Integrated Solutions: The Sole Path To Sustainability And Scalability?

~10 min read

Once upon a time, businesses focused on core competencies: do what you do best, and capture the given market. Yet in the ever-maturing tech and fintech spaces, in which user engagement is key, data is king and paths to monetization often don’t comprise a single road but a lattice of symbiotic solutions, competency, increasingly, is proven in a self-actualizing ecosystem, not a one-off product. Yet no company begins as an entire ecosystem unto itself — and the shape of that maturing ecosystem takes on quite a different character considering its initial product, the respective market and the almighty (or not) regulator. So, are one-off fintechs truly scalable and sustainable? Or are diversified, integrated solutions the only path forward once a company reaches a certain level of maturation? This week’s Insight digs in.

Too Big For A Small Pond

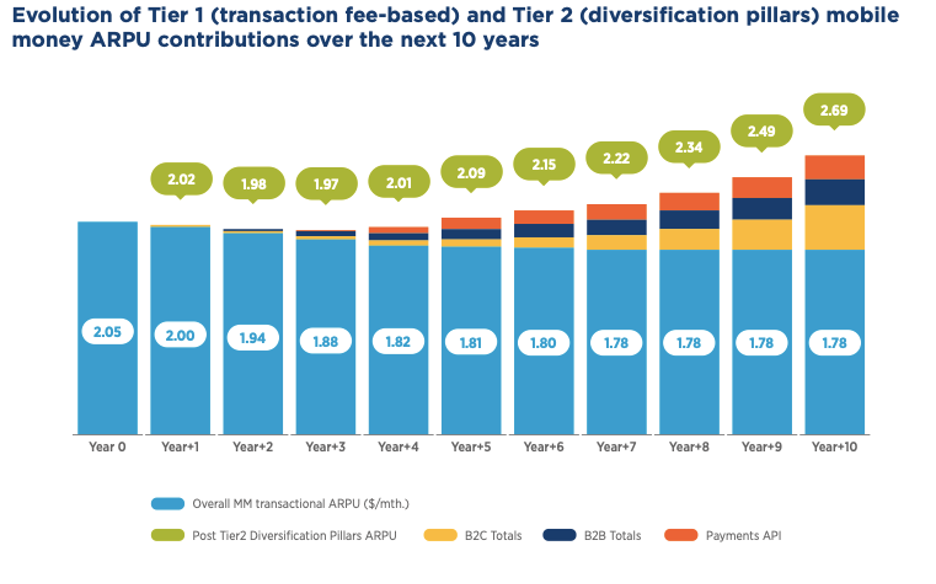

It’s in once-disruptive, now maturing subsectors where the answers to such questions are most easily discerned. The best example of this, mobile money, has seen revenue growth all but evaporate in the past couple years. Though at least in part due to COVID-related regulations and market shifts, much of the stagnation comes from the simple inability for many mobile money providers to monetize beyond cash out and transfer fees. According to GSMA’s 2022 mobile money report, 79% of all mobile money revenue last year came from cash out and P2P transfer fees, with such revenue diminishing as pitched competition drove down fees. The data is further backed up by a joint GSMA-BFA Global modeling exercise, which found that a transaction fee-based model successfully brings mobile money providers from start-up stage to maturity — but is followed with declining ARPUs and stagnating profits.

Source: GSMA’s State of the Industry Report 2022

Especially with the market downturn and funding squeeze, many are saying the result, consequently, will be consolidation. Yet while many companies will not survive the ongoing onslaught — as Mondato Insight recently discussed — it may be better to frame these developments as a consolidation of ecosystems. For the past ten years, we’ve seen the super app model first originating in Asia. The network effects corralled by East Asian super apps and Western Big Techs alike serve as a roadmap for expansion that one-off service leaders meticulously study as they look to transform themselves into an own ecosystem in their image. As Pinar Ozcan, Professor of Entrepreneurship and Innovation at Oxford’s Saïd Business School, discussed last year with Mondato Insight, Big Techs can pick and choose what expansion of financial services suit their needs best while mitigating regulatory burden. Yet according to Professor Ozcan, the roadmap is not the same for an upstart fintech seeking to distinguish itself from a saturated market, even if the overall platform aspirations are in essence the same.

