and protocols that each develop.

Mining Minerals

The use cases for blockchain are so varied that often the architects of their platforms are several degrees removed from their ultimate implementation. This is particularly true in those use cases where the consortium that brings on the technology spans multiple continents. In previous Insights, Mondato has touched on a few of the early instances where blockchain made a real splash, from supply chain finance to refugee finance and African art. But perhaps no use case makes as much sense for blockchain as those around the traceability of conflict materials.

As Mondato has also previously covered, a huge proportion of the raw materials used to make modern technologies possible — from cell phones to laptops to electric vehicles — rely on supply chains whose upstream extractive practices are fraught with human rights abuses. The Democratic Republic of the Congo, in particular, finds itself anew in the midst of global jockeying for a share not only of its estimated $24 trillion in mineral assets underground, but also access to oil.

In today’s “new cold war,” technologies like blockchain are playing a new and unpredictable role in geopolitics. Indeed, among the contenders for top crypto adopters today is Ukraine, which recently joined El Salvador in legalizing the digital currency and raked in a reported $55 million in crypto-donations for its army. Kenya, South Africa and Nigeria, for their part, rank among the top 10 countries for cryptocurrencies. As the volumes of crypto flowing through and across the African continent increase (1,200% percent between 2020-2021), whether these flows will alleviate, perpetuate or deepen existing abuses remains an open question.

Nathan Williams is the CEO of Minespider, a Berlin-based technology solution provider bringing blockchain technologies to the supply chain traceability challenge in emerging markets, with a focus on minerals. The concept is similar to that of Circulor, an Oracle-supported blockchain traceability startup specializing in the verification of conflict-free cobalt sourcing for Volvo’s electric vehicle fleet. Unlike with the cobalt value chain, whose upstream origins are disproportionately concentrated in one singular (if vast) country, Minespider has developed a proof of concept around the use of blockchain for the verification of EU Conflict Minerals Regulation compliance within the tin value chain, with blockchain digital product passports tracking shipments out of the Minsur mine in San Rafael, Peru and the Luma mine in Kigali, Rwanda.

Both Williams and Little acknowledge that one of the trickiest parts of embedding a blockchain solution in a low-trust environment is the first step, in which a physical product gets “on-boarded” onto the blockchain. Here, special attention needs to be paid to what GrandView research estimates will be the fastest growing application segment of the global technology market: digital identity.

“Often, the simplest way to get physical material on a blockchain is by manual data entry. But how do you trust that data? Same way that you trust paper data: who does the data entry.”

Nathan Williams, CEO of Minespider

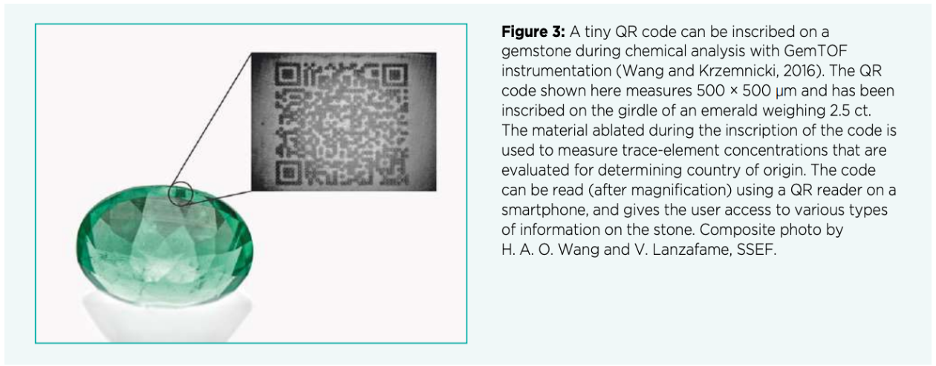

From this critical entry point, different techniques can be used to add layers of verification and auditability as a product — whether tin ingots, rocks of cobalt, or crates of olives — moves along its complex value chain. Embedded RFID chips can track cargo’s digital footprint across its global waypoints; highly controlled metal tags with difficult-to-forge embedded QR codes can be issued to trusted suppliers; chemical analyses can unearth certain materials’ indelible origins.

But each product, market and value chain is so unique that there is certainly no one blockchain-fits-all solution — even within the same use case. The trick, again, is in getting a consortium of like-minded actors who, despite potentially being in competition with one another, see the value in collectively agreeing to solve industry-wide challenges.

Blockchain Eats The World?

Marc Andreeson, noted venture capitalist, famously declared in 2011 that software was eating the world to describe the fundamental shift in industry standards — within every industry — that Silicon Valley had unleashed. Blockchain technology’s growth, seemingly in its adolescent phase with bone fide blue-chip users and legion use-cases, now seems poised to do so in particular for sectors where coopetition brings competitors together, or where powerful champions (like Walmart, or governments) make the case irrefutable.

A big part of the value in tackling such challenges comes from the real-time nature of the creation of a single record of truth. This forms the backbone of blockchain technology as an organizing principle for what is, often, simply a question of database management and access permissions. A longer paper trail is another critical component; it’s not so much about eliminating uncertainties as creating more auditability for cross-checks. In this sense, much of blockchain isn’t even remotely new — but given the improvements in efficiency and logistics brought on by the technology, sometimes it just takes a new-ish concept to shake up an old problem.

But there remain many challenges to resolve before we see total blockchain ubiquity: whether from the largest companies in the world who can use their financial clout to capture first-mover advantages from the technology’s opportunities, to those beneficiaries who might profit the most from the more responsible practices they could engender — namely, those at the source of low-visibility, low-trust value chains, like miners and farmers.

One of these hurdles is the interoperability between blockchain platforms; as their usage becomes more accepted and their popularity grows, much ink is left to be spilled figuring out how to get different blockchain platforms to eventually work together. In this process, there may well come a necessary and painful point of consolidation that may see winning platforms strengthen and those that are ultimately proven to be “expensive databases” winnowed.

Another might simply be storage space; traceability is good, but where is the line drawn? As governments slowly move towards accepting blockchain technologies as part of their central bank digital currencies, what is the cost-value equation towards being able to track the movement of a single penny over decades? When does the ability to track minute details clash with the “right to be forgotten” movement brought on by GDPR regulations? Such questions and more are yet to be answered as we witness the maturation of one of the most-hyped technological innovations of the 21st century into its adolescence.

Image courtesy of Shubham Dhage

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

What M-Pesa and Apple’s Empires Say About Platform Economies

Femtech: A Kaleidoscope Of Opportunities And Vision