“I don't think it makes sense for [Big Techs] to do everything. And that makes it a little bit different from fintechs. Because fintechs, in order for them to survive, they need scale. And when they basically saturate a certain kind of segment or financial product, then a natural way for them to grow would be to add new products and target new types of customers with those products.”

Pinar Ozcan, Professor of Entrepreneurship and Innovation, Saïd Business School, Oxford University

Yet while sustainability and scalability are the lodestars for a maturing company seeking to break out of a saturated market, there are several dimensions impacting the development of any given fintech from a one-off solution to an ecosystem-oriented, integrated solutions player. Geography, home market, core competency and regulatory regimes all play a vital role in shaping a fintech’s progression into such forays. These details matter greatly, determining whether a product will become a super app network based around payments or ecommerce, or if a product’s ecosystem finds scale by expansion of networks themselves.

In Professor Ozcan’s research, she has found that Big Techs greatly tailor their expansion to reflect synergistic benefits with their existing products. Naturally, expanding fintechs do that, too, yet distinct tiers emerge in a mostly partnership-driven expansion of services. According to Ozcan, the dynamic that emerges is a top tier of Big Tech players with an ecosystem gravitating around their network suite of products, and this is followed by a second tier of emerging fintech companies that have gained enough traction to either go into a partnership, merge with someone, or be acquired.

Certainly, there are emerging models that scramble these dynamics in play. From Professor Ozcan’s perspective, embedded finance serves as a great opportunity for a forthcoming unbundling of services, as non-financial service providers incorporate embedded financing to serve the needs of customers more precisely. Yet whether embedded financing and partnership-driven integrations represent consolidation under one gravitational ecosystem force or a symbiotic relationship among Big Techs and emerging techs may only be semantics in the grander scheme of reaching the desired scalability and sustainability. Revenue streams may diverge and proportion themselves differently, but the goal remains the same. To understand the nature and implications of different models’ path to such goals, however, it would be instructive to focus on vastly different companies undergoing transformations with similar aims yet through different means: MFS Africa and Vietnam’s MoMo.

(MoMo)ney, Mo Apps

As Mondato Insight discussed in its recent profile of Vietnam’s fintech ecosystem, MoMo is Vietnam’s market leader in the country’s most successful fintech sector, e-wallets — a sector whose oversaturation has led to unsustainable business models in which many compete for the short-term affections of customers through discounts and deals. In recent years, Momo has subsequently shifted its sights away from simple payments to be a super app ecosystem unto itself, studying the rise of East Asian Big Techs like Tencent and Ant Group in charting its own course. According to MoMo CFO Manisha Shah, the company realized that mere payment enablement in the Vietnamese market wouldn’t be enough to excite investors as a sustainable business. The solution was to diversify its products.

MoMo’s transition from e-wallet leader to super app ecosystem began not all at once, but with cinema tickets. Seeking to expand into solutions addressing both customer and merchant pain, MoMo’s expansion began in earnest with building an app for purchasing movie tickets ahead of time; with credit card penetration next to non-existent in Vietnam, MoMo saw cinema tickets, where people would have to physically come days before the actual viewing to purchase them in person, as an area with clear customer need. Embedding MoMo on individual cinema distributors’ websites as well as placing all such purchasing items on their app, the cinema app increased engagement by facilitating on its cinema app opportunities like movie reviews, trailers, and a map of nearby cinemas.

Since then, MoMo’s super app has grown beyond integrating with other companies to become the center of gravity itself, encompassing an array of financial services, games and a host of other mini apps, some of which were developed in-house but largely connecting to third-party mini apps. Shah says the main competition for MoMo is no longer one-off e-wallets, but aspiring regional super apps with their own overlapping ecosystems, like Shoppee, Grab as well as fellow Vietnamese e-wallet heavyweight, ZaloPay.

Not all mini apps are created equally, both in their origination as well as overarching ecosystem goals. Some of these mini apps are separately sustaining businesses entirely, like the 7-Eleven app, while others may be more reliant on MoMo for customer engagement and access. According to Shah, MoMo takes a holistic approach in its service expansion.

“When we think of adding new services, it is a combination of three factors. One is the monetization of the business, the second is increasing engagement, and the third is new users.”

Manisha Shah, CFO, MoMo

Underlying these three factors is the drive to increase public trust and remain “top of mind” among Vietnam’s sprawling population. Yet each service added to its partnership-driven super app occupies differing lanes of this overall mission, according to Shah. Facebook and Google accomplish all of the above by providing new users, increased engagement as well as monetization. Gamification drives engagement. Peer-to-peer is intended to unleash network effects by driving social media-style engagement. And when it comes to its expansion into financial services — which includes InvestTech and CreditTech services — the play is pure monetization; while only 20-30% of users will ever use such services, Shah approximates they will provide 30-40% of MoMo’s revenue in the future.

“If I'm doing one thing, I'm going to monetize that service. But we found that if you just do one thing, in this world, it is difficult, or rather very expensive, to keep the user engaged. So you need a gift for free, you advertise, or you build a game to engage and educate. But you do need to find a way to attract the user and for the user to feel the benefit of giving you their time.”

Manisha Shah, CFO, MoMo

In the few but select areas where MoMo sought expansion through acquisition, it has looked to access the right resources to strengthen those core goals. When MoMo purchased POS company Nhanh, Shah says the aim was to better understand and tap into SME and social seller networks — networks that, though fragmented, are where most of ecommerce is actually done in Vietnam.

However,noticeably absent from MoMo’s expansion efforts is any move beyond Vietnam’s narrow borders. With far more plans for expansion within Vietnam, Shah views its core competency — e-wallets — as a prohibitively local solution, dependent on relationships with local merchants, local banks and the regulator.

“If you're a financial services payments lead, we think it needs to be local. I struggle to see an e-wallet in Southeast Asia or India that [expanded outwards].”

Manisha Shah, CFO, MoMo

Enabling, Not Competing

While B2C payment ecosystems may find it optimal to concentrate services domestically, the B2B route offers vastly different dynamics for maturing fintechs seeking scalability and sustainability. MFS Africa’s specialty and business model is centered around facilitating interoperability of mobile money networks in Africa, allowing transactions among mobile money across Africa, with its “network of networks” including approximately 400 million Africans. To a great degree, MFS Africa’s business proposition relies on network effects. Yet as a B2B company, the expansion mission doesn’t rely on sheer, non-monetizable engagement, but in expanding the possibilities its network offers for customers. Rather than expanding domestically to encompass a suite of customer services and products like MoMo, the mission is as a cross-border enabler.

The limitations of mobile money in Africa are well-documented, but arguably its defining feature from an outsiders’ perspective is its insulating impact on African ecommerce and fintech ecosystems, as it largely shuts out African merchants from global banking systems and transacting.

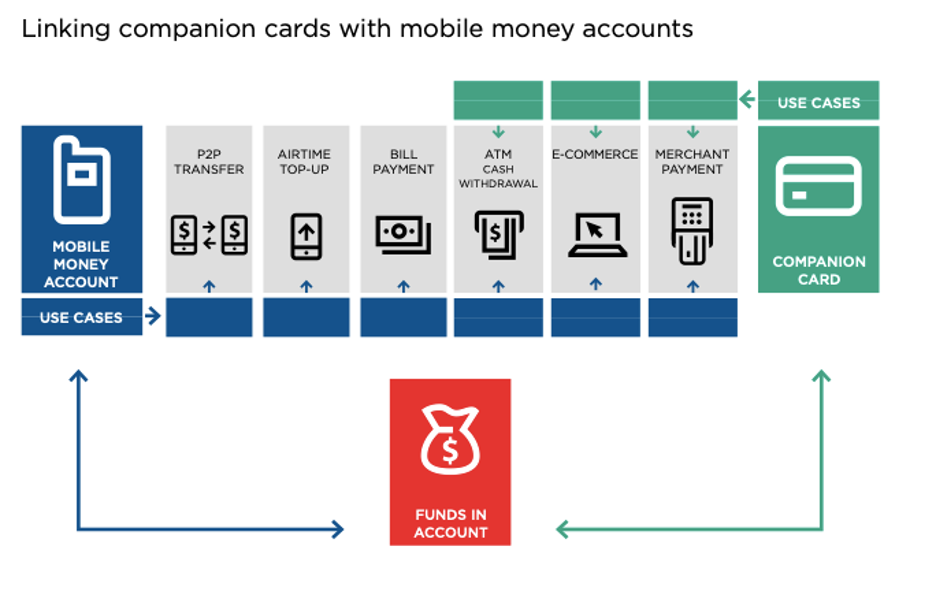

Yet MFS Africa’s seminal acquisition of US-based GTP, which specializes in prepaid cards in Africa, positions MFS Africa to dramatically expand its network beyond Africa to merchant networks worldwide. With plans to distribute prepaid cards to its network of 400 million Africans — certainly a tall task, but one that would be carried out by GTP’s local banking networks in Africa, according to MFS Arica — such integrations of mobile money with prepaid cards will allow mobile money to operate with the full suite of international payment rails it had long been unable to reach.

“In the past, we were trying to convert online merchants to accept mobile money as a payment method. And yes, you can convert some of them. But it's always this constant uphill battle — you have to explain what mobile money is, there's an impact on their checkout page, and there are a number of these mobile money operators. Are you going to put MTN mobile money there? Are you going to add M-PESA? Orange? So it's difficult, and it becomes fragmented.”

Filip Nilsson, Director of Corporate Development, MFS Africa

The GTP acquisition’s purpose was subsequently twofold. Get card credentials to its 400 million plus wallets — and utilize GTP’s banking network to connect the MFS Africa hub with all of GTP’s correspondent banks. By offering card credentials to its mobile money networks — in connection with previous deals made with Visa — African individuals and businesses with only mobile money can suddenly order goods from abroad. Financial inclusion in the mobile money context suddenly takes on a different meaning.

Source: GSMA

As a B2B company, MFS Africa’s expansion efforts are less directly in competition with others in a winner-take-all struggle as expanding B2Cs may find it. By serving as the interoperable connecting rails rather than the payment product itself, its relationship with localized super apps is far different than MoMo’s.

“We are an enabler of institutions and consumer facing apps and services. We will always be supporting those that have a lot of consumers, and we're not competing for the end user in that way. Where it can become a little bit more delicate is where those super apps have ambitions to go further down the value chain. There will be apps or services that try to go direct and build their own networking. But once you reach a certain scale, it's hard also to compete.”

Filip Nilsson, Director of Corporate Development, MFS Africa

Finding Equilibrium

As Professor Ozcan points out, it is possible for truly differentiated, difficult-to-replicate one-off services — think Spotify — to attain significant scale, but it’s not likely. Yet as tech ecosystems increasingly revolve around platform ecosystems, the real question becomes whether specialized solutions can be sustainable as third-party apps integrated within larger ecosystems. Not every company can or will become a unicorn. Though partnership terms can be unfavorable to the little guy — think Apple’s 30% fee it historically charged to app developers for its App store — the fact remains that in these unfolding super app-driven ecosystems, it will be a symbiotic relationship between small-time specialized services and the fintechs with greater ambitions for scale. And while competing super app ecosystems may cannibalize each other to some extent — though certainly not in a zero-sum dynamic — if anything, the propagation of super apps only gives specialized fintechs a greater mass audience to piggyback on the scale needed for them to be sustainable on their niche level. For such third-party solution providers, their scalability may be limited to their platform reach, but it’s plausible for them to be sustainable as a niche business.

How ubiquitous embedded financing becomes may flip dynamics around between fintechs and other tech-enabled services, but the dynamic persists, nonetheless. As the market downturn amplifies the consolidation push, three tiers of companies will clearly emerge — the platform centers of gravity, their supporting third-party apps — and the ones that simply don’t cut it.

Image courtesy of Steve Johnson

Click here to subscribe and receive a weekly Mondato Insight directly to your inbox.

Is Alternative Financing Hurting Ride-Hailing Drivers?

King Cash in the Congo: A Tale of Three Cities